Financial Implications of Divorce: How to Protect Yourself

Anúncios

Divorce is not only an emotionally challenging experience but also a complex financial transition. When a marriage ends, significant economic changes occur that can affect both parties’ financial stability for years. Understanding these financial implications is essential to safeguarding your assets, income, and overall financial wellbeing during and after the divorce process. This article explores the multifaceted financial aspects of divorce and provides practical strategies to protect yourself.

Understanding the Financial Impact of Divorce

Divorce can drastically alter your financial landscape, often resulting in decreased household income, division of assets, and new expenses. According to the American Academy of Matrimonial Lawyers, 81% of attorneys agree that finances are the primary cause of disagreements during divorce settlements, underscoring the critical nature of economic concerns.

Anúncios

Household income typically drops after divorce due to the establishment of two separate households. The U.S. Census Bureau data from 2021 reveals that the median income for divorced female heads of household was approximately $40,200, significantly lower than the $67,500 median household income for married couples. This gap highlights the importance of planning to ensure long-term financial viability post-divorce.

Financial effects extend beyond immediate income and asset division; they also affect retirement plans, tax obligations, and credit scores. In many cases, couples overlook the long-term impact on retirement savings or tax liabilities. For example, failing to update beneficiary designations on retirement accounts or life insurance policies can cause funds to go to an ex-spouse unintentionally.

Anúncios

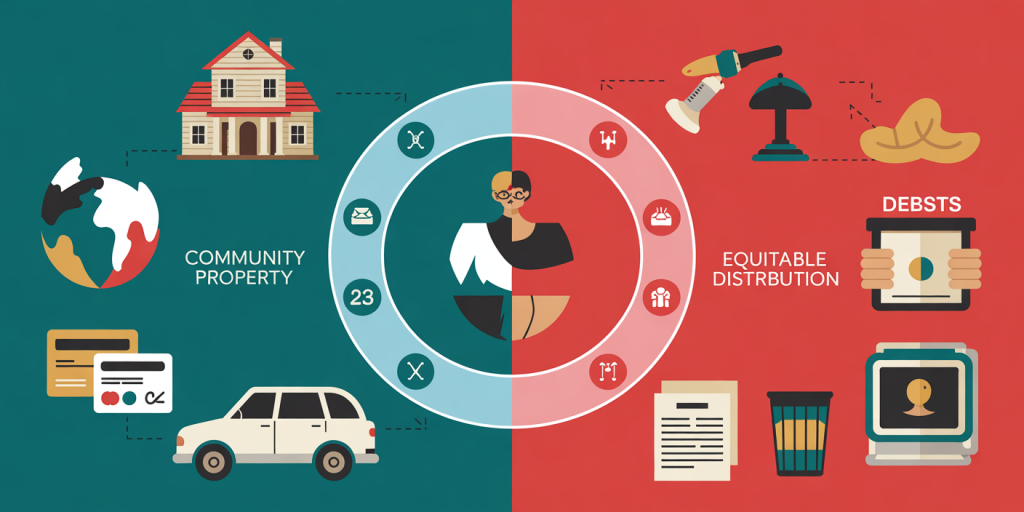

Asset Division: Navigating Marital Property and Debts

One of the most critical issues during divorce is the division of assets and liabilities. The laws governing asset division vary across states, primarily split into community property and equitable distribution states. Community property states (e.g., California, Texas) require nearly all marital property to be split 50/50, whereas equitable distribution states (e.g., New York, Florida) divide assets fairly but not necessarily equally.

Marital property generally includes real estate, investment accounts, retirement benefits earned during marriage, vehicles, and other acquired goods. Separate property, such as inheritances or gifts, usually remains with the original owner unless it has been commingled with marital assets. The accurate classification of assets is crucial to avoid giving up more than what is lawfully deserved.

Debt can complicate this process significantly. Credit card debts, mortgages, car loans, and personal loans accumulated during marriage may become joint liabilities. It is vital to identify both marital debt and separate debt early on to prevent future credit damage. For instance, a 2022 report from Experian found that 40% of divorced individuals discovered post-divorce debts were improperly assigned, affecting their credit scores adversely.

| Aspect | Community Property States | Equitable Distribution States |

|---|---|---|

| Asset Division | Equal (50/50) split | Fair and equitable, based on various factors |

| Debt Responsibility | Shared equally | Assigned based on ownership and ability to pay |

| Key Considerations | Defined by law, less room for negotiation | Negotiated or court-ordered distribution |

Taking inventory of all assets and debts with professional help, such as a forensic accountant, can ensure transparency and minimize disputes.

Protecting Your Income and Retirement

Post-divorce financial security depends heavily on protecting your income and retirement funds. Spousal support, or alimony, might provide temporary relief but is rarely a permanent solution and often depends on income disparity and marriage duration.

Retirement accounts can be a significant portion of marital wealth. According to the Employee Benefit Research Institute, the average 401(k) balance for divorced persons is approximately 30% lower than for married individuals, indicating the impact of division or lack of contribution post-divorce. It’s essential to arrange for a Qualified Domestic Relations Order (QDRO) if you are dividing retirement plans to avoid early withdrawal penalties and taxes.

Additionally, consider the future tax implications of asset division. For instance, cashing out a 401(k) plan during divorce can trigger immediate tax and penalty charges, reducing net proceeds significantly. Understanding how assets like stocks, bonds, or real estate gains will be taxed can influence negotiation strategies.

Another income protection tactic is updating income-related documentation. This includes revising your tax filing status, withholding allowances, and insurance policies. Using the example of one recent divorcee, Sarah, who failed to update her tax status immediately after divorce, she ended up with a large tax bill due to under-withholding.

Managing Legal and Professional Fees

Legal fees often constitute a substantial expense in divorce proceedings. According to a 2023 report by Lawyers.com, the average cost of a divorce in the United States is approximately $15,000 per party, not including division of expense for contested divorces which can rise to $30,000 or more.

While legal representation is often necessary, couples can reduce fees through alternative dispute resolution (ADR) methods such as mediation or collaborative divorce. These methods generally cost less, reduce conflict, and often result in faster settlements. In mediation, an impartial mediator facilitates negotiation, whereas the collaborative process involves attorneys for both parties cooperating to reach agreement without court intervention.

Deciding whether to pursue a contested or uncontested divorce impacts financial outlay greatly. Couples who can agree on financial terms upfront—such as property division and support—can minimize court time and fees. For example, John and Emily settled their finances through mediation and saved an estimated $10,000 compared to going through traditional litigation.

Budgeting for legal fees involves anticipating monthly costs and including them in your overall financial plan. It is prudent to secure an initial consultation with a divorce attorney to understand potential costs and then explore cheaper options like legal clinics or online resources for less complicated cases.

Safeguarding Credit and Financial Records

A critical but sometimes overlooked area in divorce is the protection of credit and financial records. Divorce can have a long-lasting impact on your creditworthiness if liabilities are not properly divided or if joint accounts are mismanaged post-separation.

It’s advisable to close joint credit accounts or remove your name once divorce papers are filed and arrangements are clear. Continuing to co-sign on credit cards or loans can lead to financial damage if one party defaults. According to a 2022 survey by Credit Karma, nearly 30% of divorced individuals reported credit score drops within two years due to unresolved joint debt.

Secure copies of all financial documents including tax returns, bank statements, loan agreements, and asset appraisals. Having thorough documentation aids legal processes and protects you against fraudulent claims or errors.

Practical steps include ordering credit reports from the three major bureaus at least twice a year post-divorce to monitor any suspicious activity. Also, updating financial account passwords and mailing addresses to your new residence ensures control over your finances and communications.

Looking Ahead: Long-Term Financial Planning After Divorce

While divorce imposes immediate financial challenges, long-term planning is key to rebuilding financial security. Developing a comprehensive budget incorporating new expenses, considering emergency savings, and setting achievable financial goals are essential steps.

Investing in financial literacy or consulting a certified financial planner (CFP) can provide personalized strategies tailored to your circumstances. Creating a post-divorce financial roadmap includes revisiting your retirement plans, insurance needs, and estate planning documents. For example, changing life insurance beneficiaries and wills promptly ensures that your estate plans reflect your new status.

Research by the National Endowment for Financial Education shows that 70% of divorcees who engaged in financial education post-divorce reported greater confidence and improved financial outcomes, emphasizing the value of informed decision-making.

Building credit independently, whether by obtaining a secured credit card or making timely loan payments, helps restore financial independence. Also, considering investment diversification and retirement account contributions will strengthen your financial position over time.

Planning for future tax years is paramount as well; altered filing statuses can affect deductions, credits, and debt repayment strategies. Set annual reviews to adjust your financial plans as life circumstances evolve.

Final Reflections: Preparing Financially for the Post-Divorce Future

Divorce reshapes your financial reality in significant ways, but with careful understanding and proactive measures, you can protect yourself and enhance your economic security. Navigating asset division, safeguarding income and retirement, managing legal costs, protecting credit, and focusing on long-term financial planning create a foundation for stability.

Emerging trends, such as increasing use of digital financial tools and collaborative divorce processes, offer new opportunities for efficient asset management and dispute resolution. Further, evolving laws around retirement and taxation continue to influence divorce outcomes, making it essential to stay informed with the help of professionals.

Ultimately, the financial implications of divorce are complex but manageable when approached strategically. Protecting your financial wellbeing requires knowledge, organization, and forward-thinking—tools that empower you to transition smoothly into a secure, independent future.

Post Comment