Financial Toxicity: How Emotional Spending Affects Your Budget and How to Stop It

Anúncios

In today’s fast-paced world, managing personal finances has become increasingly complex. Beyond balancing income and expenses, individuals encounter psychological barriers that impact their monetary decisions. One such challenge is financial toxicity, a term characterizing the negative effects of emotional spending on an individual’s financial well-being. Emotional spending—shopping driven by feelings rather than needs—can lead to serious budget imbalances, debt accumulation, and long-term financial stress. This article explores how emotional spending contributes to financial toxicity, how it disrupts your budget, and practical methods for regaining control of your finances.

Illustration of a stressed individual surrounded by shopping bags and bills, depicting emotional spending leading to financial toxicity and budget imbalance.

Anúncios

Understanding Financial Toxicity: The Hidden Cost of Emotional Spending

Financial toxicity originally stems from healthcare, describing overwhelming financial burdens associated with medical expenses. However, the term is now broadly applied to describe chronic financial distress triggered by non-essential spending that causes long-term harm. A key driver of financial toxicity is emotional spending—purchases motivated by feelings such as stress, boredom, sadness, or even celebration, rather than actual needs.

Anúncios

Studies reveal that approximately 53% of Americans admit to impulse buys driven by emotions, leading to roughly $5,400 wasted annually per household (CreditCards.com, 2023). Emotional spenders often fail to realize the magnitude of small, unplanned expenditures because these purchases, though seemingly negligible individually, cumulatively erode savings and derail budgets. Over time, this behavior creates a toxic financial cycle that breeds anxiety and limits opportunities for wealth building.

Consider the example of Sarah, a marketing executive who finds comfort in shopping after stressful workdays. Despite earning over $70,000 annually, she struggles to save beyond her emergency fund. Her emotional purchases—ranging from clothes to dining experiences—add up to nearly $600 monthly, leaving her with little disposable income. Without intervention, her financial toxicity will worsen, increasing her stress and impairing her future financial goals.

The Psychological Triggers Behind Emotional Spending

Emotional spending is often a subconscious effort to cope with psychological triggers. Consumers use shopping as a coping mechanism for negative feelings like loneliness, stress, or low self-esteem. The act of purchasing brings temporary pleasure through dopamine release, momentarily alleviating emotional pain. However, the euphoria is short-lived, often followed by guilt, regret, or financial worry, perpetuating a cycle of negative emotions.

Research from the Journal of Consumer Psychology (2022) highlights that anxiety-induced emotional buyers are 30% more likely to spend impulsively compared to non-anxious individuals. Additionally, social media and targeted marketing exacerbate emotional spending by preying on insecurities and fostering comparison. For example, Millennials and Gen Z, exposed to digitally curated lifestyles, report higher spending motivated by the desire to ‘keep up’ with peers, often leading to debt or diminished savings.

The case of James, a 28-year-old IT professional, illustrates these triggers. After seeing influencers promoting luxury products online, James began purchasing expensive gadgets and fashion items beyond his budget, driven more by envy and aspirations than actual necessity. His credit card balances escalated rapidly, culminating in financial toxicity marked by high-interest debt and missed bill payments.

How Emotional Spending Affects Your Monthly Budget: A Detailed Breakdown

Mapping the impact of emotional spending on a budget reveals the extent of damage it causes to financial health. Consider a typical monthly net income of $4,000. Assume the individual allocates funds as below for essential expenses:

| Category | Budgeted Amount | Percentage of Income |

|---|---|---|

| Housing (Rent/Mortgage) | $1,200 | 30% |

| Utilities & Bills | $300 | 7.5% |

| Groceries & Essentials | $500 | 12.5% |

| Transportation | $300 | 7.5% |

| Savings & Investments | $600 | 15% |

| Debt Repayments | $400 | 10% |

| Discretionary Spending | $300 | 7.5% |

When emotional spending creeps in, discretionary spending often balloons unnoticed. For example, an additional $400 spent monthly on emotional triggers such as impulsive online shopping, dining out, or entertainment can overshoot the budget, changing the layout as follows:

| Category | Revised Amount | New Percentage of Income |

|---|---|---|

| Housing (Rent/Mortgage) | $1,200 | 30% |

| Utilities & Bills | $300 | 7.5% |

| Groceries & Essentials | $500 | 12.5% |

| Transportation | $300 | 7.5% |

| Savings & Investments | $200 | 5% |

| Debt Repayments | $400 | 10% |

| Discretionary Spending | $700 | 17.5% |

In this scenario, the individual sacrifices $400 from savings to accommodate emotional purchases. The reduction in savings compromises long-term financial goals such as home ownership, retirement, or emergency funds. Moreover, if this pattern leads to credit card debt, the burden compounds with interest payments and potential late fees, further straining the budget.

A practical example comes from Lisa, who started buying impulse items like cafes and accessories during emotional lows. Her monthly discretionary budget increased by 60%, reducing her contributions to her 401(k). As a result, Lisa’s retirement prospects diminished, and she accumulated $3,000 in credit card debt within six months, leading to increased stress—a classic case of financial toxicity.

Strategies to Identify and Control Emotional Spending

Awareness is the first step toward combating financial toxicity caused by emotional spending. Track your own spending habits by maintaining detailed records of every purchase, categorizing them as “need” or “want,” and noting associated feelings. Mobile apps like Mint or YNAB offer efficient ways to monitor impulsive purchases and detect patterns linked to emotional states.

Another effective method is the “24-hour rule,” where you wait a full day before making non-essential purchases. This cooling-off period disrupts impulsivity and helps ensure decisions are rational rather than reactionary.

Replacing emotional spending with healthier coping mechanisms is crucial. For instance, Daniel, a sales executive, started engaging in regular physical exercise, journaling, and meditation whenever he felt the urge to shop emotionally. Not only did his budget improve, but his mental well-being also benefited significantly, illustrating the interconnected nature of financial and emotional health.

Additionally, setting a realistic monthly budget for “fun money” prevents feelings of deprivation while encouraging responsible spending. For example, allocating $200 for discretionary purchases provides freedom but requires discipline not to exceed the limit. Combining this with periodic financial check-ins reinforces accountability.

| Strategy | Description | Example | Outcome |

|---|---|---|---|

| Tracking Spending | Detailed recording of all purchases | Using mobile apps | Increased awareness of triggers |

| Cooling-Off Period | Waiting 24 hours before impulsive buys | Delaying online shopping | Reduced impulsivity |

| Healthy Coping Mechanisms | Activities substituting emotional shopping | Exercise, meditation | Improved mental and financial health |

| Budgeting “Fun Money” | Allocating fixed discretionary spending amount | $200 monthly discretionary budget | Maintained spending control |

Financial Education and Support Systems: Preventing Long-Term Toxicity

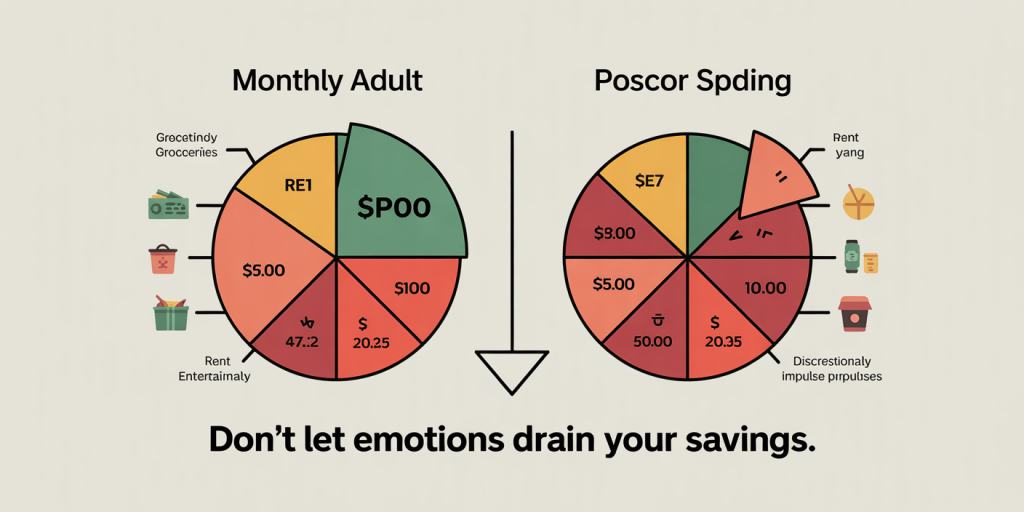

Detailed monthly budget infographic showing allocation of income before and after emotional spending, highlighting reduced savings and increased discretionary expenses.

Long-term prevention of financial toxicity requires education to understand emotional spending’s impact comprehensively. Financial literacy programs that integrate behavioral finance concepts empower individuals to recognize and control spending emotions, cultivate saving habits, and plan for the future.

Organizations like the National Endowment for Financial Education (NEFE) have reported that individuals with higher financial literacy are 25% less likely to fall into debt due to impulse spending (NEFE, 2023). Also, community support groups or credit counseling services offer environments where individuals share struggles and develop strategies under professional guidance, reducing stigma and fostering resilience.

Take the example of Maria, who attended a six-week financial wellness workshop offered by her employer. The course covered money management, emotional triggers, and debt reduction techniques. By applying learned principles and seeking accountability partners, Maria halved her monthly emotional spending within three months and improved her credit score by 45 points in a year.

Therapeutic interventions such as cognitive-behavioral therapy (CBT) can also help individuals understand underlying emotional issues fueling compulsive shopping. Integrating mental health care with financial counseling addresses root causes rather than symptoms of financial toxicity.

Future Perspectives: Technological Innovations and Behavioral Change in Addressing Financial Toxicity

Looking forward, technological advancements and rising awareness about mental health and financial wellness hold promise in mitigating financial toxicity linked to emotional spending. Artificial intelligence (AI) is increasingly embedded in personal finance tools, offering real-time spending alerts and emotional state analyses to guide users toward healthier financial habits.

For example, apps using emotion detection algorithms analyze spending trends alongside user input to flag high-risk emotional purchases before they occur. Early tests indicate such interventions reduce impulsive spending by up to 20% among users (FinTech Review, 2024).

Moreover, societal shifts toward openness about mental health encourage integrative approaches blending psychology and finance. Schools and workplaces are incorporating holistic wellness programs, increasing proactive identification and management of emotional spenders.

Financial institutions are also adapting policies, introducing features such as customizable spending limits, mandatory savings automation, and reward programs tied to responsible financial behavior. These developments make budgeting easier, categorize expenses accurately, and enhance user engagement, ultimately lowering financial toxicity risk.

Policy-makers can further contribute by promoting financial education in school curricula and enabling access to mental health resources that address behavioral spending problems early, reducing long-term consequences on public economic health.

Technological Tools and Behavioral Outcomes: A Comparative Snapshot

| Tool/Intervention | Functionality | Impact on Emotional Spending | User Adoption Level |

|---|---|---|---|

| AI-driven Spending Alerts | Detects emotional buying patterns, sends alerts | 15–20% reduction in impulsivity | Growing rapidly |

| Automated Savings Programs | Automatically moves funds to savings accounts | Decreases available funds for impulsive spend | Widely used |

| Reward-Based Behavior Apps | Incentivizes controlled spending via rewards | Improves adherence to budgets | Moderate adoption |

| Integrated Financial & Mental Wellness Programs | Combines therapy and financial coaching | Addresses root causes effectively | Emerging model |

In conclusion, the combination of education, technological innovation, and behavioral support offers significant hope to individuals struggling with financial toxicity. By understanding emotional triggers and implementing sustainable strategies, one can transform financial health and break destructive cycles. The path to financial freedom lies not only in controlling numbers but also in mastering emotions.

Post Comment