Rewards vs. Interest: How to Use Credit Cards Without Getting Burned

Anúncios

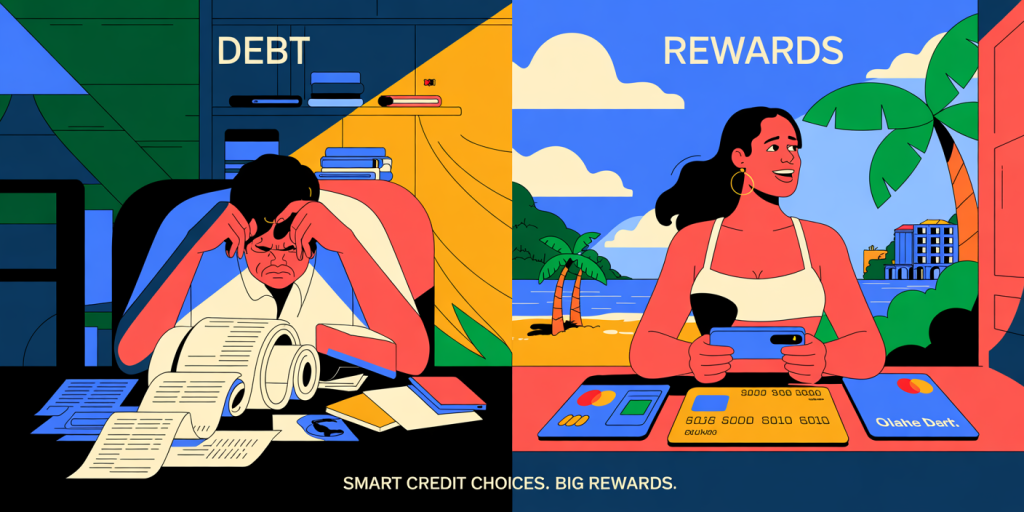

Using a credit card can be a double-edged sword. On one hand, credit cards offer an array of benefits like cashback, travel points, and exclusive discounts that can seemingly enhance your purchasing power. On the other hand, accruing interest on unpaid balances can quickly transform these benefits into costly debts. Navigating the fine line between leveraging rewards and avoiding interest charges requires knowledge, strategy, and discipline.

With Americans racking up over $930 billion in credit card debt as of early 2024 according to the Federal Reserve, understanding how to maximize credit card benefits without getting burned has never been more critical. This article explores the dynamics between credit card rewards and interest, providing practical tips and comparative insights to help you make smarter financial decisions.

Anúncios

Understanding Credit Card Rewards: Types and Applications

Credit card rewards come in various forms, which generally include cashback, points, and travel miles. Cashback rewards provide a direct percentage of your spending back as a credit or deposit, making them straightforward and versatile. Points systems typically require you to redeem accumulated points for merchandise, gift cards, or travel perks. Travel miles similarly accumulate but are specifically tailored for use with airline or hotel partners.

Anúncios

For example, the Chase Sapphire Preferred Card offers 5x points on travel purchased through their portal and 3x points on dining, which can be redeemed for travel at a rate of 1.25 cents per point. This can quickly add up if you’re a frequent traveler or dine out regularly. Alternatively, cards like the Citi Double Cash Card provide a flat 2% cashback on all purchases (1% when you buy and 1% when you pay off your balance), appealing to users seeking simplicity.

The key to maximizing credit card rewards lies in selecting a card aligned with your spending habits. For instance, if most of your expenses are groceries and utilities, a card offering elevated rewards in these categories will serve you better than a general rewards card. According to a 2023 study by NerdWallet, users who chose reward cards tailored to personal spending patterns saved an average of $230 annually compared to those who did not.

The True Cost of Credit Card Interest

Credit card interest is often the hidden cost many consumers overlook. The average credit card interest rate in the U.S. hovers around 19.5%, according to CreditCards.com data from 2024. When balances are carried month-to-month, these interest charges can swiftly decrease any rewards earned.

Consider this practical example: You have a credit card that offers 2% cashback on all purchases but carry a $2,000 balance for 12 months at an 18% APR. The $2,000 balance will accrue approximately $378 in interest over that year. Meanwhile, the 2% cashback on $2,000 in spending amounts to only $40. In this case, the interest cost far outweighs the reward benefit.

This disparity underscores why paying your balance in full each month is arguably the most important strategy for benefiting from credit card rewards. Credit Expert’s 2023 report showed that about 45% of credit card users carry a balance month-to-month, ultimately paying nearly $1,200 more in interest annually than those who pay in full.

Balancing Rewards and Interest: Best Practices to Avoid Debt Traps

To use credit cards effectively without succumbing to interest charges, managing spending and payments is crucial. Firstly, always strive to pay off your entire statement balance each month before the due date. Avoid the minimum payment trap; only paying minimal amounts extends debt and inflates interest expenses.

Secondly, track your spending by category and card to ensure you’re leveraging the right rewards. Many credit issuers now offer apps with detailed insights and alerts. For example, American Express’s app allows users to see real-time points earned and spending categorization, enabling targeted reward optimization.

Moreover, consider automating payments to avoid late fees and interest. According to a 2023 Federal Reserve survey, nearly 60% of late payments are due to forgetfulness or oversight. Setting up automatic full payments reduces this risk while building healthy credit habits.

A comparative table (Table 1) below highlights the impact of paying balances in full versus carrying debt for a typical $3,000 monthly spend with a 20% APR and a 1.5% cashback card.

| Scenario | Monthly Spend | APR | Monthly Interest | Monthly Cashback | Net Gain/Loss |

|---|---|---|---|---|---|

| Pay Balance in Full | $3,000 | 0% | $0 | $45 | +$45 |

| Carry Balance | $3,000 | 20% | $50 | $45 | -$5 |

As the table illustrates, carrying a balance negates the cashback gains and results in a net loss, reinforcing the need for disciplined payment strategies.

Real-Life Cases: Rewards Gone Wrong vs. Rewards Done Right

Real-world examples can help underscore the consequences of mismanaging credit cards or leveraging them correctly.

Case 1: Emily, a young professional, signed up for a credit card earning 3x points on dining and 1x on other purchases. Excited by the rewards, she began charging substantial amounts without paying off her balance monthly. After six months, she accrued nearly $1,200 in interest but her rewards only amounted to $300 in point value. The interest practically erased any benefits, exacerbating her debt.

Case 2: Mark, a business owner, applied for multiple cards focused on travel perks. By tracking expiration dates, redeeming points promptly, and paying monthly bills in full, Mark earned enough miles annually for two free business trips. He reported saving an estimated $4,500 in travel expenses in 2023 alone without paying a cent in interest.

These contrasting cases highlight that credit card rewards work best when coupled with financial discipline and careful planning.

Comparing Rewards Credit Cards: Which Offers the Best Value?

Choosing the right rewards credit card depends on your lifestyle, spending habits, and financial goals. The table below compares three popular rewards cards based on rewards rates, annual fees, and typical APR.

| Card Name | Rewards Type | Rewards Rate | Annual Fee | Average APR (%) | Ideal For |

|---|---|---|---|---|---|

| Chase Sapphire Preferred | Points | 5x Travel, 3x Dining | $95 | 20.49 | Frequent Travelers |

| Citi Double Cash | Cashback | 2% Cashback on all spend | $0 | 19.99 | Simple, Flat Cashback |

| Discover It Cash Back | Cashback | 5% on rotating categories | $0 | 22.49 | Category Spenders |

If you primarily want straightforward cashback without categories or fees, Citi Double Cash is an excellent choice. For those who travel often, Chase Sapphire Preferred’s elevated travel points outweigh the fee. Discover It Cash Back’s 5% rotating categories are beneficial if you can spend strategically and activate offers.

By understanding the different rewards structures alongside interest rates and fees, consumers can make informed decisions to suit their financial behavior.

Future Perspectives: How Credit Card Rewards and Interest May Evolve

Looking ahead, credit card rewards programs and interest policies are likely to continue evolving in response to shifting consumer needs and economic conditions. One emerging trend is the integration of AI-powered personalized rewards. Banks may increasingly tailor rewards offers based on AI analysis of spending patterns, enhancing value while encouraging responsible card use.

Additionally, regulatory bodies are scrutinizing interest rates and fee structures more closely. Governments worldwide are pushing for greater transparency in credit card interest calculations, which may result in more consumer-friendly terms. According to a 2024 report by the Consumer Financial Protection Bureau (CFPB), expected guidelines will require clearer disclosures on how interest is compounded and incurred.

Moreover, digital currencies and blockchain technologies may transform reward redemption options. Some issuers are experimenting with crypto-back rewards, allowing cardholders to earn Bitcoin or Ethereum instead of traditional points. This innovation, however, carries volatility risks and requires consumer education.

Finally, the rise of buy-now-pay-later (BNPL) options presents both challenges and alternatives to traditional credit card interest concerns. While BNPL splits payments interest-free for short terms, it does not build credit history like credit cards and occasionally involves hidden fees.

Taken together, these evolutionary paths suggest credit card users will need to stay informed and adaptable in leveraging rewards while minimizing interest costs.

—

Using credit cards wisely means understanding the nuanced balance between extracting valuable rewards and avoiding the pitfall of high interest charges. By selecting the right card, managing payments strategically, and keeping an eye on evolving trends, consumers can unlock the financial benefits of credit cards while steering clear of costly debt traps. The numbers and examples are clear: the rewards are real, but the interest can be a silent expense that burns your gains if left unchecked.

Post Comment