Health Insurance in America: How to Choose the Best Plan in 2025

Anúncios

Navigating the complex landscape of health insurance in America remains a crucial task for millions. With new policies, evolving healthcare costs, and changing consumer needs, selecting the best insurance plan in 2025 demands careful consideration. Whether you’re an individual enrolling for the first time, a family seeking comprehensive coverage, or a business owner exploring group options, understanding key factors is essential for making an informed choice.

By examining recent trends, comparing different types of plans, and assessing coverage options aligned with personal health goals, you can optimize both your financial outlay and healthcare access in the year ahead.

Understanding the Current Health Insurance Landscape in 2025

Anúncios

Healthcare expenditure in the United States exceeded $4.3 trillion in 2023, representing nearly 18% of the country’s GDP, according to the Centers for Medicare & Medicaid Services (CMS). This staggering figure underscores the importance of choosing an efficient health insurance plan that balances affordability with comprehensive coverage. In 2025, the situation is further influenced by legislative changes under the Inflation Reduction Act and continued post-pandemic healthcare adjustments.

For example, the Affordable Care Act (ACA) marketplace continues to expand options for individuals and families, but premiums have varied significantly by state. A report by eHealth found average premiums increased by approximately 5% nationwide for 2025 coverage, with subsidies helping many lower-income buyers manage costs. Meanwhile, employer-sponsored insurance remains the most common coverage type, accounting for about 49% of insured Americans, according to the Kaiser Family Foundation.

Anúncios

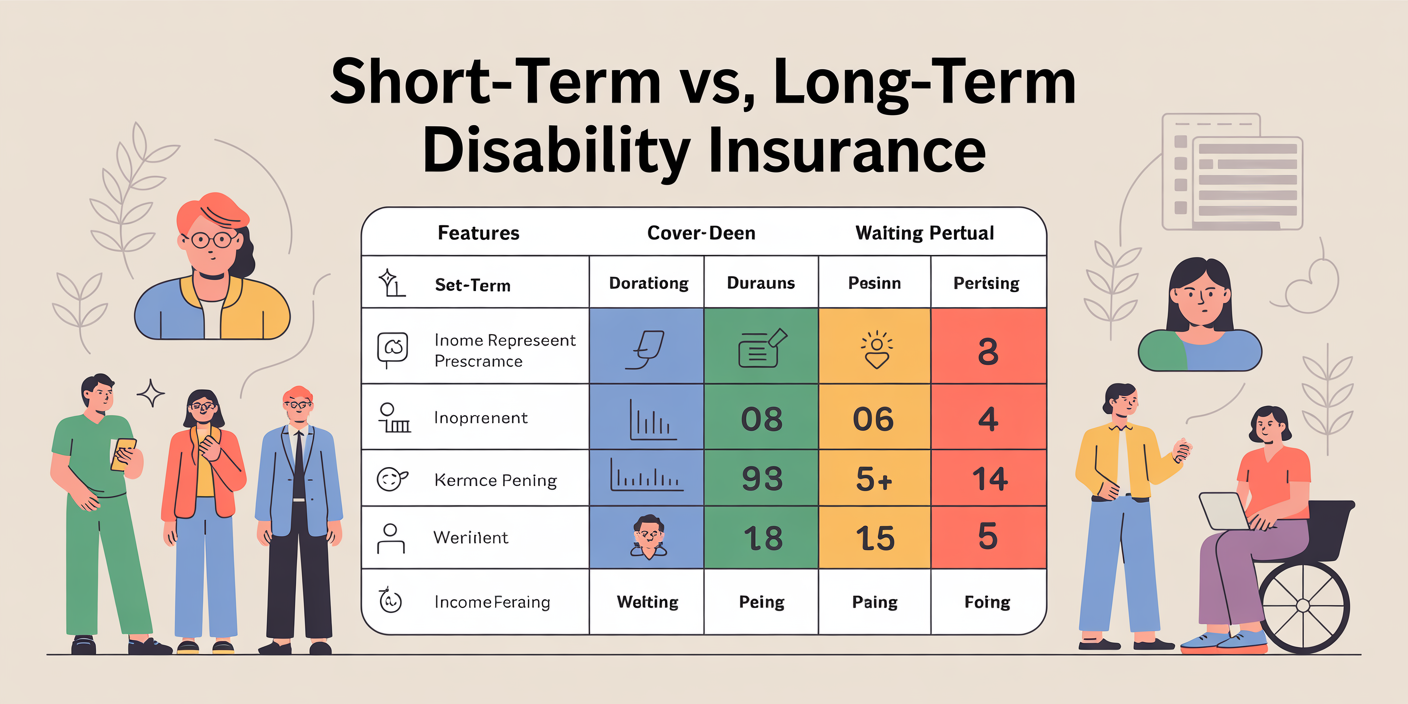

This evolving environment means consumers face choices among Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and High Deductible Health Plans (HDHPs), each with unique features affecting access, premiums, and out-of-pocket expenses. Moreover, telehealth services and mental health benefits have become standard offerings in many plans, reflecting growing healthcare delivery trends.

Types of Health Insurance Plans and Their Appropriate Uses

When choosing a plan, understanding the differences between common types helps align your health needs with the plan’s structure. HMOs generally require selecting a primary care physician and referrals for specialists, which can keep costs down but limit flexibility. PPOs allow seeing any provider without referrals but usually come with higher premiums and deductibles. EPOs provide a middle ground, offering more network flexibility but typically excluding out-of-network coverage.

High Deductible Health Plans (HDHPs), often paired with Health Savings Accounts (HSAs), have gained popularity in 2025. They feature lower monthly premiums but require higher out-of-pocket payments before coverage kicks in. An example could be a single individual under 40 choosing an HDHP with a $3,000 deductible and contributing pre-tax funds to an HSA to cover urgent care or prescription expenses.

Here’s a comparative table illustrating the characteristics of these plans:

| Plan Type | Network Restrictions | Referral Requirement | Premiums | Deductibles | Suitable For |

|---|---|---|---|---|---|

| HMO | Yes | Yes | Low | Low | Budget-conscious, primary care-focused individuals |

| PPO | No | No | High | Moderate | Those needing specialist access without referrals |

| EPO | Yes | No | Moderate | Moderate | People wanting some network flexibility |

| HDHP + HSA | Varies | No | Low | High | Healthy individuals, those wanting tax advantages |

Consider Jane, a 35-year-old professional who values provider flexibility due to ongoing specialist consultations. She chose a PPO plan despite higher premiums, prioritizing convenience and access. In contrast, Mark, a 28-year-old healthy individual with minimal healthcare needs, preferred an HDHP paired with an HSA, saving on monthly premiums and benefiting from tax-free medical savings.

Evaluating Coverage Needs and Budget Constraints

Choosing the best health insurance plan is inherently tied to personal health requirements and financial circumstances. Begin by assessing your typical medical usage — including chronic conditions, prescription medications, planned surgeries or pregnancies, and preferred healthcare providers. This self-analysis helps estimate total expected costs rather than just monthly premiums.

For instance, if you or a family member requires frequent specialty visits or costly medications, plans with higher premiums but lower copays and deductibles might be more economical annually. Conversely, if you rarely visit doctors, a plan emphasizing low monthly costs with moderate risk of out-of-pocket expenses during emergencies could be more suitable.

It’s also critical to consider the total cost of ownership, which includes premiums, deductibles, copayments, coinsurance, and out-of-pocket maximums. A 2024 survey by the Commonwealth Fund revealed that 30% of insured Americans faced unexpected medical bills due to misunderstanding their coverage limitations, highlighting the importance of thorough cost evaluation.

Budget constraints are often decisive. For some, subsidy eligibility through ACA or Medicaid programs offers substantial relief. For example, a family of four earning under 400% of the federal poverty level ($115,240 for 2024) may receive premium tax credits reducing monthly payments drastically. Individuals working for small businesses should inquire about available group insurance and Flexible Spending Accounts (FSAs) to offset medical costs.

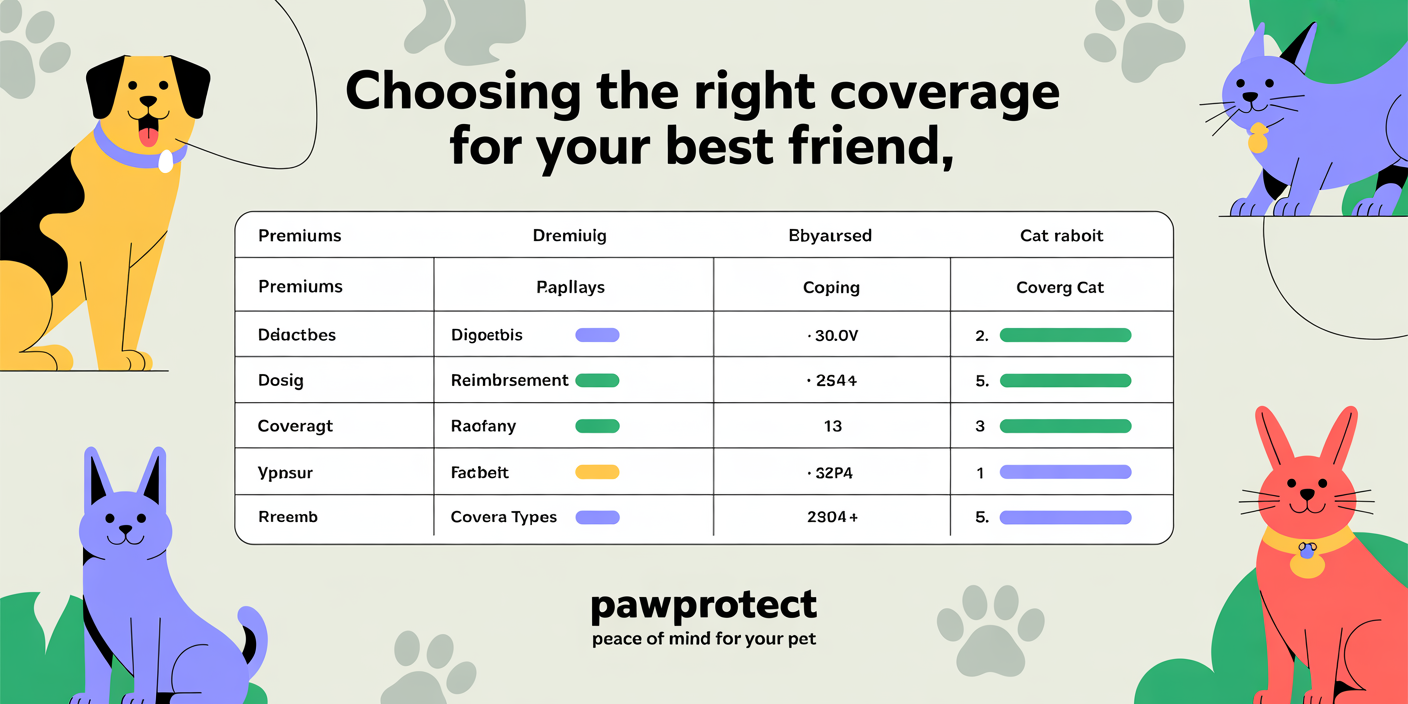

Utilizing Provider Networks and Additional Benefits

When selecting a health insurance plan, verifying whether your preferred doctors, hospitals, and specialists are within the network is a key step. Out-of-network care often leads to substantially higher bills or complete denial of coverage for non-emergency services. Before finalizing your choice, consult provider directories provided by the insurer or online databases.

Consider the case of a retired couple in Florida who switched insurance plans only to discover their longtime cardiologist was out-of-network, leading to exorbitant expenses during a cardiac event. They had to reconsider their choice despite initially favorable premiums.

Furthermore, many plans now offer enhanced benefits such as mental health services, wellness programs, telemedicine, and prescription drug coverage that can improve accessibility and convenience. In 2025, telehealth consultations surged by 35% compared to 2023, according to a report by McKinsey & Company, reflecting demands for flexible healthcare delivery.

Competitively priced insurance with integrated mental health coverage can be particularly valuable given rising awareness around mental well-being. Plans that include counseling sessions, substance abuse treatment, and chronic condition management offer more holistic care and may reduce long-term healthcare costs.

Comparing Employer-Sponsored vs. Marketplace Insurance Options

For most working Americans, employer-sponsored insurance (ESI) provides the primary health coverage route. These plans frequently benefit from negotiated rates and employer contributions, resulting in lower premiums for employees. According to the Kaiser Family Foundation’s 2024 Employer Health Benefits Survey, 83% of firms offered health insurance, with an average employer contribution covering about 72% of premiums for single coverage.

However, some employer plans may be restrictive in networks or benefits. For example, an employee working in a rural area might find their employer’s network lacking local specialists, pushing the employee to consider supplemental coverage or marketplace plans.

The ACA marketplace remains a critical alternative, especially for self-employed individuals, freelancers, and those without employer coverage. The 2025 marketplace offers tiered plan levels labeled Bronze, Silver, Gold, and Platinum, which differ mainly in premiums vs. out-of-pocket balance. The table below summarizes the general distinctions:

| Plan Tier | Monthly Premium | Deductibles and Copays | Best For |

|---|---|---|---|

| Bronze | Lowest | Highest | Healthy individuals, low usage |

| Silver | Moderate | Moderate | Eligible for cost-sharing reductions, moderate usage |

| Gold | Higher | Lower | Frequent healthcare use |

| Platinum | Highest | Lowest | Chronic conditions, high usage |

Real case: Sarah, a freelance graphic designer, initially bought a Bronze marketplace plan to save money but faced high hospital bills during an unexpected accident. She upgraded to a Gold plan in 2025 to reduce out-of-pocket expenditures, sacrificing higher premiums for peace of mind.

Projecting Future Trends: What to Expect in Health Insurance by 2026 and Beyond

The health insurance industry is dynamically evolving, influenced by legislative adjustments, technology adoption, and shifting consumer preferences. Looking beyond 2025, several trends could shape the way Americans choose and use their health insurance plans.

First, artificial intelligence (AI) and big data analytics are expected to deepen personalization of insurance offerings, enabling more accurate risk assessment and tailored premiums. For example, wearable technology data may increasingly impact plan pricing or wellness incentives.

Second, value-based care models, which reimburse providers based on health outcomes rather than service volume, will likely become more prevalent. This shift means insurance plans may incentivize preventive care measures, chronic disease management, and coordinated care networks, potentially lowering overall costs.

Telehealth expansion accelerates continuously. According to a survey by FAIR Health in 2024, telehealth claims increased by 42% year-over-year, signaling insurer willingness to customize plans around virtual care access. This trend enhances convenience and supports mental health care integration.

Legislative initiatives such as potential expansions of Medicaid in various states and evolving ACA reforms could broaden subsidized insurance eligibility, increasing competitive pressures on insurers to innovate and reduce prices.

Lastly, climate change-related health impacts, such as increased respiratory illnesses caused by environmental factors, may prompt insurers to revise risk models and coverage benefits, emphasizing adaptability in future plan selections.

Selecting the best health insurance plan in 2025 requires evaluating numerous factors—plan types, network inclusions, coverage specifics, budget constraints, and personal health considerations. By leveraging up-to-date data, practical examples, and an informed approach, consumers can optimize their healthcare financial plans to gain both protection and affordability. As technology and policy evolve, staying attuned to future trends will remain crucial for making well-informed health insurance decisions for 2026 and beyond.

Post Comment