The Ultimate Guide to Budgeting: Techniques that Work

Anúncios

Budgeting is an essential skill that empowers individuals, families, and businesses to manage their finances effectively, avoid debt, and build wealth over time. Despite its importance, many people struggle to maintain a consistent budget that aligns with their goals and lifestyle. This guide delves into proven budgeting techniques, supported by real-world examples and data-driven insights, to help you create a reliable financial plan that works. Whether you’re a beginner or seeking to refine your approach, these strategies offer practical solutions to improve your monetary well-being.

With consumer debt in the United States exceeding $16 trillion as of 2023 (Federal Reserve), managing expenses has never been more critical. Budgeting allows you to prioritize spending, save for emergencies, and invest for future growth. In this article, we explore various budgeting methods, compare their effectiveness, and offer actionable tips for sustainable financial management.

Understanding Different Budgeting Techniques

Anúncios

There is no one-size-fits-all approach to budgeting; different techniques cater to varying income types, spending habits, and financial priorities. Here, we examine some of the most effective budgeting methods, highlighting their unique features and practical applications.

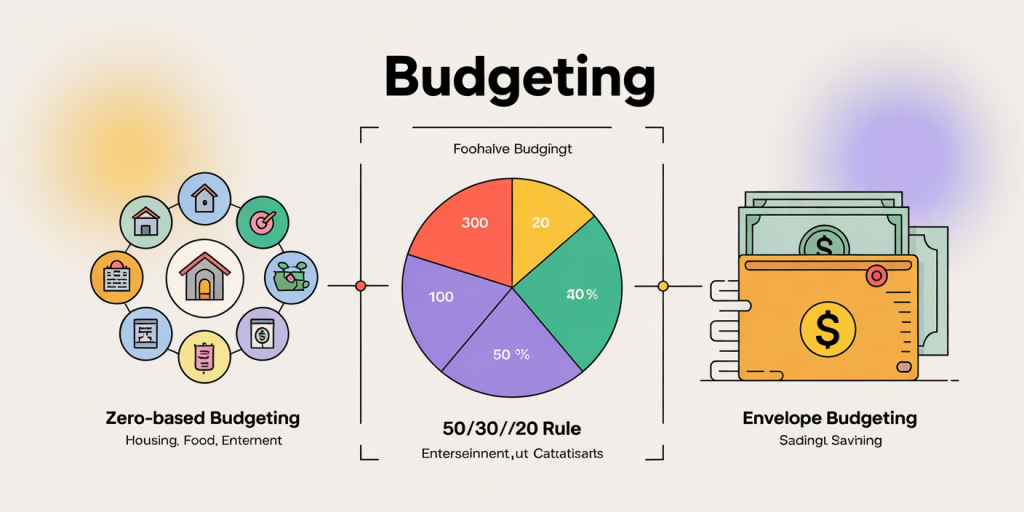

The Zero-Based Budgeting Method

Anúncios

Zero-based budgeting requires assigning every dollar of your income to specific expenses, savings, or debt repayment, until you reach “zero” at the end of the budgeting period. This method ensures that no money goes unaccounted for, which can be especially useful for individuals who want tight control over their finances.

For example, consider a monthly income of $4,000. You might allocate $1,200 for rent, $400 for groceries, $300 for utilities, $500 for debt repayment, $700 for savings, and $900 for discretionary spending. The goal is to have your income minus expenditures equal zero, eliminating waste and encouraging mindful spending.

This technique is favored by many financial advisors because of its accountability factor. According to a 2022 survey by NerdWallet, individuals practicing zero-based budgeting reported a 25% higher likelihood of meeting saving goals compared to those using other methods.

The 50/30/20 Budget Rule

Popularized by Senator Elizabeth Warren, the 50/30/20 rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This method is straightforward and adaptable, making it suitable for beginners or those seeking a balanced budgeting structure.

For instance, if a person earns $3,000 monthly after taxes, they would allocate $1,500 to necessities like housing and utilities, $900 to wants such as dining out and entertainment, and $600 towards savings and debt.

While simple, this rule assumes a stable income and average expense ratios. It may require adjustments for high cost-of-living areas or irregular income sources like freelancing.

Envelope Budgeting System

Envelope budgeting is a cash-based method where money is divided into physical envelopes labeled for specific categories (e.g., groceries, fuel, entertainment). Once the cash in an envelope is spent, you cannot spend more in that category until the next budgeting cycle.

This system provides a tangible way to control overspending. A case study from a 2021 financial literacy program in Michigan showed that participants using the envelope system reduced impulse purchases by 40% within three months.

Although modern budgeters use digital “envelope” apps that replicate this system, the principle remains the same: limit spending category by category to stay disciplined.

| Budgeting Method | Pros | Cons | Best For |

|---|---|---|---|

| Zero-Based Budgeting | Precise control, promotes accountability | Time-consuming, requires detailed tracking | Organized planners, debt payoff |

| 50/30/20 Rule | Simple, flexible | May not fit irregular incomes | Beginners, balanced spenders |

| Envelope System | Effective spending control, reduces impulsivity | Requires cash handling, less convenient with digital spending | Impulse spenders, cash-based households |

Practical Steps to Build a Customized Budget

Creating a budget tailored to your needs involves several key steps. The process starts with a thorough assessment of your income and expenses, followed by setting realistic financial goals.

Tracking Your Income and Expenses

Begin by documenting all sources of income, including salaries, side gigs, dividends, and any other cash inflows. A comprehensive understanding of your monthly income provides a baseline for allocation.

Next, monitor your spending closely for at least a month. Use banking apps, receipts, or budgeting software to categorize expenses accurately. Many people underestimate their discretionary spending, so tracking reveals real patterns and potential areas for cuts.

For example, a recent study by the University of Chicago found that individuals who tracked their expenses for a month cut non-essential spending by an average of 18%.

Setting Financial Priorities

With clear data on your finances, identify your short-term (e.g., paying off credit card debt), medium-term (saving for a vacation), and long-term goals (retirement, buying a house). Prioritizing helps allocate funds appropriately and enhances motivation.

Consider Sarah, a 32-year-old professional who prioritized paying off $5,000 in credit card debt before funneling savings toward retirement. Using a zero-based budget, she designated 30% of her income toward debt repayment, paying off her credit cards in less than six months.

| Step | Description | Tools/Examples |

|---|---|---|

| Income Assessment | Calculate all income sources | Pay stubs, tax returns |

| Expense Tracking | Record and categorize every expense | Mint, YNAB, spreadsheets |

| Goal Setting | Define clear financial objectives | SMART goal framework |

| Budget Selection | Choose a budgeting method that suits lifestyle | Zero-based, 50/30/20, Envelope |

| Implementation | Apply the budget and modify as needed | Monthly reviews, automation |

Leveraging Technology for Effective Budgeting

In today’s digital age, technology simplifies the budgeting process, providing tools that automate tracking, offer insights, and encourage consistency.

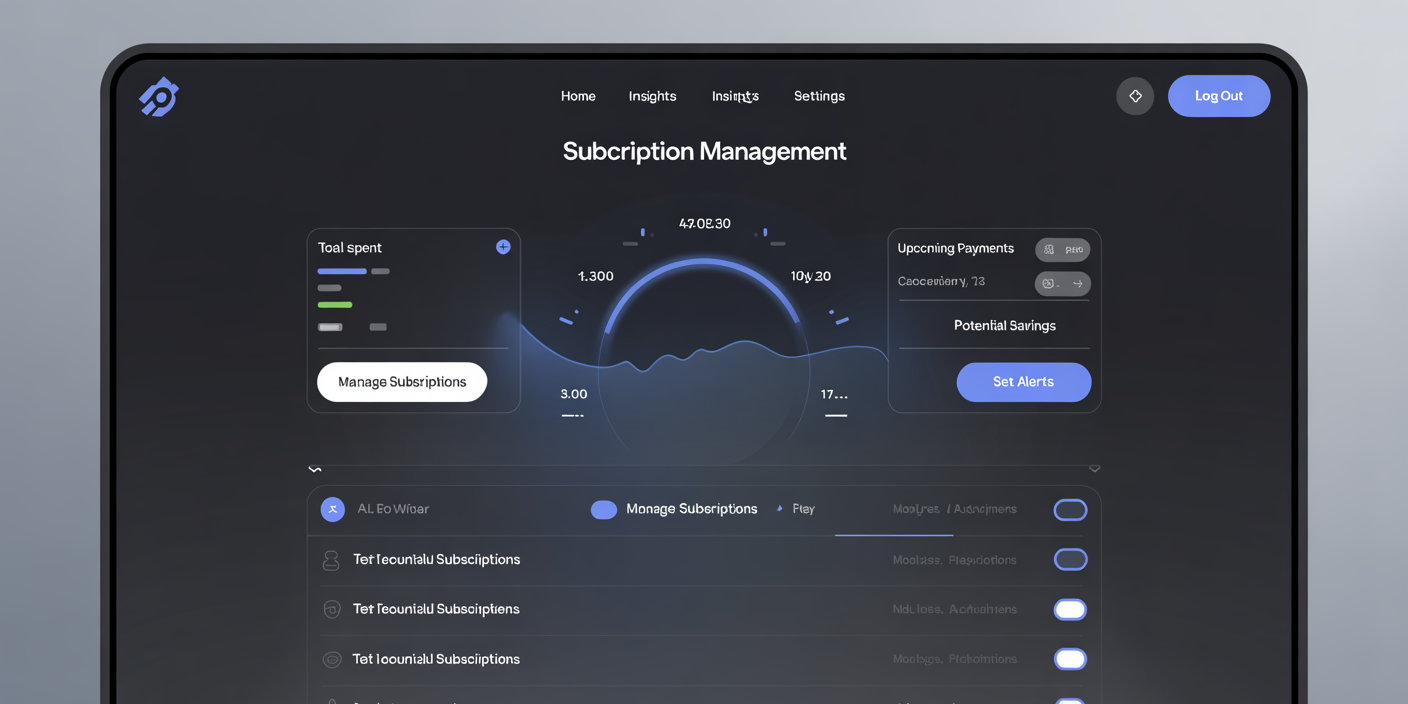

Apps and Software Solutions

Popular apps like Mint, You Need A Budget (YNAB), and PocketGuard link directly with bank accounts and credit cards to provide real-time updates on spending. These tools offer alerts for overspending, categorize expenditures automatically, and generate reports to visualize financial trends.

For example, according to a 2023 report by Statista, 58% of millennials use financial planning apps, which contributed to an average 15% increase in saving rates among users.

YNAB promotes a hands-on approach that aligns well with zero-based budgeting, helping users assign “every dollar a job” through its budgeting cycles, which a case study by YNAB showed increased saving balances by up to 20% in one year.

Automation and Alerts

Automating bill payments and savings transfers reduces the risk of missed payments and ensures consistent saving habits. Also, setting alerts for budget limits can prevent overspending before it happens.

John, a freelance graphic designer, uses automated transfers to his emergency fund every payday and receives notifications when his entertainment budget nears its limit, which helps him stay within budget despite variable income.

Overcoming Common Budgeting Challenges

Many individuals start budgeting enthusiastically only to falter over time. Recognizing common pitfalls helps maintain momentum and achieve financial goals.

Dealing with Irregular Income

Freelancers, commission workers, and seasonal employees often experience income fluctuations, complicating traditional budgeting. A recommended approach is to calculate an average monthly income based on the past six months and base the budget on the lowest figure to ensure safety.

Another tactic is differentiating between fixed and variable expenses, prioritizing necessities to be covered first. Any excess during higher-income months can go into savings for leaner periods.

Avoiding Lifestyle Inflation

Lifestyle inflation occurs when spending increases proportionally with income, stalling saving efforts. According to a 2022 Bankrate survey, 47% of Americans admit to lifestyle inflation after salary increases, reducing their ability to build wealth.

To counter this, financial planners suggest “paying yourself first” by automating increased contributions to savings or retirement accounts immediately following income boosts, rather than increasing discretionary spending.

Future Perspectives: The Evolution of Budgeting

As financial ecosystems evolve with advancements in technology and shifts in economic landscapes, budgeting methods are expected to become more personalized and data-driven.

Integration of Artificial Intelligence

AI-powered budgeting tools are emerging, offering predictive analytics and personalized recommendations. These systems analyze spending habits, income cycles, and financial goals to customize budgets that dynamically adapt, optimizing balance between saving and enjoying life.

For example, upcoming platforms like Cleo and Albert use AI chatbots to provide financial advice, making budgeting interactive and accessible, particularly for younger generations.

Emphasis on Financial Wellness

Corporate employers and governments increasingly recognize the importance of financial wellness programs, integrating budgeting education and resources to improve overall well-being. This broader approach may help reduce national debt levels and improve savings rates.

Data from the National Endowment for Financial Education indicates that financial wellness programs among employees can lead to a 30% increase in productivity and a 22% reduction in financial stress.

By adopting effective budgeting techniques, utilizing modern tools, and preparing for future innovations, individuals can take decisive steps toward financial stability and prosperity. Understanding your unique financial situation and committing to adjustable, realistic budgets enables you to meet your goals and build a secure financial future.

Post Comment