Detailed Guide to Debt-to-Income Ratio and Its Impact on Your Finances

Anúncios

Understanding personal finance metrics is essential for achieving long-term financial stability. Among these metrics, the Debt-to-Income (DTI) ratio is a critical figure that lenders and financial advisors closely scrutinize. The DTI ratio directly influences your ability to secure loans, credit cards, mortgages, and sometimes even affects rental agreements or employment offers. This comprehensive guide dives deep into the DTI ratio, its calculation, its relevance, and how it impacts your overall financial health.

What Is Debt-to-Income Ratio and Why Does It Matter?

The Debt-to-Income ratio measures how much of your monthly gross income goes toward paying debts. In simple terms, it compares your monthly debt payments to your pre-tax monthly income. A low DTI ratio indicates good financial health because a smaller portion of your income is being used to service debts, leaving more room for savings and discretionary spending.

Anúncios

For example, if your gross monthly income is $5,000 and your monthly debts—such as credit card payments, student loans, car loans, and mortgage payments—total $1,500, your DTI ratio is 30% ($1,500 ÷ $5,000 = 0.3 or 30%). Financial experts generally recommend maintaining a DTI below 36%, though some lenders accept higher percentages depending on the loan type and borrower’s credit profile.

A high DTI ratio can signal financial stress and raises red flags for lenders. People with excessive debt obligations relative to their income have decreased borrowing power and may face higher interest rates or loan denials. Understanding your DTI is therefore essential not only for borrowing but also as a benchmark for personal financial planning.

Anúncios

How to Calculate Your Debt-to-Income Ratio Accurately

Calculating the DTI ratio is straightforward but requires careful accounting of all recurring debts and understanding of what counts toward the ratio. The two major components are: Monthly Debt Payments: Includes mortgage or rent, student loans, auto loans, credit card minimum payments, personal loans, child support payments, and any other fixed debt obligations. Gross Monthly Income: This is your total pre-tax income, including wages, salaries, bonuses, overtime, alimony, and social security payments.

Let’s take a practical example. Suppose: Gross monthly income: $6,000 Monthly debts: Mortgage: $1,200 Car loan: $350 Credit card minimum payments: $150 Student loan payment: $200

Total monthly debts = $1,900

DTI ratio = $1,900 ÷ $6,000 = 0.316 or 31.6%

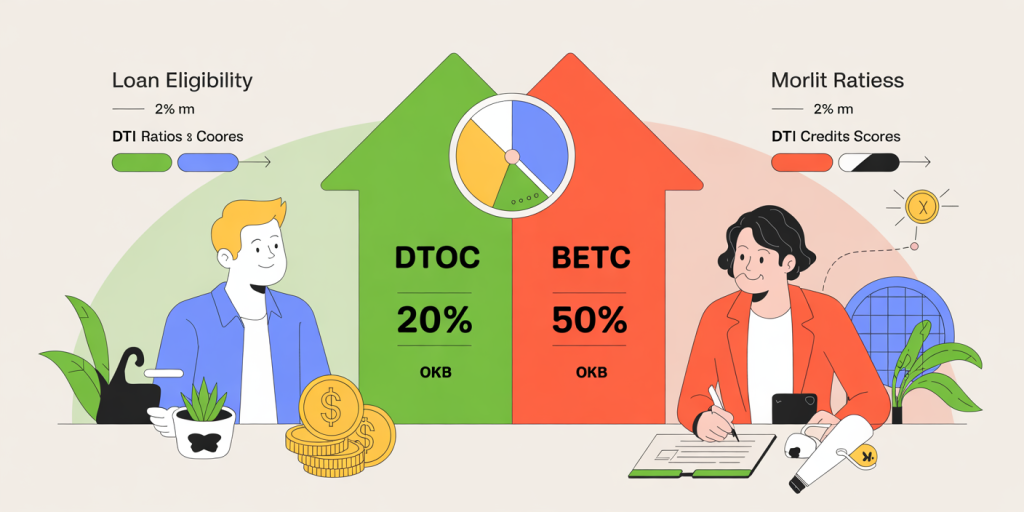

Types of DTI Ratios: Lenders often calculate two ratios: front-end and back-end DTI. Front-end DTI focuses only on housing-related payments (mortgage, property taxes, insurance). For example, if your housing payment is $1,200 and your income is $6,000, front-end DTI is 20%. Back-end DTI encompasses all monthly debts, as illustrated above.

Including both allows lenders to assess your housing cost burden and total debt obligations more precisely, assisting in risk evaluation.

| Debt Type | Monthly Payment | Counted in Front-End DTI? | Counted in Back-End DTI? |

|---|---|---|---|

| Mortgage/Rent | $1,200 | Yes | Yes |

| Car Loan | $350 | No | Yes |

| Credit Card Debt | $150 | No | Yes |

| Student Loan | $200 | No | Yes |

The Impact of DTI Ratio on Loan Eligibility and Interest Rates

One of the primary uses of the DTI ratio is loan eligibility determination. Mortgage lenders, for instance, tend to prefer a back-end DTI of under 43% for most borrowers. According to the Consumer Financial Protection Bureau, surpassing this threshold considerably lowers chances of approval.

Beyond loan approval, the DTI ratio impacts the interest rates you’ll receive. A consumer with a lower DTI ratio is considered less risky and may receive more favorable rates on loans and credit cards. Conversely, borrowers with high DTI ratios often encounter higher interest rates and stricter lending terms.

Consider two borrowers applying for a $250,000 mortgage: Borrower A has a DTI of 30%, credit score of 750. Borrower B has a DTI of 50%, credit score of 720.

Even with a decent credit score, Borrower B might receive a mortgage rate 0.5% to 1% higher than Borrower A due to the elevated DTI. Over a 30-year term, this could mean tens of thousands of dollars in additional interest.

Data from Fannie Mae’s 2022 loan origination report shows that borrowers with DTIs under 36% default at nearly half the rate of borrowers with DTIs exceeding 45%. This statistic validates lenders’ emphasis on DTI and highlights how it serves as a risk gauge.

Practical Strategies to Manage and Reduce Your Debt-to-Income Ratio

Reducing a high DTI ratio is a multifaceted task that can be accomplished by either increasing income, decreasing debt, or a combination of both. Here are effective ways to approach this:

1. Prioritize Paying Off High-Interest Debt: Credit card debts usually carry the highest interest rates and minimum payments can prolong debt burdens. By aggressively paying down credit cards, you reduce monthly payment obligations and improve your DTI ratio.

2. Refinance or Consolidate Loans: Refinancing existing debts into lower-interest loans or consolidating multiple obligations can decrease monthly payments. For instance, refinancing a car loan from 8% to 4% might lower monthly payments by hundreds, making a significant dent in your debt load.

3. Increase Your Earnings: Taking on a side job, seeking promotions, or exploring passive income streams can bolster your gross monthly income, which mathematically lowers your DTI ratio.

4. Avoid Taking On Additional Debt: When trying to improve your DTI, it is imperative to avoid new large debts. Even small new payments add to monthly obligations.

For example, Maria had a gross monthly income of $4,500 and $1,800 in monthly debts—a DTI of 40%. By selling an unused car and using the proceeds to pay off $8,000 credit card debt, she reduced monthly payments by $350, bringing her DTI down to about 32%. This significant reduction made her eligible for a home loan that she was previously denied.

| Strategy | Potential Monthly Savings | Effect on DTI Ratio |

|---|---|---|

| Paying off credit card debt | $300 | Reduces total monthly debt |

| Refinancing auto loan | $150 | Lowers monthly obligation |

| Increasing income by part-time work | $400 | Increases gross monthly income |

| Avoiding new debts | $0 | Prevents increase in DTI |

Broader Financial Consequences of Your Debt-to-Income Ratio

Besides impacting loan approvals, your DTI ratio affects various other facets of financial well-being. A high DTI ratio often signals limited financial flexibility, leaving little room for emergencies or savings. Consequently, this can lead to late payments, credit score drops, and increased vulnerability to economic downturns.

For example, during an unexpected job loss, someone with a high DTI might not have adequate cash flow to cover debts, leading to defaults or foreclosure. According to a 2023 survey by the Federal Reserve, nearly 40% of Americans reported that ongoing debt obligations make it challenging to cover basic living expenses monthly.

Maintaining a manageable DTI ratio also enables better budgeting and goal setting. Lower fixed monthly debts mean you can allocate funds toward retirement accounts, education, or other investments that can compound wealth over time. In contrast, high DTI ratios trap individuals in debt cycles that are difficult to escape.

Emerging Trends and Future Perspectives in DTI Evaluation

As financial services continue evolving, the methods for evaluating DTI ratios are becoming more sophisticated. Traditional DTI calculations mainly rely on gross income and fixed debt payments. However, lenders are increasingly considering alternative data points, such as regular expenses, savings history, and even cash flow patterns, to gain a holistic view of an applicant’s financial health.

Additionally, the rise of fintech lending platforms has introduced more flexible DTI benchmarks. For example, some peer-to-peer lenders may approve borrowers with DTIs higher than traditional standards but couple this with other risk mitigation strategies like higher interest rates or shorter loan terms.

Looking ahead, advancements in artificial intelligence and machine learning may enable real-time assessment of income volatility and debt stress, allowing lenders to tailor loans precisely to borrower risk profiles. This dynamic approach may benefit gig economy workers or those with irregular incomes who traditionally struggle to meet rigid DTI guidelines.

Regulatory changes could also shape how DTI is used. There is ongoing debate about whether more comprehensive measures should replace or supplement DTI in creditworthiness evaluations, to prevent exclusion of creditworthy individuals who do not fit the standard mold.

In the personal finance realm, increasing awareness of DTI’s importance is encouraging more consumers to track these ratios proactively. Tools and apps that integrate income and debt data are becoming commonplace, empowering users to monitor and manage DTI in real time.

Post Comment