FHA Loans Explained: A First-Time Homebuyer’s Guide in the U.S.

Anúncios

Making Homeownership More Accessible Through Flexible Financing

Buying your first home is one of the most exciting milestones in life. But if you’ve started researching the process, you’ve likely realized just how complex it can be—especially when it comes to mortgages. Credit requirements, down payments, interest rates, closing costs… it can all feel overwhelming.

For many first-time buyers, one of the most accessible and realistic options is an FHA loan—a mortgage program backed by the Federal Housing Administration. These loans are specifically designed to help people who may not qualify for traditional mortgages due to limited credit history, lower income, or modest savings.

In this guide, we’ll take a deeper look at how FHA loans work, their pros and cons, who qualifies, and how to navigate the application process. If you’re hoping to buy a home but worry that traditional financing is out of reach, an FHA loan may be the key to turning your dream into reality.

Anúncios

What Is an FHA Loan?

An FHA loan is a government-insured mortgage loan designed to make homeownership more accessible—particularly for first-time buyers or those with less-than-perfect credit. The program is run by the Federal Housing Administration, which is part of the U.S. Department of Housing and Urban Development (HUD).

Anúncios

Here’s how it works:

-

The FHA doesn’t lend money directly. Instead, it insures loans made by FHA-approved private lenders (like banks, credit unions, and mortgage companies).

-

This insurance protects lenders from financial loss if the borrower defaults. Because the risk is reduced, lenders can offer more favorable loan terms to borrowers who might otherwise be denied a conventional mortgage.

Top Benefits of an FHA Loan

What makes FHA loans so appealing, especially for first-time homebuyers?

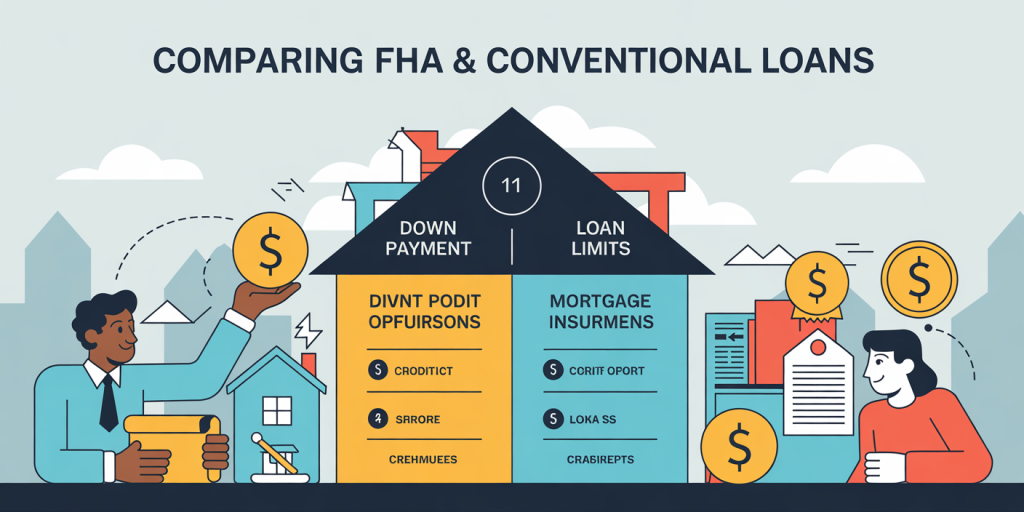

✅ Low Down Payment

One of the biggest draws is the low minimum down payment requirement. Qualified borrowers with credit scores of 580 or higher can put down as little as 3.5% of the home’s purchase price.

Compare that to conventional loans, which typically require a down payment of at least 5% to 20%.

✅ Lenient Credit Requirements

FHA loans are ideal for people with lower credit scores. While conventional loans often require a minimum score of 620 or higher, FHA loans may be available with scores as low as 500—though a 10% down payment is typically required at that level.

✅ Flexible Debt-to-Income (DTI) Ratios

FHA loans allow for higher DTI ratios, which means you may still qualify even if you have other debts, such as student loans or credit card balances.

✅ Option to Include Closing Costs

FHA loans allow some closing costs to be rolled into the loan or covered by seller concessions, easing the upfront financial burden.

✅ Assumable Loans

FHA loans are assumable, meaning that if you sell your home, the buyer can take over your existing loan (if they qualify). This can be a major selling point if interest rates have risen.

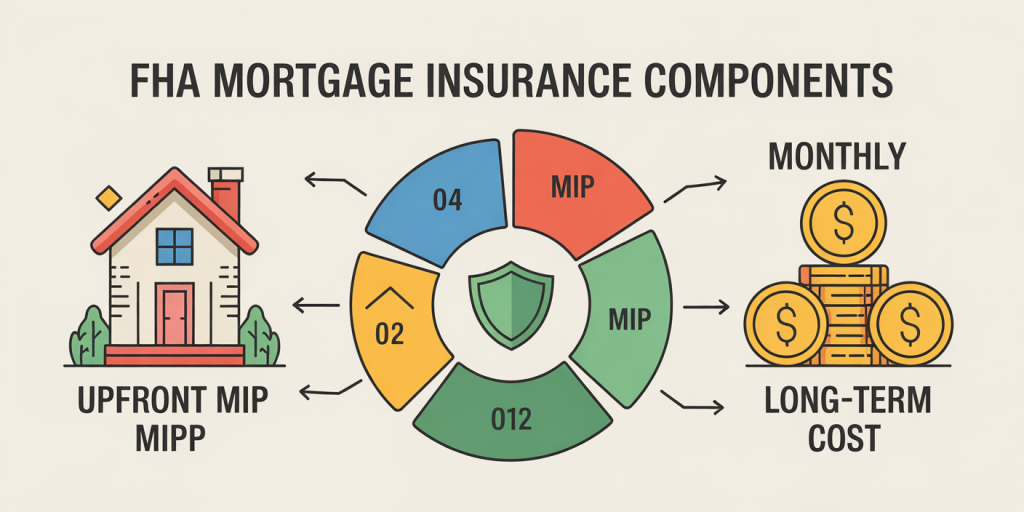

FHA Mortgage Insurance Premiums (MIP)

While FHA loans have clear advantages, they also come with a notable cost: Mortgage Insurance Premiums (MIP).

There are two components:

-

Upfront MIP (UFMIP):

Paid at closing, this is typically 1.75% of the loan amount. It can be paid in full or rolled into your loan. -

Annual MIP:

This is an ongoing premium paid monthly and ranges from 0.45% to 1.05% of the loan amount, depending on the loan term, amount, and down payment.

📌 Important Note:

If you put down less than 10%, MIP is required for the life of the loan. If you put down 10% or more, MIP lasts for 11 years.

FHA Loan Eligibility Requirements

To qualify for an FHA loan, borrowers must meet several criteria. Requirements may vary slightly between lenders, but here are the standard guidelines:

1. Credit Score

-

580+: Eligible for 3.5% down payment

-

500–579: May still qualify, but must put down at least 10%

-

Below 500: Typically not eligible for FHA loans

Each lender may have their own minimum score above 580, so it’s worth shopping around.

2. Steady Employment and Income

Lenders want to see at least two years of consistent employment and income. This can be verified through:

-

Pay stubs

-

Tax returns

-

W-2 forms

-

Employer contact information

Self-employed applicants may need to provide profit-and-loss statements and business tax returns.

3. Debt-to-Income (DTI) Ratio

Your DTI ratio compares your monthly debt payments to your gross monthly income. Generally, FHA guidelines require a DTI of 43% or lower, though higher ratios may be accepted with strong compensating factors, such as:

-

Large cash reserves

-

Significant down payment

-

Strong credit history

4. Primary Residence Only

FHA loans can only be used to buy a primary residence—not investment properties or vacation homes.

5. FHA Property Standards

The home you’re purchasing must meet FHA’s Minimum Property Standards, ensuring the property is:

-

Safe

-

Structurally sound

-

Sanitary and livable

An FHA-approved appraiser will inspect the home to ensure it meets these requirements.

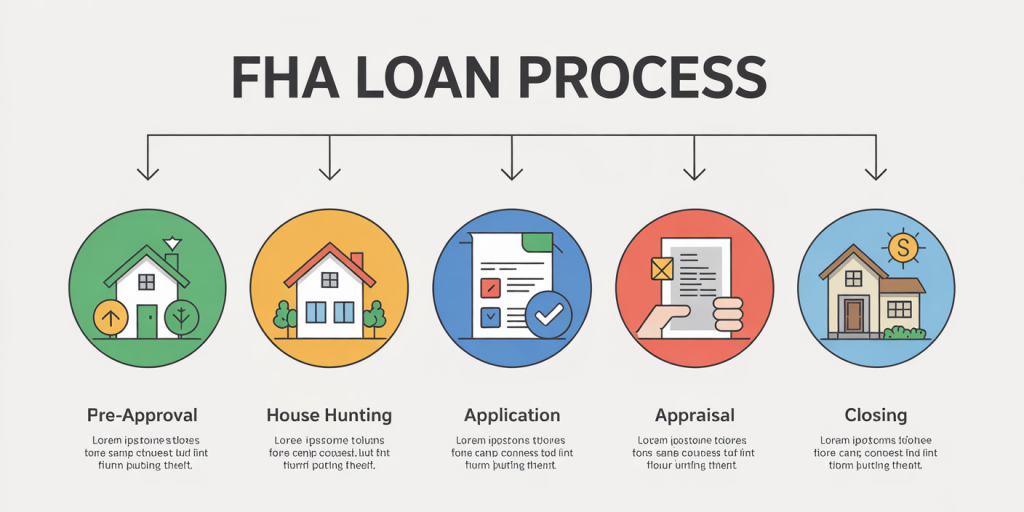

The FHA Loan Process: Step-by-Step

Although similar to the process for other mortgages, there are some unique steps in the FHA application journey. Here’s a step-by-step look:

Step 1: Pre-Approval

Begin by getting pre-approved through an FHA-approved lender. During this stage, the lender will:

-

Review your credit

-

Verify your income and assets

-

Calculate your DTI ratio

You’ll receive a pre-approval letter showing how much you can borrow. This strengthens your position when making offers on homes.

Step 2: Home Shopping

With pre-approval in hand, you can begin searching for homes within your budget. Work with a real estate agent who understands FHA guidelines to help identify properties that meet the criteria.

Step 3: Make an Offer and Apply

Once your offer is accepted, you’ll complete the full loan application. The lender will order:

-

A home appraisal (FHA-specific)

-

Verification of all financial information

-

Title search and underwriting review

Step 4: Final Loan Approval

If the appraisal and underwriting go smoothly, you’ll receive final loan approval. This is when you lock in your interest rate and prepare for closing.

Step 5: Closing Day

At closing, you’ll:

-

Sign the mortgage documents

-

Pay your down payment and any required closing costs

-

Receive the keys to your new home

Who Should Consider an FHA Loan?

FHA loans are a great fit for:

-

First-time homebuyers without a large down payment

-

Buyers with limited credit history or previous credit challenges

-

Individuals with high DTI ratios who may not qualify for conventional loans

-

Buyers looking to purchase a modest, move-in ready home

However, FHA loans may not be ideal for:

-

Those purchasing high-end homes (FHA loans have county-based limits)

-

Buyers who want to avoid mortgage insurance

-

Investors or second-home buyers

Tips for FHA Loan Success

-

Check your credit early and work on improving it before applying.

-

Compare lenders to get the best rate and lowest fees.

-

Understand the full cost of MIP over the life of the loan.

-

Be realistic about your budget—just because you’re approved for a certain amount doesn’t mean you should spend it all.

-

Use the FHA loan limit tool on HUD’s website to find out the cap for your area.

Final Thoughts: Homeownership Within Reach

Buying a home doesn’t have to be reserved for the wealthy or those with perfect credit. FHA loans exist to bridge the gap—offering everyday people a real opportunity to invest in homeownership.

If you’ve been dreaming of owning a home but assumed you couldn’t qualify, an FHA loan might be the answer. With low down payments, flexible requirements, and trusted lender partnerships, this program has already helped millions of Americans achieve their homeownership goals—and you could be next.

Recap:

-

FHA loans offer accessibility and affordability

-

Backed by the government, but issued by private lenders

-

Perfect for first-time buyers and those building (or rebuilding) their credit

With the right guidance and preparation, you’ll be holding the keys to your new home sooner than you think.

Post Comment