How Artificial Intelligence Is Reshaping Budgeting Strategies

Anúncios

Smarter Tools for Smarter Financial Decisions

Artificial Intelligence (AI) is rapidly reshaping how we manage our money. While it has already revolutionized sectors like healthcare, marketing, and transportation, AI is also having a transformative—though more subtle—impact on personal finance, particularly in the way we budget, save, invest, and plan.

No longer just a futuristic concept, AI is now embedded in everyday tools, apps, and financial platforms. From tracking spending habits to forecasting potential risks, AI-powered budgeting solutions are giving people greater control over their finances with significantly less effort.

Anúncios

Let’s explore how AI is redefining financial decision-making, empowering users to make smarter, faster, and more informed choices.

The Power of AI in Budgeting

Anúncios

Modern budgeting apps have long assisted users in organizing expenses, setting goals, and saving money. But with the integration of artificial intelligence, budgeting has evolved beyond basic tracking.

AI-driven systems bring intelligent algorithms into the mix—enabling them to:

-

Analyze your spending trends

These tools can review your financial history, detect recurring patterns, and highlight areas where you’re overspending or undersaving. -

Offer real-time insights

Rather than waiting until the end of the month to view reports, AI tools send instant alerts and suggestions as soon as something important happens. -

Recommend budget adjustments

If your dining expenses spike during the holidays or your utility bill increases, AI will proactively suggest changes to balance your overall budget. -

Warn about potential financial problems

By monitoring cash flow, due dates, and account balances, AI systems can notify you in advance if you’re at risk of overdrawing or missing a payment.

Unlike traditional spreadsheets that require constant manual updates, these intelligent platforms automatically sync with your accounts and learn from your behavior over time. The longer you use them, the more personalized and accurate their recommendations become.

Increased Automation and Simplicity

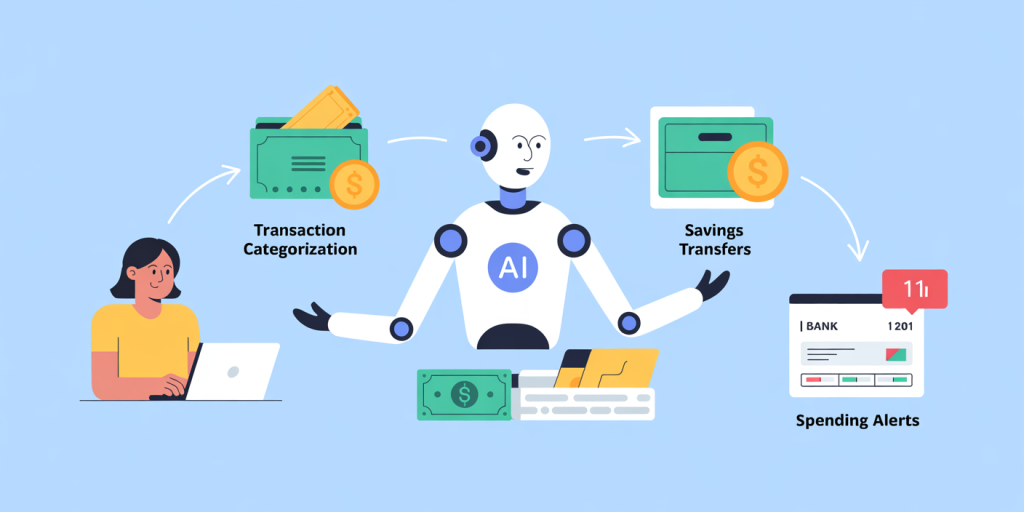

One of the most practical—and appreciated—benefits of AI in personal finance is automation. It reduces the friction of money management and eliminates much of the manual work involved in budgeting.

With AI-based platforms, you can automate tasks such as:

-

Categorizing and tagging transactions

-

Setting spending limits for specific categories

-

Automatically transferring money into savings or investment accounts

Apps like Cleo offer budget insights through a conversational chatbot interface, providing feedback in a friendly, engaging way. Meanwhile, tools like Digit analyze your financial habits and automatically save small amounts of money based on what you can afford—without requiring any user action.

This level of intelligent automation turns budgeting from a chore into something that’s practically hands-free.

Smarter Financial Planning

AI isn’t just useful for managing daily expenses—it also shines in helping with long-term financial planning.

By analyzing historical data and forecasting trends, AI tools can:

-

Predict months with higher or lower expenses

-

Forecast income fluctuations (especially useful for freelancers or gig workers)

-

Model different financial scenarios (e.g., a job change, a loan application, or a vacation)

Let’s say you’re thinking about buying a new car or moving to a more expensive apartment. An AI budgeting assistant can simulate how those choices would affect your budget over time, helping you plan more confidently.

Some advanced systems can even incorporate external market trends—like interest rate changes or inflation projections—to refine their advice and ensure you’re always one step ahead.

Personalized Financial Education

Many people were never formally taught how to budget, save, or invest. This financial literacy gap is where AI tools are making a tremendous impact by delivering personalized financial education.

Apps like Mint, YNAB (You Need A Budget), and Monarch Money leverage AI to offer tips and lessons based on the user’s behavior and financial goals. For example:

-

If you consistently overspend in a certain category, the app might suggest educational content on mindful spending.

-

If you receive a tax refund, it might propose strategies to make the most of that extra cash.

-

If your savings habits improve, you could receive tailored advice on how to begin investing.

Some platforms go further by offering virtual financial coaches that use AI to break down complex financial concepts—like compound interest or asset allocation—into bite-sized, easily digestible explanations. Over time, this guidance helps users build a stronger foundation and develop healthier money habits.

Enhanced Security and Fraud Detection

Security is a top concern in today’s digital-first financial world. Fortunately, AI also contributes significantly to safeguarding your money.

Using machine learning and behavioral analysis, AI systems can detect unusual or suspicious activity in real time. For example:

-

Duplicate transactions

-

Large, unexpected withdrawals

-

Purchases from unfamiliar locations

These events can trigger instant alerts, allowing users to take action quickly. Many banks and fintech platforms also employ AI for:

-

Biometric logins (e.g., facial recognition, fingerprint scanning)

-

Predictive risk modeling

-

Fraud detection systems that evolve as new threats emerge

By learning what “normal” behavior looks like for each user, AI can flag anomalies far faster than traditional systems—giving you peace of mind.

AI as a Smart Investing Partner

Investing is another area where AI is making a major impact. Robo-advisors like Wealthfront, Betterment, and SoFi Invest use AI to automatically manage your investment portfolio based on:

-

Your risk tolerance

-

Time horizon

-

Financial goals

These systems monitor market conditions 24/7 and adjust your asset allocation as needed—automatically and efficiently. By removing emotion from the equation, robo-advisors help prevent common investor mistakes like panic selling or chasing short-term trends.

For those new to investing, AI makes the process less intimidating. You don’t need to understand every nuance of the stock market to begin—AI handles the strategy and rebalancing, while you focus on the bigger picture.

Some apps are even beginning to integrate AI-based forecasting tools that show how your portfolio might perform under different market conditions, adding another layer of insight.

Limitations to Be Aware Of

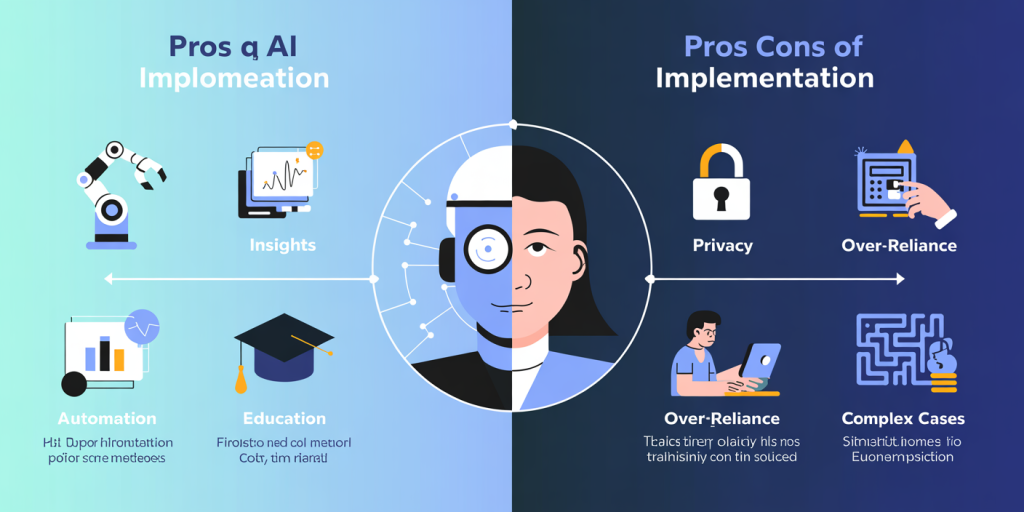

While AI brings many benefits, it’s not perfect. Users should be mindful of its limitations:

-

Personalization Limits

Not all financial situations can be handled by algorithms. People with complex financial needs—like multiple income sources, dependents, or non-traditional investments—might find AI tools too simplistic. -

Privacy Concerns

AI tools often require access to sensitive data. While reputable platforms use encryption and strict privacy protocols, it’s essential to understand how your data is being used and stored. -

Over-Reliance on Automation

AI is a support tool, not a replacement for critical thinking. Relying entirely on automation without reviewing your finances or understanding basic principles can lead to blind spots.

Always stay informed, question unusual suggestions, and use AI as a complement—not a substitute—for good financial judgment.

What’s Next for AI in Budgeting?

The future of AI in budgeting and personal finance looks promising. As technology continues to evolve, we can expect:

-

Dynamic budgeting systems that adjust automatically as your financial situation changes

-

Lifestyle-aware recommendations that factor in health, family planning, and work changes

-

Hyper-personalized financial advice based on behavioral psychology and market trends

-

Integrated financial ecosystems where budgeting, investing, saving, and insurance are all managed through a single AI-powered platform

Imagine a world where your financial assistant alerts you before you’re likely to overspend during the holidays, recommends investments aligned with your values, and helps you prepare for life changes months in advance. That future is quickly becoming a reality.

Post Comment