How to Transition From College Budgeting to Adult Financial Planning

Anúncios

Graduating from college is an exciting milestone. You’ve spent years working hard, learning new skills, and dreaming about your future. But with that diploma comes a new kind of responsibility: financial adulthood.

During college, budgeting typically revolves around managing part-time job income, student loans, and surviving on a tight schedule and even tighter wallet. But post-graduation brings a broader financial landscape—rent, insurance, taxes, long-term debt, and retirement planning. Transitioning from a student mindset to adult financial independence is one of the most important shifts you’ll make.

In this guide, we’ll explore how to move from basic college budgeting to a comprehensive adult financial plan—step by step.

Anúncios

Step 1: Assess Where You Are Now

Before you start planning your financial future, it’s essential to take inventory of your current financial situation.

Anúncios

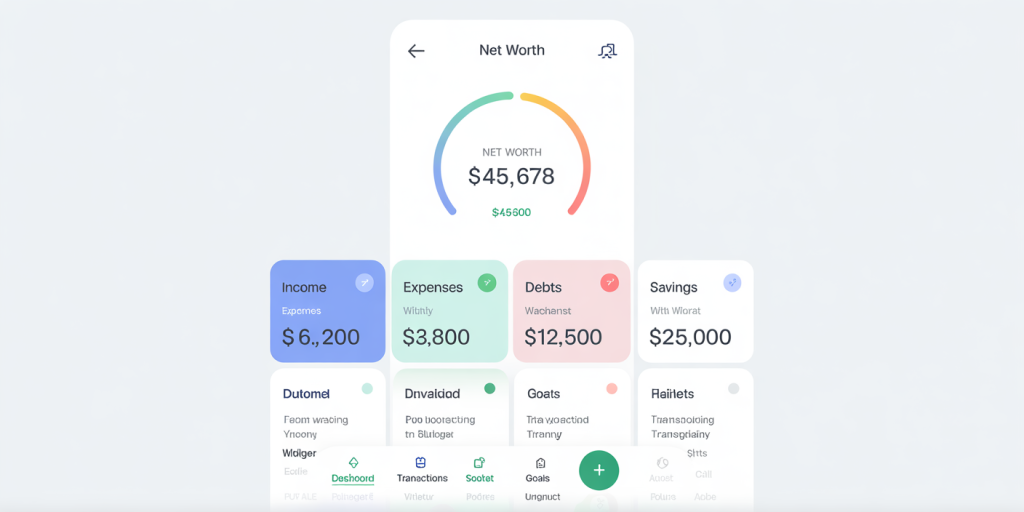

Create a Financial Snapshot:

-

Income: What is your current monthly take-home pay?

-

Expenses: List out monthly rent, groceries, transportation, subscriptions, etc.

-

Debts: Include credit card balances, student loans, and personal loans.

-

Assets: Note any savings, investments, or cash you currently have.

-

Credit Score: Check your credit score through a free service like Credit Karma or your bank.

Having a clear overview will help you build a realistic plan—and avoid surprises.

Step 2: Rebuild Your Budget for Real Life

Your college budget likely focused on ramen, textbooks, and part-time job income. Now, your priorities and expenses are shifting.

Key Differences in an Adult Budget:

-

Fixed Living Costs: Rent, utilities, and insurance replace dorm payments.

-

Debt Repayment: Student loan payments begin (usually six months post-graduation).

-

Retirement Contributions: 401(k), IRA, or other long-term savings.

-

Health Costs: You may need to pay for your own insurance if you’re off your parents’ plan.

-

Taxes: Understand withholding from your paycheck and start planning for tax season.

Use a budgeting method like the 50/30/20 rule to start:

-

50% on needs (rent, bills, groceries)

-

30% on wants (entertainment, shopping)

-

20% on savings and debt repayment

Budgeting apps like YNAB, Mint, or Monarch Money can help you organize and automate this process.

Step 3: Build an Emergency Fund

An emergency fund is your financial safety net—and one of the first things you should establish in adulthood. It covers unexpected expenses like medical bills, car repairs, or job loss.

How Much to Save:

-

Aim for 3 to 6 months of essential living expenses.

-

Start with a goal of $1,000 and work your way up.

-

Keep the money in a high-yield savings account (not your checking account).

Having a cushion can keep a small setback from turning into a financial crisis.

Step 4: Make a Plan for Student Loans

Student loans don’t need to define your future, but they do require attention.

Know Your Loans:

-

Are they federal or private?

-

What are the interest rates and minimum payments?

-

When does repayment begin?

Choose a Strategy:

-

Standard Repayment Plan: Fixed monthly payments over 10 years.

-

Income-Driven Repayment Plans: Adjusted to your income level (for federal loans).

-

Aggressive Payoff: Make extra payments to reduce interest and term.

Use tools like the Federal Student Aid loan simulator to compare options.

If you’re struggling, look into deferment, forbearance, or consolidation. Never ignore your loans—delinquency and default damage your credit and limit financial freedom.

Step 5: Start Building Credit the Right Way

Your credit score is your financial reputation. It affects your ability to rent an apartment, buy a car, or get a mortgage someday.

Good Credit Habits:

-

Pay bills on time—every time.

-

Keep credit card balances below 30% of your limit.

-

Only open accounts you need.

-

Monitor your credit report annually via AnnualCreditReport.com.

If you’re just starting, consider a starter credit card or secured card to build history responsibly.

Step 6: Begin Saving for Retirement Now

Yes, even if you’re in your 20s.

Time is your greatest asset in retirement planning thanks to compound interest. Starting early—even with small amounts—can significantly impact your future wealth.

Where to Start:

-

Employer 401(k): If your company offers a match, contribute enough to get the full match—it’s free money.

-

Roth IRA: Great option if you don’t have access to a 401(k) or want tax-free growth.

Contribute what you can. Even $50–$100 per month adds up over time.

Step 7: Understand Taxes and Withholding

Your first adult paycheck might be smaller than expected due to federal, state, and payroll taxes.

What to Know:

-

W-4 Form: This determines how much tax your employer withholds. Use the IRS Tax Withholding Estimator to fill it out correctly.

-

Tax Filing: Learn how to file your taxes annually or use tools like TurboTax, FreeTaxUSA, or hire a professional.

-

Deductions & Credits: Student loan interest, retirement contributions, and education expenses may reduce your tax burden.

Staying tax-savvy ensures you aren’t caught off guard in April.

Step 8: Get the Right Insurance

Insurance protects you from large, unexpected financial losses. As an adult, you’ll likely need to secure coverage on your own.

Types of Insurance to Consider:

-

Health Insurance: Mandatory in many states; use your employer or marketplace plans.

-

Renter’s Insurance: Covers your belongings and liability in your rental unit.

-

Auto Insurance: Required if you drive—shop for competitive rates.

-

Life Insurance: If someone depends on your income, term life insurance is affordable and smart.

Don’t go uninsured. A single incident can wipe out your savings.

Step 9: Set Short- and Long-Term Financial Goals

In college, goals may have included affording spring break or paying off textbooks. As an adult, you’ll want to think bigger and longer-term.

Examples of SMART Goals:

-

Pay off $5,000 in credit card debt in 12 months

-

Save $10,000 for a house down payment in 3 years

-

Contribute $200/month to a Roth IRA starting this year

-

Build a 6-month emergency fund in 18 months

Write down your goals and revisit them quarterly. Adjust as your income and priorities evolve.

Step 10: Learn to Say No to Lifestyle Inflation

As your income increases, so does the temptation to spend more. This is called lifestyle inflation, and it’s one of the biggest obstacles to building wealth.

Combat It By:

-

Keeping housing and car costs in check

-

Avoiding subscription overload

-

Automating savings and retirement contributions

-

Comparing purchases to your goals: “Does this help future me?”

Enjoy your income—but don’t let spending grow faster than your wealth.

Step 11: Educate Yourself Continuously

Personal finance is a lifelong learning journey. The more you know, the more empowered you’ll feel to make informed decisions.

Resources to Explore:

-

Books: The Psychology of Money, I Will Teach You to Be Rich, Your Money or Your Life

-

Podcasts: Afford Anything, ChooseFI, The Dave Ramsey Show

-

Blogs & Courses: NerdWallet, Investopedia, Khan Academy, Coursera personal finance classes

Knowledge compounds like money. Make it a habit.

Final Thoughts

The leap from college budgeting to adult financial planning can feel overwhelming—but it’s also incredibly empowering. By building good habits now, you’ll lay the foundation for a secure, flexible, and financially independent future.

Start with small wins: create a budget, build an emergency fund, and make your first retirement contribution. From there, grow your plan as your career and income evolve. Don’t compare yourself to others—everyone’s financial journey is different.

What matters most is that you start. Because once you take control of your finances, you take control of your future.

Post Comment