How to Track Your Expenses with Mint: A Step-by-Step Guide

Anúncios

Master Your Budget and Improve Your Financial Health Using Mint

Managing your money can be overwhelming, especially when you’re juggling multiple accounts, bills, and financial goals. Fortunately, technology has made it easier than ever to stay on top of your finances—and Mint stands out as one of the most trusted and comprehensive personal finance tools available today.

Developed by Intuit (the creators of TurboTax and QuickBooks), Mint is a free budgeting app that brings all your financial information into one place. With its intuitive interface, powerful automation, and real-time insights, Mint helps users track spending, create budgets, monitor credit, and set meaningful financial goals.

Whether you’re just getting started with budgeting or looking to level up your financial strategy, Mint can help. Below is a complete guide—expanded and enriched—to help you master your budget and improve your financial health using Mint.

Anúncios

What Is Mint?

Mint is a digital personal finance platform that aggregates your financial data and turns it into actionable insights. By linking to your bank accounts, credit cards, loans, and investment accounts, Mint provides a real-time snapshot of your finances.

Anúncios

Some key features include:

-

Automatic transaction categorization

-

Customizable monthly budgets

-

Spending and savings goal tracking

-

Credit score monitoring

-

Bill reminders and alerts

-

Financial reports and trend analysis

And the best part? Most of Mint’s core features are completely free to use, with optional premium services for users who want an ad-free experience or more in-depth financial tools.

Why Use Mint?

Mint simplifies budgeting and financial management by automating what used to be time-consuming tasks:

-

No more manually logging transactions

-

No more guessing how much you spent this month

-

No more scattered spreadsheets

Everything is centralized and updated automatically. Whether you want to reduce debt, build savings, or just understand where your money is going, Mint makes it easier to stay on track.

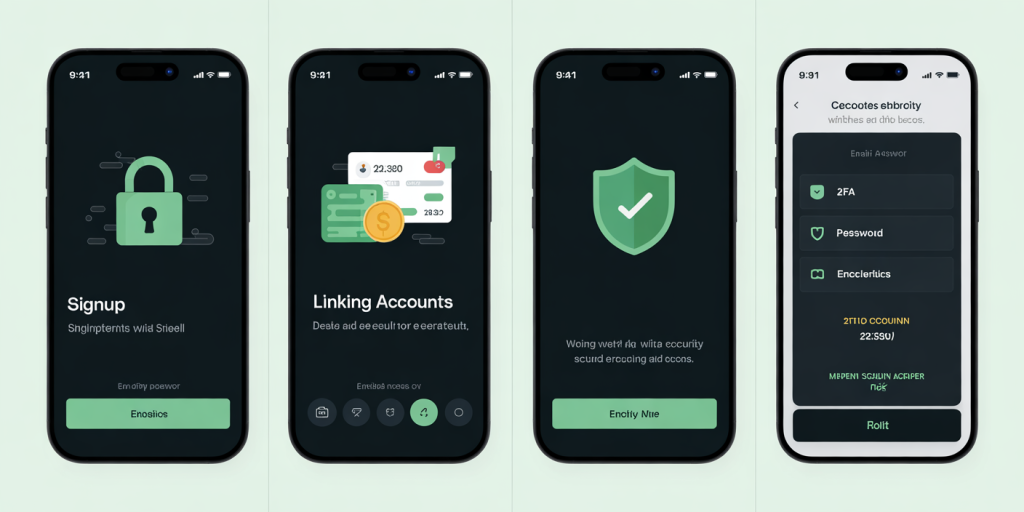

Step 1: Set Up Your Mint Account

To get started, download the Mint app on your smartphone (available for iOS and Android) or visit mint.intuit.com on your desktop.

Creating Your Account:

-

Enter your email address

-

Create a secure password

-

Agree to the terms of service

Once you’re in, you’ll be prompted to link your financial accounts. This includes:

-

Checking and savings accounts

-

Credit cards

-

Loans (e.g., auto loans, student loans)

-

Investment and retirement accounts

Mint uses bank-level encryption and security protocols, so your sensitive data is safe. You can also set up multi-factor authentication for added protection.

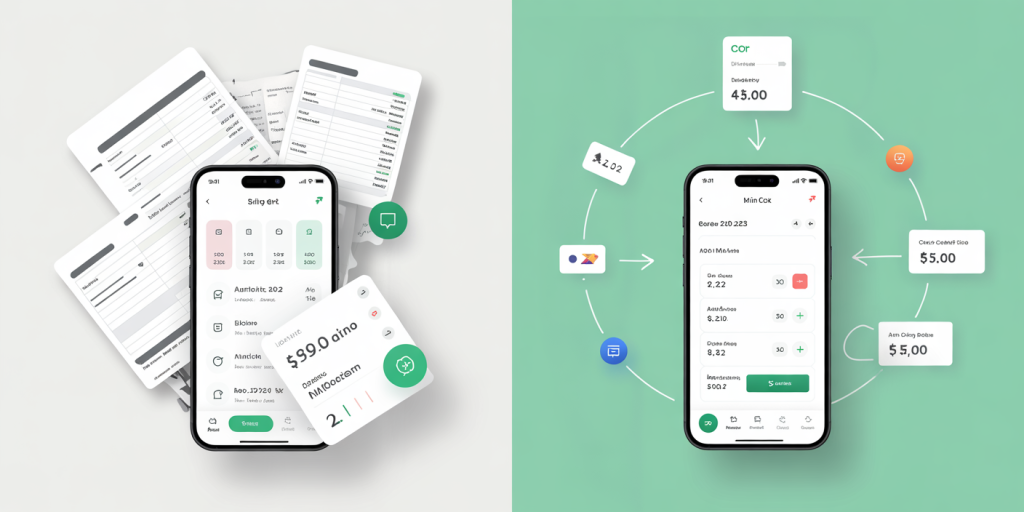

Step 2: Link Your Bank and Credit Accounts

Linking your accounts is crucial to unlocking Mint’s full potential. The more accounts you connect, the more complete and accurate your financial picture becomes.

How to Link Accounts:

-

Tap “Add Account”

-

Search for your bank or financial institution

-

Enter your login credentials

-

Confirm the connection

Within moments, Mint will pull in your recent transactions, balances, and statements. These are updated daily (or more frequently), so you always have the latest info.

You can also manually add cash transactions or offline accounts if needed.

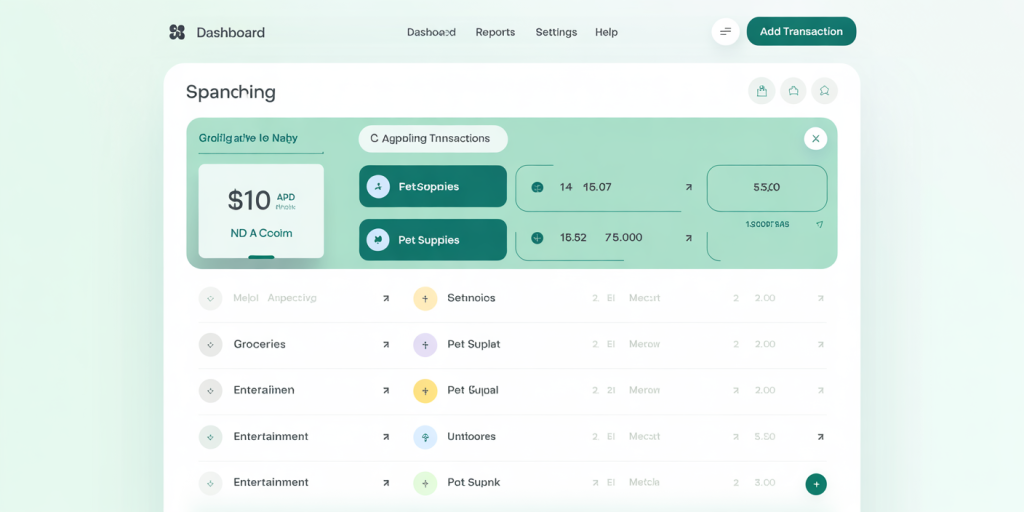

Step 3: Customize Your Spending Categories

Mint automatically assigns categories to your transactions—groceries, rent, gas, entertainment, etc.—based on merchant information. But these categories can be adjusted to better reflect your lifestyle.

How to Re-Categorize:

-

Tap on a transaction

-

Choose a different category from the list

-

Or create a custom category (e.g., “Pet Supplies” or “Fitness Classes”)

Over time, Mint learns your preferences and begins categorizing transactions more accurately. This customization is key to creating accurate spending summaries and budgets.

Step 4: Build Your Monthly Budget

One of Mint’s most powerful features is the ability to create customized monthly budgets. You can set specific spending limits for each category—like dining, transportation, or entertainment—and track your progress throughout the month.

To Set a Budget:

-

Tap “Budgets” in the main menu

-

Select a category (e.g., Groceries)

-

Set a monthly spending limit

-

Choose if the budget should repeat each month

Mint will track your spending in real time and visually show:

-

How much you’ve spent

-

How much remains in each category

-

Whether you’re approaching or exceeding your budget

This feature helps prevent overspending and creates accountability for everyday purchases.

Step 5: Monitor Your Daily Expenses

With Mint’s clean and colorful dashboard, tracking expenses becomes simple and even enjoyable. You can view:

-

Spending charts (pie or bar) broken down by category

-

Trends over days, weeks, or months

-

Alerts for large or unusual transactions

-

Reminders for upcoming bills

This constant visibility helps you spot spending leaks and redirect money toward your goals.

Example: If you notice your dining-out expenses are growing every month, you might decide to set a stricter budget or start cooking more meals at home.

Step 6: Create and Track Savings Goals

Financial goals give your money a purpose. Mint allows you to create specific savings goals and tracks your progress visually.

To Set a Goal:

-

Go to the “Goals” section

-

Choose a goal type (e.g., Emergency Fund, Vacation, Car Down Payment)

-

Enter the target amount and target date

-

Link a savings account to monitor progress

Mint will calculate how much you need to save each month to stay on track. It may also suggest budget changes to free up money toward your goal.

Pro tip: Make your goals SMART—Specific, Measurable, Achievable, Relevant, and Time-bound—for better results.

Step 7: Review Financial Reports and Make Adjustments

Each month, Mint generates a summary of your income, spending, and budget performance. These reports are invaluable for reviewing habits and making smarter decisions.

Look for:

-

Categories where you consistently overspend

-

Income vs. expenses analysis

-

Trends that suggest seasonal or habitual spending patterns

Then, adjust your budget accordingly. For instance, if your utility bill is higher in winter, increase that category’s budget from November to March and reduce another area temporarily.

Step 8: Keep Your Data Synced

Mint automatically updates your account info as new transactions occur. You don’t need to manually refresh or input data.

Syncing Tips:

-

Log in regularly to review new transactions

-

Correct any categorization errors promptly

-

Re-link any accounts that show “connection issues”

Keeping your data current ensures your budget and reports reflect your actual financial situation, helping you make better decisions in real time.

Bonus Features Worth Exploring

Credit Score Monitoring

Mint provides free access to your credit score along with a breakdown of the factors that impact it—like payment history, credit utilization, and total debt.

Bill Tracking and Alerts

Set reminders for upcoming bills to avoid late fees or missed payments.

Spending Forecast

Mint can project future expenses based on your current trends, giving you insight into potential budget gaps before they happen.

Final Thoughts: A Smarter Way to Manage Money

Mint is more than just a budgeting app—it’s a full-fledged financial command center. Whether your goal is to get out of debt, grow your savings, improve your credit, or simply gain more control over your day-to-day spending, Mint offers the tools to make it happen.

With Mint, you can:

-

Track every dollar automatically

-

Build flexible, personalized budgets

-

Stay accountable with real-time insights

-

Set and achieve specific financial goals

-

Improve your overall financial literacy and discipline

And the best part? You can do it all from your phone, for free.

So don’t wait for the “perfect moment” to take control of your finances. Start today, get clarity, and make Mint your money’s best friend.

Post Comment