Digital Banking & Automation: Tools to Simplify Personal Finances in 2025

Anúncios

The landscape of personal finance management is evolving rapidly, driven by the twin forces of digital banking and automation. With technological advancements seamlessly integrating into everyday financial activities, consumers are empowered like never before to manage their money efficiently, securely, and conveniently. As we approach 2025, the adoption of digital banking tools paired with automation technologies has transcended novelty and become an essential facet of financial wellness for millions worldwide. This article explores how these innovations are revolutionizing personal finance management, supported by real-world examples, relevant data, and practical insights geared toward simplifying financial lives effortlessly.

The Rise of Digital Banking: Convenience Meets Innovation

Digital banking has transformed the traditional banking experience by enabling customers to handle most financial operations natively on their smartphones, tablets, or desktops. Gone are the days when stepping into a branch was mandatory for basic transactions. Now, users benefit from 24/7 access to savings accounts, loans, payments, and investment management, all consolidated in intuitive apps or online portals.

Anúncios

A 2024 report by Statista highlights that over 72% of global consumers use digital banking services actively, representing a steep rise from just 48% in 2017. Such statistics emphasize the accelerating trend toward digital-first banking, fueled by consumers’ desire for accessibility and personalized financial control. For instance, platforms like Chime and Revolut have gained millions of users by offering fee-free, user-friendly digital-only accounts, often with features like instant transaction alerts and real-time spending categorization.

The implications are far-reaching. Beyond simplicity, digital banking reduces reliance on paperwork, minimizes physical branch visits, and introduces enhanced security protocols such as biometric authentication and two-factor verification. The convenience offered translates to improved financial discipline, as users receive timely notifications and insights into their spending habits, helping them avoid overdrafts or late fees.

Anúncios

A futuristic secure digital banking environment illustrating cybersecurity measures such as biometric authentication, two-factor verification, encryption icons, and privacy shields, emphasizing data protection and user privacy in digital finance.

Automation in Personal Finance: Harnessing AI and Machine Learning

Automation within personal finance leverages artificial intelligence (AI) and machine learning to optimize money management without requiring constant user input. Whether it’s automatic bill payments, savings transfers, or investment rebalancing, automation removes friction and errors common in manual financial oversight.

Take for example automated budgeting apps like YNAB (You Need a Budget) or Simplifi by Quicken, which connect to bank accounts and credit cards to track spending patterns in real time. These apps automatically categorize expenses, highlight trends, and suggest adjustments, helping users maintain budgets aligned with their financial goals. Additionally, robo-advisors such as Betterment and Wealthfront manage investment portfolios using algorithms that assess risk tolerance and market conditions, executing trades automatically to maximize returns.

A 2023 Deloitte fintech survey revealed that 67% of respondents favored automation for routine financial tasks, reporting greater satisfaction and less stress. Automation not only saves time but improves accuracy, eliminating human errors that can lead to missed payments or poor investment decisions. For example, an automated savings tool like Digit analyzes users’ income and spending to determine safe amounts to transfer into savings without jeopardizing daily expenses, orchestrating personal finance with remarkable precision.

Practical Financial Management Tools in 2025: A Comparative Overview

In 2025, various tools offer nuanced features tailored to different financial needs. Understanding their functions and optimal use cases can empower individuals to make informed choices aligned with personal finance objectives.

| Tool Category | Leading Platforms | Key Features | Ideal Users |

|---|---|---|---|

| Digital Banking Apps | Chime, Revolut, Monzo | No-fee accounts, instant notifications, crypto integration | Millennials, frequent travelers |

| Budgeting & Expense Tracking | YNAB, Simplifi, PocketGuard | Spending categorization, goal setting, alert systems | Budget-conscious individuals |

| Robo-Advisors | Betterment, Wealthfront | Portfolio automation, tax-loss harvesting, goal-based investing | Novice investors, long-term planners |

| Automated Savings Tools | Digit, Qapital | AI-driven savings transfers, round-up transactions | Users struggling to save consistently |

| Bill Payment Automation | Prism, Payable | Consolidated bill management, auto-pay scheduling | Busy professionals, families |

Each category addresses unique pain points: digital banking apps prioritize seamless access and everyday transactions; budgeting tools foster awareness and control; robo-advisors simplify investment complexities; savings automation tackles behavioral challenges; and bill payment platforms ensure on-time payments. By integrating multiple tools, users can create a personal finance ecosystem that offers comprehensive support.

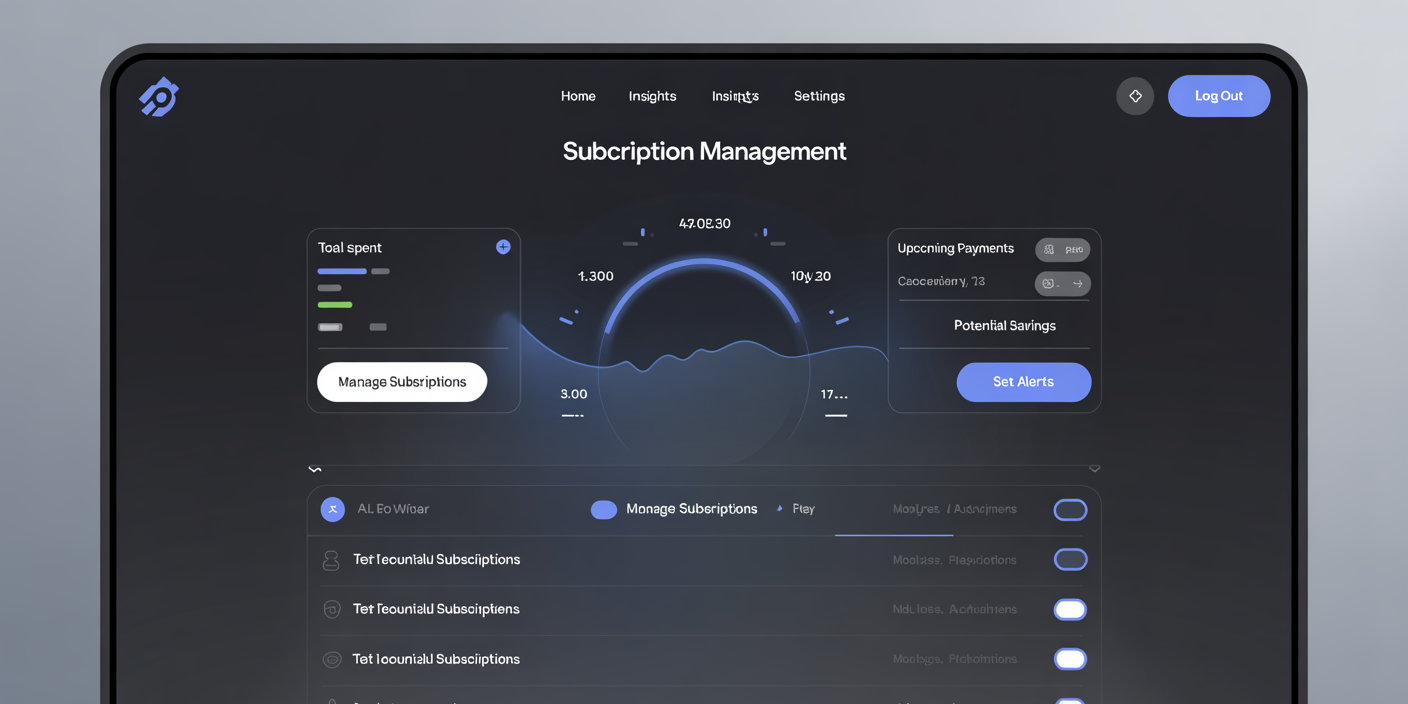

A modern digital banking interface on multiple devices (smartphone, tablet, desktop) showing real-time notifications, spending categorization, and biometric login features, symbolizing convenience and innovation in personal finance for 2025.

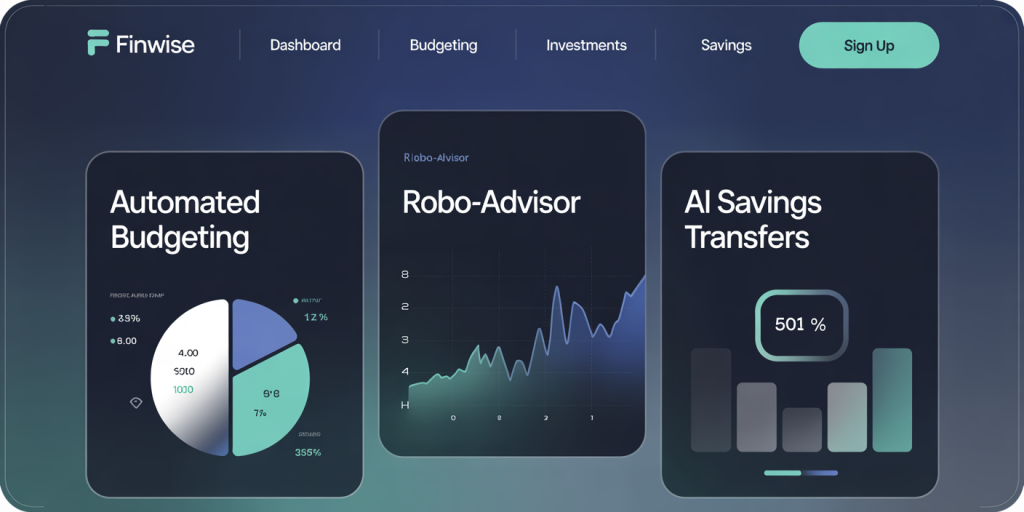

Visualization of AI-driven automation in personal finance: a sleek dashboard displaying automated budgeting, robo-advisor investment management, and AI savings transfers, highlighting seamless integration of machine learning tools simplifying money management.

Real-World Examples: How Digital Banking and Automation Simplify Lives

To illustrate, consider Sara, a 32-year-old marketing executive working remotely across different time zones. She uses Revolut as her primary bank due to its multi-currency accounts and real-time spending alerts that adjust to currency fluctuations. To keep her budget in check, she leverages Simplifi, which connects to Revolut and categorizes her expenses into essentials, dining out, and subscriptions. The app even reminds her when subscription payments are upcoming, avoiding surprise charges.

Sara automates her monthly rent and utility bills through Prism, which consolidates bills into one interface and enables scheduled payments. For savings, Digit ensures that small, unnoticeable amounts are transferred into her emergency fund, helping her build a financial cushion without effort.

Meanwhile, John, a 45-year-old small business owner, entrusts his investment growth to Betterment, which autonomously adjusts asset allocation based on market trends and his retirement timeline. His digital bank, Chime, alerts him instantly on every large transaction, increasing his spending awareness. The automated tools free time and reduce mental load, letting these users focus on professional and personal priorities without sacrificing financial management quality.

Security and Privacy: Challenges and Solutions in 2025

Digital banking and automation introduce unparalleled convenience but naturally bring concerns about data security and privacy. The increasing frequency and volume of online financial transactions necessitate robust protections against cyber threats.

Banks and fintech companies have responded by deploying multifactor authentication (MFA), biometric logins (fingerprint, facial recognition), end-to-end encryption, and continuous fraud monitoring. The 2024 Verizon Data Breach Investigations Report identified banking and finance as sectors with heightened successful cybersecurity attacks, making vigilance critical.

For users, adopting secure habits such as using strong, unique passwords and enabling privacy settings in apps is essential. Moreover, regulatory frameworks like PSD2 in Europe and the Consumer Financial Protection Bureau’s guidelines in the US ensure that customers maintain control over how their data is used and permissioned third-party access remains transparent. Platforms like Plaid facilitate secure data sharing for app integrations, improving user confidence.

Despite these measures, users should stay informed about the privacy policies of chosen tools and regularly update software to protect against vulnerabilities. Balancing convenience and security remains a dynamic challenge central to digital finance.

Future Perspectives: Innovations Shaping Personal Finance in 2025 and Beyond

Looking ahead, the trajectory of digital banking and automation heralds even greater personalization and intelligence embedded in financial management. Advances in AI will mean tools can proactively advise on optimal debt repayment, identify unseen spending leaks, or customize investment portfolios responding instantaneously to global economic shifts.

Voice-activated banking assistants integrated into smart home devices will enable users to manage finances hands-free, retrieving account balances, making payments, or transferring funds via natural conversations. Augmented reality (AR) might soon allow users to visualize spending impacts in immersive dashboards, making budgeting more engaging and less daunting.

Decentralized finance (DeFi) and blockchain technologies are poised to introduce more transparency and security, enabling peer-to-peer lending and instant settlements without intermediaries. Banks are exploring these to expand financial inclusivity and reduce costs, potentially reshaping service delivery by the mid-2020s.

Furthermore, predictive analytics will refine automation by anticipating life changes such as job transitions or family planning, adjusting savings and insurance recommendations accordingly. Collaboration between financial institutions, fintechs, and data scientists will create ecosystems responsive to the evolving financial behaviors and goals of diverse populations.

As these trends converge, the role of digital banking and automation moving forward is not just to simplify finances but to empower users with smart, adaptive, and trustworthy financial companions that foster long-term security and prosperity.

The integration of digital banking and automation in personal finance continues to disrupt traditional paradigms, delivering tools that enhance convenience, accuracy, and financial insight. In 2025, individuals have unprecedented access to technologies designed not only to manage money but also to optimize and personalize financial health, backed by secure, transparent frameworks. Embracing these innovations responsibly ensures that simplifying personal finances becomes a sustainable journey toward economic empowerment for all.

Post Comment