Maximize Your Roth IRA Tax Benefits: A Strategic Retirement Guide

Anúncios

Roth IRAs: A Smart Strategy for Tax-Free Retirement Growth

When it comes to preparing for retirement, Roth IRA accounts stand out as one of the most effective and accessible tools available to U.S. citizens. Thanks to their favorable tax treatment and long-term growth potential, they play a key role in smart retirement planning. Whether you’re just getting started or looking to optimize your existing savings strategy, a Roth IRA can offer long-lasting benefits that go far beyond traditional retirement accounts.

This guide will walk you through how Roth IRAs work, the tax benefits they offer, and smart strategies to help you get the most out of your retirement savings.

What Is a Roth IRA?

Anúncios

A Roth IRA is a type of retirement savings account that allows your money to grow tax-free. Unlike traditional IRAs, where contributions may be tax-deductible in the year they’re made, Roth IRA contributions are made with after-tax dollars. That means you pay taxes on the money before you contribute, but qualified withdrawals in retirement—including both contributions and earnings—are completely tax-free.

This structure makes Roth IRAs especially attractive for individuals who expect to be in the same or a higher tax bracket during retirement.

Anúncios

A Standout Advantage: No Required Minimum Distributions

One unique and highly valuable feature of Roth IRAs is the fact that they have no required minimum distributions (RMDs). Unlike traditional IRAs and 401(k)s, which require you to start withdrawing money at age 73 (as of 2023), Roth IRAs allow you to keep your funds invested for as long as you wish.

This means:

-

Your investments can continue compounding tax-free throughout your retirement.

-

You can pass on more wealth to your heirs.

-

You maintain full control over when and how much to withdraw.

This flexibility makes Roth IRAs an excellent choice not only for retirement income but also for legacy and estate planning purposes.

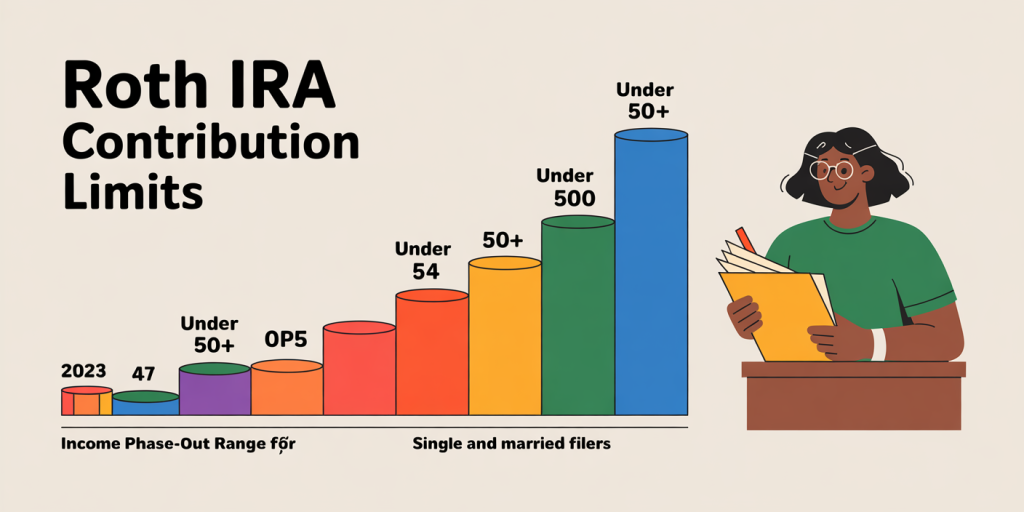

Contribution Rules and Income Limits

To get the full benefits of a Roth IRA, it’s important to understand the rules surrounding contributions, including the annual limits and income thresholds.

Contribution Limits (As of 2023):

-

If you’re under age 50, you can contribute up to $6,500 per year.

-

If you’re 50 or older, you can contribute up to $7,500 annually, thanks to catch-up contributions designed to help older savers build their nest egg faster.

These limits apply across all IRA accounts combined. So if you contribute to both a Roth and a traditional IRA, your total contributions to both accounts cannot exceed the limit for your age group.

Income Limits:

Your ability to contribute to a Roth IRA depends on your modified adjusted gross income (MAGI) and your tax filing status.

-

For single filers, the phase-out for Roth IRA contributions begins at $138,000, and eligibility phases out entirely at $153,000.

-

For married couples filing jointly, the phase-out starts at $218,000, with full phase-out at $228,000.

If your income exceeds these thresholds, you cannot contribute directly to a Roth IRA—but there are still ways to benefit from one (explained later).

The Power of Timing

When it comes to maximizing the tax advantages and growth potential of your Roth IRA, timing matters a lot.

Early Contributions = Bigger Growth

Making contributions early in the tax year gives your money more time to benefit from compounding returns. The longer your funds remain invested, the more they can grow—especially if you contribute consistently year after year.

💡 Example:

If you contribute $6,500 in January versus waiting until the following April (the tax filing deadline), you gain 15 additional months of potential growth—every year.

Over decades, these small differences can add up to tens of thousands of dollars, especially when invested in diversified assets like index funds or ETFs.

Take Advantage of Roth Conversions

Another way to grow your Roth IRA—even if you’re not eligible to contribute directly—is through a Roth conversion.

What Is a Roth Conversion?

A Roth conversion involves transferring money from a tax-deferred retirement account (such as a traditional IRA or a 401(k)) into a Roth IRA. The converted amount becomes taxable in the year of the conversion, but once inside the Roth, it grows tax-free and can be withdrawn tax-free in retirement.

This strategy is particularly effective in years when your income is lower, such as during a career break, in early retirement, or before you begin collecting Social Security.

Advanced Strategies for Savvy Savers

If you’re already familiar with the basics, there are a few additional tactics to help you get even more from your Roth IRA.

1. The Backdoor Roth IRA

If your income is too high to qualify for direct Roth IRA contributions, consider a backdoor Roth IRA, which works in two steps:

-

First, make a non-deductible contribution to a traditional IRA.

-

Then, convert that contribution to a Roth IRA.

Because the contribution was made with after-tax dollars, there’s no tax due on the conversion—unless you have pre-tax IRA balances, in which case pro-rata rules may apply. This strategy is perfectly legal and widely used by high-income earners.

2. Diversify Your Retirement Accounts

Even though Roth IRAs are powerful, they work best as part of a broader retirement plan. Consider maintaining a mix of:

-

Roth IRAs: For tax-free withdrawals

-

Traditional IRAs or 401(k)s: For tax-deferred growth and deductible contributions

-

Taxable brokerage accounts: For flexible access and capital gains optimization

This diversification gives you flexibility in retirement, helping you manage your tax bracket year by year and withdraw funds in the most tax-efficient way possible.

Strategic Roth Conversions

Timing your Roth conversions can amplify their benefits.

When Does It Make Sense?

-

In a year where your income is unusually low

-

After retirement but before collecting Social Security or starting RMDs from other accounts

-

If you expect tax rates to rise in the future

Converting smaller amounts strategically over several years (a process known as “laddering” conversions) helps you avoid jumping tax brackets and spreads out your tax liability while still shifting money into a Roth.

Roth IRAs and Estate Planning

Roth IRAs are not just for your personal retirement—they also make an excellent estate planning vehicle.

Key Benefits for Heirs:

-

No RMDs during your lifetime = more tax-free growth

-

Heirs inherit tax-free withdrawals (under certain IRS rules)

-

Allows you to pass on wealth efficiently, especially compared to taxable brokerage accounts or traditional IRAs

As of current IRS guidelines, non-spouse beneficiaries must fully distribute inherited Roth IRAs within 10 years—but they can still enjoy tax-free distributions during that period.

If you’re planning to leave a legacy, a Roth IRA can be a smart way to do it without saddling your heirs with tax burdens.

Final Thoughts

Roth IRAs offer a rare and powerful combination of tax efficiency, investment growth potential, and flexibility in both retirement planning and estate strategy. Whether you’re just starting to save or fine-tuning your approach in your 40s or 50s, taking advantage of Roth IRA rules can have a profound impact on your long-term wealth.

To make the most of your Roth IRA:

-

✅ Contribute early and consistently

-

✅ Understand income limits and eligibility

-

✅ Use Roth conversions wisely

-

✅ Consider the backdoor Roth strategy if needed

-

✅ Build a diverse portfolio of tax-advantaged accounts

-

✅ Think about your legacy goals and how a Roth IRA fits in

A well-planned Roth IRA today can mean tax-free financial freedom tomorrow, providing both peace of mind and a reliable income stream in retirement.

Post Comment