Understanding Dynamic Interest Rates: A Smart Guide for Modern Borrowers

Anúncios

Dynamic Interest Rates in the U.S. Market: How They Work and Who Should Use Them

In the U.S. financial system, the structure of interest rates is a fundamental pillar that directly influences the economy as a whole. From homebuyers and students to corporations and investors, nearly everyone feels the impact of how interest rates are designed and how they move. One particular category—dynamic interest rates, also known as variable rates—has gained considerable relevance in recent years, especially in a financial environment shaped by high inflation, Federal Reserve (Fed) policy shifts, and global economic volatility.

Understanding how these rates operate and when they make sense for your financial strategy is essential. In this guide, we’ll explore what dynamic rates are, how they work, their benefits and drawbacks, and how to manage their inherent risks effectively.

Anúncios

What Are Dynamic Interest Rates?

Dynamic interest rates are rates that fluctuate over time, depending on various macroeconomic indicators. They’re typically tied to a financial benchmark or index, such as the Prime Rate or SOFR (Secured Overnight Financing Rate), and are calculated by adding a fixed margin set by the lender to the current value of that index.

This means that your interest rate—and, in many cases, your monthly payments—can go up or down depending on how the index changes.

Anúncios

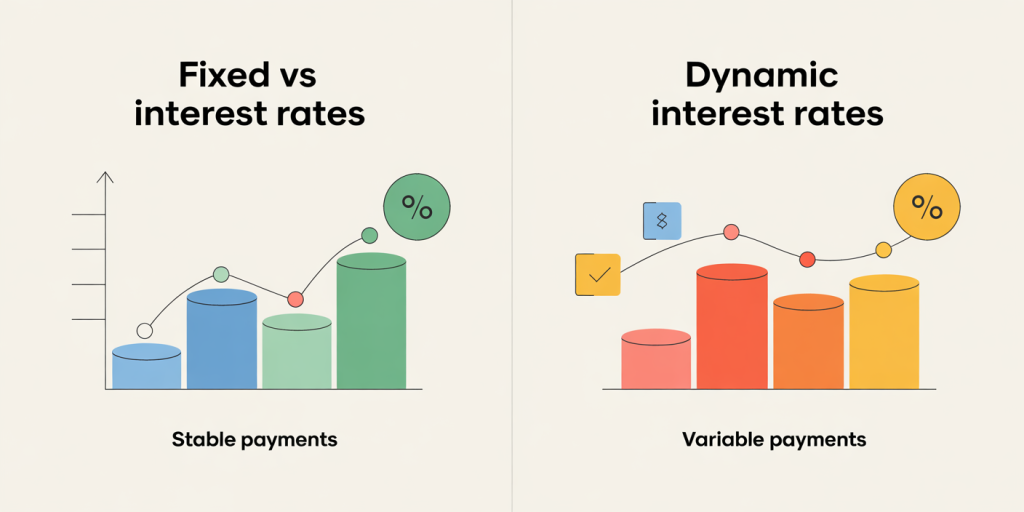

Key Differentiator:

-

Fixed-rate loans: Stay the same for the life of the loan.

-

Dynamic-rate loans: Adjust periodically based on index movement + lender margin.

Where Are Dynamic Rates Commonly Found?

Dynamic interest rates are used across a wide range of financial products, both for individuals and businesses. Some of the most common include:

-

Adjustable-rate mortgages (ARMs) – Home loans with an introductory fixed-rate period that later adjusts annually or semi-annually.

-

Private student loans – Some education loans offer variable rates as an alternative to fixed options.

-

Credit cards – Most cards in the U.S. use variable APRs that shift in response to Fed rate changes.

-

Commercial credit lines – Business loans and lines of credit often come with floating interest rates.

Why use them? Lenders may offer lower initial rates on variable products to attract borrowers, especially when market interest rates are relatively low.

How Do Dynamic Interest Rates Work?

The most common structure for dynamic interest rates is:

Benchmark Index (e.g., SOFR or Prime Rate) + Fixed Margin = Your Interest Rate

📈 Example:

Suppose you take out a student loan with a variable rate tied to SOFR. If SOFR is currently 4.5%, and the lender adds a 3% margin, your rate would be 7.5%. If SOFR rises to 5.0%, your new rate becomes 8.0%. The opposite is also true—if the index drops, your rate may decline.

🏠 Example: Adjustable-Rate Mortgage (ARM)

Let’s say you apply for a 5/1 ARM. This means:

-

Your interest rate is fixed for the first 5 years.

-

After that, it adjusts annually based on the index + margin.

If the initial rate is 3.5% for 5 years, and the benchmark rises to 5% in year six, your mortgage could jump to 6.5% or more, depending on the cap structure.

📌 Important Terms to Know:

-

Initial Fixed-Rate Period: The period during which the rate is locked.

-

Adjustment Frequency: How often your rate can change (annually, semi-annually).

-

Rate Caps: Limits on how much the rate can increase at each adjustment and over the life of the loan.

Pros vs. Cons of Dynamic Interest Rates

Dynamic rates offer several advantages—but they also come with real risks. Understanding both sides is crucial before committing.

✅ Benefits of Dynamic Rates

-

Lower Initial Interest Rates

Borrowers often start with a lower interest rate compared to fixed-rate alternatives. This can reduce early repayment amounts, especially helpful for borrowers looking to save in the short term. -

Automatic Savings When Rates Drop

If the benchmark index decreases, your rate adjusts downward automatically, potentially reducing your monthly payments without requiring a refinance. -

Potentially Easier Approval Terms

Because lenders assume less long-term risk, borrowers with average credit scores may find it easier to qualify for variable-rate loans.

⚠️ Risks of Dynamic Rates

-

Uncertainty in Monthly Payments

Interest rates may rise unexpectedly, causing a significant increase in monthly payments. For those on tight budgets, this could lead to financial strain or default risk. -

Unpredictable Long-Term Costs

Over the full term of a loan, you may end up paying more interest than with a fixed-rate loan—especially if rates trend upward over time. -

Stress and Financial Complexity

Managing a loan where your payment can change annually (or more frequently) requires financial discipline, planning, and adaptability.

How to Protect Yourself from Rate Volatility

If you’re considering a dynamic-rate product, it’s essential to take proactive measures to manage the risks.

🧠 1. Understand Your Loan Terms Thoroughly

Before signing, make sure you understand:

-

The length of the fixed-rate period (if any)

-

Adjustment frequency

-

Lifetime and periodic rate caps

-

Index used and lender’s margin

The more informed you are, the fewer surprises you’ll face later.

📊 2. Monitor Market Trends

Interest rates rise and fall in response to:

-

Federal Reserve monetary policy decisions

-

Inflation trends

-

Economic growth indicators (GDP, unemployment)

By staying aware of these trends, you can anticipate shifts in your own loan rates and budget accordingly.

🔄 3. Refinance If Conditions Worsen

If interest rates begin rising and you’re worried about future increases, consider refinancing into a fixed-rate loan. This can lock in your rate and give you peace of mind—though it may come with upfront costs and new terms.

💰 4. Build a Financial Cushion

An emergency fund acts as a buffer for unexpected rate hikes. If your payments increase by hundreds of dollars, your savings can help bridge the gap.

🔐 Aim to save 3–6 months’ worth of essential expenses in a separate, easily accessible account.

🧮 5. Use Financial Calculators

Before committing, use online tools to simulate different scenarios:

-

What happens if rates rise by 2%?

-

What’s your monthly payment at different benchmarks?

-

How much will you pay over the life of the loan?

This helps you prepare emotionally and financially for the full range of outcomes.

When Are Dynamic Interest Rates a Good Idea?

Although not ideal for everyone, dynamic rates work well in some specific situations.

🔹 Short-Term Borrowing Plans

If you plan to pay off the loan early (within a few years), the lower introductory rates of variable products can save you money before any adjustments occur.

🔹 Falling Rate Environment

If economic indicators show that interest rates are expected to drop, a variable rate can help you take advantage of the trend—your rate may decrease automatically without needing to refinance.

🔹 Higher Risk Tolerance

If you’re a financially flexible borrower or investor, you may be comfortable with some payment volatility in exchange for potential savings. This is especially true if you’re confident in your ability to react to changes or absorb temporary increases.

When Should You Avoid Dynamic Rates?

Dynamic rates may not be the right fit if:

-

You’re on a fixed income or strict monthly budget.

-

You’re financing a long-term purchase (e.g., a 30-year mortgage).

-

Interest rates are already rising rapidly due to inflationary pressures.

-

You prioritize financial predictability and peace of mind.

In these cases, a fixed-rate product offers more stability and can help you sleep easier at night.

Final Thoughts

Dynamic interest rates can be powerful financial tools—but they require informed decision-making and active management. For the right borrower, they offer flexibility, short-term savings, and adaptability to changing market conditions.

However, they also introduce uncertainty and potential long-term costs, especially in volatile economic climates.

✅ Key Takeaways:

-

Know your terms, your tolerance for risk, and your long-term goals.

-

Plan for both the upside and downside of rate fluctuations.

-

Stay informed and ready to adjust your strategy if needed.

With the right approach, dynamic rates can support your financial goals—just be sure to approach them with eyes wide open and a plan in place.

Post Comment