How to Set SMART Financial Goals and Actually Achieve Them

Anúncios

Setting financial goals is one of the most empowering steps you can take to improve your life. Whether you’re saving for your first home, trying to get out of debt, or planning for early retirement, clearly defined financial goals provide direction, motivation, and a framework for progress.

But vague ambitions like “I want to save more money” or “I should invest” often fall flat. That’s where SMART financial goals come into play. By turning general desires into specific, actionable plans, you can build momentum and actually achieve the financial life you envision.

In this guide, we’ll break down the SMART goal-setting method and walk you through how to apply it effectively to your personal finances—step by step.

Anúncios

What Are SMART Financial Goals?

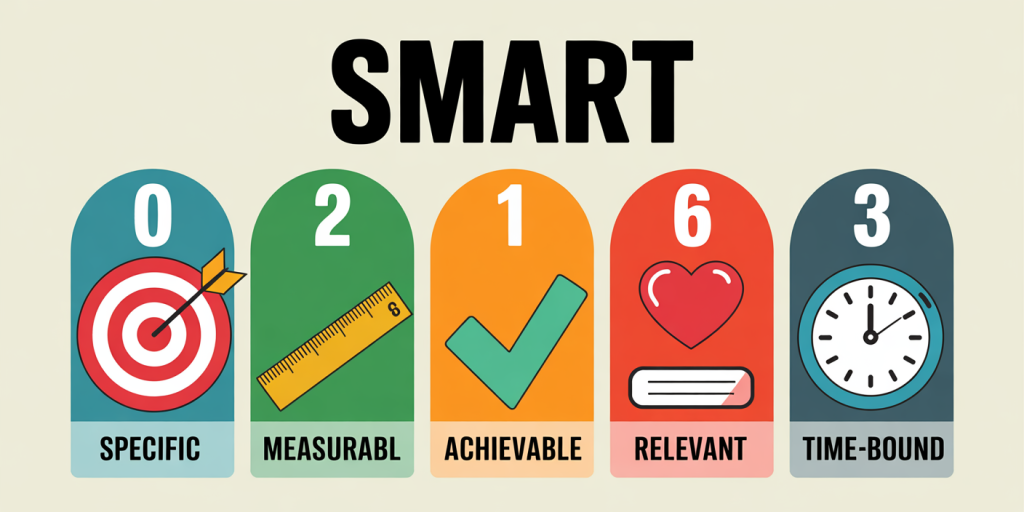

The SMART framework transforms vague goals into clear, structured, and measurable action plans. SMART stands for:

Anúncios

-

Specific

-

Measurable

-

Achievable

-

Relevant

-

Time-bound

This approach is widely used in business, education, and personal development, and it’s especially powerful in the context of financial planning.

Why SMART Goals Work

Traditional goal-setting often fails because it lacks clarity or direction. Saying “I want to be rich someday” offers no clear path or criteria for success. SMART goals solve this problem by:

-

Clarifying exactly what you want

-

Setting a clear benchmark to track progress

-

Making goals feel realistic and motivating

-

Ensuring your goals align with your life values

-

Creating urgency and structure through deadlines

Whether you’re working toward debt freedom, savings, investment growth, or major purchases, SMART goals act like a GPS for your financial journey.

Step 1: Make Your Goal Specific

Your financial goal should be crystal clear. Ask yourself:

-

What exactly do I want to achieve?

-

Who is involved?

-

Where will this happen?

-

Why is it important to me?

Vague: “I want to save money.”

Specific: “I want to save $10,000 for a down payment on a house.”

This level of specificity gives your goal a meaningful target and eliminates ambiguity.

Step 2: Make Your Goal Measurable

If you can’t measure your progress, you can’t manage it. Measurable goals help you track improvements and stay motivated.

Ask yourself:

-

How much?

-

How many?

-

How will I know when I’ve reached it?

Example: Instead of “Save more each month,” say “Save $500 per month in a high-yield savings account.”

Tracking apps like Mint, YNAB (You Need a Budget), or even a simple spreadsheet can help you visualize progress toward your goal.

Step 3: Make Your Goal Achievable

Your goal should be challenging but still realistic based on your income, obligations, and resources.

Ask:

-

Is this goal within my control?

-

Can I reasonably achieve this with the time and tools I have?

-

What obstacles might I face?

Unrealistic: “Save $100,000 in six months on a $40,000 salary.”

Achievable: “Save $5,000 in one year by cutting non-essential expenses and taking on side gigs.”

This step ensures your ambition won’t lead to burnout or discouragement.

Step 4: Make Your Goal Relevant

Your financial goal should align with your personal values and long-term vision. A goal that doesn’t resonate with your priorities is unlikely to stick.

Ask:

-

Why does this goal matter?

-

Does it align with my broader life or career plans?

-

Will achieving this improve my quality of life?

Example: If your dream is to travel the world, a relevant goal might be “Save $15,000 over 18 months for a six-month trip across Asia.”

Relevance fuels your motivation—especially when sacrifices are required.

Step 5: Make Your Goal Time-Bound

A deadline creates urgency and helps you build a timeline for milestones. Without it, your goal becomes a “someday” dream rather than a real plan.

Ask:

-

What is my target date?

-

What can I do this week, this month, this quarter?

-

How will I track progress on a schedule?

Example: “Save $6,000 in 12 months by setting aside $500 per month starting this January.”

Deadlines break your goal into manageable chunks and keep you accountable.

Examples of SMART Financial Goals

Here are several SMART financial goal examples across different scenarios:

💳 Debt Payoff:

“Pay off my $3,000 credit card balance in 10 months by making $300 monthly payments.”

🏡 Homeownership:

“Save $20,000 for a down payment on a house within 24 months by automating $834 monthly deposits into a savings account.”

🏖 Vacation:

“Save $4,000 for a trip to Europe by next July by cutting eating-out expenses and contributing $330/month to a travel fund.”

📚 Education:

“Pay off $10,000 in student loans over 2 years by paying $420/month and applying tax refunds to the balance.”

📈 Investing:

“Invest $250 monthly into an index fund to build a $3,000 portfolio by the end of next year.”

These examples show how combining clarity, purpose, and structure increases your chances of success.

How to Stay on Track With Your SMART Goals

Even the most well-designed goals can fall off track without follow-through. Here’s how to stay committed and adaptive:

1. Automate Everything

Use auto-transfers to savings or investment accounts so that progress happens behind the scenes—even when life gets hectic.

2. Review Monthly

Check your progress at the end of each month. Celebrate small wins and adjust if your income or priorities change.

3. Use Visual Aids

Track your progress with goal charts, coloring sheets, or apps like Goalsetter and Monarch Money. Visualization keeps your motivation alive.

4. Build in Accountability

Share your goal with a partner, coach, or financial advisor. Regular check-ins increase follow-through.

5. Expect Setbacks

Life happens. Don’t let one missed month derail your entire plan. Reassess, reset, and keep going.

Adapting Your SMART Goals Over Time

Your financial situation and priorities will evolve, so should your goals. Set a reminder to revisit your SMART goals at least once per quarter.

Ask:

-

Are my goals still relevant?

-

Have my income or expenses changed?

-

Is my timeline still realistic?

-

Should I set a new goal now that one is complete?

Being flexible keeps your financial planning dynamic and sustainable.

Final Thoughts

Setting SMART financial goals is about more than budgeting or saving—it’s about creating a roadmap for your future. When you define your goals clearly and realistically, you remove the guesswork and replace it with structure, confidence, and momentum.

Whether you’re climbing out of debt, building an emergency fund, or saving for something you love, SMART goals turn dreams into plans—and plans into progress.

Remember: Start where you are, use what you have, and commit to steady action. With the right mindset and system in place, your financial goals are not only achievable—they’re inevitable.

Post Comment