How to Set Up a Financial Emergency Binder for Your Family

Anúncios

Imagine this: there’s a sudden emergency—an accident, illness, natural disaster, or even death—and your family is left scrambling to find critical financial documents. No one knows where the insurance policies are. Bills go unpaid. Assets are frozen. Stress skyrockets.

Now imagine a different scenario: your loved ones open a binder, neatly organized with every important financial document, account, and instruction they need. There’s no confusion, no panic—just clarity and peace of mind.

That’s the power of a financial emergency binder. And the good news? You don’t have to be wealthy to need one—or to create one.

Anúncios

In this guide, you’ll learn exactly what a financial emergency binder is, why it matters, and how to set one up step by step—so your family is protected, no matter what life throws your way.

What Is a Financial Emergency Binder?

Anúncios

A financial emergency binder (sometimes called an “In Case of Emergency” or “ICE” binder) is a centralized, physical or digital location that holds all the essential information your family would need in a crisis.

It includes things like:

-

Account numbers

-

Insurance policies

-

Passwords

-

Bills and debts

-

Legal documents

-

Emergency contacts

-

Instructions for care, finances, or funerals

Whether you’re married, single, a parent, or retired, having this binder is a smart and loving way to protect your household from chaos during life’s most stressful moments.

Why Every Family Needs One

Creating a financial emergency binder isn’t about expecting the worst—it’s about preparing for it. Here’s why every family should have one:

✅ Peace of Mind

Your loved ones won’t be left guessing or digging through file cabinets.

✅ Time-Saving in Emergencies

Quick access to information saves time when every second counts—like during a hospitalization or disaster.

✅ Reduces Legal Delays

Having updated documents helps avoid probate issues or frozen accounts.

✅ Ensures Your Wishes Are Followed

Your financial and personal instructions are clearly laid out.

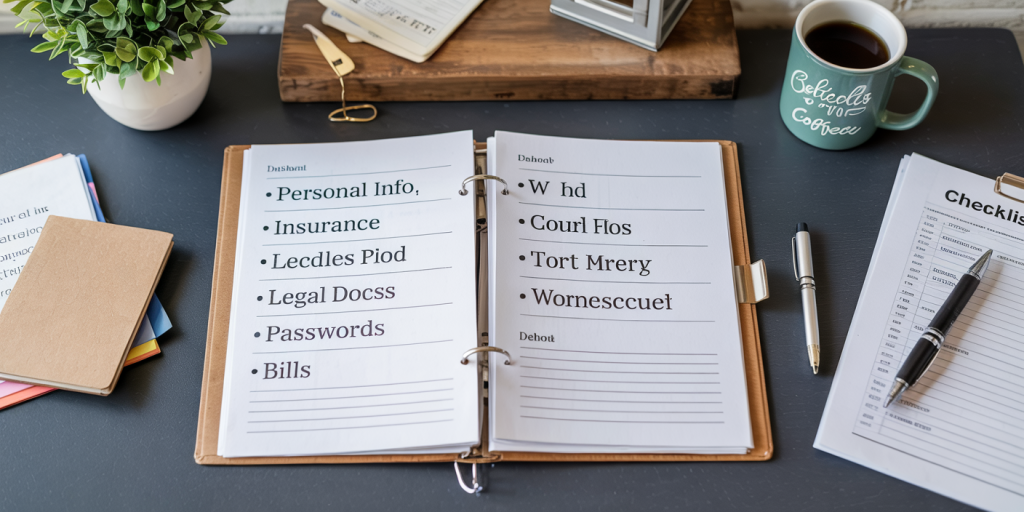

Step-by-Step: How to Set Up a Financial Emergency Binder

Let’s break it down into clear, manageable steps.

Step 1: Choose the Format

There are two main ways to organize your binder:

🔹 Physical Binder

Use a three-ring binder with labeled tabs and plastic sleeves for documents. Keep it in a waterproof, fireproof safe.

🔹 Digital Binder

Scan all documents and store them securely using:

-

A password-protected USB drive

-

Encrypted cloud storage (like Google Drive or Dropbox with 2FA)

-

Digital vaults like 1Password or Everplans

You can also do both for added protection.

Step 2: Include These Core Sections

Each section should have clear labels and updated documents. Here’s what to include:

🔸 1. Personal Information

-

Full names and birthdates of household members

-

Social Security numbers

-

Copies of driver’s licenses and passports

-

Marriage certificates, divorce decrees, adoption papers

-

Military service records

🔸 2. Emergency Contacts

-

Doctors

-

Attorney

-

Financial advisor

-

Insurance agents

-

Key family and friends

List full names, relationships, phone numbers, and email addresses.

🔸 3. Medical Information

-

Health insurance cards

-

List of medications and allergies

-

Advance directives / living wills

-

Organ donor cards

-

Power of attorney for healthcare

-

Vaccination records

🔸 4. Financial Accounts

-

Bank account details (institution, type, account number)

-

Credit cards (last four digits and issuers)

-

Loan information (mortgage, auto, student loans)

-

Investment accounts (brokerages, retirement plans)

-

PayPal, Venmo, or other digital wallets

Also include online access info (username + password) in a separate, secure section.

🔸 5. Income and Employment

-

Pay stubs or employer contact info

-

Social Security statements

-

Pension or annuity details

-

Business ownership documents

If self-employed, include client lists and billing platforms.

🔸 6. Insurance Policies

-

Life insurance

-

Health insurance

-

Auto insurance

-

Homeowners or renters

-

Disability and long-term care policies

Include policy numbers, coverage details, and agent contact info.

🔸 7. Monthly Bills and Subscriptions

-

Utilities

-

Mortgage or rent

-

Cell phone and internet

-

Credit cards

-

Streaming services

-

Gym memberships

Create a simple spreadsheet with:

-

Company name

-

Account number

-

Amount due

-

Due date

-

How it’s paid (auto-pay/manual)

🔸 8. Legal Documents

-

Will and/or trust

-

Power of attorney (financial and medical)

-

Guardianship instructions for children

-

Property deeds and car titles

These documents help avoid costly legal delays in times of crisis.

🔸 9. Passwords and Digital Access

Include:

-

Master password list or access to a password manager

-

Email logins

-

Social media logins

-

Cloud storage logins

Use a separate, secure section or keep it encrypted on a USB.

🔸 10. Funeral or Final Wishes

While it may feel uncomfortable, include instructions such as:

-

Burial or cremation preference

-

Funeral service details

-

Obituary preferences

-

Memorial donation requests

Having this in writing removes decision pressure from grieving loved ones.

Step 3: Keep It Updated

Schedule a time every 6 to 12 months to review and update your binder. You should also update it after:

-

Major life events (births, deaths, marriages, divorces)

-

Job changes

-

New accounts or insurance policies

-

Moving or purchasing property

Add a “last updated” date on the first page.

Step 4: Communicate With Loved Ones

Let trusted people know the binder exists and where to find it. Ideally:

-

Tell your spouse or adult children

-

Share location (or access) with your power of attorney or executor

-

Provide digital access instructions if applicable

Never leave it out in the open or with anyone you don’t trust 100%.

Optional Add-Ons for Even More Protection

While the core binder covers the essentials, consider adding:

-

Pet care instructions (vets, food routines, sitters)

-

Rental property info (leases, tenants, property manager contacts)

-

Business continuity plans if you’re a business owner

-

Important receipts or warranties for major purchases

-

Family emergency plans (fire escape plan, meeting points)

Emergency Binder Templates and Tools

If you’d like to speed up the process, consider using:

-

Printable PDF templates (many are free or low-cost online)

-

Emergency Binder workbooks like “The Ultimate Life Binder” or “Smart HER Binder”

-

Spreadsheet tools with tabbed categories

These can help you structure the information and ensure nothing’s missed.

Final Thoughts: A Gift of Clarity and Care

Setting up a financial emergency binder isn’t just about preparing for the worst—it’s an act of love. It ensures that your family won’t be left in confusion or crisis when the unexpected happens.

It doesn’t take much to get started. In fact, the hardest part is deciding to begin. But once your binder is complete, you’ll have something invaluable: peace of mind for you, and a lifeline for those you care about most.

Start today with just one section. Build from there. A little effort now can save your family a world of stress later.

Post Comment