Auto Loans in the U.S.: What You Need to Know Before Financing a Vehicle

Anúncios

A Smart Guide to Buying a Car Without Breaking Your Budget

Purchasing a car is a major financial milestone—and for many people in the United States, it’s one of the largest expenses they’ll ever take on besides buying a home. Because few people can afford to pay the full price of a vehicle upfront, auto loans have become the go-to method for financing a new or used car.

While auto loans can make vehicle ownership more accessible, understanding how they work is critical to avoiding financial strain and securing the best deal possible. Whether you’re a first-time buyer or considering trading in your current vehicle, this guide walks you through everything you need to know—from how auto loans work to how to qualify, compare offers, and manage your loan responsibly.

What Is an Auto Loan?

Anúncios

An auto loan is a type of secured loan specifically used to finance the purchase of a vehicle, such as a car, truck, or SUV. Unlike unsecured personal loans, auto loans are backed by the vehicle you’re purchasing. That means the car serves as collateral—and if you default on the loan, the lender can repossess the vehicle to recover its losses.

Key Features of Auto Loans:

-

Fixed Interest Rates: Most auto loans offer fixed rates, meaning your monthly payments remain the same for the life of the loan.

-

Flexible Loan Terms: Loan durations typically range from 24 to 72 months, though you may find options as short as 12 months or as long as 84 months.

-

Amount & Terms Vary by Profile: Your loan terms—including the interest rate, approval amount, and term length—depend on factors like your credit score, income, and the price of the car.

⚠️ Tip: While longer loan terms may lower your monthly payments, they typically result in more interest paid overall. Balancing affordability with long-term cost is key.

The Role of Down Payments

Anúncios

Although some dealers promote zero-down financing, putting money down at the time of purchase can offer significant benefits. A down payment reduces the loan principal and shows lenders that you’re financially invested.

Benefits of a Down Payment:

-

Reduces the loan amount

-

Lowers monthly payments

-

May help you qualify for better interest rates

-

Improves your loan-to-value (LTV) ratio

-

Decreases risk of negative equity (owing more than the car is worth)

A down payment of 10% to 20% is ideal, but even a small amount can improve your financing options.

How to Qualify for an Auto Loan

Getting approved for an auto loan depends largely on your creditworthiness, but lenders look at more than just your credit score.

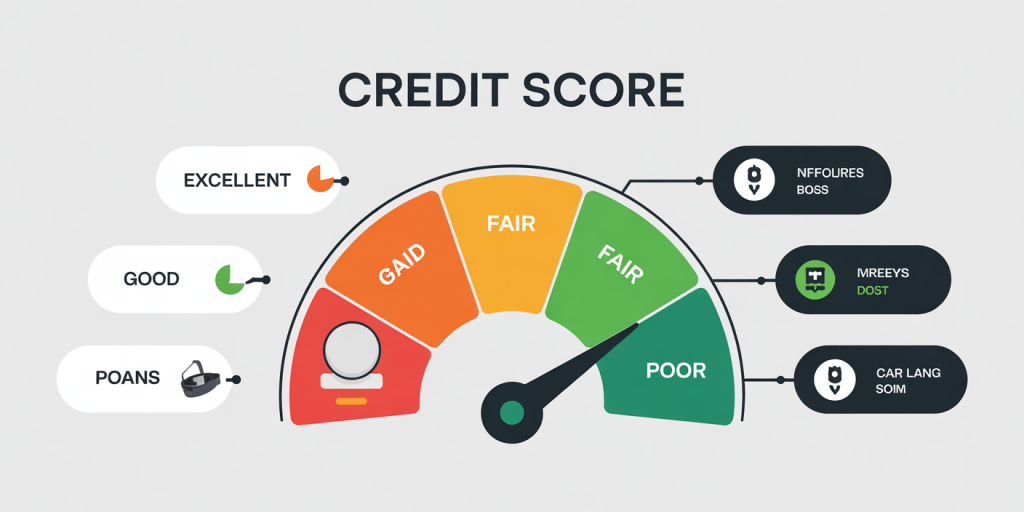

1. Credit Score

Your credit score plays a key role in determining the interest rate and terms you’ll be offered. Here’s how different score ranges typically affect rates:

-

750+ (Excellent): Qualifies for the lowest interest rates and best terms

-

700–749 (Good): Competitive rates, strong approval chances

-

650–699 (Fair): Higher interest rates, fewer lender options

-

600–649 (Poor): Subprime rates, stricter requirements

-

Below 600 (Very Poor): Limited access to financing, high interest

✅ Tip: Check your credit score before shopping for a loan. If it’s low, consider taking a few months to improve it before applying.

2. Debt-to-Income Ratio (DTI)

Your DTI ratio measures how much of your monthly income goes toward paying debts. A DTI of 36% or lower is generally favorable. Lenders prefer to see that you have room in your budget for additional loan payments.

3. Income and Employment Stability

Lenders want to ensure you can make your monthly payments. Having a steady source of income and a reliable employment history strengthens your application. You’ll likely need to provide documentation such as:

-

Pay stubs

-

Tax returns

-

Employment verification

Where to Get an Auto Loan

There are several types of lenders you can approach when shopping for an auto loan:

-

Banks: Traditional institutions offer competitive rates, especially for customers with strong credit.

-

Credit Unions: Often provide lower rates than banks, especially for members.

-

Online Lenders: Quick application process and easy rate comparisons.

-

Dealership Financing: Convenient, but may involve higher interest rates or added fees—especially with “buy here, pay here” models.

📌 Pro Tip: Always compare at least three loan offers to ensure you’re getting the best deal.

The Auto Loan Application Process

Here’s a breakdown of how the auto loan process works from start to finish:

Step 1: Gather Required Documentation

To apply for an auto loan, prepare:

-

Government-issued ID (e.g., driver’s license)

-

Proof of income (recent pay stubs, W-2s, or tax returns)

-

Proof of residence (utility bill, lease agreement)

-

Credit references (if requested)

-

Vehicle details (make, model, VIN) if already chosen

Step 2: Prequalify or Apply

Many lenders allow you to prequalify online. This gives you an idea of what loan terms you may be eligible for without affecting your credit score.

If you move forward with a formal application, the lender will run a hard credit check and review your financial documents.

Step 3: Loan Approval and Disbursement

Once approved, the lender will either:

-

Send funds directly to the dealership

-

Provide you with a check or voucher to complete the purchase

At this point, you’ll sign the loan agreement and take ownership of the car.

Understanding Loan Terms

Before signing, carefully review the terms of your loan agreement:

-

Interest Rate (APR): Includes interest and any fees charged by the lender

-

Loan Term: Number of months you’ll make payments

-

Monthly Payment Amount: Based on loan amount, rate, and term

-

Total Loan Cost: Includes all interest and fees paid over time

-

Early Repayment Penalties: Some lenders charge a fee for paying off your loan early

Be sure to ask questions if anything is unclear.

Managing Your Auto Loan Responsibly

Once you drive off the lot, your focus should shift to managing your loan effectively. Here are best practices to help you stay on track:

1. Make On-Time Payments

Missing payments can hurt your credit score and lead to fees or repossession. Set up automatic payments or reminders to avoid missing due dates.

2. Pay More Than the Minimum (If Possible)

Extra payments toward the loan principal can reduce the total interest paid and help you pay off the loan early—just make sure your lender applies it correctly.

3. Avoid Long Loan Terms

While 72- or 84-month loans offer lower monthly payments, they result in higher interest and increased risk of negative equity. Stick to shorter terms if your budget allows.

4. Monitor Your Loan Balance and Vehicle Value

Keep an eye on how much you owe versus the car’s current value. This helps you avoid being “upside-down” on your loan (owing more than the vehicle is worth).

5. Refinance If Conditions Improve

If your credit score improves or interest rates drop, consider refinancing your auto loan for better terms.

Red Flags to Watch Out For

![]()

Not all auto loans are created equal. Stay alert for:

-

High fees or prepayment penalties

-

Add-ons you didn’t request (e.g., extended warranties, GAP insurance)

-

Dealer markups on interest rates

-

“Yo-yo” financing tricks, where loan terms change after you take the car home

Always read the fine print and don’t be afraid to walk away if something feels off.

Final Thoughts: Drive Smart, Spend Smarter

Buying a car is a big decision—and taking out an auto loan is an even bigger responsibility. But with the right knowledge and preparation, it can be a positive and empowering financial move.

By understanding how auto loans work, improving your credit profile, comparing offers, and managing your loan wisely, you can drive away in a vehicle that suits your needs without compromising your financial future.

Your next car should bring freedom and convenience—not financial stress. Use this guide to make sure your financing fits your budget, your lifestyle, and your long-term goals.

Post Comment