Retirement Planning: Securing Financial Freedom in Your Golden Years

Anúncios

As life expectancy increases and traditional pension plans become less reliable, retirement planning has emerged as a critical aspect of financial management. With the average American expected to live over 19 years after retiring at age 65, adequate preparation is essential to maintain financial independence and quality of life. This article explores key strategies, practical examples, and data-driven insights to help individuals craft a robust retirement plan, ensuring they are well-equipped to meet their post-retirement goals.

Understanding the Importance of Early Retirement Planning

Early retirement planning significantly influences the wealth accumulation trajectory of an individual. According to a 2023 report from the Federal Reserve, nearly 35% of U.S. adults have saved less than $5,000 for retirement, reflecting the consequences of delayed or inadequate planning. Starting early allows compounding interest to work effectively, making even modest contributions grow substantially over time.

Anúncios

For instance, consider two individuals: Sarah, who begins investing $300 monthly at age 25, and John, who starts the same investment at age 40. Assuming an average annual return of 7%, Sarah would accumulate approximately $615,000 by age 65, whereas John would have just around $180,000. This stark contrast highlights the compounding advantage gained through early and consistent saving.

Anúncios

Practical retirement planning starts with assessing one’s current financial status and setting realistic, measurable goals. Whether it is traveling the world, funding grandchildren’s education, or maintaining a same-standard lifestyle, clear objectives help guide saving strategies and risk tolerance levels.

Estimating Retirement Needs and Income Sources

Determining how much money is needed during retirement is a foundational step in any retirement plan. A widely accepted rule of thumb is to aim for 70-80% of pre-retirement income annually to sustain a comfortable lifestyle. However, individual circumstances often vary due to geographic location, health care costs, and lifestyle choices.

For example, retirees living in metropolitan areas such as New York or San Francisco may incur significantly higher living expenses than those in smaller towns or rural settings. A study by the Employee Benefit Research Institute (EBRI) in 2022 indicates that retirees spend on average 20% of their post-retirement income on healthcare, which tends to rise with age.

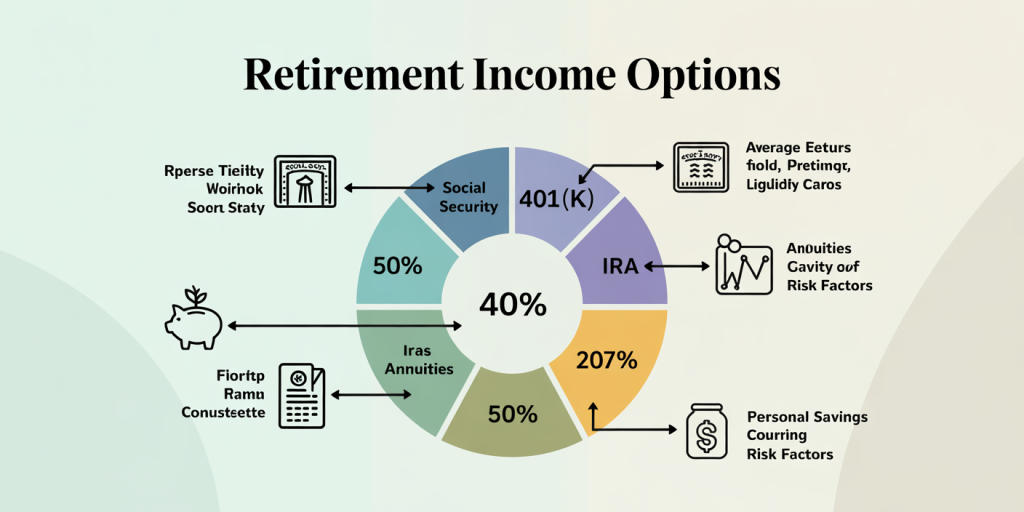

There are multiple income sources to consider while planning, including Social Security benefits, employer-sponsored 401(k) plans, IRAs, personal savings, and annuities. Social Security currently provides an average monthly benefit of $1,827, translating to approximately $21,924 annually, which may cover only a portion of retirement expenses. Therefore, supplementing Social Security with other income streams is essential.

The table below illustrates a comparative overview of common income sources in retirement:

| Income Source | Average Annual Return/Benefit | Liquidity | Risk Factors |

|---|---|---|---|

| Social Security | $21,924 annually (2023 data) | Monthly payments | Inflation erosion, policy changes |

| 401(k) Plans | 5-8% (average market return) | High (tax penalties past 59.5 yrs) | Market volatility |

| Individual Retirement Accounts (IRAs) | 5-7% (depends on investments) | Moderate | Market risk, RMD requirements |

| Annuities | 3-6% depending on contract | Low (limited access) | Fees, inflation risk |

| Personal Savings | Varies | Very high | Low returns on cash accounts |

Understanding the characteristics of each source helps retirees balance liquidity, risk, and return, customizing their portfolios in alignment with retirement timelines and needs.

Strategies for Effective Retirement Savings

Maximizing retirement savings requires a multi-faceted approach adaptable to the individual’s age, income level, and risk tolerance. One of the most effective methods is utilizing tax-advantaged accounts such as 401(k)s and IRAs. Contributions to traditional 401(k)s often reduce taxable income, while Roth IRAs provide tax-free withdrawals in retirement.

A practical case involves Mark, a 35-year-old professional earning $75,000 annually, who contributes 10% to his employer’s 401(k) plan with a 4% company match. Over 30 years, this consistent contribution could yield over $1 million, assuming an average 7% return, highlighting the cumulative power of matching contributions.

Diversification across asset classes—stocks, bonds, and cash equivalents—is another vital strategy. Younger investors may allocate a larger portion to equities, which offer higher growth potential but come with market volatility risks. As retirement approaches, shifting toward bonds and fixed income can reduce exposure to risk and preserve accumulated wealth.

Budgeting to trim unnecessary expenses can also accelerate retirement fund growth. Simple lifestyle changes such as reducing dining out or opting for a modest vehicle can free up additional funds for savings. According to a 2023 survey by Bankrate, individuals who created and adhered to a detailed budget were 40% more likely to meet retirement savings targets.

Managing Risks in Retirement Planning

Retirement planning is not complete without accounting for risks that could disrupt financial stability. Market risks, longevity risk, inflation risk, and unexpected healthcare expenses are major concerns that require proactive management.

Market risk is the possibility of investment losses due to economic downturns. For example, during the 2008 financial crisis, many retirees saw their portfolios shrink by 30-40%, forcing some to delay retirement or reduce spending drastically. Managing this risk involves asset allocation adjustment, regular portfolio review, and avoiding panic selling during downturns.

Longevity risk refers to the possibility of outliving one’s savings. The Social Security Administration reports that a 65-year-old woman today has nearly a 30% chance of living to 90, which extends the retirement savings horizon significantly. Utilizing annuities that offer lifetime income streams or adopting a “bucket strategy” that segments funds based on time horizon can mitigate this risk effectively.

Inflation risk, which erodes purchasing power over time, is especially pertinent for fixed income retirees. Historically, U.S. inflation averaged about 3.1% annually. Even a small inflation rate compounds significantly over decades. Choosing investments with growth potential outpacing inflation or indexing income streams to inflation can help maintain standard of living.

Healthcare costs remain another high-impact risk. The Fidelity Retiree Health Care Cost Estimate for 2023 says a 65-year-old couple retiring today will need approximately $315,000 to cover healthcare expenses throughout retirement. Long-term care insurance can provide coverage for extended care needs that Medicare typically does not cover.

Leveraging Professional Advice and Tools

Given the complexities involved, consulting certified financial planners (CFPs) or retirement specialists can enhance plan effectiveness. These professionals provide tailored advice aligned with personal goals, risk appetite, and tax considerations.

Advances in technology have also facilitated access to retirement calculators, robo-advisors, and budgeting apps that help individuals track progress and simulate retirement scenarios. For example, tools like Fidelity’s Retirement Score or Vanguard’s Retirement Nest Egg Calculator provide actionable insights based on current savings rates, projected returns, and desired retirement age.

However, it is crucial to remain vigilant about fees and conflicts of interest. Transparent fee structures and fiduciary responsibility are essential qualities to seek in financial advisors to ensure recommendations align with the client’s best interests.

Future Perspectives on Retirement Planning

The retirement landscape is evolving rapidly due to demographic shifts, technological innovation, and policy changes. With the global population aging—projected to double the number of individuals over 65 to 1.5 billion by 2050 according to the United Nations—the pressure on traditional pension systems intensifies.

Future retirees may need to adapt to longer working lives, partially supported by trends toward flexible or gig employment models. Additionally, the rise of health technologies and telemedicine may alter healthcare cost dynamics, potentially lowering out-of-pocket expenses but also introducing new kinds of risks and uncertainties.

Environmental, social, and governance (ESG) investing is growing in popularity as retirees seek portfolios that align with their values while generating sustainable returns. As green bonds and impact funds become mainstream, they may serve as valuable tools in retirement portfolios.

Lastly, artificial intelligence and big data analytics will likely provide more personalized and dynamic retirement planning solutions, allowing better prediction of life expectancy, spending needs, and risk tolerance shifts.

In conclusion, retirement planning is a multifaceted, dynamic process that requires early action, disciplined saving, risk management, and adaptation to emerging trends. By leveraging diverse income sources, consulting professionals, and embracing technology, individuals can build resilient plans that secure financial freedom throughout their golden years.

Post Comment