Financial Minimalism: How Owning Less Can Lead to Greater Wealth

Anúncios

In an era dominated by consumer culture and material accumulation, the concept of financial minimalism is emerging as a powerful antidote to the traditional wealth-building narrative. Financial minimalism is centered on the philosophy that owning less and focusing on essentials can enhance financial health, improve decision-making, and ultimately lead to increased wealth. This article explores how financial minimalism works, examines practical approaches to adopting it, provides real-world examples, and analyses future financial trends influenced by minimalist principles.

Understanding Financial Minimalism in Today’s Economy

Financial minimalism is not merely about spending less; it’s a strategic shift in mindset toward simplifying one’s financial life with intentional choices. Studies have shown that Americans spend an average of 39% of their income on non-essential purchases, often motivated by impulse or social pressures (Bureau of Labor Statistics, 2023). Financial minimalism challenges this norm by advocating purposeful spending, prioritizing quality over quantity, and reducing financial clutter.

Anúncios

One core benefit of this approach is the increase in savings and investment capability. By consciously limiting consumption, individuals can redirect their monetary resources to long-term assets such as retirement accounts or real estate. Additionally, owning fewer possessions reduces ongoing costs like maintenance, storage, and insurance, further improving net financial position.

Streamlining Expenses: The Power of Intentional Spending

Anúncios

Intentional spending is fundamental to financial minimalism. It involves evaluating purchases against personal values and financial goals before committing funds. This contrasts with habitual or emotional spending, which can drastically erode financial stability over time. For example, Sarah, a graphic designer from Seattle, cut unnecessary expenditures such as multiple streaming services and frequent dining out, reallocating those savings to an emergency fund and a Roth IRA. Within two years, she notably increased her net worth by 20%.

To illustrate the impact, consider this comparative table:

| Expense Category | Average Monthly Spend (Traditional) | Minimalist Monthly Spend | Annual Savings |

|---|---|---|---|

| Dining Out | $300 | $100 | $2,400 |

| Subscriptions | $150 | $30 | $1,440 |

| Clothing/Apparel | $200 | $80 | $1,440 |

| Impulse Purchases | $250 | $50 | $2,400 |

| Total | $900 | $260 | $7,680 |

This table demonstrates how reducing discretionary items can save nearly $7,700 annually, a sum that can be invested to generate compound returns or used to pay down debt.

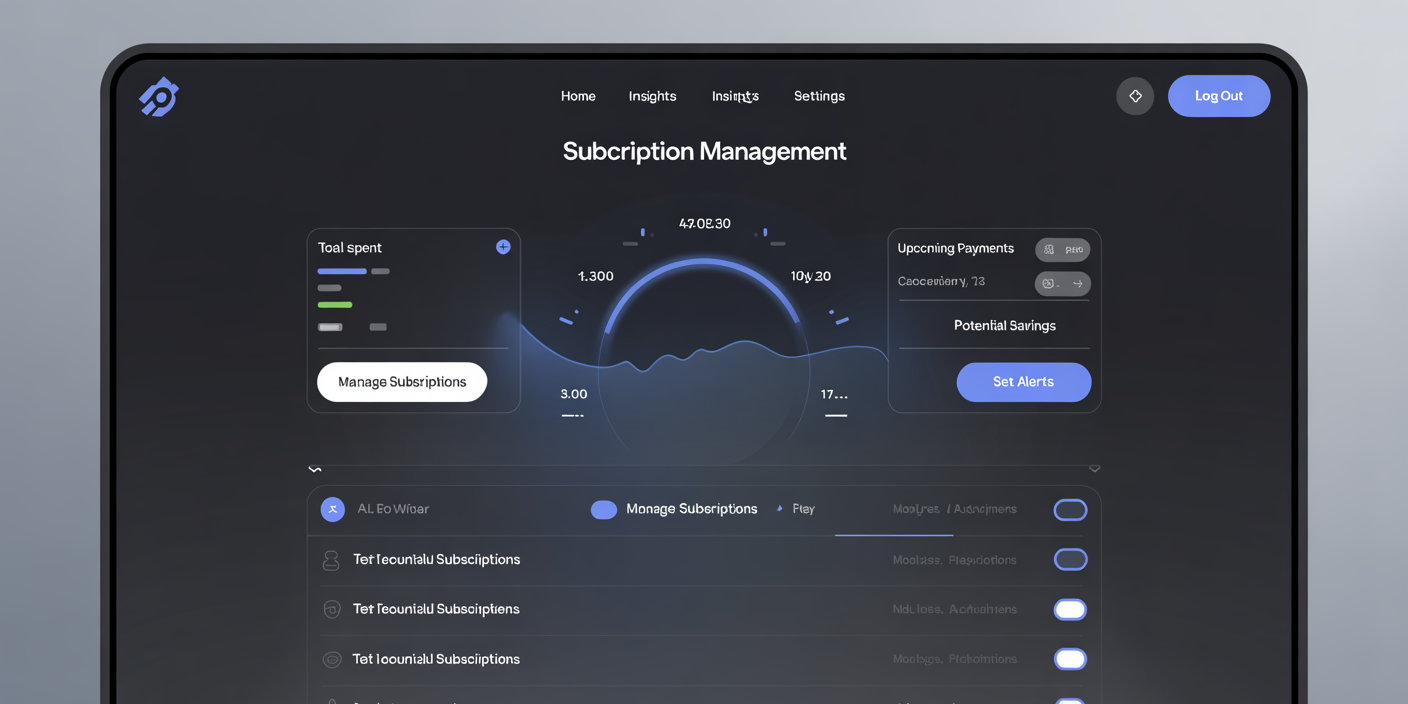

A comparative infographic/table illustrating traditional vs. minimalist monthly expenses and savings, highlighting financial benefits of reducing discretionary spending.

Real-Life Success Stories: Minimalism and Wealth Creation

Several high-profile entrepreneurs and investors embody financial minimalism and attribute part of their success to owning less. For instance, Warren Buffett, one of the world’s richest individuals, is famously known for his frugal lifestyle. Despite having a net worth exceeding $100 billion, Buffett still resides in the same Omaha house he purchased in 1958 for $31,500. This minimalist approach extends to his spending habits, choosing value and longevity over extravagance.

Similarly, many individuals following financial minimalism report fewer financial anxieties and improved cash flow. Jacob, a software engineer, adopted minimalism after realizing his desire for luxury gadgets and clothes was delaying his homeownership plans. By focusing on essentials, reducing debt, and investing monthly savings into index funds, he purchased his first property at 28, five years earlier than his peers.

Data confirms these anecdotes. A survey by The Minimalists Project (2022) found that 68% of financial minimalists experienced improved credit scores and 59% reported increased investment balances within three years of adopting minimalist practices.

Simplifying Asset Management: Less is More

Beyond spending, financial minimalism extends to asset management. This means focusing on a straightforward portfolio rather than excessively diversifying with complicated investments. Retail investors often fall into the trap of juggling numerous stocks, cryptocurrencies, and alternative assets, increasing the time and effort spent managing finances and risking poor decisions.

Minimalists prefer long-term investment vehicles such as low-cost index funds or real estate — assets with proven stability and growth over time. This approach not only reduces fees and taxes but also lowers stress associated with speculation or frequent portfolio rebalancing.

A clean, organized investment portfolio concept with few assets (index funds, real estate icons), symbolizing streamlined asset management and long-term wealth growth.

Consider the typical vs. minimalist portfolio comparison below:

| Portfolio Type | Number of Assets | Average Annual Return (10 years) | Management Complexity | Management Fees (%) |

|---|---|---|---|---|

| Traditional Portfolio | 15+ | 7.2% | High | 1.2 |

| Minimalist Portfolio | 3-5 | 7.5% | Low | 0.2 |

This comparison shows that minimalist portfolios can slightly outperform while decreasing management challenges and costs, contributing to greater net wealth accumulation.

The Psychological and Social Dimensions of Financial Minimalism

Financial minimalism also taps into the psychological benefits of owning less. The accumulation of goods often comes with a hidden cost: mental clutter and stress over maintenance, decision fatigue, and social comparison. By paring possessions down to essentials, individuals report better focus, enhanced contentment, and increased motivation to achieve financial objectives.

Socially, minimalism counters the pervasive consumerist narratives propagated through social media and advertising, where worth is frequently equated with material acquisition. By rejecting these pressures, minimalists foster healthier self-esteem rooted in personal achievements, relationships, and meaningful experiences rather than possessions.

A minimalist lifestyle scene showing a person happily managing finances with few possessions around, emphasizing simplicity and intentional spending.

For example, Emma, a teacher in Chicago, described how downscaling her wardrobe and selling unused household items empowered her to live within a fixed income comfortably and fund her children’s college savings without anxiety. This highlights the relationship between financial minimalism and improved well-being.

Future Perspectives: Financial Minimalism in a Changing World

As global financial landscapes evolve with technology, environmental concerns, and shifting social values, financial minimalism is poised to grow in relevance. Digital banking, robo-advisers, and automated budgeting tools align perfectly with minimalist principles by simplifying money management and reducing unnecessary financial noise.

Moreover, societal awareness about sustainability is prompting individuals and institutions to rethink consumption patterns. Financial minimalism dovetails with this shift by promoting mindful resource use that benefits both personal finances and the planet.

According to a 2024 report by Deloitte, sustainable investing grew by 15% annually over the past five years, with many investors focusing more on quality than quantity. This trend suggests that the minimalist approach to ownership and investment will increasingly intersect with environmental, social, and governance (ESG) criteria—fostering wealth creation that supports lasting impact.

Furthermore, as automation and artificial intelligence reshape workplace dynamics, there is increasing cultural emphasis on life balance and financial security, making minimalism an attractive strategy for achieving resilience against economic uncertainties.

In summary, financial minimalism represents a compelling paradigm that integrates deliberate spending, streamlined asset management, psychological wellness, and future readiness. By owning less, individuals can free themselves from the financial and emotional burdens of excess, invest more strategically, and build sustainable wealth over time. As economic and social factors continue to evolve, minimalism is set to become not only a personal finance tool but a vital framework for holistic financial success.

Post Comment