The Hidden Dangers of Low Credit Utilization You Might Not Know

Anúncios

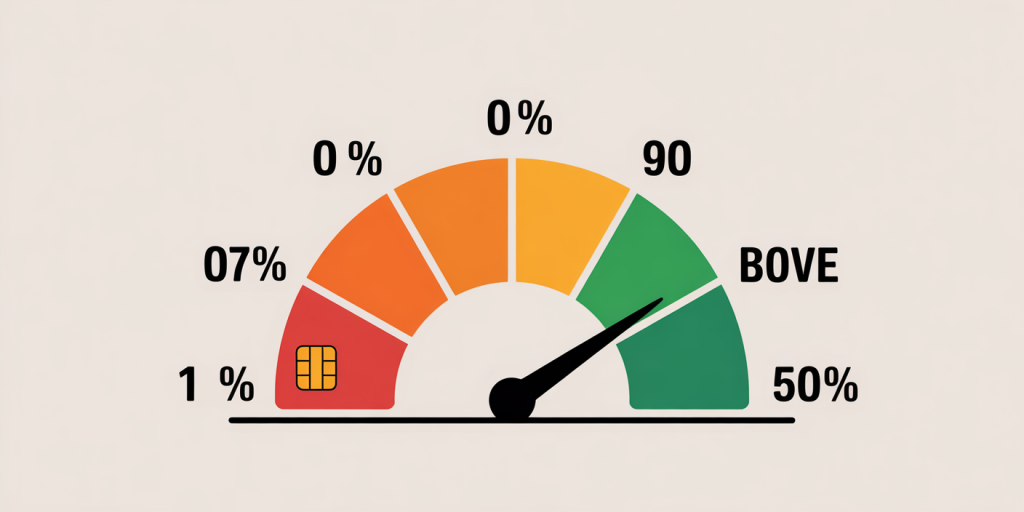

Credit utilization ratio is a widely recognized factor in credit scoring models. It refers to the percentage of a borrower’s available credit that is currently being used. Conventional financial wisdom often promotes maintaining a low credit utilization rate—usually below 30%—to maintain or improve credit scores. However, while low credit utilization has its benefits, there are lesser-known drawbacks and risks associated with very low or near-zero usage that can affect credit health in unexpected ways. This article explores the hidden dangers of low credit utilization you might not know, supported by data, real-life cases, and practical tips for balanced credit management.

Understanding Credit Utilization and Its Role in Credit Scores

Credit utilization is a significant factor within credit scoring models, particularly FICO and VantageScore. Typically, credit scores consider credit utilization on revolving credit lines such as credit cards and lines of credit. This ratio is calculated by dividing the total revolving credit balances by the total available credit limits and multiplying by 100 to get a percentage.

Anúncios

Maintaining a credit utilization below 30% is widely advised by experts, as studies show that scores tend to improve when utilization is kept low but not zero. For example, FICO reports that consumers with utilization rates between 1% and 9% often have the highest credit scores, averaging around 760 to 800+. On the other hand, consumers who report 0% utilization sometimes face difficulties because credit scoring systems lack enough recent account activity to evaluate credit risk properly.

Consider Sarah, an individual with a credit card limit of $10,000 but who rarely uses the card, keeping her outstanding balance at $0 month after month. Despite her perfect payment history, Sarah noticed her credit score occasionally fluctuated lower than expected. This case illustrates that while low utilization generally helps, extremely low utilization (close to 0%) may not provide sufficient positive signals to credit models.

Anúncios

Potential Negative Impacts of Too Low Credit Utilization

While high credit utilization can damage scores, excessively low utilization carries its own risks. One critical drawback is the lack of visible credit activity. Credit bureaus and scoring models thrive on fresh, positive data showing responsible credit use and timely payments. When consumers use little or no credit, their accounts appear dormant or inactive, which can cause lenders or scoring algorithms to assign lower risk weight or exclude that data for the scoring period.

Another hidden concern is lenders’ perception during credit evaluations for new loans. Credit issuers look for evidence of active credit management and the borrower’s capacity to handle credit responsibly. Too little utilization might raise doubts about the borrower’s creditworthiness, leading to lower loan limits, higher interest rates, or even application rejections.

A comparative study by Experian in 2022 analyzed over 5 million credit reports and found that consumers with credit utilization consistently below 5% had a 15% higher chance of credit line decreases or account closures compared to those maintaining utilization between 5% and 15%. It suggests that banks may prefer seeing moderate credit activity to justify extending or maintaining higher credit limits.

Table 1: Effects of Credit Utilization Levels on Credit Outcomes

| Credit Utilization Range | Impact on Credit Score | Likelihood of Credit Line Increase | Risk of Account Closure |

|---|---|---|---|

| 0% (No usage) | May plateau or slightly lower | Low | Higher |

| 1%-9% | Optimal for improving scores | High | Low |

| 10%-30% | Good credit usage | Moderate | Moderate |

| 31%-50% | Slight score decrease | Low | Low |

| >50% | Significant score decrease | Very low | Low |

This data highlights the complexity of credit utilization effects and underscores why extremely low utilization could ironically hinder credit growth.

The Impact on Credit Mix and Credit History

Credit scoring models consider not just how much credit you use but also the diversity and length of your credit history. If your credit usage is very low, you might inadvertently affect these parameters.

For example, if you rarely use your credit cards, lenders might eventually close inactive accounts, reducing your overall available credit and shortening your credit history length. As a result, your credit score might drop due to higher utilization (after losing available credit) and reduced account age.

Take the case of John, who had multiple credit cards but used only one for his purchases, leaving others at zero balance for years. Over time, some issuers closed his inactive accounts. When John applied for a mortgage, his credit utilization suddenly appeared higher due to fewer total credit lines, and his credit score decreased by 25 points, impacting his loan terms negatively.

Furthermore, some scoring algorithms give weight to the credit mix—having various forms of credit, including installment and revolving accounts. Without consistent usage on revolving accounts, these models may receive mixed signals, potentially affecting creditworthiness evaluations.

Behavioral and Psychological Pitfalls Leading to Low Credit Utilization Risks

Beyond numerical scoring effects, maintaining exceedingly low or zero credit utilization can have psychological and behavioral impacts that worsen financial health.

Some consumers avoid using credit out of fear of debt or financial mismanagement. However, total avoidance may limit opportunities to build a stronger credit history or take advantage of credit benefits such as rewards, fraud protection, and improved financial flexibility.

Moreover, with too little monthly or regular usage, consumers might miss payment reminders or fail to track changes or fees on their credit accounts, leading to unintended missed payments or unpaid balances. This scenario ironically results in score drops and financial setbacks, especially for those relying only on credit in emergencies without recent positive usage history.

For instance, a 2023 survey by the National Endowment for Financial Education (NEFE) found that 22% of consumers do not use credit cards regularly, and among them, over 35% experienced at least one late payment or fee in the last two years, primarily due to forgetting billing cycles or account changes.

Recommendations for Balanced Credit Utilization

To mitigate risks associated with low credit utilization while taking advantage of its benefits, a balanced approach is essential.

1. Regular, Small Monthly Usage: Experts recommend charging small recurring expenses such as streaming services or utility bills to your credit cards monthly. This maintains usage above 1% while supporting automatic payments and timely credit reports.

2. Pay Off Balances in Full: Utilizing credit is different from carrying large balances. Using benefits strategically while paying off the balance before interest accrual maximizes credit health and avoids debt accumulation.

3. Monitor Credit Reports Frequently: Regularly checking credit reports ensure accounts are active, errors are corrected, and unexpected closures are avoided. Tools like AnnualCreditReport.com allow free yearly checks from the three major credit bureaus.

4. Keep Old Accounts Open: Avoid closing unused credit lines manually, as they contribute to your available credit and length of credit history.

5. Build a Credit Mix: Apart from revolving credit, consider diversifying with installment loans or secured credit if appropriate to your financial situation.

Table 2: Practical Tips to Maintain Healthy Credit Utilization

| Action | Purpose | Frequency |

|---|---|---|

| Use credit card for recurring payments | Maintain 1%-10% utilization and regular activity | Monthly |

| Pay full card balance on or before due date | Avoid interest and late fees | Monthly |

| Review credit reports | Verify account activity, errors, and limit changes | Quarterly to annually |

| Retain long-standing accounts | Preserve credit history length and available credit | Continuous |

| Diversify credit types | Enhance credit mix | As needed |

Real-Life Cases Demonstrating Low Utilization Risks

One notable case involved Lisa, a software engineer with a perfect payment history but extremely low credit usage for over a year. When she applied for a car loan, her lender offered a higher interest rate citing insufficient recent credit activity. Lisa’s credit utilization hovered around 0%, which led to less favorable terms. Upon using her credit cards moderately for a few months before refinancing the loan, her score improved by 30 points and she qualified for better interest rates.

Similarly, a case shared by a financial blogger, Mark, involved an Australian consumer whose credit card issuer decreased his credit limit after 18 months of no usage. The drop reduced his total available credit, increasing utilization on another card and inadvertently reducing his credit score by 20 points. Mark’s experience emphasizes the risks of letting credit lines go inactive.

Looking Ahead: Future Perspectives on Credit Utilization

As credit scoring models evolve, so do the metrics and data points considered. Emerging technologies such as AI-driven credit risk profiling may incorporate a broader array of behavioral data, minimizing reliance on traditional factors like utilization alone.

Some lenders and scoring services are already experimenting with alternative data, such as utility payments, rental history, and even social signals, to build a more holistic credit profile. However, revolving credit behavior and utilization will likely remain an important metric due to its predictive power in assessing risk.

Consumers should anticipate more dynamic credit scoring systems that reward consistent and responsible use rather than penalizing low or no usage per se. This shift could reduce the hidden dangers of low credit utilization while encouraging balanced credit practices.

Moreover, there might be increased customization in credit offers based on personalized utilization patterns, allowing lenders to better tailor credit limits and terms to individual use cases rather than conventional thresholds.

Final Thoughts on Managing Credit Utilization

While low credit utilization is generally positive for credit health, extremely low or zero utilization presents hidden risks that can impact credit scores, loan terms, and credit availability. Maintaining balanced credit usage—in conjunction with timely payments, a diverse credit mix, and ongoing credit monitoring—is essential for optimizing financial wellbeing.

Understanding these nuances helps consumers make smarter credit decisions, avoid surprises, and harness credit as a valuable tool for growth and financial flexibility in a complex and evolving lending landscape.

Post Comment