Best Credit Cards to Consider in 2025

Anúncios

The Best Credit Cards to Consider in 2025: Smarter Spending, Better Rewards

As we step into 2025, more consumers across the U.S. are seeking smarter financial tools to help them maximize the value of everyday purchases. Whether your goal is to earn travel rewards, save on interest, build your credit, or simply get more cashback, choosing the right credit card can make a major difference in your financial strategy.

Credit cards today are not just about convenience—they’re about earning and saving. But with hundreds of options available, it can be overwhelming to know which one is truly best for your needs.

Anúncios

To simplify your decision, here’s a carefully curated list of the top credit cards to consider in 2025, based on reward potential, fees, features, and everyday value.

1. Chase Freedom Unlimited®

A long-standing favorite, the Chase Freedom Unlimited® continues to top the list as one of the most well-rounded cash back cards available.

Anúncios

🏆 Key Benefits:

-

Earn up to 5% cash back on select bonus categories (including travel booked through Chase Ultimate Rewards).

-

3% on dining and drugstores, and 1.5% on all other purchases.

-

No annual fee, making it easy to keep long-term.

-

Travel protections and international usability included.

This card is ideal for users who want flexible rewards, whether they’re traveling, shopping, or dining out. It also integrates seamlessly with the Chase Ultimate Rewards portal, offering opportunities to redeem points for travel, gift cards, or statement credits.

2. Chase Sapphire Preferred®

The Chase Sapphire Preferred® is a top-tier card for frequent travelers who want premium benefits without the ultra-premium annual fees of luxury cards.

✈️ Highlights:

-

60,000-point welcome bonus after meeting the spending requirement.

-

Earn:

-

5x points on travel through Chase Ultimate Rewards,

-

3x on dining,

-

2x on other travel expenses,

-

1x on all other purchases.

-

-

Includes comprehensive travel insurance, purchase protection, and trip delay coverage.

With a $95 annual fee, it offers incredible value, especially for users who book travel through the Chase portal. Points can also be transferred 1:1 to airline and hotel partners, offering excellent redemption flexibility.

3. Discover It® Cash Back

The Discover It® Cash Back card remains a top choice for users who want to earn generous rewards without paying an annual fee.

💸 Why It’s Great:

-

5% cashback on rotating categories each quarter (activation required), such as gas, grocery stores, restaurants, and Amazon purchases.

-

1% cashback on all other purchases.

-

No annual fee—great for long-term value.

-

Cashback Match: At the end of your first year, Discover automatically matches all the cash back you’ve earned.

It’s an ideal card for budget-conscious consumers who are willing to plan their spending around quarterly categories to maximize rewards.

4. American Express® Platinum

For those seeking luxury perks and high-end travel rewards, the American Express® Platinum is one of the most elite cards available in 2025.

🌟 What You Get:

-

Up to 80,000 Membership Rewards® points as a welcome offer.

-

5x points on eligible flights and hotels booked through Amex Travel.

-

Global Lounge Collection® access—over 1,300 airport lounges worldwide.

-

$200 airline fee credit, $200 Uber Cash annually, and hotel status upgrades.

-

Annual fee: $695.

Although the annual fee is steep, frequent travelers can easily recoup the cost through premium perks, exclusive access, and point redemption flexibility.

5. American Express® Hilton Honors

The Hilton Honors Amex card is designed for travelers who frequently stay within the Hilton hotel family—including brands like Hilton Garden Inn, Conrad, and Waldorf Astoria.

🏨 Key Features:

-

Earn up to 80,000 Hilton Honors Bonus Points with qualifying spend.

-

7x points at Hilton hotels, 5x on dining, and 3x on all other purchases.

-

No annual fee, making it an accessible entry point to the Hilton ecosystem.

-

Enjoy complimentary Silver status, with the ability to fast-track to Gold.

For those who travel regularly for work or leisure and prefer staying in Hilton properties, this card offers substantial point-earning power without a cost barrier.

6. Discover It® Student Chrome

The Discover It® Student Chrome is ideal for college students looking to build credit history while earning rewards on daily purchases.

🎓 What Makes It Stand Out:

-

2% cashback at gas stations and restaurants (up to $1,000 quarterly).

-

1% cashback on all other purchases.

-

No annual fee, and students can qualify with little or no credit history.

-

Access to FICO® credit scores and Discover’s robust app for financial tracking.

Discover even offers a Cashback Match on first-year earnings, doubling your rewards at the end of year one. It’s a great starting point for building financial habits early.

7. Ink Business Unlimited® Credit Card

Designed for small business owners and entrepreneurs, the Ink Business Unlimited® card is a powerful tool for managing business expenses and earning rewards.

🧾 Key Benefits:

-

$750 welcome bonus after meeting the qualifying spend.

-

1.5% unlimited cash back on all business purchases—no rotating categories.

-

$0 annual fee, making it cost-effective to maintain.

-

Intro APR of 0% for 12 months on purchases.

-

Includes purchase protection and extended warranty coverage.

This card is perfect for freelancers, side-hustlers, and startups looking to simplify expense tracking while earning flat-rate rewards.

8. Wells Fargo Reflect® Card

If your top priority is reducing interest and managing existing debt, the Wells Fargo Reflect® Card delivers outstanding value through its long introductory APR.

🔄 Standout Features:

-

0% introductory APR for up to 21 months on balance transfers and purchases (with on-time payments).

-

Cell phone protection up to $600 when using the card to pay your phone bill.

-

Access to My Wells Fargo Deals for special discounts and cash-back offers.

While it doesn’t offer a cashback program, this card is perfect for users focused on paying off balances or financing a large purchase without accumulating interest.

Final Thoughts: Choosing the Right Card in 2025

Choosing the best credit card in 2025 depends on your personal financial goals, spending habits, and lifestyle. There is no “one-size-fits-all” option, but there’s definitely a card out there that’s right for you.

Whether you’re:

-

Building credit as a student,

-

Managing a small business,

-

Traveling frequently,

-

Paying down existing debt, or

-

Looking to earn the most from everyday spending,

…each of the cards on this list offers a unique combination of rewards, benefits, and value.

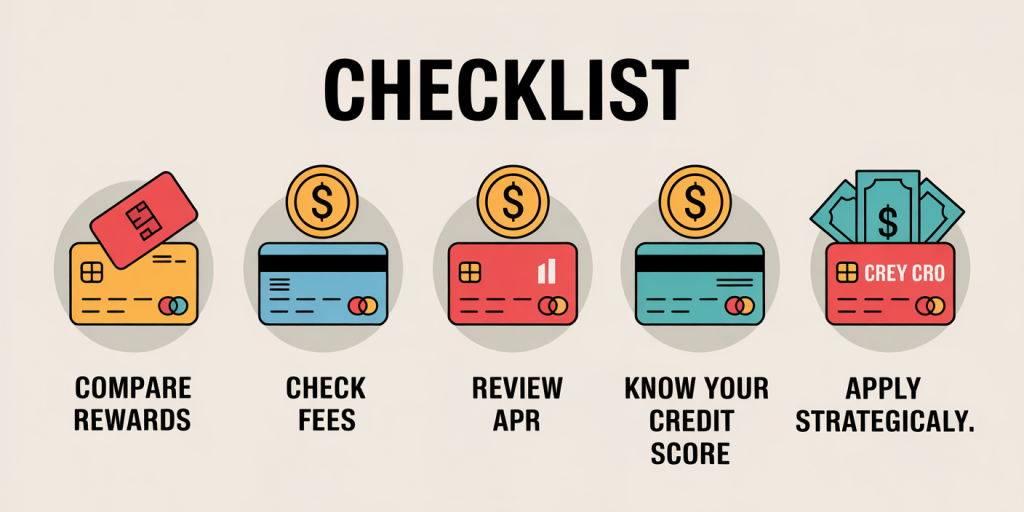

📝 Tips for Choosing the Right Card:

-

Compare reward structures and make sure they align with your typical spending.

-

Evaluate the total value of benefits relative to annual fees.

-

Understand APR terms—especially if you plan to carry a balance.

-

Consider bonus offers and sign-up rewards, but don’t apply solely based on them.

-

If building or rebuilding credit, opt for cards designed for students or new users.

💳 Make 2025 Your Most Rewarding Financial Year Yet

By choosing the right credit card and using it wisely, you can unlock valuable perks, enhance your financial flexibility, and make everyday spending more rewarding.

Take the time to compare your options, read the fine print, and apply only for cards that fit your long-term goals. With the right card in your wallet, 2025 could be your smartest financial year yet.

Post Comment