How Side Hustles Can Complicate Your Taxes (and How to Prepare for It)

Anúncios

In today’s gig economy, side hustles have become an essential source of additional income for millions of Americans. Whether it’s driving for a ride-sharing service, freelancing in graphic design, selling handmade crafts online, or tutoring students virtually, side hustles offer flexibility and financial opportunity. According to a 2023 survey by Bankrate, about 45% of U.S. adults reported earning money outside of their main job, a substantial increase from previous years. However, while side gigs are financially rewarding, they also introduce complications when it comes to filing taxes. Unlike regular salaried jobs with straightforward tax deductions and reporting, side hustles often involve complex tax obligations and increased record-keeping demands.

An illustration of a gig economy worker juggling multiple side hustles like ride-sharing, freelancing on a laptop, and selling crafts online, with tax forms (W-2, 1099) and receipts scattered around, symbolizing complex tax responsibilities.

Anúncios

This article explores the ways in which side gigs complicate your tax situation, highlights common challenges faced by side hustlers, and offers practical strategies to streamline tax preparation. By understanding the nuances of tax law as it applies to secondary income sources, gig workers can avoid errors, penalties, and missed deductions, ultimately maximizing their earnings after taxes.

Why Side Hustles Make Taxes More Complex

Anúncios

One of the primary reasons side hustles complicate taxes is that income earned outside a traditional employer relationship generates different tax reporting requirements. Most full-time employees receive a W-2 form, which clearly states gross earnings and taxes withheld by the employer. Conversely, side hustle income is typically reported on a 1099 form or must be self-reported if no formal tax document is issued, resulting in greater taxpayer responsibility.

For example, if you drive for a ride-share company like Uber or Lyft, you will likely receive a Form 1099-K or 1099-NEC based on transactions or earnings, not your actual net income after expenses. This means you must track all allowable deductions such as mileage, vehicle maintenance, and phone expenses yourself to reduce your taxable earnings. Failure to do so leads to overpayment of taxes.

Beyond reporting, the Internal Revenue Service (IRS) treats side hustle income as self-employment income, subject to self-employment tax in addition to regular income tax. This self-employment tax is currently 15.3%, covering both Social Security and Medicare, an obligation not automatically withheld from your paycheck. In 2022, the IRS collected approximately $1.2 trillion in self-employment taxes, indicating how critical this tax component is for anyone earning outside traditional employment.

Common Tax Challenges Faced by Side Hustlers

Understanding and managing side hustle taxes is challenging for many because of several common issues. One pervasive problem is inadequate record-keeping. Many side hustlers track sales or payouts but neglect to document related expenses, leading to higher taxable income than necessary. Without detailed records of business expenditures such as office supplies, software subscriptions, or advertising fees, taxpayers miss essential deductions that could save hundreds or even thousands of dollars annually.

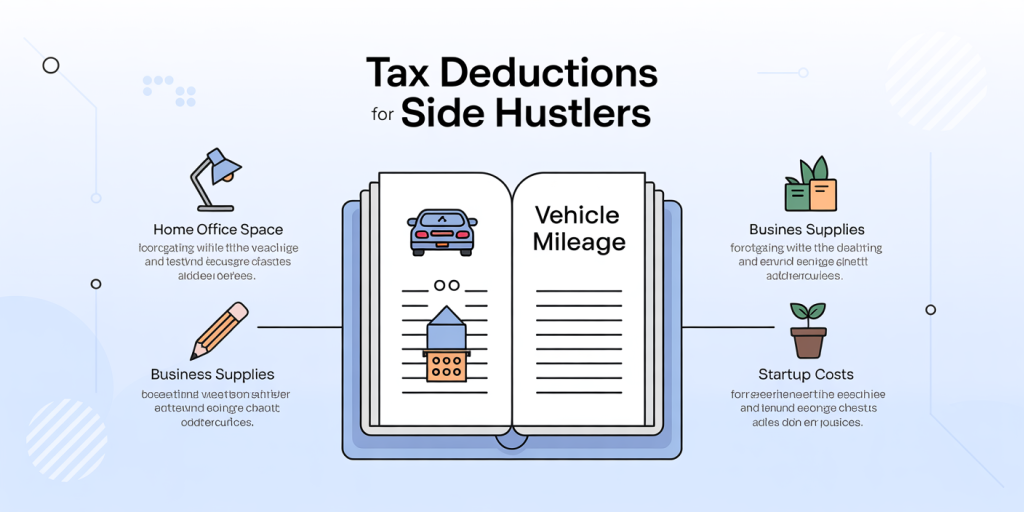

A detailed infographic-style image showing common tax deductions for side hustlers, including home office space, vehicle mileage, business supplies, and startup costs, with icons and brief descriptions for each category.

Another frequent tax challenge is confusion over estimated tax payments. Unlike traditional employees, side hustlers don’t have taxes automatically withheld from their earnings. As a result, they must calculate and remit estimated taxes quarterly to avoid underpayment penalties. Many first-time gig workers are unaware of this requirement and face unexpected tax bills and fines when filing their annual returns. According to data from the IRS, approximately 20% of taxpayers who should submit estimated payments fail to do so, resulting in significant penalties totaling millions in fines each year.

Additionally, distinguishing between personal and business expenses can be complicated when side hustles blur the line between personal finance and entrepreneurship. For example, using a smartphone for both personal calls and side business communications requires allocating costs appropriately, often by the percentage of business use. Errors here can trigger audits or disallow claimed deductions.

A visual representation of organized tax preparation for side hustlers: a freelancer using accounting software on a laptop, a smartphone app tracking mileage, and labeled folders for receipts and estimated tax payments, conveying streamlined financial management.

Tax Deductions and Credits Available for Side Hustles

Despite the complexities, side hustlers have access to numerous tax deductions and credits that can offset the additional tax burden. Understanding and leveraging these deductions effectively can significantly increase take-home pay.

One of the most valuable deductions is the home office deduction. If you use a specific area of your home exclusively and regularly for side hustle activities, you can deduct a portion of housing expenses related to that space, including rent or mortgage interest, utilities, and repairs. For instance, a graphic designer working from a dedicated home studio can lower taxable income by deducting associated costs.

Another common deduction is vehicle expenses. If you drive your car for delivering goods or transporting clients, you may choose between deducting actual expenses like fuel and maintenance or using the IRS standard mileage rate (which was 65.5 cents per mile in 2023). For example, a food delivery driver logging 10,000 business miles could deduct $6,550 in vehicle expenses under the standard mileage rate.

Additionally, side hustlers can deduct startup costs, supplies, internet and phone expenses, software subscriptions, and even educational expenses that relate directly to improving their business skills. Claiming such deductions requires careful documentation, such as receipts and mileage logs.

| Deduction Type | Examples | 2023 Standard Rates or Limits |

|---|---|---|

| Home Office | Portion of rent, utilities | Based on percentage of home used |

| Vehicle | Fuel, maintenance, depreciation | 65.5 cents/mile standard mileage rate |

| Business Supplies | Tools, software subscriptions | Full expense deduction allowed |

| Start-up Costs | Advertising, website setup | Up to $5,000 immediate deduction |

Strategies to Organize and Simplify Tax Filing for Side Hustles

Effective organization is critical for managing the tax implications of side hustles. One practical approach is maintaining a dedicated business bank account and credit card. This separation simplifies tracking income and expenses and provides clear documentation if audited. For example, freelance writers who funnel all payments and costs through dedicated accounts can easily pull accurate summaries when tax season arrives.

Technology also plays an important role. Accounting software such as QuickBooks Self-Employed or FreshBooks allows gig workers to automatically track income, categorize expenses, and estimate quarterly tax payments. Many apps can sync with bank accounts and generate IRS-compliant reports, saving time and reducing the risk of errors.

Another strategy is keeping thorough mileage logs for vehicle use, especially if you opt for the standard mileage deduction. Using apps like MileIQ that track trips automatically ensures accuracy and convenience. Similarly, keeping digital copies of all receipts using apps or scanning tools prevents lost evidence of deductible expenses.

Side hustlers should also mark quarterly estimated tax deadlines—typically April, June, September, and January—to avoid penalties. Setting aside a percentage of earnings each month in a separate savings account designated for taxes can prevent surprises. Financial advisors often recommend saving between 25% to 30% of gross side hustle income to cover combined income and self-employment taxes.

Real-World Cases Demonstrating Tax Complications from Side Hustles

Real examples illustrate the tax challenges side hustlers face. Consider Sarah, a graphic designer who began freelancing on weekends in addition to her full-time job. She earned $15,000 annually via her side hustle but did not keep detailed expense records. When filing taxes, her taxable side income was reported as the full amount, increasing her tax bill by $3,500. Upon consulting a tax specialist, she realized she could have deducted over $4,000 in business expenses, including office supplies and software fees, potentially eliminating her side hustle tax liability.

In another case, James rents out his apartment occasionally on Airbnb. However, he failed to report some rental income because no 1099-K form was received. The IRS audit identified unreported earnings, resulting in back taxes plus penalties totaling $5,000. James’ experience underscores the importance of self-reporting all income irrespective of tax forms issued.

These scenarios highlight the need for proactive tax awareness and professional advice when navigating multiple income streams.

Future Perspectives: How Taxes on Side Hustles May Evolve

The taxation of side hustles is poised for further evolution as gig work becomes an integral part of the economy. Lawmakers and regulators are increasingly focused on clarifying tax responsibilities for independent workers and improving IRS enforcement under the gig economy framework.

For example, the IRS introduced enhanced reporting requirements for gig platforms such as rideshare companies and marketplaces, pushing for greater transparency. IRS Commissioner Danny Werfel announced in 2023 plans to increase audits on non-filers and underreporters in the self-employed sector, reflecting growing attention.

Additionally, potential legislative reforms aim to simplify side hustle tax processes or provide specialized tax credits for gig workers to offset complicated compliance burdens. Some states are experimenting with digital tools and educational programs to assist side hustlers in understanding tax obligations.

Tax technology innovations, including AI-driven tax prep tools, promise to reduce taxpayer errors and optimize deductions aligned with emerging tax codes. As the landscape shifts, side hustlers should remain informed about regulatory changes, maintain meticulous records, and consider professional tax help, ensuring compliance while maximizing net earnings.

In summary, while side hustles provide valuable income and economic flexibility, they come with tax complexities that require attention and preparation. Understanding self-employment tax obligations, tracking business expenses meticulously, and utilizing technology and professional resources can greatly ease the tax filing process and safeguard earnings. As this work model grows, staying abreast of legislative and regulatory updates will empower side workers to navigate their tax responsibilities confidently and accurately.

Post Comment