Understanding the Stock Market Cycles and How to Invest Accordingly

Anúncios

Investing in the stock market can be a rewarding venture, but it also demands a thorough understanding of market dynamics. One key aspect that every investor should grasp is the concept of stock market cycles. These cycles represent the repetitive phases through which financial markets progress, influencing market sentiment, asset prices, and investment opportunities. Understanding these cycles allows investors to make informed decisions, optimize returns, and minimize risks.

Stock market cycles are inherently linked to economic activities, investor behavior, and external factors such as geopolitical events and monetary policies. Each cycle encapsulates various stages characterized by distinct market conditions. Knowledge of these phases, coupled with strategic investment adjustments, can significantly enhance portfolio performance. This article explores the nature of stock market cycles, their phases, how they impact investments, and practical approaches to navigate them effectively.

The Nature of Stock Market Cycles

Anúncios

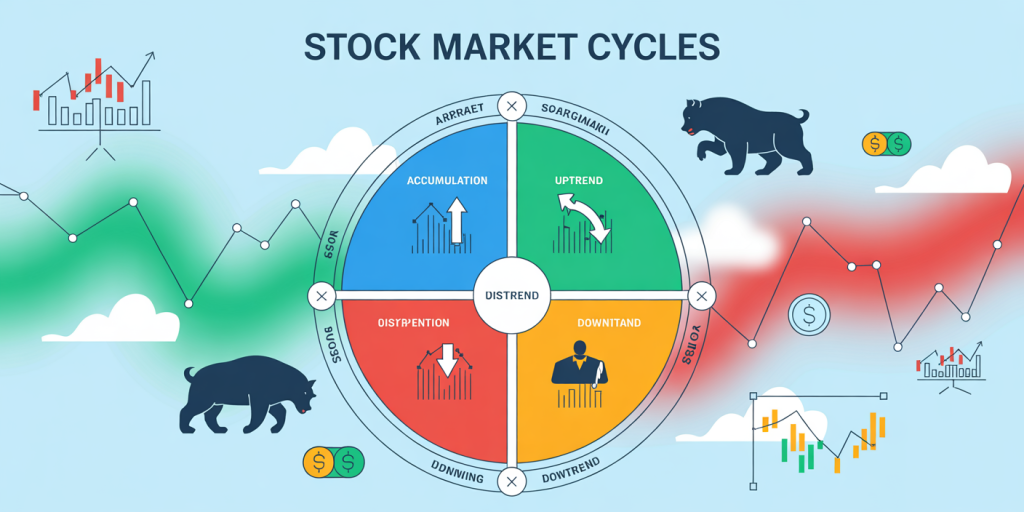

Stock market cycles do not occur in random or isolated manners; instead, they follow identifiable patterns influenced by macroeconomic variables and investor psychology. These cycles typically span several years, with the duration varying depending on economic developments and unforeseen shocks. The standard model divides the cycle into four primary phases: accumulation, uptrend (or expansion), distribution, and downtrend (or contraction).

During the accumulation phase, smart money and institutional investors begin to buy undervalued assets after a market downturn. This stage is usually characterized by low volumes and stagnant prices. Next, the uptrend phase sees a broad-based rally as economic indicators improve, corporate earnings grow, and optimism pervades the market. Investor confidence is high, and many retail investors join in.

Anúncios

The distribution phase marks the point where prices reach a peak, and savvy investors start to sell holdings, often signaling an impending downturn. Market volatility tends to increase as contradictory signals emerge. Finally, the downtrend or contraction phase involves a sustained decrease in prices, economic slowdown, and risk aversion. These phases collectively compose the cyclic behavior observed over decades in global stock markets.

Identifying the Four Phases of the Market Cycle

Understanding the specific characteristics of each phase is critical for effective investment strategies. During the accumulation phase, asset valuations are generally low, and market sentiment is pessimistic. For example, after the 2008 Global Financial Crisis, many stocks were significantly undervalued. Investors who recognized this phase, such as Warren Buffett, made substantial purchases that later yielded market-beating returns as prices climbed.

The uptrend phase benefits from improving economic indicators—like rising GDP, falling unemployment, and increasing corporate profits—which drive stock prices higher. The U.S. stock market between 2009 and 2020 experienced one of the longest bull markets recorded, with the S&P 500 increasing by approximately 400%. This period is marked by increasing investor participation and often exuberance, sometimes heightening the risk of market bubbles.

During the distribution phase, market valuations become stretched. Price increases slow, and volatility spikes. Retail investors often become fearful of missing out, fueling increased buying even as more seasoned investors exit. The dot-com bubble of the late 1990s exemplifies this phase, where technology stocks were sold at extraordinarily high valuations before the crash in 2000.

The downtrend phase follows, featuring declining prices and negative economic sentiments. Asset prices often fall below intrinsic values, which, although painful for holders, presents opportunities for contrarian investors with a long-term view. The market crash triggered by the COVID-19 pandemic in early 2020 was a stark example, followed by a rapid recovery as stimulus measures revived confidence.

| Phase | Market Sentiment | Typical Price Movement | Investor Behavior | Economic Indicators |

|---|---|---|---|---|

| Accumulation | Pessimistic | Stable to Slight Rise | Institutional Buying | Low growth, economic recovery signs |

| Uptrend | Optimistic/Confident | Steady Rise | Retail and Institutional Buying | High GDP growth, rising earnings |

| Distribution | Mixed/Volatile | Plateau or Slow Rise | Institutional Selling, Retail Buying | Peak growth, emerging risks |

| Downtrend | Pessimistic/Fearful | Declining Prices | Selling by all investors | Recession, falling profits |

How Economic Indicators Influence Market Cycles

Economic indicators act as vital signals that correlate with the stages of the stock market cycle. Leading indicators, such as manufacturing orders, new housing starts, and consumer confidence indices, tend to shift before the economy changes its course. For example, a persistent rise in unemployment claims during the distribution or downtrend phase often predicts further economic contraction and declining markets.

The Federal Reserve’s monetary policy also significantly impacts market cycles. In periods of market expansion, central banks might raise interest rates to prevent overheating, which can lead to tighter liquidity and initiate the distribution or downtrend phases. Conversely, during contractions, lower rates and quantitative easing aim to stimulate spending and investment, supporting the accumulation or uptrend phases.

Corporate earnings reports provide direct insight into company health and profitability. For instance, companies in cyclical sectors such as automotive or raw materials often show earnings trends that closely mirror overall economic cycles. During the 2020 pandemic-induced downturn, technology companies with strong balance sheets fared better relative to industrial sectors, showcasing the importance of sector analysis within the cycle context.

Investment Strategies Tailored to Market Cycles

Adapting investment strategies to the stage of the market cycle can help investors maximize returns and mitigate risks. During the accumulation phase, value investing and buying undervalued stocks tend to be effective. Investors might focus on distressed sectors or companies with strong fundamentals but poor recent performance. Dollar-cost averaging in this phase can reduce timing risk as prices are relatively low.

In the uptrend phase, growth investing flourishes. This is the time to capitalize on momentum with stocks demonstrating strong earnings growth and positive market sentiment. Sector allocation tilts toward cyclical industries like technology, consumer discretionary, and financials often perform well as consumer spending and lending increase.

The distribution phase calls for caution and selective profit-taking. Diversifying into defensive sectors such as utilities, healthcare, and consumer staples is prudent as these tend to exhibit steady cash flows regardless of economic conditions. Investors might also consider hedging strategies, including options or inverse ETFs, to protect against potential downturns.

Finally, during the downtrend phase, risk aversion is key. Investors may prioritize capital preservation by shifting to cash equivalents, bonds, or gold. At the same time, contrarian investors can seek bargains by targeting beaten-down assets with strong recovery potential, as observed with airline and tourism stocks after the 2020 crash.

| Market Cycle Phase | Recommended Strategy | Sector Focus | Risk Management Approach |

|---|---|---|---|

| Accumulation | Value Investing, Dollar-Cost Averaging | Financials, Industrials | Gradual Position Building |

| Uptrend | Growth Investing, Momentum Trading | Technology, Consumer Discretionary | Increased Exposure, Trend Following |

| Distribution | Profit Taking, Defensive Rotation | Utilities, Healthcare, Staples | Diversification, Hedging |

| Downtrend | Capital Preservation, Contrarian Buying | Bonds, Gold, Select Cyclicals | Reduced Exposure, Flight to Safety |

Practical Examples and Case Studies

A classic case illustrating the importance of recognizing market cycles is the 2008-2009 Global Financial Crisis (GFC). Before the crisis, during the distribution phase, valuations in the real estate and banking sectors were inflated. Investors who failed to anticipate the downturn suffered substantial losses as these sectors collapsed during the downtrend phase. Conversely, those who shifted to safer assets or curtailed exposure to high-risk financial stocks managed to preserve capital.

Post-GFC, the accumulation phase began, marked by low valuations and pessimistic market sentiment. Investors like Berkshire Hathaway aggressively accumulated bank stocks such as Wells Fargo at significant discounts. The subsequent uptrend phase, lasting over a decade, rewarded this patient, phase-aware investment approach.

Another recent example is the rapid market fall and rebound in 2020 caused by the COVID-19 pandemic. Investors who understood the cyclical depth of the downturn and maintained liquidity were positioned to buy quality stocks at reduced prices. The S&P 500 recovered fully within months, highlighting that strategic investing aligned with cycle phases can lead to outperformance even in turbulent times.

Future Perspectives on Market Cycles and Investing

The stock market environment is continuously evolving due to technological innovation, regulatory changes, and global interconnectedness. Nevertheless, the fundamental nature of market cycles is expected to endure. Future investors will likely benefit from enhanced data analytics, artificial intelligence, and improved economic forecasting tools to identify cycle phases with greater precision.

The rise of algorithmic and high-frequency trading may reduce the durations of market phases, amplifying volatility but also creating new opportunities for nimble investors. Additionally, environmental, social, and governance (ESG) factors are becoming increasingly integrated into investment decisions, potentially impacting sector rotations and risk assessments across cycles.

Investors should also consider geopolitical risks and shifting global economic power dynamics, which could influence traditional cycle behaviors. For example, the growing economic influence of China and other emerging markets introduces new variables to global market interconnectedness.

In summary, while the mechanics of stock market cycles remain a foundational aspect of investing, adaptability and the integration of modern tools and perspectives are essential for future success. Regularly reviewing macroeconomic indicators, maintaining a diversified portfolio, and adjusting strategies per cycle phases will remain fundamental best practices for achieving long-term investment goals.

Post Comment