Understanding Asset Allocation: How to Balance Risk and Reward

Anúncios

When it comes to building wealth through investing, the decisions you make about where to place your money are just as important as how much you invest. At the heart of a successful investment strategy lies a concept called asset allocation—the art and science of balancing risk and reward by strategically dividing your investments among different asset classes.

Asset allocation is a core principle of portfolio management. It helps investors achieve long-term financial goals while managing risk in line with personal comfort levels. Whether you’re new to investing or looking to refine your strategy, understanding how asset allocation works is essential to your success.

In this guide, we’ll explore the fundamentals of asset allocation, how it balances risk and reward, and how to build an allocation strategy that aligns with your financial goals.

Anúncios

What Is Asset Allocation?

Asset allocation is the process of distributing your investments across different categories, or asset classes, such as:

Anúncios

-

Stocks (Equities)

-

Bonds (Fixed-Income Securities)

-

Cash or Cash Equivalents

-

Alternative Investments (e.g., real estate, commodities, or crypto)

The primary objective of asset allocation is to maximize returns while minimizing risk by leveraging the unique characteristics of each asset class.

Rather than placing all your eggs in one basket, asset allocation diversifies your holdings so that gains in one area can offset losses in another. This principle is what makes it one of the most powerful tools in personal finance.

Why Asset Allocation Matters

Markets are unpredictable. Economic cycles shift, sectors rotate, and even the most successful stocks can experience significant volatility. Asset allocation helps you:

-

Reduce risk by spreading investments across assets that don’t move in sync

-

Manage volatility with a cushion from more stable assets like bonds or cash

-

Customize your portfolio to reflect your risk tolerance, goals, and time horizon

-

Improve returns through strategic rebalancing and diversification

Studies have shown that asset allocation decisions account for more than 90% of a portfolio’s long-term performance, far outweighing individual stock selection or market timing.

The Major Asset Classes Explained

📈 1. Stocks (Equities)

-

Risk Level: High

-

Return Potential: High

-

Best For: Long-term growth

Stocks represent ownership in a company and typically offer higher returns than other asset classes over the long run. However, they are also subject to market volatility and are best suited for investors with longer time horizons.

💵 2. Bonds (Fixed Income)

-

Risk Level: Low to Medium

-

Return Potential: Moderate

-

Best For: Income and capital preservation

Bonds are loans to governments or corporations that pay interest. They’re generally safer than stocks and help provide steady income. Adding bonds to a portfolio can reduce overall volatility.

💰 3. Cash and Cash Equivalents

-

Risk Level: Very Low

-

Return Potential: Low

-

Best For: Emergency funds and short-term goals

Cash investments include savings accounts, money market funds, and short-term certificates of deposit (CDs). While safe, they offer minimal returns and are vulnerable to inflation.

🏠 4. Alternative Investments

-

Risk Level: Medium to High

-

Return Potential: Variable

-

Best For: Diversification

These include real estate, commodities (like gold), private equity, and cryptocurrencies. They can offer returns uncorrelated with traditional markets but may carry higher fees and complexity.

Risk Tolerance and Time Horizon

Before choosing an asset allocation strategy, you must assess two key personal factors:

1. Risk Tolerance

This is your ability and willingness to endure losses in exchange for potential gains. It’s influenced by:

-

Age

-

Income stability

-

Financial goals

-

Personality

If market downturns make you panic, a conservative allocation may suit you better. If you’re comfortable with ups and downs for the chance of higher returns, you may prefer a more aggressive approach.

2. Time Horizon

This refers to the amount of time you plan to hold investments before needing the money.

-

Short-Term (0–3 years): Prioritize capital preservation (e.g., cash, short-term bonds)

-

Medium-Term (3–10 years): Balanced approach (mix of stocks and bonds)

-

Long-Term (10+ years): Emphasize growth (higher stock allocation)

Generally, the longer your time horizon, the more risk you can take, because you’ll have more time to recover from market dips.

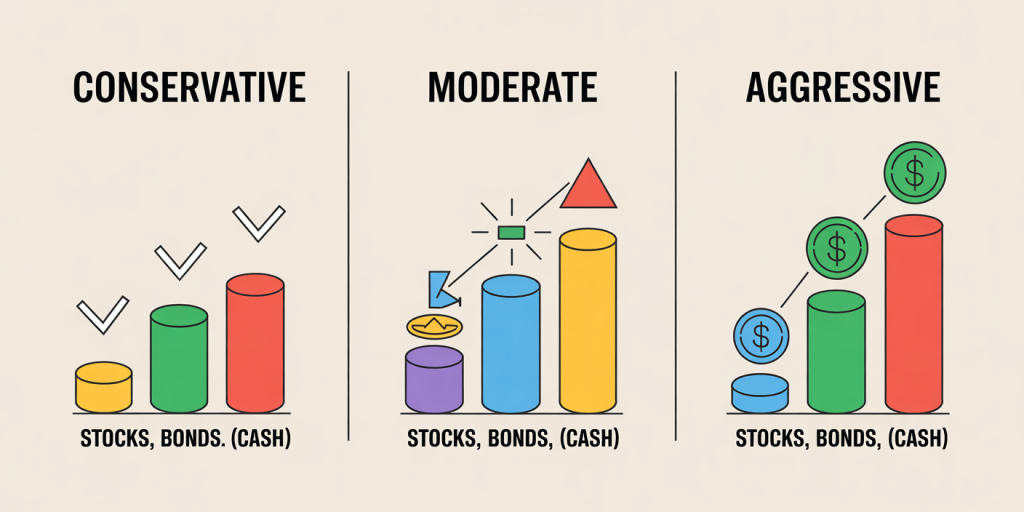

Common Asset Allocation Models

Here are some sample allocation models based on risk tolerance and investing timeline:

🟩 Conservative Portfolio (Low Risk)

-

20% Stocks

-

70% Bonds

-

10% Cash

Ideal for retirees or those close to needing their money.

🟨 Moderate Portfolio (Balanced Risk)

-

60% Stocks

-

35% Bonds

-

5% Cash

Suitable for investors with medium time horizons or moderate risk tolerance.

🟥 Aggressive Portfolio (High Risk)

-

90% Stocks

-

10% Bonds

Designed for young investors with a long time horizon and high risk tolerance.

These models are starting points. Your allocation can evolve based on life events, goals, and market conditions.

Dynamic Asset Allocation

Your investment needs will change over time. That’s why asset allocation isn’t something you set and forget. You should review and adjust your portfolio regularly based on:

-

Age or retirement status

-

Changes in income or expenses

-

Market performance

-

Shifts in financial goals

A common approach is glide path investing, which gradually shifts the portfolio from aggressive to conservative as you near your goal (like retirement).

Rebalancing Your Portfolio

Over time, market movements can cause your portfolio to drift from its original allocation. For example, a strong stock market could turn your 60/40 mix into a 75/25, increasing your risk exposure.

Rebalancing involves:

-

Selling assets that have grown too large in proportion

-

Buying more of the underweighted assets

-

Bringing your portfolio back to target allocation

You can rebalance:

-

Annually or semi-annually (calendar-based)

-

When an asset deviates by a set percentage (threshold-based)

-

When your goals or risk tolerance change

Rebalancing helps you maintain discipline, manage risk, and “buy low, sell high.”

Tax Considerations

Rebalancing or reallocating investments in taxable accounts can trigger capital gains taxes. To minimize tax impact:

-

Use tax-advantaged accounts (e.g., IRAs, 401(k)s)

-

Offset gains with tax-loss harvesting

-

Consider tax-efficient funds or ETFs

-

Rebalance with new contributions instead of selling assets

Always consult a tax advisor before making large portfolio changes.

Asset Allocation and Investment Vehicles

You can implement your asset allocation using different investment tools:

🧺 Mutual Funds and ETFs

-

Many funds offer pre-diversified portfolios based on risk level (e.g., target-date funds)

-

Low-cost ETFs are popular for DIY asset allocation

🤖 Robo-Advisors

-

Platforms like Betterment, Wealthfront, or SoFi automatically manage allocation and rebalance your portfolio

📊 Individual Securities

-

If you prefer control, you can buy specific stocks, bonds, and alternatives directly—but it requires more expertise

Final Thoughts

Asset allocation is not about predicting the future—it’s about preparing for it. By diversifying across asset classes and adjusting your strategy based on your goals, risk tolerance, and timeline, you create a resilient investment portfolio that can weather volatility and grow steadily over time.

Rather than chasing quick wins, smart investors use asset allocation to balance risk and reward in a way that supports long-term success. Whether you’re just getting started or rethinking your strategy, making allocation a core part of your financial plan will help you stay focused, confident, and in control of your financial future.

Post Comment