Full Guide to Consolidating Debt: Pros, Cons, and Best Practices

Anúncios

In today’s financial landscape, managing multiple debts can become overwhelming, leading many individuals to seek viable solutions for streamlining their repayments. Debt consolidation has emerged as a popular strategy for handling multiple debt obligations by combining them into a single loan or payment plan. This approach aims to simplify debt management, reduce interest costs, and potentially improve one’s credit score. However, understanding the nuances of debt consolidation—including its advantages, drawbacks, and strategies—is critical to making informed financial decisions.

This detailed guide explores the landscape of debt consolidation, presenting practical examples, relevant data, and actionable advice to help consumers weigh their options and choose the best debt consolidation method tailored to their unique financial situations.

Anúncios

Understanding Debt Consolidation: What It Entails

Debt consolidation is the process of combining multiple debts, such as credit card balances, personal loans, and medical bills, into one loan with a single monthly payment. This consolidation can take place through a personal loan, balance transfer credit card, home equity loan, or debt management program. By merging debts, borrowers often seek to lower the overall interest rate, extend payment terms, or simplify the complexity of managing numerous payments.

Anúncios

For example, consider a borrower with three credit card balances totaling $15,000, each charging interest rates between 18-24%. If the borrower consolidates the $15,000 into a personal loan with a 10% fixed interest rate and a five-year repayment term, the monthly payments become predictable and potentially lower. This can ease budgeting and reduce the likelihood of missed payments, which affect credit scores negatively.

According to the Federal Reserve, as of 2023, American consumers hold nearly $930 billion in credit card debt, often spread among multiple accounts. This fragmentation contributes to stress and financial inefficiency, making debt consolidation an attractive option for many.

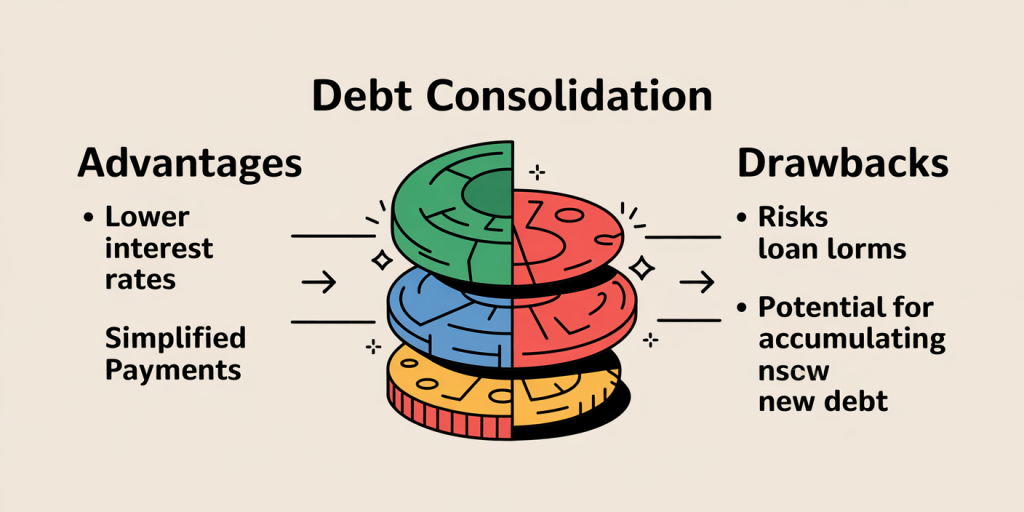

Advantages of Debt Consolidation: Simplification and Savings

One of the primary benefits of debt consolidation is the simplification of one’s financial obligations. Managing various due dates, minimum payments, and interest rates can be confusing and lead to missed payments. A single monthly payment reduces the risk of errors and helps borrowers maintain discipline in debt repayment.

Moreover, consolidation may offer substantial cost savings. By replacing high-interest debts with a loan featuring a lower interest rate, borrowers can reduce the amount spent on interest over time. For instance, a survey by the National Foundation for Credit Counseling (NFCC) found that 61% of individuals who consolidated debt experienced lower interest rates post-consolidation.

Another advantage is the possibility of improving credit scores through better management. Successful consolidation, combined with consistent payments, reduces credit utilization rates and prevents late payments, both factors that contribute positively to credit scores. For example, Emily, a borrower from Ohio, consolidated $20,000 in credit card debt at 22% APR into a personal loan at 12% APR. After 18 months of disciplined payments, her credit score improved by 85 points, increasing her eligibility for better loan offers.

Potential Drawbacks: What to Watch Out For

Though debt consolidation offers many advantages, it also has pitfalls that borrowers must consider. First, consolidating unsecured debt into a secured loan, such as a home equity loan, can put assets at risk. If payments are missed, the borrower may face foreclosure or repossession, which could lead to even more severe financial consequences.

Additionally, extending the loan term to lower monthly payments can result in paying more interest overall. For example, transforming $10,000 in debt over a two-year repayment schedule at 18% APR into a five-year loan at 10% APR might reduce monthly payments but increase lifetime interest costs by over $1,000. The trade-off between monthly affordability and cost should be carefully evaluated.

Another common concern is the temptation to accumulate more debt after consolidation. Without changes to spending habits or budgeting, borrowers may find themselves in a worse position, with the same underlying problems but additional debt layered on top. A 2022 study by the Consumer Financial Protection Bureau (CFPB) reported that roughly 29% of consumers who consolidated debt reaccumulated new debt within 12 months of consolidation.

Best Practices for Effective Debt Consolidation

To maximize the benefits of debt consolidation, it is essential to follow best practices. First and foremost, evaluate all loan offers carefully. Comparing interest rates, loan terms, and fees will help identify the option that best suits your financial goals. Using tools like online loan calculators or consulting a financial advisor can provide a clearer picture of expected costs and savings.

Next, make a comprehensive budget that includes the consolidated payment and allows for emergency savings. Budget discipline prevents the risk of reaccumulating debt and supports timely payments. Consider enrolling in automatic payment plans, which many lenders offer, to avoid missed payments.

It’s also vital to understand the differences between consolidation types. Debt management programs often involve working with credit counseling agencies that negotiate with creditors on your behalf, sometimes reducing interest rates or fees. Meanwhile, balance transfer credit cards may offer promotional 0% interest periods but can introduce higher rates afterward. Evaluating these nuances ensures the consolidation method aligns with your long-term repayment capacity.

| Debt Consolidation Method | Interest Rate Range | Term Length | Key Advantages | Potential Drawbacks |

|---|---|---|---|---|

| Personal Loan | 6% – 24% | 1 – 7 years | Fixed rates, predictable payments | May require good credit score |

| Balance Transfer Credit Card | 0% (promo) – 25% | 6 months – 18 months | No interest during promo period | High rates post-promo, transfer fees |

| Home Equity Loan or Line of Credit | 4% – 10% | 5 – 30 years | Lower rates, tax-deductible interest | Risk of foreclosure if default |

| Debt Management Plan (DMP) | Varies | 3 – 5 years | Negotiated rates, creditor support | Enrollment fees, impacts credit score |

Real-World Case Studies Illustrating Debt Consolidation Outcomes

To further illustrate effective debt consolidation, consider the case of John, a graphic designer with $25,000 spread across credit cards and medical bills at 20-22% APR. He secured a debt consolidation loan at 12.5% APR with a three-year term. This lowered his monthly payment from $900 to $820. More importantly, with his interest savings, John was able to increase payments by $50 monthly, clearing debt six months earlier than planned.

Conversely, Sarah, a recent college graduate, used a balance transfer card with a 0% APR for 12 months to consolidate $10,000 credit card debt. However, after the promotional period ended, she failed to pay off the full balance. The interest soared to 23.9%, significantly increasing her debts. Without a solid repayment plan, Sarah’s financial situation worsened despite the initial consolidation effort.

These examples underline the importance of discipline and careful planning in debt consolidation.

Future Perspectives: Trends and Innovations in Debt Consolidation

Looking ahead, debt consolidation will continue evolving, influenced by technological advances and economic factors. Artificial intelligence (AI) is increasingly being leveraged to provide personalized debt management recommendations. Fintech companies now offer tailored loan offers based on real-time credit analysis, optimizing interest rates and repayment schedules.

Further, the expansion of financial literacy initiatives aims to equip consumers with better tools to assess and manage their debt. According to a 2024 report by The World Bank, improved financial education correlates with increased uptake of debt consolidation options that genuinely reduce financial strain.

Environmental, social, and governance (ESG) investing is also beginning to impact consumer finance products, with some lenders offering “green loans” that incentivize responsible borrowing and reward positive financial behavior with lower rates.

Economists also predict that rising interest rates and inflationary pressures will push more consumers toward debt consolidation as a method to stabilize their finances. This trend suggests consolidation programs may become more accessible and diversified, including options for gig economy workers and those with irregular incomes.

By understanding the complexities of debt consolidation, including its advantages, pitfalls, and best practices, consumers can make well-informed decisions. Whether through personal loans, balance transfers, or debt management plans, consolidation offers a promising pathway to financial stability when implemented correctly. Continued innovation and education will likely enhance these tools, helping more individuals manage their debt effectively in the coming years.

Post Comment