Mortgage Refinancing in the U.S.: A Practical Guide for Homeowners

Anúncios

Save Money, Lower Payments, or Unlock Equity — When to Refinance and How to Do It Right

Refinancing your mortgage can be one of the most impactful financial decisions you’ll make as a homeowner. Done strategically, it can lower your monthly payments, reduce the total interest you pay, or even give you access to cash for other goals—like home improvements, paying off debt, or funding a major life event.

But refinancing is not a one-size-fits-all solution. Timing, personal goals, market conditions, and your financial situation all play key roles in whether refinancing is a smart move. In this comprehensive guide, we’ll cover what refinancing really means, how it works, when it makes sense, and the step-by-step process to ensure you get the best possible outcome.

What Is Mortgage Refinancing?

Anúncios

At its core, mortgage refinancing means replacing your current home loan with a new one—typically one that offers better terms. This new loan pays off your existing mortgage, and you begin making payments on the new loan going forward.

Refinancing can offer a range of financial benefits depending on your objective, such as:

Anúncios

-

Lowering your interest rate

-

Reducing your monthly mortgage payment

-

Changing the loan term (e.g., from 30 years to 15 years)

-

Switching from a variable interest rate to a fixed one

-

Accessing cash through home equity

When done correctly, refinancing can save thousands of dollars over the life of the loan or improve your monthly cash flow, giving you more breathing room in your budget.

Common Reasons to Refinance a Mortgage

![]()

Every homeowner has a different motivation for refinancing. Some of the most common include:

1. Reduce Your Interest Rate

If market interest rates have dropped since you first obtained your mortgage, refinancing to a lower rate can dramatically reduce how much you pay over time.

Example: Reducing a 6.5% rate to 4.5% on a $300,000 mortgage could save tens of thousands in interest over 30 years.

2. Lower Your Monthly Payments

Extending your loan term (e.g., from 15 to 30 years) can spread your payments over a longer period, which results in lower monthly costs—even if the overall interest paid increases.

This option may be ideal if your income has decreased, or if you need short-term financial relief.

3. Switch Loan Types

Many people begin with an adjustable-rate mortgage (ARM), which starts with a low interest rate that adjusts over time. If rates rise, your payments may become unpredictable. Refinancing to a fixed-rate loan can provide long-term stability.

4. Cash-Out Refinance

With a cash-out refinance, you borrow more than your current mortgage balance and receive the difference in cash. This option allows you to tap into your home’s equity to pay for things like:

-

Home renovations or repairs

-

High-interest debt consolidation

-

College tuition

-

Business ventures

Keep in mind: A cash-out refinance increases your loan balance, so it should be used strategically.

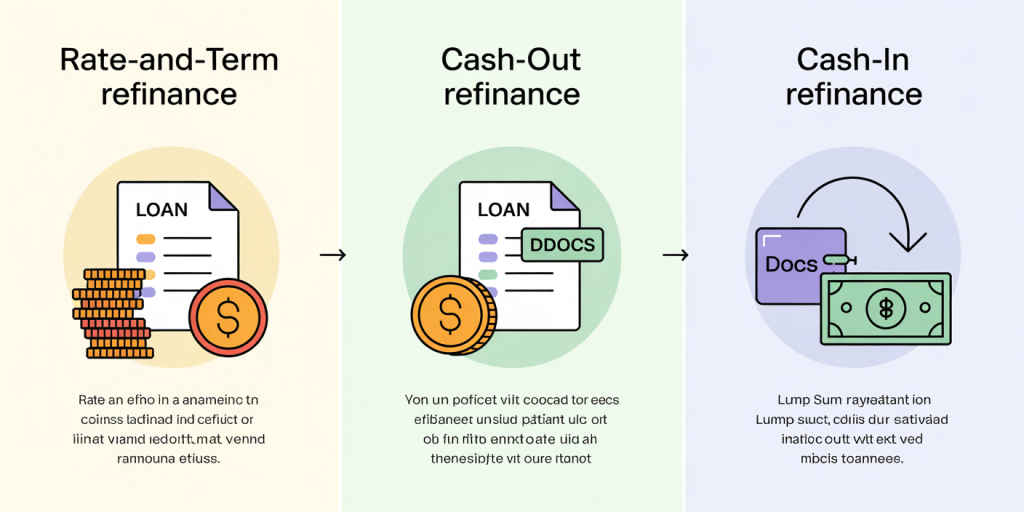

Types of Mortgage Refinancing

● Rate-and-Term Refinance

The most common type. You refinance to change the interest rate, the loan term, or both—without changing the total loan amount.

● Cash-Out Refinance

You refinance for a higher amount than you currently owe, and take the difference in cash. This increases your total loan balance.

● Cash-In Refinance

Less common, but beneficial in some cases—this involves bringing a lump sum to the table at closing to reduce the new loan amount. This could help you qualify for a lower interest rate or eliminate private mortgage insurance (PMI).

Is Refinancing Right for You? Key Factors to Consider

Before starting the process, take time to evaluate whether refinancing aligns with your financial goals and life circumstances.

1. Review Your Credit Score

Your credit score heavily influences the interest rate you’re offered. A score of 740 or above generally qualifies for the best rates. If your credit has improved since you took out your original loan, refinancing may offer more favorable terms.

2. Know Your Home’s Current Value

Your home’s appraised value affects your loan-to-value (LTV) ratio. A lower LTV means more equity and typically better rates. If your home has appreciated significantly, you may qualify for lower interest rates or a larger cash-out refinance.

3. Compare Your Current Loan Terms to Market Rates

Refinancing makes the most sense if current mortgage rates are substantially lower than your existing rate. Even a 1% drop can lead to big savings—especially on a large balance.

Use online calculators or speak with a lender to estimate potential savings.

4. Understand the Costs Involved

Refinancing isn’t free. Expect to pay closing costs that range from 2% to 5% of the loan amount. These may include:

-

Application fees

-

Loan origination fees

-

Title search and insurance

-

Appraisal fees

-

Credit check fees

Be sure to calculate your break-even point—the time it takes for your monthly savings to outweigh the upfront costs.

5. Consider How Long You’ll Stay in the Home

If you’re planning to sell or move within a few years, refinancing may not be worth it. Make sure you’ll live in the home long enough to recoup the costs of refinancing.

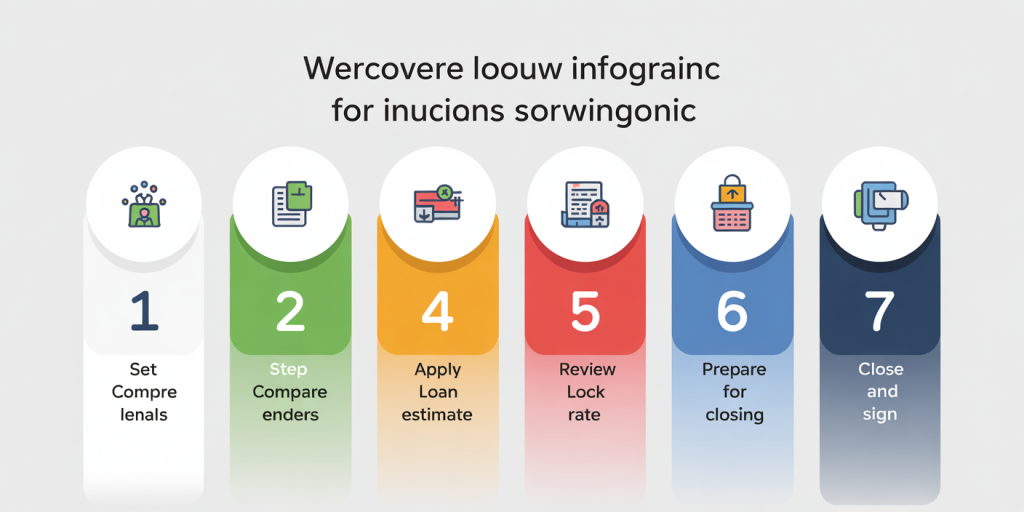

Step-by-Step Guide to Refinancing Your Mortgage

Refinancing follows a similar process to getting your first mortgage. Here’s what to expect:

Step 1: Set Your Goals

Be clear about what you want to achieve:

-

Lower your rate?

-

Access cash?

-

Shorten the loan term?

-

Stabilize payments with a fixed rate?

Knowing your objective will help guide all decisions.

Step 2: Compare Lenders and Get Prequalified

Shop around and request quotes from several sources, such as:

-

Traditional banks

-

Online lenders

-

Credit unions

-

Mortgage brokers

Look beyond just the interest rate—compare annual percentage rates (APR), fees, and closing costs.

Getting prequalified gives you a rate estimate without impacting your credit.

Step 3: Complete the Application

Once you’ve chosen a lender, begin the application process. Be prepared to provide documentation such as:

-

Pay stubs or proof of income

-

Tax returns and W-2s

-

Recent bank statements

-

Current mortgage statement

-

A government-issued ID

Your lender will also order a home appraisal to verify the current market value.

Step 4: Review the Loan Estimate

Within three business days of applying, your lender must provide a Loan Estimate. This document outlines:

-

Interest rate and APR

-

Monthly payment

-

Estimated closing costs

-

Prepayment penalties (if any)

-

Total loan amount

Review everything carefully and ask questions. Don’t hesitate to negotiate or ask about discounts.

Step 5: Lock In Your Rate (Optional)

Mortgage rates fluctuate daily. Once you’re satisfied with the terms, ask your lender about locking in your rate to prevent changes before closing.

Step 6: Prepare for Closing

If you move forward, the lender will schedule a closing date. Before then:

-

Finalize any required documents

-

Review the Closing Disclosure (received at least 3 days before closing)

-

Make arrangements to pay closing costs, unless they’re rolled into the loan

Step 7: Close and Sign

At closing, you’ll:

-

Sign all final documents

-

Pay closing costs (if not financed)

-

Set up your new escrow and payment schedule

Your original loan is then paid off, and the new mortgage begins immediately.

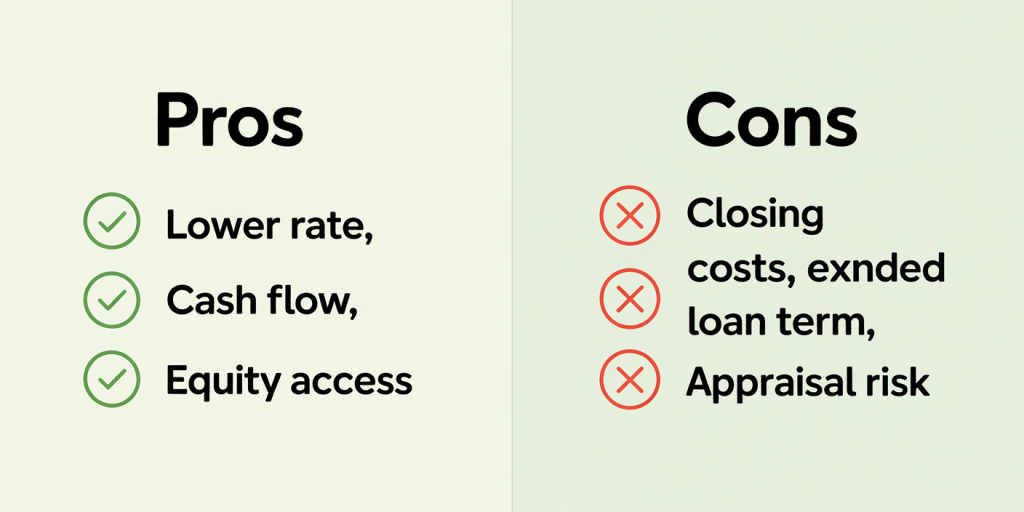

Pros and Cons of Refinancing

✅ Pros

-

Lower interest rate = long-term savings

-

Reduced monthly payments = more cash flow

-

Fixed-rate stability vs. adjustable-rate volatility

-

Access to cash through home equity

-

Opportunity to remove PMI

⚠️ Cons

-

Closing costs can be significant

-

Extending loan term may increase total interest

-

Home appraisal could limit options

-

Possible reset of amortization schedule

Final Thoughts: Make Refinancing Work for You

Refinancing your mortgage is a powerful financial strategy—but only if it aligns with your broader goals. It’s not just about chasing lower rates; it’s about making choices that improve your financial stability and flexibility over the long term.

Before moving forward:

-

Understand your current mortgage terms

-

Check market rates and loan products

-

Factor in the costs vs. the savings

-

Choose a lender you trust

-

Ensure you plan to stay in your home long enough to benefit

Whether your goal is to reduce payments, build equity faster, or tap into home value for other needs, refinancing—when done wisely—can be a step toward a stronger financial future.

Post Comment