Learn How to Apply for a Wells Fargo Active Cash Card

Anúncios

What do You Need to Know Before Applying for the Wells Fargo Active Cash Card?

The Wells Fargo Active Cash Credit Card has two major benefits: unlimited 2% cashback on all categories and a $200 reward bonus!

* you will be sent to another site

CREDIT CARD

Anúncios

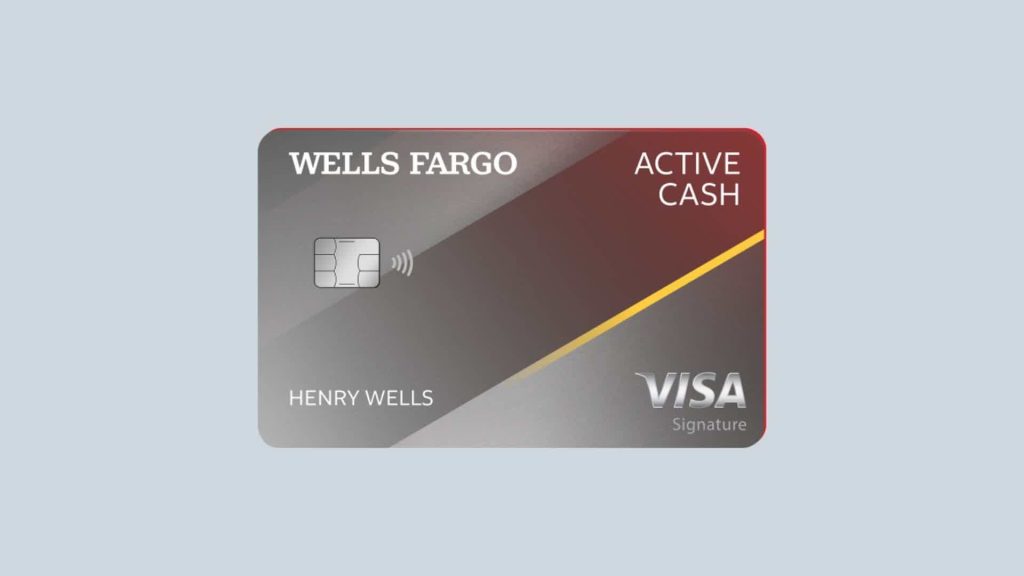

Wells Fargo Active Cash

Want a safe everyday card? Apply now.

Anúncios

The Wells Fargo Active Cash® Card: Widely Acclaimed and Rewarding

The Wells Fargo Active Cash® Credit Card is one of the most celebrated cards in the U.S. market, consistently praised for its simplicity and value. Its recognition includes:

Best Simple Cashback Credit Card — NerdWallet, 2022, 2023, and 2024

Best No Annual Fee Card — The Ascent, 2023

Best Fixed-Rate Cashback Card — Bankrate Awards, 2024

Unlimited 2% Cash Back with Flexible Redemption

The Active Cash card offers unlimited 2% cash back on all purchases, with no rotating categories or activation required.

You can redeem your rewards in multiple ways:

Statement credit

Gift cards

Direct deposit into your Wells Fargo account

ATM withdrawals (at eligible ATMs)

PayPal purchases

Transparent Fees and Introductory APR

Annual Fee: $0

Introductory APR: 0% for 15 months on qualifying purchases and balance transfers

Ongoing Variable APR: 20.24%, 25.24%, or 29.99%, depending on creditworthiness

Balance Transfer Details: The standard APR applies after 120 days

Extra Benefits for Everyday and Emergency Needs

This card is designed to serve you well in everyday situations and during travel. Key benefits include:

Cell Phone Protection — Up to $600 per claim for damage or theft (with a $25 deductible)

Emergency Travel Assistance — Available 24/7

Zero Liability Protection — No responsibility for unauthorized transactions when promptly reported

My Wells Fargo Deals — Personalized merchant offers and cashback discounts

Credit Close-Up® — Real-time FICO® Score tracking

Roadside Dispatch — Available 24/7

Auto Rental Collision Damage Waiver — Coverage for damage or theft of eligible rental cars

Visa Signature® Privileges — Concierge services, luxury hotel access, and more

Who Can Apply?

The eligibility requirements for the Active Cash card are accessible to many:

Must be a U.S. citizen or have a valid work visa

Must have up-to-date documentation, regardless of nationality

Be at least 18 years old (age may vary by state, usually 19–21)

Have verifiable income

Possess a FICO score in the “Good” to “Excellent” range (typically 670+)

Your annual income and credit score will also help determine your approved credit limit.

How to Apply for the Wells Fargo Active Cash Card

Ready to get started? Here’s how to apply:

Visit the official Wells Fargo website

Click on “Apply Now” for the Active Cash card

If you’re already a Wells Fargo customer, sign in to auto-fill your application

If you’re new to Wells Fargo, provide the following:

Full name

Social Security Number

Date of birth

U.S. address, city, ZIP code

Email and phone number

Country of birth

Answer to a security question

Housing status (own, rent, etc.)

Employment status (employed, self-employed, unemployed, or retired)

Total annual income

Agree to the bank’s terms and verification procedures

Submit the form and wait for a decision

Wells Fargo generally provides quick responses, especially when all information is accurate and complete.

⚠️ Note: Meeting all criteria does not guarantee approval, as final decisions are made at Wells Fargo’s discretion.

Explore More Options?

If you’re searching for a card with up to 5% cashback in customizable categories, the U.S. Bank Cash+® Visa Signature® Card is a great alternative. It features similar application requirements and offers generous cashback across various spending areas.

Post Comment