Prepaid Cards vs. Secured Cards: What’s Better for New Credit Builders?

Anúncios

Starting to build credit can feel like navigating a maze for many individuals, especially young adults, recent immigrants, or those recovering from financial setbacks. Choosing the right financial product is crucial, as it can impact one’s creditworthiness and access to better financial opportunities over time. Two commonly suggested tools for new credit builders are prepaid cards and secured credit cards. Each serves specific purposes and comes with unique pros and cons. This article dives deep into prepaid cards versus secured cards, exploring which option is better for those embarking on their credit-building journeys.

Understanding the Basics: Prepaid Cards and Secured Cards Explained

Prepaid cards are essentially reloadable wallets that require users to deposit money upfront. Unlike traditional debit or credit cards, prepaid cards do not draw money from a bank account nor extend credit. Users spend only the amount they load on the card, making prepaid cards a popular choice for budgeting, gift-giving, and for individuals without bank accounts.

Anúncios

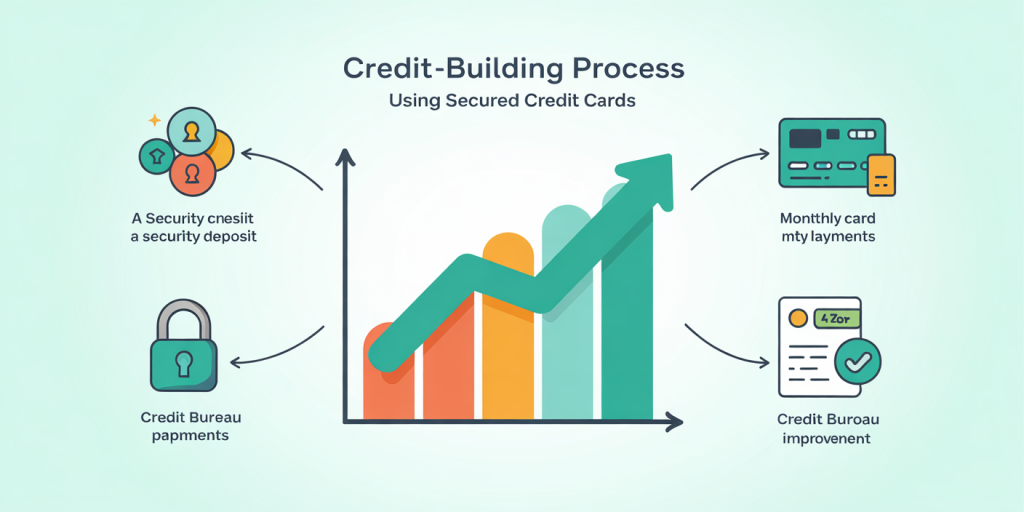

Secured credit cards, on the other hand, are designed explicitly for credit building. These cards require a security deposit, which typically serves as the cardholder’s credit limit. The card functions like a regular credit card; users make purchases on credit, then repay the balance. Payments are reported to credit bureaus, which allows the cardholder to build or rebuild credit when managed responsibly.

For example, Maria, a 22-year-old college student, started with a prepaid card to manage her expenses but realized it wouldn’t improve her credit. Later, she opted for a secured card where she deposited $500 as collateral. After 12 months of consistent payments, Maria’s credit score increased by over 70 points—enabling her to qualify for an unsecured credit card.

Anúncios

Credit Building Potential: Why It Matters

A central goal for anyone using financial products in their early credit-building stages is to enhance their credit score. Credit scores are crucial for determining loan approval, interest rates, and even rental opportunities. According to Experian (2024), 69% of U.S. consumers check their credit scores regularly, emphasizing how important credit is in financial decision-making.

Prepaid cards do not impact credit scores at all. Since they do not involve borrowing or repayments, there is no credit activity to report to bureaus like Equifax, Experian, or TransUnion. Consequently, prepaid card users won’t see any credit history or score improvements by using them.

Secured cards, by contrast, are one of the few credit-building products accessible to people with no credit or bad credit. Monthly payments and usage are reported to credit bureaus, meaning responsible card usage—such as paying balances on time and maintaining low credit utilization—can reflect positively on credit reports. For instance, a report by the Consumer Financial Protection Bureau (2022) showed that 67% of secured card users with responsible payment histories improved their credit scores by an average of 50 points within nine months.

Comparative Table: Credit Building Features

| Feature | Prepaid Cards | Secured Credit Cards |

|---|---|---|

| Credit Reporting | No | Yes |

| Credit Limit Determination | Based on prepaid balance | Based on security deposit |

| Risk of Debt | None | Potential if spending exceeds budget |

| Ideal for Credit Building | No | Yes |

| Typical Annual Fees | Low to moderate | Moderate to high |

Cost and Fees: What Will You Pay?

Understanding the cost structure of prepaid versus secured cards is key for new credit builders. Prepaid cards often carry fees such as activation fees, monthly maintenance charges, ATM withdrawal fees, and transaction fees. For example, the NetSpend prepaid card charges activation fees up to $9.95 and monthly fees of about $5-$10 depending on the plan. These fees can add up quickly and diminish the cardholder’s spending power.

Secured credit cards may have annual fees, which range widely by issuer—from zero up to $75 or more. Some cards waive fees for the first year as a promotion. Additionally, secured cards may have standard credit card interest rates if balances are not paid in full each month. Interest rates for secured cards typically range from 18% to 25% APR, so users are advised to pay off balances monthly to avoid extra costs.

Take the case of Jordan, a 30-year-old startup employee who initially chose a prepaid card but found it difficult to save money due to substantial monthly fees. Switching to a secured card with a $35 annual fee and no monthly maintenance fee ended up saving Jordan over $100 per year, while also helping build credit.

Fees Comparison Table

| Fee Type | Prepaid Card Examples | Secured Card Examples |

|---|---|---|

| Activation Fee | $5 – $10 | None or $25 initial deposit (security) |

| Monthly Fee | $5 – $10 | $0 – $35 annual fee (no monthly fee mostly) |

| ATM Withdrawal Fee | $2 – $3 per withdrawal | Varies by issuer, sometimes reimbursed |

| Interest Rate | 0% (no credit) | 18% – 25% APR (if balance not paid) |

Usage and Accessibility: Convenience vs. Credit Utility

Prepaid cards provide ease and convenience. They are widely accessible, often requiring no credit check or bank account. They can be purchased at retail stores or online with minimal paperwork. This is beneficial for people with poor or no banking history, enabling them to participate in non-cash transactions such as online shopping, bill payments, or managing allowances.

However, prepaid cards have spending limitations as users can only use the balance stored on the card. Moreover, prepaid cards usually cannot be used to establish credit relationships or earn rewards.

Secured cards function like traditional credit cards, accepted anywhere major credit cards are. With secured cards, users can make purchases without upfront spending limits tied to a prepaid balance, allowing for more flexible budgeting. Cardholders also often benefit from the ability to earn rewards points or cash back.

Consider the example of Angela, a recent immigrant who found it difficult to obtain traditional credit due to no U.S. credit history. She started with a prepaid card for everyday transactions but quickly transitioned to a secured card which allowed her greater flexibility and access to rental car bookings and online marketplaces that required credit.

Security and Fraud Protection: Which Offers Better Safety?

One of the concerns for new users venturing into financial products involves security and fraud protection. Prepaid cards do provide some consumer protections, but these vary by provider. The Federal Trade Commission (FTC) notes that while prepaid cards protect consumers under regulations such as the Electronic Fund Transfer Act, the process of recovering lost or stolen funds can be slow and limited.

Secured cards, classified as credit products, offer stronger fraud protection under the Truth in Lending Act. Cardholders are liable for a maximum of $50 in unauthorized charges, and many issuers provide zero-liability policies as a standard.

Hidden fees and spending confusion on prepaid cards can also lead to unintended overdrawing or declined transactions. On the flip side, because secured cards allow credit, users must be vigilant to avoid debt accumulation through overspending.

Accordingly, Robert, a young professional, reported being relieved after switching from a prepaid card—which he used for online shopping but had limited fraud support—to a secured credit card, where he could dispute unauthorized charges more efficiently and avoid financial loss.

Future Perspectives for Credit Builders

Looking ahead, the financial industry continues to innovate in the realm of credit building tools targeted at underserved populations. Credit bureaus and fintech companies are exploring alternative data, such as rental payments, utility bills, and even subscription services, to help consumers build credit beyond traditional revolving credit products.

For prepaid cards, integration with credit reporting is minimal but may evolve as regulatory landscapes change. Meanwhile, secured cards are expected to become more affordable and accessible, with some issuers offering no-fee secured cards and customizable deposit requirements to accommodate varying financial situations.

Moreover, artificial intelligence and machine learning are being used to create “smart” products tailored to individual credit-building goals, offering personalized spending alerts, automatic payments, and real-time credit insights.

In practice, new credit builders might benefit from a hybrid approach. Starting with prepaid cards for budgeting and transitioning to secured cards as soon as possible could harness the strengths of both. Additionally, financial education initiatives will likely continue to focus on helping users understand when secured credit cards provide superior benefits for growth over prepaid cards.

In summary, for individuals determined to build credit, secured credit cards, despite their potential costs and responsibilities, offer tangible advantages over prepaid cards through credit reporting, practical credit usage, and fraud protection. However, the right choice depends on personal circumstances, goals, and financial discipline.

Post Comment