Comprehensive Tax Planning Strategies to Reduce Your Liability

Anúncios

Effective tax planning remains a crucial element for individuals and businesses aiming to optimize their financial health and reduce the burden of tax liabilities. With ever-evolving tax laws and regulations, understanding the most strategic approaches can save significant amounts of money, improve cash flow, and ensure compliance. This article explores comprehensive tax planning strategies designed to minimize tax liabilities by leveraging deductions, credits, investment planning, retirement contributions, and more, supported by practical examples and relevant data.

Understanding the Importance of Tax Planning

Tax planning is essential to legally minimize your tax liabilities through strategic organization of finances, investments, and expenses. It is no longer optional but a necessity in optimizing financial outcomes. According to the IRS, taxpayers who engage in proactive tax planning often reduce their annual tax bills by 10-20%, an advantage that can compound significantly over time.

Anúncios

Failing to plan can lead to missed opportunities for deductions and credits, resulting in higher taxes and potential penalties. For example, a study by the Tax Foundation found that U.S. taxpayers overpay by an average of $1,000 annually due to inefficient planning and lack of awareness of available tax benefits. This highlights that comprehensive tax planning not only supports savings but also fosters financial discipline.

Maximizing Deductions and Tax Credits

Anúncios

One of the foundational strategies in reducing tax liability is to maximize deductions and tax credits. Deductions reduce taxable income, while credits directly reduce tax owed, making both essential tools.

Utilizing Itemized Deductions Effectively

Many taxpayers default to the standard deduction without exploring itemized deductions that may offer greater savings. Common deductions include mortgage interest, state and local taxes (up to $10,000), charitable contributions, and medical expenses exceeding 7.5% of adjusted gross income (AGI). For instance, consider an individual with mortgage interest of $8,000, state taxes of $6,000, and donations of $3,000. These itemized deductions total $17,000, surpassing the 2023 standard deduction of $13,850 for single filers, resulting in reduced taxable income.

Real-world case: A California resident family leveraged itemized deductions totaling $22,000 versus the $27,700 federal standard deduction for married filing jointly. Their mortgage interest and charitable donations alone were enough to justify itemization, reducing their taxable income by $5,000 more than standard deduction would have achieved.

Leveraging Tax Credits for Greater Impact

Tax credits, unlike deductions, reduce tax directly and are often more valuable. Examples include the Earned Income Tax Credit (EITC), Child Tax Credit, and credits for education expenses like the American Opportunity Credit. Recent IRS data indicate that over $20 billion in tax credits go unclaimed annually due to lack of awareness. For example, a working parent with two children may qualify for a Child Tax Credit of up to $2,000 per child, directly reducing tax owed by up to $4,000.

Employing these tax credits strategically, especially refundable credits, can substantially decrease your tax bill or increase your refund, making it essential to research eligibility thoroughly.

Strategic Investment Planning to Defer or Reduce Taxes

Investments can either increase tax liabilities due to capital gains or offer strategic avenues for tax deferral or exemption. Understanding the tax implications of different investments is critical in minimizing associated tax burden.

Using Tax-Advantaged Accounts

Tax-advantaged accounts like Individual Retirement Accounts (IRAs), 401(k)s, and Health Savings Accounts (HSAs) provide tax deferral or tax-free growth opportunities. For example, traditional IRA contributions are tax-deductible, reducing taxable income in the contribution year. Gains within these accounts grow tax-deferred until withdrawal, usually during retirement when the tax rate may be lower.

A practical example is a 35-year-old investor contributing $6,500 yearly to a traditional IRA, reducing annual taxable income by that amount. Over 30 years, assuming a 7% return compounded annually, the account grows to nearly $600,000 while deferring taxes until retirement, which could significantly reduce lifetime tax liability.

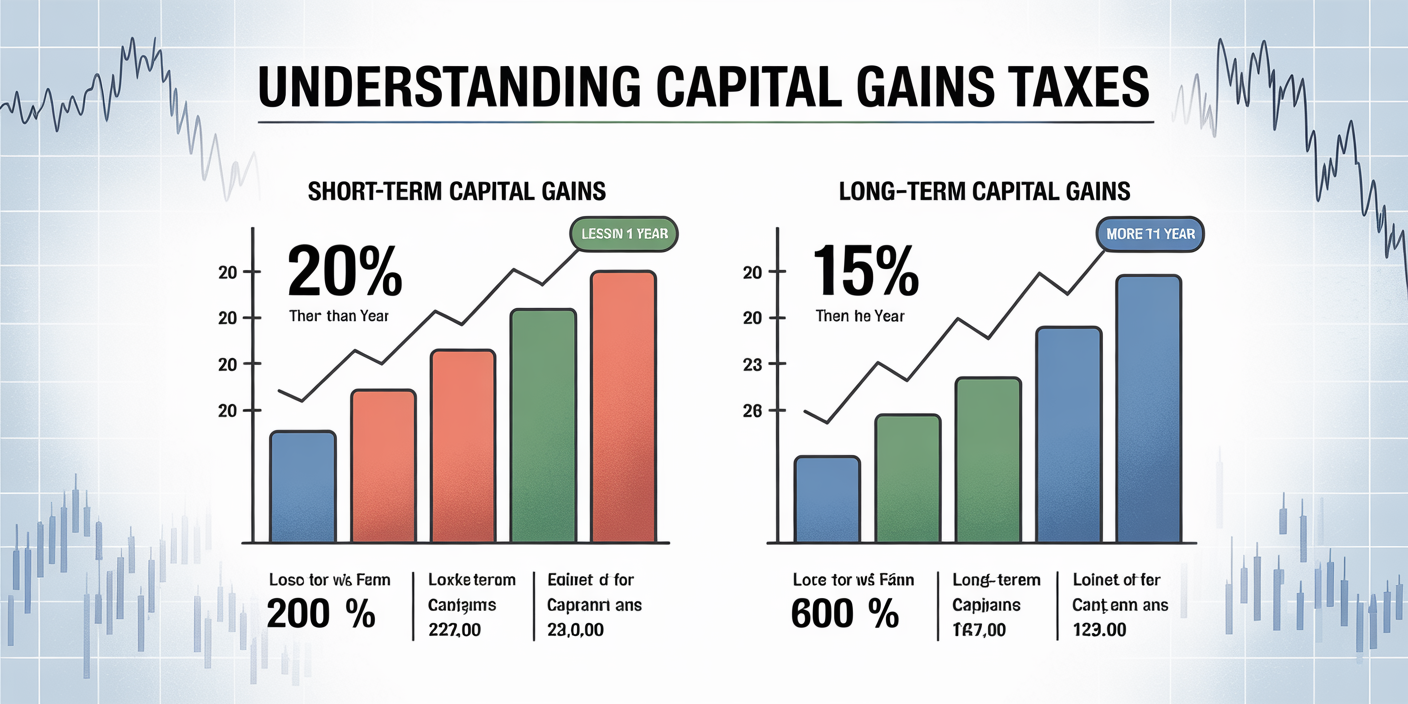

Capital Gains Tax Optimization

Long-term capital gains are taxed at lower rates (0%, 15%, or 20%) compared to ordinary income, incentivizing longer holding periods for investments. Tax planning involves timing asset sales to qualify for preferential rates or offsetting gains with capital losses through tax-loss harvesting.

Consider an investor who sells appreciated stock generating $10,000 in long-term capital gains. By identifying $8,000 worth of losses in other assets sold during the same year, they can offset most of the gains, thus minimizing taxes. This approach is widely used in portfolio management to optimize after-tax returns.

The following table compares tax rates:

| Tax Type | Short-Term Capital Gains | Long-Term Capital Gains | Qualified Dividends |

|---|---|---|---|

| Tax Rate Range (2023) | Ordinary Income Rates (10-37%) | 0%, 15%, 20% depending on income | Same as long-term capital gains |

Understanding these distinctions lets taxpayers plan asset sales and dividends for maximum tax efficiency.

Retirement Contributions: A Vital Tax Reduction Tool

Contributing to retirement plans is among the most effective ways to reduce current tax liability while securing financial futures. Both employer-sponsored and individual retirement plans offer tax advantages.

Employer-Sponsored Retirement Plans

401(k) and similar plans allow employees to make pre-tax contributions, lowering taxable wages and hence income tax liability. Contributions up to $22,500 (2023 limit) can significantly reduce taxes.

A real case is an employee earning $80,000 who contributes the full $22,500 pre-tax to their 401(k). This reduces their taxable income to $57,500, which lowers their marginal tax bracket and overall tax liability.

Individual Retirement Accounts and Roth Options

Traditional IRAs provide deductible contributions, especially for taxpayers under income thresholds who are not covered by employer plans. Conversely, Roth IRAs are funded with after-tax dollars but offer tax-free withdrawals in retirement, optimizing tax planning beyond just reducing current tax.

For example, a young professional expects higher future income and tax rates. Choosing Roth contributions today pays taxes now, but allows tax-free withdrawals later, which can reduce lifetime tax costs in high-tax environments.

Business Tax Planning: Enhancing Savings for Entrepreneurs

Small business owners and self-employed individuals have unique tax planning opportunities to reduce liabilities through a variety of methods including expense deductions, entity selection, and retirement planning.

Deducting Business Expenses

All ordinary and necessary expenses incurred in running a business are deductible. This includes office supplies, travel, home office expenses, and even depreciation on business equipment. For example, a freelancer tracks $10,000 in deductible expenses every year, reducing taxable business income accordingly.

Choosing the Right Business Entity

Selecting the optimal business entity (LLC, S-corp, sole proprietorship) impacts tax liability. An S-corporation, for instance, allows pass-through taxation while enabling owners to pay themselves reasonable salaries and take additional profits as distributions, potentially reducing self-employment taxes.

A study from the Small Business Administration found that switching from sole proprietorship to S-corp status allowed some businesses to reduce self-employment tax liabilities by 15-20% annually.

Future Perspectives in Tax Planning

Tax laws continuously evolve, making adaptable and forward-looking strategies essential. Increasing digitization and data analytics are enabling more personalized and automated tax optimization advice. For instance, artificial intelligence tools can analyze spending patterns and investment portfolios to recommend timely tax-saving measures.

Looking ahead, policymakers may adjust tax brackets and incentives to address economic needs and fiscal deficits. Taxpayers should monitor legislative trends such as potential increases in capital gains taxes or modifications to retirement plan limits.

Moreover, comprehensive tax planning is increasingly integrated with holistic financial planning, encompassing estate planning, charitable giving, and wealth transfer mechanisms. For example, utilizing donor-advised funds can help reduce current tax liability while supporting philanthropic goals.

In conclusion, thorough tax planning involves continually assessing personal and business financial circumstances, employing multiple strategies, and adapting to changing regulations. By doing so, taxpayers can legally reduce their liabilities, preserve wealth, and plan for future financial security effectively.

Post Comment