Disability Insurance: The Most Overlooked Financial Safety Net

Anúncios

Disability insurance remains one of the most underappreciated yet crucial components of a comprehensive financial plan. Despite the significant impact disabilities can have on an individual’s earning ability, many people neglect to secure this form of insurance, risking severe financial instability in the face of unforeseen health challenges. This article explores the importance of disability insurance, its types, the gaps it aims to fill, and instructions for selecting the right coverage. Real-world cases and data are integrated to underscore its value and to debunk common misconceptions.

The Hidden Financial Risks of Disability

Most working adults assume their income is secure until retirement or a voluntary job change, seldom considering the possibility of a disabling illness or injury. However, statistics reveal a harsher reality. According to the Social Security Administration, approximately one in four individuals entering the workforce today will become disabled before retirement age. This statistic alone highlights how substantial the risk truly is.

Anúncios

When a disability strikes, income interruptions can lead to devastating financial consequences. Daily expenses, mortgage payments, debts, and other fixed costs do not pause for health crises. Without sufficient income replacement, a disabled individual might deplete savings rapidly, dip into retirement funds prematurely, or incur debt, compromising long-term financial security. Despite this, a LIMRA report found that only about 51% of working Americans have some form of disability insurance, indicating a large gap in financial preparedness.

Understanding Disability Insurance and Its Varieties

Anúncios

Disability insurance protects your income when you are unable to work due to illness or injury. There are two main types: short-term disability (STD) and long-term disability (LTD) insurance. Each caters to different durations of income loss and operates under varying conditions.

Short-term disability typically covers a period from several weeks up to six months. It provides a percentage of your salary—usually between 50% and 70%—during the initial recovery period. Conversely, long-term disability takes effect after short-term benefits expire and can continue for several years or even until retirement. LTD policies often replace roughly 60% of pre-disability income, offering a more extensive safety net.

An example where these policies mattered can be seen in the case of Sarah, a 34-year-old graphic designer who fractured her spine in a car accident. Her employer provided short-term disability coverage, which helped cover her initial medical leave. However, her recovery took longer than expected, and her long-term disability policy allowed her to continue receiving an income replacement for over two years, preventing financial collapse during this extended period.

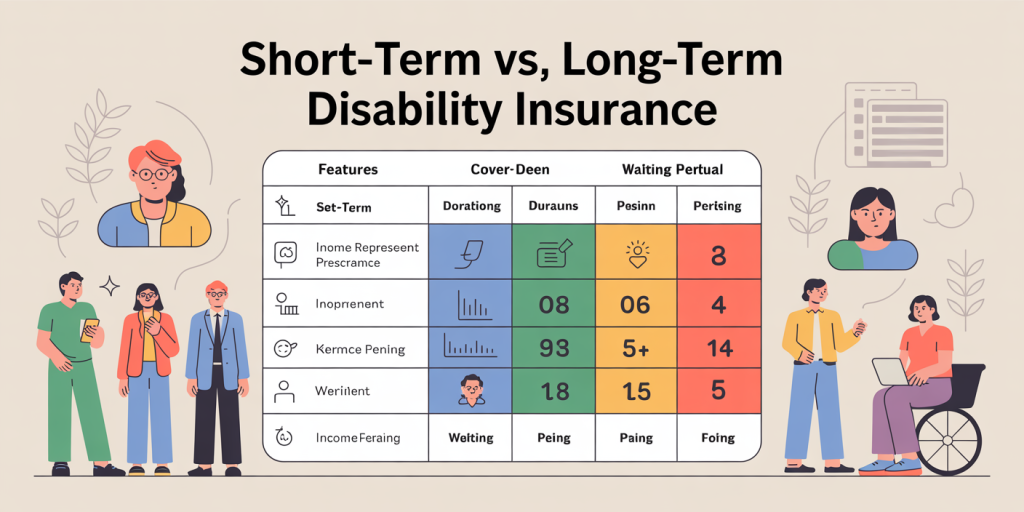

Comparative Table: Short-Term vs Long-Term Disability Insurance

| Feature | Short-Term Disability (STD) | Long-Term Disability (LTD) |

|---|---|---|

| Coverage Duration | 3 weeks to 6 months | Several years or until retirement |

| Income Replacement | 50% – 70% of salary | ~60% of pre-disability income |

| Waiting Period | Usually immediate or within 1-14 days | Typically 90-180 days |

| Typical Cost to Insured | Lower premium costs | Higher premium costs |

| Medical Examination Needed | Sometimes required | Almost always required |

Why Disability Insurance Is Overlooked

Comparative infographic showing short-term vs long-term disability insurance features, coverage durations, income replacement percentages, and waiting periods in a clear, visually engaging table format.

Despite the clear benefits, disability insurance is often disregarded due to several prevailing myths and misconceptions. Many individuals underestimate the likelihood of becoming disabled, believing it only happens to others or is relevant only for high-risk occupations. This misconception can be costly.

Additionally, some workers rely solely on Employer-Provided Benefits (EPB), which are often limited in coverage and duration. According to a 2022 report by the Council for Disability Awareness, employer-provided long-term disability benefits replace only 40-60% of income and may cease entirely if employment is terminated. Overreliance on these plans might leave individuals underinsured.

Many people also cite premium costs as a barrier. However, data shows that the average monthly premium for long-term disability insurance is between 1% and 3% of gross income—a relatively affordable expense considering the financial consequences of losing one’s income. A proactive approach involves understanding the value proposition rather than dismissing the costs outright.

Real-Life Impact: Cases of Disability Insurance Success and Failure

Case studies reveal how disability insurance serves as a financial lifesaver or, conversely, how its absence leads to hardship. Take the story of Tom, a 45-year-old construction project manager who suffered a severe back injury at work. Tom had a long-term disability policy through his employer, which paid 60% of his income during his two-year recovery. This coverage allowed him to cover mortgage payments, medical bills, and daily expenses. Without this safety net, Tom would have faced foreclosure and bankruptcy.

Contrast this with the situation of Emily, a 29-year-old marketing consultant who never purchased disability insurance. When she was diagnosed with multiple sclerosis, her illness forced her out of the workforce indefinitely. Without income protection, Emily quickly exhausted her savings and was forced to move back in with family. Her financial struggles highlight how lacking disability insurance can derail even a young professional’s life.

Illustration of a worried professional reviewing financial documents with symbols representing disability insurance as a financial safety net protecting income and family stability.

The Social Security Disability Insurance (SSDI) program in the U.S. offers benefits but is difficult to qualify for and often insufficient relative to previous earnings. According to the Social Security Administration, average monthly SSDI payments were roughly $1,483 in 2023, well below the median monthly wage of approximately $4,400. Private disability insurance thus plays a vital role in bridging this significant gap.

How to Choose the Right Disability Insurance Policy

Selecting an appropriate policy involves evaluating several key factors: the definition of disability, waiting periods, benefit periods, and coverage amount. Policies vary widely in how they define disability. Some define it as the inability to perform “any occupation,” while others use the broader “own occupation” standard, which means unable to perform your specific job.

Choosing a policy with an “own occupation” clause can be essential for professionals with specialized skills. For instance, an accountant unable to work in their specific role might still be capable of other types of employment but could lose significant income without this type of coverage. Policies that base benefits on “any occupation” tend to be more restrictive and may lead to claim denials.

Waiting periods—the time between the onset of disability and when benefits begin—also impact financial planning. Shorter waiting periods reduce out-of-pocket expenses but often come with higher premiums. Conversely, longer waiting periods require larger emergency funds but lower insurance costs. A typical strategy is to align waiting periods with other resources such as emergency savings or employer benefits.

Benefit periods indicate the length of time coverage lasts. Policies that pay benefits until retirement age come with higher premiums but offer greater peace of mind. Most policies offer options ranging from two years to lifetime benefits, with lifetime coverage often best for those without substantial retirement savings.

Table: Key Policy Terms Impacting Disability Insurance Performance

| Policy Feature | Description | Impact on Cost & Coverage |

|---|---|---|

| Definition of Disability | “Own Occupation” vs “Any Occupation” | “Own Occupation” = Broader coverage, higher premiums |

| Waiting Period | Delay before benefits start (30, 60, 90, 180 days) | Shorter wait = higher premiums |

| Benefit Period | Duration of benefit payments | Longer periods = higher cost |

| Residual Benefits | Partial disability coverage | Offers income replacement for limited work capacity |

| Cost-of-Living Rider | Adjusts benefits for inflation | Maintains benefit value over time |

Integrating Disability Insurance into Holistic Financial Planning

Disability insurance should not be viewed in isolation but rather as a key pillar in overall financial security planning. It complements health insurance, life insurance, and retirement savings by addressing income risk. For example, reliance solely on savings or liquidating investment accounts during a disability could result in a diminished nest egg and compromised future financial goals.

Financial advisors often recommend a multi-layered strategy that leverages employer plans, private policies, and savings to optimize financial resilience. Many employers offer group disability plans at a low cost, but these often are insufficient alone. Private policies can fill the gaps, especially for higher earners or those with unique occupational risks.

Additionally, integrating disability insurance with estate planning and tax strategies can enhance overall effectiveness. Some premiums are tax-deductible depending on the policy type and ownership, and benefits can be structured to minimize tax liabilities. Consulting professionals knowledgeable in insurance and tax law is valuable for customizing coverage.

Shifting Perspectives: The Future of Disability Insurance

As the modern workforce evolves, with remote work and gig economy roles expanding, the landscape of income protection is changing. Traditional employer-based disability insurance may not adequately cover freelancers and independent contractors, increasing the importance of individually purchased coverage.

Depiction of diverse workers including freelancers, remote employees, and traditional office workers, highlighting the evolving landscape of disability insurance coverage needs in the modern workforce.

Healthcare advances may reduce the incidence or duration of some disabilities but may also introduce complexities in claims adjudication and policy terms. Additionally, emerging technology, such as digital health data, could streamline claims processing and fraud detection, increasing efficiency.

Policy innovation is trending toward more flexible and customizable plans that can adapt to diverse employment situations. Legislative efforts are also underway in various jurisdictions to enhance social disability benefits and incentivize private coverage.

Looking ahead, awareness campaigns and educational initiatives spearheaded by industry organizations and government agencies aim to improve public understanding of disability risk and insurance. The U.S. Council for Disability Awareness campaigns, for instance, strive to close the knowledge gap through targeted messaging and practical guidance.

Employers, financial advisors, and individuals alike play critical roles in elevating the priority placed on disability insurance. By recognizing it as a fundamental financial safety net and integrating it carefully into financial strategies, people can safeguard their income against the unexpected and ensure long-term stability.

Disability insurance, though often overlooked, plays a vital role in financial protection by mitigating the potentially devastating impact of lost income due to disability. By understanding its types, dispelling myths, learning from real cases, and selecting the right policy, individuals can secure a dependable safety net. As workforce dynamics and technology evolve, disability insurance will continue to adapt, offering new avenues for awareness and coverage. Prioritizing this essential insurance today can preserve financial independence and peace of mind tomorrow.

Post Comment