A Comprehensive Guide to Student Loans in the United States

Anúncios

How to Fund Your Education and Manage Debt Responsibly

Pursuing higher education is a life-changing investment—but it’s also an expensive one. In the United States, student loans have become a primary tool to help individuals access college and university opportunities. While these loans provide crucial support for millions of students, they also come with long-term financial obligations that must be carefully understood and managed.

Whether you’re a high school graduate planning for college, a current student navigating financial aid, or a recent graduate preparing for repayment, this comprehensive guide will help you understand how student loans work, how to apply for them, and how to manage them responsibly to protect your financial future.

What Are Student Loans?

Anúncios

Student loans are a form of financial aid designed specifically to cover the costs of post-secondary education. These include tuition, fees, room and board, textbooks, supplies, and sometimes transportation or technology needs.

In the U.S., student loans are broadly categorized into two main types:

Anúncios

1. Federal Student Loans

Federal loans are funded by the U.S. Department of Education and are generally the first and most favorable option for students. They offer:

-

Lower fixed interest rates

-

Flexible repayment options

-

Access to income-driven repayment (IDR) plans

-

Possibilities for deferment, forbearance, and forgiveness

Federal student loans do not require a credit check (except for PLUS loans) and are accessible through the FAFSA process. Their borrower protections make them preferable to private loans in nearly all cases.

2. Private Student Loans

Issued by banks, credit unions, or online lenders, private loans are typically used to fill the funding gap left after exhausting federal aid. However, they come with more rigid terms:

-

Higher (often variable) interest rates

-

Strict repayment terms

-

Limited deferment or forgiveness options

-

Often require a creditworthy co-signer

Because of these limitations, private loans should only be considered after you’ve maximized all federal aid and grant options.

Types of Federal Student Loans

Understanding the distinctions between different federal loans can help you borrow strategically:

-

Direct Subsidized Loans: Available to undergraduate students with demonstrated financial need. The government pays the interest while you’re in school, during the grace period, and any deferment periods.

-

Direct Unsubsidized Loans: Available to both undergraduate and graduate students. Interest begins accruing from the time the loan is disbursed, even while you’re in school.

-

Direct PLUS Loans: Available to graduate/professional students and parents of dependent undergrads. These loans require a credit check and have higher interest rates.

-

Federal Perkins Loans (discontinued): Previously offered to low-income students. While no longer issued, borrowers may still be in repayment.

How to Apply for Student Loans

1. Complete the FAFSA (Free Application for Federal Student Aid)

This is the first step to accessing federal student aid. The FAFSA determines your eligibility for:

-

Federal loans

-

Grants (such as Pell Grants)

-

Work-study programs

-

Some state and institutional aid

📌 Important Tips:

Fill it out as early as possible each academic year (October 1st is the opening date).

Use accurate financial information, ideally using the IRS Data Retrieval Tool.

List all the colleges you’re considering.

Once submitted, you’ll receive a Student Aid Report (SAR) which summarizes your FAFSA data and includes your Expected Family Contribution (EFC). Colleges use this to create your financial aid package.

2. Review Your Financial Aid Award Letter

After acceptance, each school sends you a financial aid offer outlining:

-

Grants or scholarships (free money)

-

Work-study eligibility

-

Loan amounts (subsidized and unsubsidized)

Tip: You don’t have to accept the full amount offered. Only borrow what you truly need.

Applying for Private Loans

If federal aid isn’t enough, and you’ve already pursued scholarships or work-study, private loans can help—but use caution.

-

Apply directly with the lender

-

Interest rates and approval are based on credit score and/or co-signer’s creditworthiness

-

Read the fine print for terms, penalties, and payment flexibility

Compare multiple private lenders using platforms like Credible, LendKey, or College Ave to find competitive terms.

Managing Student Loan Repayment

Whether you’re still in school or already graduated, it’s essential to understand your repayment obligations and prepare accordingly.

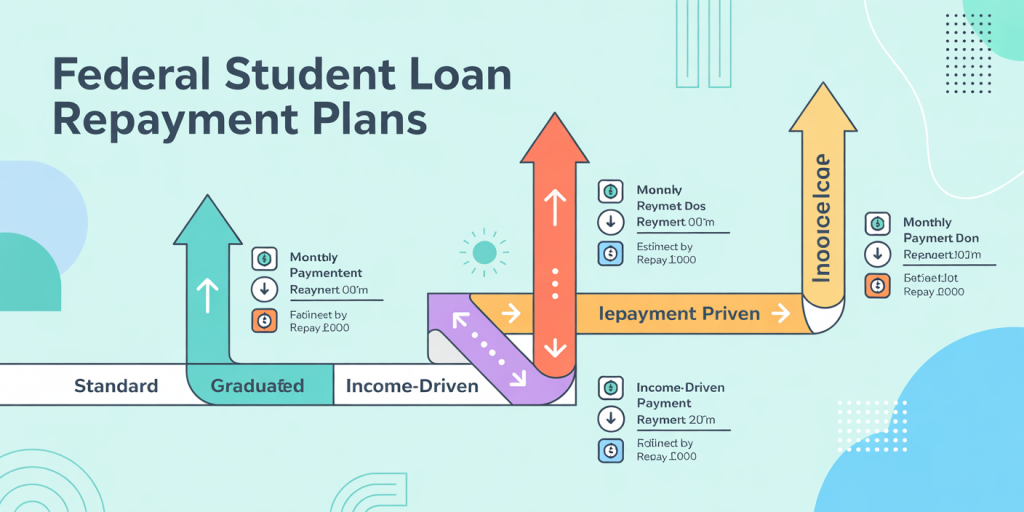

Federal Loan Repayment Options

Repayment usually begins six months after graduation, leaving school, or dropping below half-time enrollment. Borrowers have several repayment plans:

-

Standard Repayment Plan

Fixed payments over 10 years. Pays off the loan fastest with the least interest. -

Graduated Repayment Plan

Starts with lower payments that increase every two years—ideal for borrowers expecting higher income in the future. -

Extended Repayment Plan

Stretches repayment over 25 years. Available for borrowers with $30,000+ in federal loans. -

Income-Driven Repayment (IDR) Plans

Designed for borrowers with high debt-to-income ratios. Monthly payments are calculated as a percentage of discretionary income. Examples include:

-

PAYE (Pay As You Earn)

-

REPAYE (Revised Pay As You Earn)

-

Income-Based Repayment (IBR)

-

Income-Contingent Repayment (ICR)

After 20–25 years of qualifying payments, the remaining balance may be forgiven, although it may be considered taxable income.

-

Public Service Loan Forgiveness (PSLF)

Forgives federal loans after 120 qualifying payments for borrowers working in government or eligible nonprofit jobs.

Private Loan Repayment

Repayment terms for private loans vary widely and often include:

-

Fixed or variable interest rates

-

Limited or no deferment options

-

No access to IDR or forgiveness programs

Some lenders offer:

-

Interest-only payments while in school

-

Hardship forbearance

-

Refinance options

Always contact your lender early if you’re facing payment difficulties.

Tips for Borrowing and Repayment Success

![]()

✅ 1. Borrow Smart

-

Only borrow what’s absolutely necessary.

-

Consider total cost of attendance (tuition, housing, supplies).

-

Aim to keep student loan debt below your expected first-year salary.

✅ 2. Understand Your Interest

-

Interest accrues daily, especially on unsubsidized and private loans.

-

If possible, make interest payments while in school to reduce long-term costs.

✅ 3. Keep Records Organized

-

Know your loan servicer and keep track of balances.

-

Use tools like the Federal Student Aid website or StudentAid.gov to monitor loans.

-

Set calendar reminders for payment due dates.

✅ 4. Set Up Autopay

Many loan servicers offer a discount on your interest rate (typically 0.25%) if you set up automatic payments from your bank account.

✅ 5. Explore Refinancing (Cautiously)

Refinancing private loans could lower your interest rate if your credit improves. However, refinancing federal loans into private ones means losing all federal benefits—like forgiveness, IDR, and deferment options. Only consider refinancing federal loans if you’re absolutely sure you won’t need these protections.

Scholarships and Grants: Free Money First

Before turning to loans, exhaust all opportunities for scholarships and grants—money you don’t have to repay. Search for aid through:

-

Your college’s financial aid office

-

Local organizations and foundations

-

Online platforms like:

-

Fastweb

-

Scholarship.com

-

Cappex

-

Going Merry

-

Apply early, and apply often. Even small awards can add up.

Final Thoughts: Education Without a Lifetime of Debt

Student loans are a powerful tool to help you access education and opportunity—but they’re also a long-term responsibility. With proper planning, smart borrowing, and proactive repayment strategies, you can avoid the financial pitfalls that have burdened many borrowers.

Always Remember:

-

Prioritize federal loans over private ones

-

Understand every loan’s terms and costs

-

Stay organized, informed, and proactive in managing your debt

-

Seek guidance from your school’s financial aid office if you’re unsure about your options

By taking control of your education financing today, you lay the foundation for a more secure and successful financial future tomorrow.

Post Comment