How to Use Buy Now, Pay Later Services Wisely

Anúncios

Buy Now, Pay Later: A Guide to Responsible Use

In recent years, Buy Now, Pay Later (BNPL) services have transformed the way Americans shop. With the rise of platforms like Affirm, Afterpay, Klarna, Zip, and others, consumers now have the option to spread out the cost of purchases over several payments—often without interest.

From fashion and electronics to groceries and travel, BNPL has embedded itself across various retail sectors, both online and in-store. For many, it offers a refreshing alternative to traditional credit cards and store financing. However, as with any financial product, the convenience of BNPL can come with consequences if not managed responsibly.

This guide will help you understand how BNPL works, evaluate whether it fits your financial situation, and adopt strategies to use it safely and wisely—so you can enjoy the benefits without falling into debt.

Anúncios

What Is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later is a type of short-term financing that allows consumers to break the cost of a purchase into smaller, scheduled installments. Usually, this means splitting payments into four equal parts, paid biweekly or monthly, depending on the provider.

Anúncios

Here’s how it works:

-

At checkout—either online or in-store—you select a BNPL option instead of using a credit card.

-

The service conducts a soft credit check or risk assessment (no impact on your score).

-

You’re instantly approved (or denied), and the transaction is completed.

-

You pay an initial installment, and the remaining amount is spread across the following weeks or months.

Many BNPL plans are interest-free, as long as you make payments on time. However, some providers offer longer financing plans with interest rates ranging from 10% to 30%, especially for larger-ticket items.

✅ Example: You buy a $200 pair of headphones using a BNPL plan. Instead of paying the full $200 upfront, you make four $50 payments every two weeks.

Why Is BNPL So Popular?

Several factors contribute to the explosion of BNPL use across the U.S.:

-

Convenience: Instant approval at checkout without lengthy applications.

-

Budgeting: Smaller, predictable payments fit more easily into monthly budgets.

-

Interest-free options: For shorter terms, there’s often no interest—unlike traditional credit cards.

-

Appeal to younger users: BNPL services are especially popular among Millennials and Gen Z, many of whom prefer alternatives to credit cards.

In 2023 alone, BNPL services were used by over 100 million Americans, and their reach continues to grow. Yet, with popularity comes risk—especially when users engage these services without a full understanding of the terms.

Assess Your Financial Readiness First

Before clicking “Pay Later,” pause and assess your current financial picture.

Ask yourself:

-

Do I have existing debt (credit cards, student loans, personal loans)?

-

What are my fixed monthly obligations (rent, utilities, car payments)?

-

Do I have disposable income that can absorb a new BNPL plan?

If you’re already juggling multiple bills, adding more—even small ones—can increase your stress level and risk of missed payments.

📌 Pro Tip: Use a budgeting app like YNAB, Mint, or Monarch to run scenarios. Plug in your upcoming BNPL payments to see how they’ll impact your cash flow.

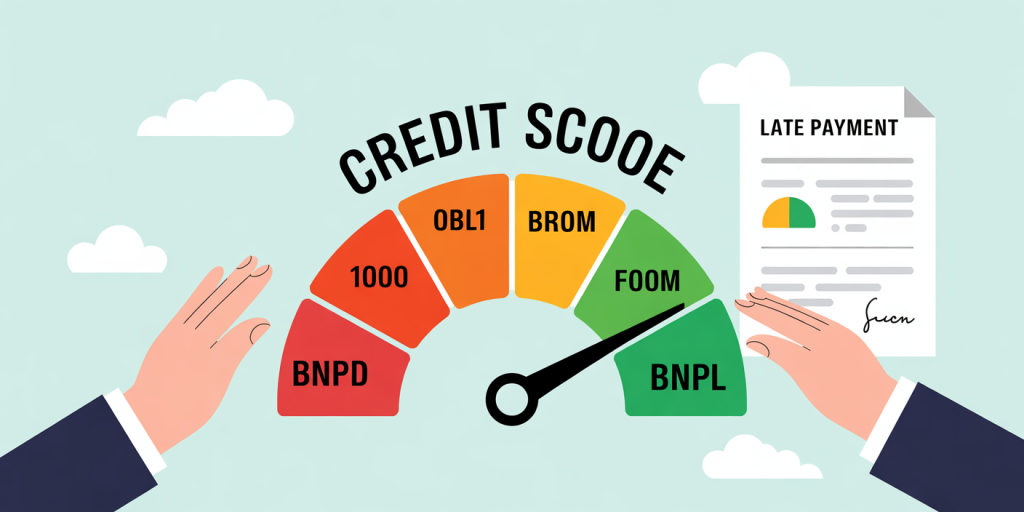

It’s also important to remember that missed or late BNPL payments can sometimes be reported to credit bureaus, depending on the provider. This could harm your credit score, especially if late payments are sent to collections.

Read the Terms Carefully

Every BNPL service operates slightly differently. Before committing to a plan, take the time to read and understand:

1. Interest Rates and Fees

-

Is the plan interest-free or are there APR charges?

-

What happens if you miss a payment? Are there late fees?

2. Payment Schedule

-

How often are payments due—biweekly or monthly?

-

When is the first payment taken? Some services deduct it immediately.

3. Credit Reporting Policies

-

Some BNPL providers report to credit bureaus (e.g., Affirm reports to Experian).

-

Others do not report unless your account becomes delinquent or sent to collections.

4. Return and Refund Policy

-

What happens if you return a product?

-

Will you still owe payments while the return is processed?

-

Some providers continue to collect installments until the return is fully verified.

Understanding these details helps you avoid unpleasant surprises and ensures you’re not unknowingly entering into unfavorable terms.

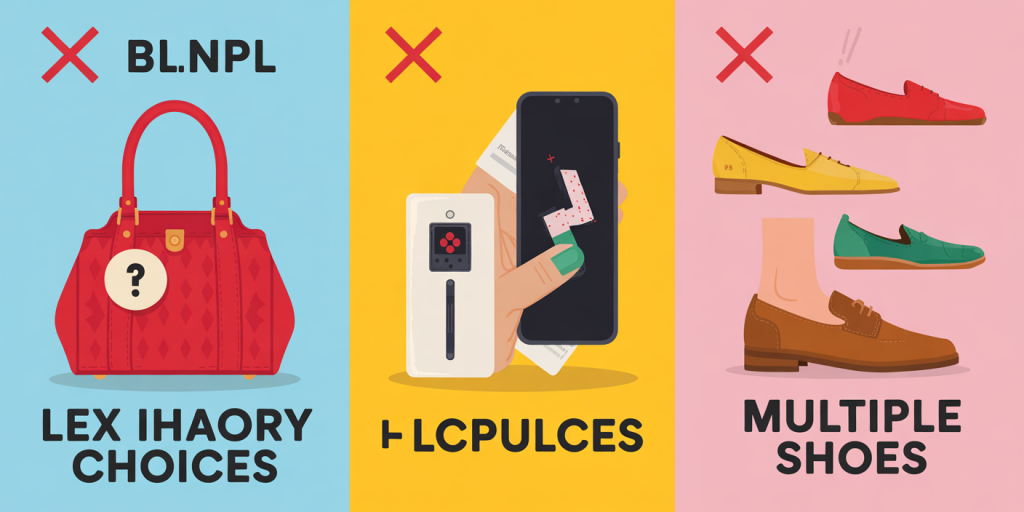

Spend with Intention, Not Impulse

One of the most powerful marketing advantages of BNPL is psychological: it makes purchases feel smaller than they actually are. This can lead to impulse buying—a major risk for your financial health.

To spend intentionally:

-

Introduce a cooling-off period before large or nonessential purchases.

-

Create a wishlist instead of buying on the spot.

-

Establish a BNPL budget—a portion of your income specifically allocated to these types of purchases.

💡 Rule of Thumb: If you wouldn’t be comfortable buying it in full today, you shouldn’t BNPL it either.

Using BNPL only for pre-planned purchases (like new work attire, seasonal gifts, or household essentials) helps prevent regret and supports long-term financial discipline.

Stay on Top of Your Payments

Managing BNPL plans responsibly is key to avoiding debt and preserving your credit.

Here’s how to stay organized:

-

Set up automatic payments to avoid missing due dates.

-

Use your BNPL provider’s mobile app to monitor upcoming installments.

-

Sync your BNPL payments with your personal budget or expense tracker.

-

Enable email or SMS reminders.

Also, monitor your bank account regularly to ensure sufficient funds are available before automatic withdrawals. Insufficient funds can result in overdraft fees from your bank in addition to late fees from the BNPL provider.

Avoid Overlapping BNPL Plans

It’s easy to lose track when you have multiple BNPL plans active at once. While each plan might seem manageable on its own, together they can snowball into a burdensome web of payments.

Risks of overlapping plans include:

-

Payment dates colliding with rent or credit card bills

-

Forgetting due dates and accruing late fees

-

Overestimating your repayment ability

-

Damaging your credit profile (if reported)

⚠️ Stat: In a 2022 study by the CFPB, 42% of BNPL users had multiple plans open simultaneously, and nearly a third struggled to make payments.

Limit yourself to one or two active BNPL plans at a time. Finish paying off one before starting another. This approach keeps your financial commitments manageable and transparent.

When to Use BNPL — And When Not To

✅ Good Uses of BNPL:

-

Emergency expenses (e.g., car repairs, medical devices)

-

Planned purchases with clear repayment capability

-

Items that are needed now but paid off quickly

❌ Avoid Using BNPL For:

-

Impulse buys

-

Subscriptions or recurring services

-

Luxury or status-driven purchases

-

Anything you couldn’t afford without BNPL

How BNPL Impacts Your Credit

Most BNPL platforms do not conduct a hard credit inquiry when approving a plan, but their relationship with your credit doesn’t stop there.

-

Positive payment history may not be reported (missing out on potential credit score improvement).

-

Negative behavior, such as missed payments or defaults, can harm your credit if reported or sold to collections.

If credit-building is a goal, consider using traditional credit cards responsibly or looking for BNPL providers that report on-time payments.

Final Thoughts: BNPL With Balance and Intention

Buy Now, Pay Later services can be powerful financial tools—when used intentionally and with a clear understanding of the terms. They offer flexibility, interest-free plans, and smoother budgeting for life’s essential (and sometimes unexpected) purchases.

However, just like credit cards or personal loans, they can cause real harm if used irresponsibly.

To use BNPL wisely:

-

✅ Evaluate your budget before applying

-

✅ Read the full terms and repayment rules

-

✅ Limit how many BNPL plans you juggle at once

-

✅ Avoid impulsive spending

-

✅ Track your payments religiously

When approached with mindfulness and strategy, BNPL can enhance your financial flexibility—not erode it.

Post Comment