Emotional Investing: How Your Emotions Affect Your Investment Decisions

Anúncios

Investing is often portrayed as a purely rational activity, guided by data analysis, market trends, and logical strategies. However, the reality is far more complex. Human emotions profoundly influence investment decisions, frequently leading to outcomes that deviate from what classic financial theory would predict. Emotional investing can manifest in various ways, from impulsive buying and panic selling to overconfidence and herd behavior. This phenomenon is not only prevalent among individual investors but can also sway institutional decisions, affecting market dynamics on a broader scale.

Understanding the role of emotions in investment decisions is crucial for both novice and seasoned investors. Recognizing emotional triggers and learning to manage them can improve investment performance and reduce undue risk. This article explores how emotions influence investment behavior, practical examples of emotional investing, common psychological biases tied to finance, and strategies to mitigate their effects, backed by statistics and notable case studies.

The Emotional Underpinnings of Investment Behavior

Anúncios

Investing involves uncertainty and risk, two elements that naturally evoke emotional responses. Fear, greed, hope, and regret are among the most common emotions that shape financial choices. For example, fear can cause investors to sell off assets prematurely during a market downturn, often crystallizing losses that might have been avoided through patience. Conversely, greed may drive excessive risk-taking as investors chase quick profits or follow hype around certain stocks.

Research highlights the significant impact of emotions on decision-making processes. According to a 2022 report by the National Bureau of Economic Research, investors who admitted experiencing strong emotional reactions during market volatility were 30% more likely to make suboptimal selling decisions, such as panic selling or timing the market incorrectly. Moreover, a survey by Charles Schwab found that 58% of investors felt that fear influenced their decision to sell stocks during the 2020 market crash. These data points underscore the ubiquity of emotions in investing.

Anúncios

The neurological basis of these behaviors also offers insight. The amygdala, a part of the brain associated with processing emotions, particularly fear and pleasure, plays a pivotal role in investment decision-making. Studies utilizing fMRI scans reveal that heightened emotional reactions can override the prefrontal cortex, responsible for logical reasoning, thereby skewing decisions towards impulsivity rather than calculated risk management.

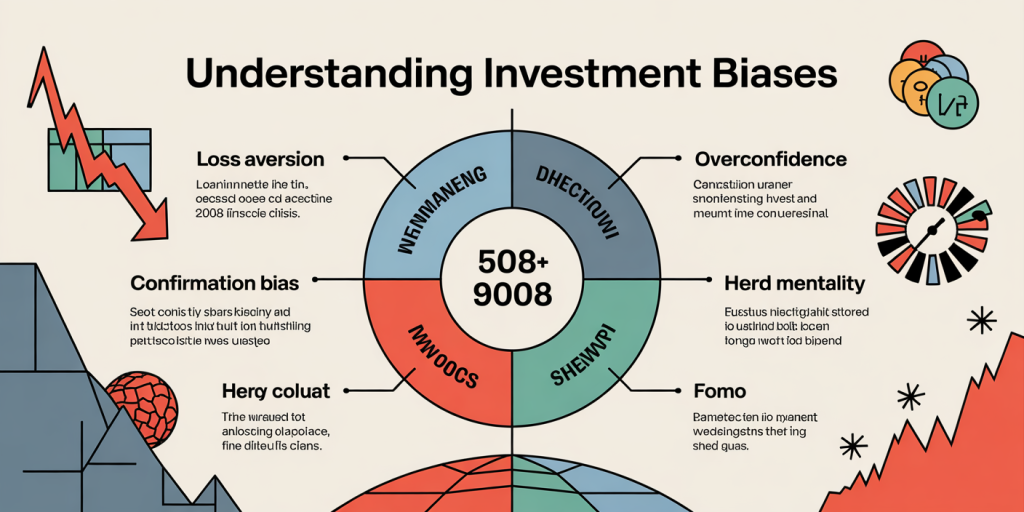

Common Emotional Biases Impacting Investors

Several well-documented emotional biases affect investor behavior, often leading to detrimental financial outcomes. Understanding these biases is vital to recognizing and counteracting their influence.

Loss Aversion and the Disposition Effect

Loss aversion refers to the tendency to prefer avoiding losses over acquiring equivalent gains. This bias explains why many investors hold onto losing stocks for too long, hoping to break even, while quickly selling winning assets to “lock in” gains. This behavior is known as the disposition effect and can hinder optimal portfolio rebalancing.

An example involves investors during the 2018 stock market correction. Despite falling prices signaling the need to reassess holdings, many clung to declining stocks instead of reallocating funds to more promising opportunities. Over time, this caused portfolio underperformance relative to the market average.

Overconfidence and Confirmation Bias

Overconfidence bias leads investors to overestimate their knowledge, forecasting ability, or control over investment outcomes. This often results in excessive trading, concentrated portfolios, and inadequate diversification. Confirmation bias compounds this by making investors seek information that affirms their existing beliefs while ignoring opposing data.

For instance, during the tech bubble of the late 1990s, many investors were overly confident in the potential of internet companies, disregarding fundamental valuations. This overconfidence contributed to inflated asset prices and eventual market collapse.

Herd Mentality and FOMO (Fear of Missing Out)

Herd mentality describes the tendency to mimic the investment actions of the majority, influenced by social proof rather than independent analysis. FOMO intensifies this effect, pushing investors to jump into trending stocks or sectors without thorough due diligence.

A recent example includes the GameStop short squeeze in early 2021, where retail investors coordinated purchasing, driven by excitement and social media momentum. While some made significant profits, many entered too late or exited at losses, illustrating the danger of emotion-driven herd investing.

Practical Cases Demonstrating Emotional Investing

Examining real-world examples provides clarity on how emotional investing plays out and its ramifications.

The 2008 Financial Crisis: Fear-Induced Market Selloff

During the 2008 global financial crisis, widespread fear triggered massive selloffs in both equity and bond markets. Retail investors, fearing catastrophic losses, liquidated substantial portions of their portfolios. A study by the Journal of Financial Economics found that individuals who remained invested through the downturn experienced average recoveries of 100% or more within the subsequent five years, compared to those who sold early.

This crisis highlighted that while fear is rational in response to uncertainty, acting impulsively on it can result in lost opportunities for recovery and growth.

The Dot-Com Bubble: Overconfidence and Speculation

The late 1990s dot-com bubble exemplifies investor overconfidence, where exuberance about internet technology stocks caused valuations to soar beyond realistic earnings potential. Many investors were persuaded by optimistic media reports and ignored warning signs. The subsequent crash wiped out trillions in market value.

Professional investors who maintained disciplined, value-oriented strategies outperformed their counterparts caught up in the frenzy. This case underlines the importance of tempering enthusiasm with rigorous analysis.

Strategies to Manage Emotional Investing

Given the evident impact of emotions on investment decisions, adopting strategies to mitigate emotional biases is essential for improved outcomes.

Developing a Clear Investment Plan

Setting well-defined investment goals, asset allocation, and risk tolerance levels creates a structured framework that reduces impulsive decisions based on short-term market noise. Automated investment vehicles like robo-advisors can help enforce discipline by executing predefined strategies without emotional interference.

Regular Portfolio Reviews and Rebalancing

Periodic reassessment helps maintain alignment with long-term objectives, preventing portfolio drift caused by market fluctuations or emotional reactions. For instance, if equities outperform significantly, rebalancing by selling some stocks and buying bonds can prevent excessive risk concentration driven by timing attempts.

Mindfulness and Emotional Awareness

Investors benefit from cultivating self-awareness regarding their emotional responses to market events. Techniques such as journaling investment decisions, seeking third-party advice, and pausing before acting on strong emotions can moderate impulsive behavior.

Educational Resources and Support Networks

Investor education on behavioral finance principles increases knowledge of common pitfalls. Additionally, leveraging advisory services or investment clubs provides diverse perspectives, counteracting insular decision-making prone to emotional bias.

Comparative Analysis: Emotional Investing vs. Rational Investing

| Aspect | Emotional Investing | Rational Investing |

|---|---|---|

| Decision Drivers | Emotions such as fear, greed, and herd behavior | Data-driven analysis and predefined strategies |

| Timing of Buy/Sell | Often impulsive or reactive to market volatility | Based on market fundamentals and long-term outlook |

| Risk Management | Risk often underestimated or ignored during highs; panic-selling during lows | Consistent risk assessment and portfolio diversification |

| Impact on Returns | Generally leads to lower and more volatile returns | Potential for steady, optimized returns over time |

| Common Mistakes | Panic selling, chasing trends, overtrading | Emotional detachment can sometimes overlook opportunities for value investing |

| Typical Investor Profile | Novice investors, influenced by media and social cues | Experienced investors, institutional investors |

This table summarizes how emotional investing contrasts with rational, disciplined approaches. While emotions are unavoidable, awareness and strategic controls can bridge the gap towards rational decision-making.

Looking Ahead: The Future of Emotional Investing in a Digital Era

The rise of algorithmic trading, artificial intelligence, and behavioral finance research is transforming how emotions influence investing. Automated systems reduce emotional interference by executing trades based on pre-set parameters. However, investors still face emotional challenges in deciding when and how to engage with these tools.

Emerging technologies like sentiment analysis use machine learning to interpret social media trends and investor psychology, potentially providing early warnings of herd behavior or irrational exuberance. Platforms offering personalized coaching and emotional analytics aim to assist investors in recognizing their biases.

Moreover, the proliferation of social investing platforms increases both opportunities and risks. While democratizing investment access, these platforms often amplify herd mentality and FOMO, making emotional literacy more critical than ever.

In the future, integrating behavioral insights with technological innovation will be essential to help investors manage emotions effectively. Financial education programs are increasingly incorporating emotional intelligence modules, and regulatory frameworks may evolve to protect retail investors from emotion-driven exploitation.

In conclusion, emotions are an integral, powerful force shaping investment decisions. By understanding their mechanisms, recognizing common biases, and employing strategies to limit emotional impact, investors can improve financial discipline and long-term performance. The intersection of psychology and technology offers promising pathways to navigate the emotional complexities of investing, ensuring both individual and market stability in an ever-changing financial landscape.

Post Comment