Understanding Social Security Benefits: Maximizing Your Retirement Income

Anúncios

Navigating the complexity of Social Security benefits is crucial for building a secure financial future. Millions of Americans rely on Social Security as a foundational source of retirement income, yet many are unaware of how to optimize these benefits. Understanding when and how to claim, the impact of earnings, and spousal or survivor benefits can significantly enhance retirement readiness. This article unpacks the intricacies of Social Security to help you maximize your retirement income effectively.

The Role of Social Security in Retirement Planning

Social Security benefits represent a vital component of retirement income for approximately 65 million Americans as of 2023, according to the Social Security Administration (SSA). These benefits are primarily funded through payroll taxes under the Federal Insurance Contributions Act (FICA), which workers and employers contribute to throughout an individual’s career. For many retirees, Social Security accounts for nearly 40% of their total retirement income, underscoring its importance.

Anúncios

Understanding the structure of Social Security starts with recognizing the Personal Earnings Record maintained by the SSA. Each year of work adds credits toward eligibility, with a minimum of 40 credits (typically earned over 10 years) required to qualify for benefits. The amount you receive is calculated based on your 35 highest-earning years, adjusted for inflation. This formula rewards consistent, long-term work history, highlighting the importance of career planning in maximizing benefits.

Claiming Benefits: Timing and Its Impact on Income

Anúncios

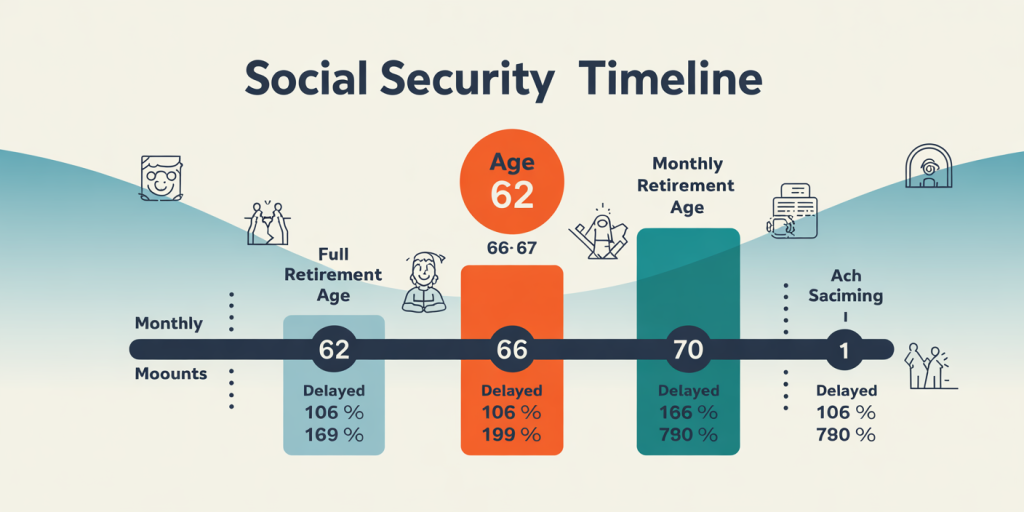

One of the most impactful decisions retirees face is the timing of their Social Security claim. The earliest you can begin collecting benefits is at age 62, but this option results in reduced monthly payments—up to 30% less than the full retirement age (FRA) benefit. FRA varies based on birth year; for instance, individuals born between 1943 and 1954 have an FRA of 66, while those born after 1960 have a FRA of 67.

Opting to delay benefits past the FRA up to age 70 can increase your monthly payout through delayed retirement credits, which accrue at a rate of approximately 8% annually. For example, a retiree with an FRA benefit of $1,500 per month who waits until 70 to claim could receive about $1,980 monthly. This increment can prove invaluable in countering inflation and longevity risk.

Real-life Example: Jane’s Decision

Jane, born in 1960, faces the choice of claiming Social Security at 62, 67, or 70. Her full retirement benefit at age 67 is $1,800 per month. Claiming at 62 reduces this to roughly $1,260 monthly, while waiting until 70 elevates it to approximately $2,304 per month. Over 10 years, the monthly increase from delayed claiming yields significant additional income, highlighting the financial benefits of strategic timing.

Understanding Spousal, Survivor, and Disability Benefits

Social Security offers more than retirement benefits; it also includes spousal, survivor, and disability benefits designed to provide financial security to families and individuals facing hardship. Spousal benefits allow a spouse to receive up to 50% of the other spouse’s benefit if it exceeds their own. For example, a lower-earning spouse with a personal benefit of $800 monthly could receive additional spousal benefits topping $900 if the primary earner’s benefit is $1,800.

Survivor benefits are available to widows and widowers and can be claimed as early as age 60 (or age 50 if disabled). These benefits help mitigate income loss after the death of a spouse. For example, the average survivor benefit paid in 2022 was approximately $1,434 monthly, providing critical support. Importantly, survivors can choose to claim survivor benefits first and delay their retirement benefits to maximize income.

Disability benefits are another critical aspect, providing financial assistance to those unable to work due to severe health conditions. Monthly disability benefits average around $1,483 as of 2023, supporting nearly 9 million Americans. These benefits interact with retirement benefits, as disability benefits transition into retirement benefits upon reaching FRA.

Earnings and Benefit Reduction: What You Need to Know

Claiming Social Security benefits while continuing to work impacts your benefit amount depending on your age and earnings. For those who claim before FRA and continue earning above the established limits, the SSA reduces benefits based on a formula designed to prevent “double dipping.”

In 2024, the earnings limit for individuals below FRA is $21,240 annually. For every $2 earned above this threshold, $1 in benefits is withheld. In the year you reach FRA, a higher limit applies—$56,520, with $1 withheld for every $3 earned above. After reaching FRA, there is no earnings limit, allowing retirees to work without benefit reduction.

Table 1: Earnings Limits and Benefit Reductions in 2024

| Age Group | Annual Earnings Limit | Benefit Reduction Rate | Notes |

|---|---|---|---|

| Under Full Retirement Age | $21,240 | $1 withheld per $2 over limit | Benefits reduced until FRA |

| Year Reaching Full Retirement Age | $56,520 | $1 withheld per $3 over limit | Reduction applies before birthday |

| At or After Full Retirement Age | No Limit | No reduction | Unlimited earnings allowed |

Understanding how earnings impact Social Security helps retirees plan work and claiming strategies to avoid unnecessary reductions and taxes.

Strategies for Couples: Coordinating Claims for Maximum Benefits

Couples have unique options for maximizing Social Security income through coordinated claiming strategies. Combining spousal and individual benefits effectively can boost household income over time. For instance, one spouse might claim early spousal benefits while the other delays retirement benefits to increase future payouts.

A popular approach is the “file and suspend” strategy, where one spouse files for benefits to allow the other to claim a spousal benefit while their own benefits grow. Although SSA rules have limited some tactics since 2016, strategic claiming remains relevant.

Case Study: The Johnsons

Mr. Johnson has an FRA benefit of $2,200, while Mrs. Johnson’s personal benefit at FRA is $1,200. By Mrs. Johnson claiming a spousal benefit at age 66 rather than her own benefit, and Mr. Johnson delaying till age 70, the household increases total income significantly. Mrs. Johnson receives 50% of Mr. Johnson’s benefit ($1,100), and Mr. Johnson’s delayed benefit rises to approximately $2,904 monthly, resulting in total monthly income of around $4,004 versus $3,400 if both filed at FRA.

This example demonstrates the power of coordination and timing to enhance Social Security income for couples.

Planning Ahead: Future Perspectives on Social Security

Looking forward, several factors could influence Social Security benefits and the ability to maximize retirement income. The SSA projects that the Social Security Trust Fund may face depletion by 2034, potentially triggering automatic benefit reductions unless Congress intervenes. Estimates suggest reductions of up to 23% in benefits might occur if no remedial action is taken.

Additionally, demographic shifts such as an aging population and lower birth rates put pressure on the program’s sustainability. For retirees planning decades ahead, staying informed on legislative changes and adapting claiming strategies accordingly is imperative.

Technological advancements are also improving access to benefit information and tools. The SSA’s online portal provides personalized estimates, and the use of AI-driven retirement planners is rising, enabling better decision-making based on individual careers and goals.

The Importance of Diversification

Given potential uncertainties, relying solely on Social Security is risky. Financial advisors recommend diversifying retirement income through personal savings, employer-sponsored plans like 401(k)s, and other investments. Proactive financial planning involving Social Security estimation and optimization is a cornerstone of retirement security.

In summary, although Social Security remains a fundamental retirement resource, proactive management, strategic timing, and an understanding of complementary income sources are essential to maximize your financial wellbeing in retirement.

Post Comment