Understanding Capital Gains Tax When Selling Your Home or Stocks

Anúncios

Capital gains tax can be a complex topic for many investors and homeowners alike. Whether you are selling a home or liquidating stock assets, understanding how capital gains tax applies is crucial for effective financial planning and minimizing tax liabilities. This article aims to provide a comprehensive, SEO-optimized exploration of capital gains tax, making it easier for you to navigate your own financial decisions.

Conceptual image of tax strategies for minimizing capital gains tax, featuring elements like tax-loss harvesting, home improvements, record-keeping folders, and a financial advisor consulting a client.

Anúncios

What Is Capital Gains Tax?

Capital gains tax (CGT) is a tax imposed on the profit you make from selling an asset. These assets can include anything from real estate such as your primary residence to investment assets like stocks, bonds, and mutual funds. The tax is usually applicable only on the “capital gain,” which is calculated by subtracting the asset’s purchase price (adjusted for certain factors) from its sale price.

Anúncios

For example, if you bought shares of a company for $10,000 and sold them for $15,000, your capital gain would be $5,000. That $5,000 profit is subject to capital gains tax unless specific exemptions or deductions apply. The type and amount of tax you pay depend on various factors, including the duration for which you held the asset, your income bracket, and the tax laws in your jurisdiction.

The significance of understanding capital gains tax grew as homeowners and investors increasingly focus on wealth accumulation through property and stock markets. According to the IRS, billions of dollars in capital gains tax are collected annually, reflecting the prominence of this tax in personal finance.

Capital Gains Tax on Home Sales: Key Considerations

When you sell a home, capital gains tax may apply, but several exemptions and regulations make this a nuanced subject. The most notable provision in the United States is the Section 121 exclusion, which allows homeowners to exclude up to $250,000 ($500,000 for married couples filing jointly) of capital gains on the sale of their primary residence, provided certain conditions are met.

Illustration of a homeowner calculating capital gains tax on the sale of a primary residence, showing documents, a house, and tax forms with exclusion amounts ($250,000/$500,000).

To qualify for this exclusion, the homeowner must have owned and lived in the home for at least two of the five years prior to the sale. This rule helps millions of homeowners avoid or minimize capital gains tax, effectively encouraging homeownership as part of wealth-building strategies.

For example, consider Sarah, married and filing jointly, who bought a home for $300,000. Ten years later, she sells it for $600,000. Her gain is $300,000, but after applying the exclusion of $500,000, she pays no capital gains tax. However, if she had only owned the home for one year, this exclusion would not apply, and she might owe tax on the gain.

It is also important to note that if the home was used for business or rental purposes, or if major improvements were made, the tax situation might become more complex, potentially affecting taxable gains.

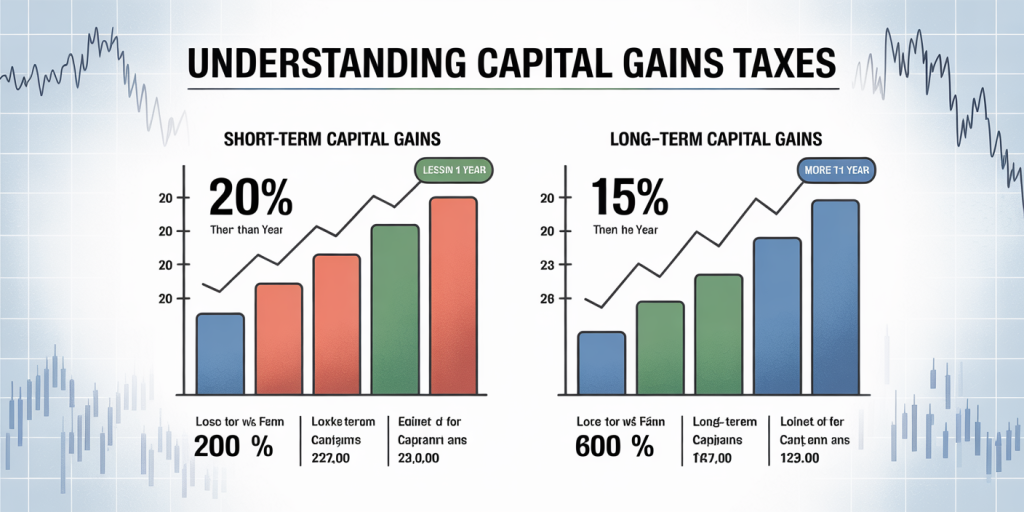

Capital Gains Tax on Stocks: Long-Term vs. Short-Term Rates

For stock sales, the capital gains tax you pay depends primarily on how long you’ve held the asset before selling it. The IRS distinguishes between short-term and long-term capital gains, each taxed at different rates.

Short-term capital gains apply to assets held for one year or less and are taxed at your ordinary income tax rate, which can range from 10% to 37% federally in 2024. In contrast, long-term capital gains—profits on assets held longer than one year—are taxed at reduced rates: 0%, 15%, or 20%, depending on your taxable income.

To illustrate, suppose John buys shares worth $20,000 and sells them six months later for $25,000. The $5,000 gain will be taxed at his ordinary income rate, which could be as high as 35%. If John had held those shares for 18 months before selling, the $5,000 gain might be taxed at a long-term rate, which could be significantly lower, say 15%.

This tax differentiation incentivizes investors to hold assets longer, reducing the tax burden and potentially fostering more stable investment portfolios.

| Holding Period | Tax Rate Range (%) | Applies To |

|---|---|---|

| Less than 1 year | 10% to 37% (ordinary rate) | Short-term capital gains on stocks |

| More than 1 year | 0%, 15%, or 20% | Long-term capital gains on stocks |

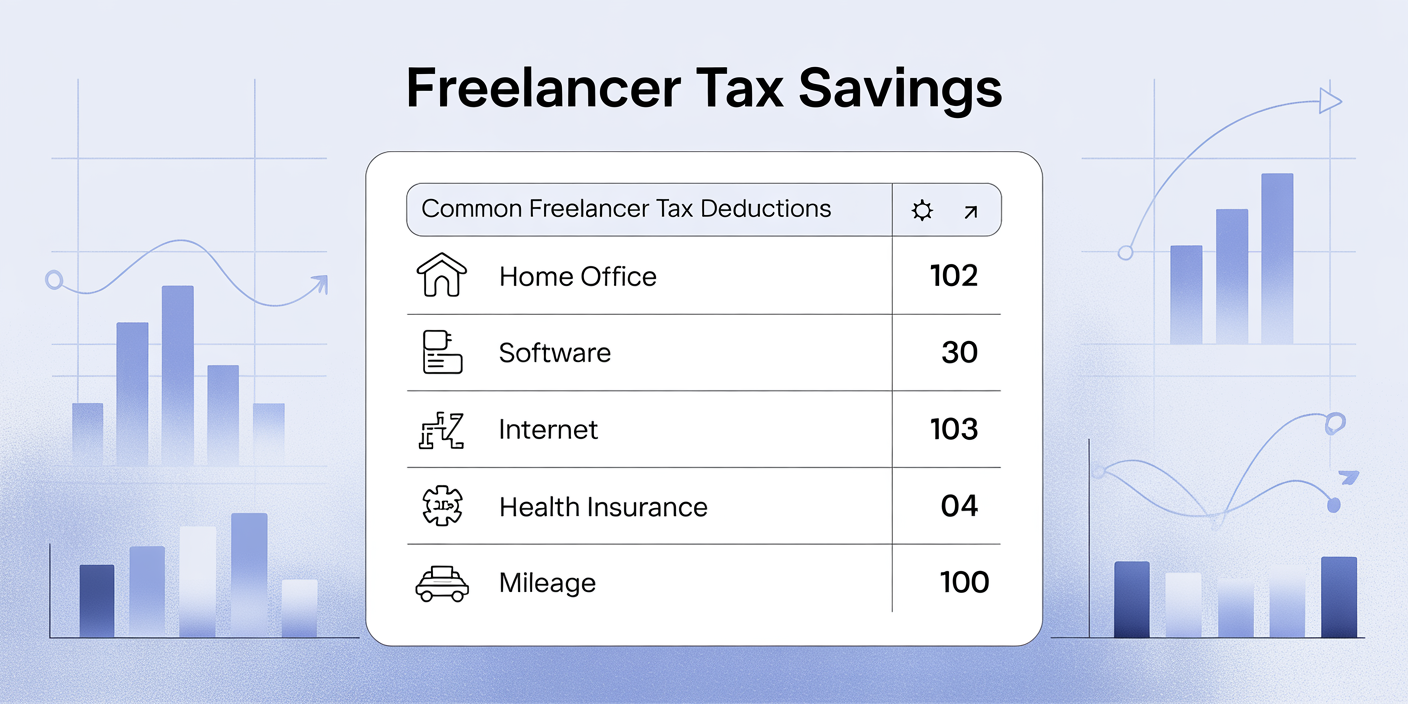

Practical Tax Strategies for Minimizing Capital Gains

Understanding capital gains tax rules is the first step toward effective tax planning. Numerous strategies can help reduce your capital gains tax burden when selling homes or stocks.

One common strategy is the tax-loss harvesting method, often used with stock investments. By selling investments that are currently at a loss, investors can offset capital gains from other sales, reducing their overall tax liability. For example, if Jane realizes a $10,000 capital gain from selling stock A and also sells stock B at a $6,000 loss, she may only owe capital gains tax on a net gain of $4,000.

In the case of home sales, timing your sale can make a substantial difference. Because the exclusion applies only to the sale of a primary residence used for at least two years in the last five, homeowners who have recently moved into a home may want to wait until meeting this threshold. Additionally, strategically investing in home improvements can increase the basis of the property, thereby reducing the taxable gain.

Record-keeping is essential. Keeping documentation of purchase prices, improvements, and sale-related expenses such as commissions and closing costs can reduce your gain by increasing your adjusted basis.

Real-Life Cases Highlighting Capital Gains Tax Implications

To better understand capital gains tax, let’s examine some real-life scenarios that illustrate how tax rules impact homeowners and investors.

Case 1: Maria, a single homeowner, bought her home for $200,000 and lived there for six years. She sold it recently for $350,000. Her capital gain is $150,000, which is under the $250,000 exclusion for single filers, so she owes no capital gains tax.

Case 2: Alex and Tom, a married couple, inherited stock worth $100,000, which stepped up in basis to the market value at the time of inheritance. After ten years, they sold the stock for $130,000. The gain of $30,000 benefits from a stepped-up basis, meaning they pay capital gains tax only on the gain after adjusting for the inheritance value, demonstrating the tax advantage of inherited assets.

Case 3: Lisa sold her rental property for a substantial gain but faced depreciation recapture tax, a special kind of tax triggered by prior property depreciation deductions. Depreciation recapture is taxed at a maximum rate of 25%, which added complexity and higher tax liability compared to a primary residence sale.

These cases highlight how ownership type, length of tenure, and asset category influence capital gains tax outcomes dramatically.

Comparative Overview: Capital Gains Tax on Homes vs. Stocks

While both home and stock sales can trigger capital gains tax, understanding their differences and similarities can clarify your tax planning approach.

| Aspect | Home Sales | Stock Sales |

|---|---|---|

| Primary Exclusion | $250,000 (single), $500,000 (married) exclusion on primary residences | No such exclusion |

| Holding Period Impact | Must own and live in home 2 out of last 5 years to qualify | One year or less = short-term; more than one year = long-term |

| Tax Rates | Generally capital gains rates, but exemptions apply | Short-term gains taxed as ordinary income; long-term gains taxed at lower rates |

| Adjusted Basis Impact | Add improvements, closing costs, etc. | Add commissions and purchase costs |

| Special Cases | Rental property, business use complicate tax | Tax-loss harvesting and wash sale rules exist |

| Depreciation Recapture | Applicable to rental or business properties | Not applicable |

Understanding these key distinctions enables taxpayers to tailor their strategies based on asset class, valuation, and time horizon.

Visual comparison chart of short-term vs. long-term capital gains tax rates on stock sales, including timelines (less than 1 year vs. more than 1 year) and corresponding tax percentages.

Emerging Trends and Future Perspectives in Capital Gains Taxation

The landscape of capital gains taxation is subject to ongoing policy debates and changes, often reflecting broader economic and social goals.

One emerging trend is the discussion around increasing capital gains tax rates for higher-income individuals. For example, the proposed changes under the Biden administration aimed to raise the top capital gains rate from 20% to as high as 39.6% for taxpayers earning over $1 million annually, though this has yet to be enacted into law. Such changes underscore the importance of proactive tax planning and staying informed about regulatory updates.

Additionally, some states have started implementing or increasing state-level capital gains taxes, adding another layer of complexity. For instance, California already taxes capital gains as ordinary income, reaching up to 13.3%, which can significantly impact overall tax bills.

Technology also plays a role in shaping how capital gains are tracked and managed. Automated tools and tax software help taxpayers accurately calculate gains, apply offsets, and file returns efficiently, reducing errors and missed opportunities for savings.

Lastly, demographic shifts, like the aging population approaching retirement, may lead to increased capital gains realizations. How lawmakers respond—whether by adjusting exemptions, rates, or introducing new incentives—will shape future investment and homeownership strategies.

Capital gains tax can significantly affect your net proceeds when selling key assets like homes or stocks. By understanding fundamental rules, applying prudent tax strategies, and staying updated on tax law developments, taxpayers can make more informed decisions and optimize their financial outcomes over time. Whether it’s leveraging exclusions on home sales or timing stock sales to benefit from long-term rates, knowledge is your most powerful tax tool.

Post Comment