Cryptocurrency and Taxes: What U.S. Investors Need to Know in 2025

Anúncios

As cryptocurrencies continue to gain mainstream adoption in 2025, understanding how they are taxed in the United States has become more important than ever. Whether you’re trading Bitcoin, staking Ethereum, or earning DeFi rewards, every crypto transaction could have tax implications that affect your annual return and long-term financial planning.

This comprehensive guide breaks down everything U.S. investors need to know about crypto taxes in 2025 — from how the IRS classifies digital assets to the most common taxable events, reporting requirements, and smart strategies to reduce your tax burden.

How the IRS Classifies Cryptocurrency

Anúncios

Since 2014, the Internal Revenue Service (IRS) has classified cryptocurrency as property — not currency — for tax purposes. This means that crypto is subject to capital gains tax when sold, exchanged, or disposed of, similar to stocks or real estate.

As of 2025, the IRS has expanded its guidance to include areas like staking rewards, NFTs, DeFi, and even airdrops. The rules are still evolving, but the underlying principle remains: if your crypto activity results in income or a gain, it is likely taxable.

Anúncios

Key takeaway: Crypto is not treated like cash. Any time you sell or use it, you could owe taxes.

Common Taxable Events in Crypto

Here are the most common scenarios that trigger taxable events in 2025:

-

Selling crypto for fiat (e.g., selling BTC for USD)

-

Trading one crypto for another (e.g., ETH to SOL)

-

Using crypto to pay for goods or services

-

Receiving crypto through mining, staking, or airdrops

-

Earning crypto through interest, yield farming, or DeFi platforms

-

Getting paid in crypto as income or freelance compensation

Each of these events may result in either capital gains or ordinary income, depending on how the crypto was acquired and how long you held it.

Non-Taxable Events

Not every crypto activity is taxable. The following are typically not considered taxable events:

-

Buying crypto with fiat currency

-

Transferring crypto between your own wallets

-

Holding crypto without selling it

-

Giving crypto as a gift (under annual exclusion limits)

Note: If you hold crypto long-term (over 12 months), your gains may be taxed at favorable long-term capital gains rates.

Short-Term vs. Long-Term Capital Gains

Just like with stocks, crypto gains are categorized based on how long you held the asset before selling it.

-

Short-term capital gains (held under 1 year) are taxed at ordinary income tax rates (10%–37%)

-

Long-term capital gains (held over 1 year) are taxed at reduced rates: 0%, 15%, or 20%, depending on income level

Example: If you bought 1 ETH at $1,500 and sold it 13 months later for $2,500, the $1,000 gain would be taxed at the long-term capital gains rate. But if you sold after 6 months, it would be taxed at your regular income tax rate.

Crypto Income: How It’s Taxed

If you receive cryptocurrency as income (through mining, staking, freelancing, etc.), it is taxed as ordinary income at the fair market value on the day it was received.

Example: You earn 0.1 ETH from staking, valued at $250 on the day received. You must report $250 in income for that year. If you later sell the ETH for $300, you would owe capital gains tax on the $50 profit.

Special Cases in 2025

-

Staking and DeFi Rewards

The IRS now treats staking rewards and most DeFi earnings as taxable income when received. Some platforms issue 1099 forms if earnings exceed a certain amount. -

NFTs

Profits from selling NFTs are subject to capital gains tax. If you create and sell an NFT, the proceeds are treated as income and subject to self-employment tax if you’re an artist or creator. -

Airdrops

If you receive airdropped tokens, you must report the fair market value as income on the day of receipt — even if you didn’t request or use them. -

Crypto Used for Payments

Using crypto to pay for goods or services triggers a capital gain or loss, calculated as the difference between the purchase price and market value at the time of use.

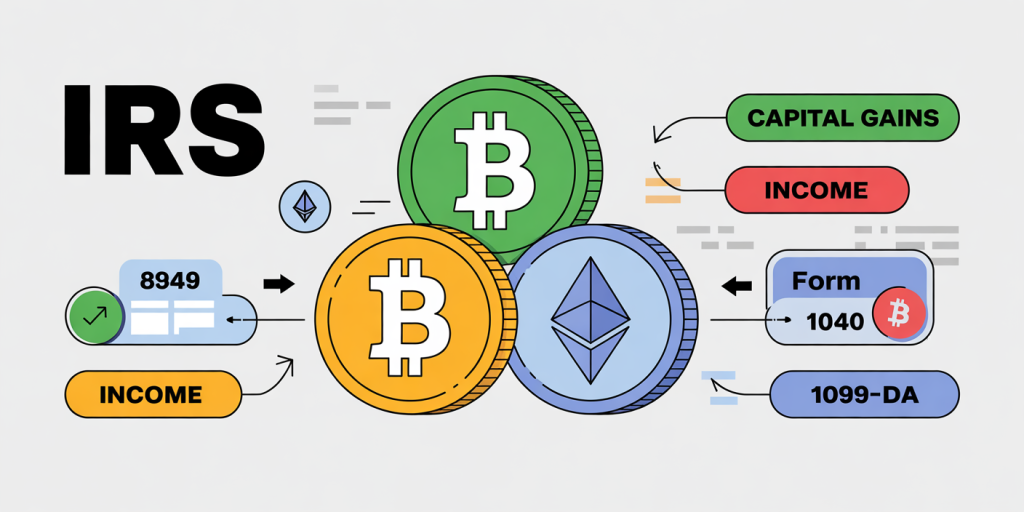

New IRS Rules and Form Updates in 2025

The IRS has expanded its enforcement and updated reporting standards:

-

Form 1040 still asks: “At any time during 2025, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

-

Form 1099-DA (Digital Assets) is issued by many exchanges and DeFi platforms to report income and transactions.

-

All crypto-to-crypto trades must be reported on Form 8949, with details including dates acquired, dates sold, cost basis, and proceeds.

Failure to report crypto activity can result in penalties, interest, or audits. In serious cases, it may lead to criminal charges for tax evasion.

Tracking Your Transactions

Keeping accurate records is essential. You should track:

-

Dates and amounts of purchases and sales

-

The fair market value at the time of each transaction

-

Exchange used and any associated fees

-

Income earned via staking, mining, or airdrops

Crypto Tax Software Tools

Popular platforms include:

-

CoinTracker

-

Koinly

-

ZenLedger

-

TokenTax

These tools help import transactions, categorize them correctly, and generate IRS-ready reports.

Tax-Loss Harvesting with Crypto

Tax-loss harvesting means selling crypto at a loss to offset capital gains from other assets. In 2025, crypto remains exempt from the wash-sale rule, so you can sell and rebuy the same coin immediately without penalty.

This gives investors a unique tax planning edge compared to stockholders — though legislation may soon change that.

State Tax Considerations

Crypto taxes don’t stop at the federal level. Some states — like California and New York — tax crypto gains and income. Others, like Texas, Florida, and Wyoming, do not have state income taxes, making them attractive locations for crypto holders.

Avoiding IRS Red Flags

To stay compliant:

-

Report all crypto-related income and gains

-

Use reliable tax software or work with a professional

-

Don’t omit transactions thinking they are untraceable

-

File required forms for foreign crypto exchanges

The IRS now uses blockchain analytics software to track wallets and identify underreported income.

Using a Tax Professional

If you:

-

Trade frequently across exchanges

-

Earn income from staking or NFTs

-

Use international platforms

-

Run a crypto-based business

… then it’s strongly recommended to work with a CPA or EA experienced in digital asset taxation. They can help you identify deductions, stay compliant, and prepare for audits.

Common Crypto Tax Myths

-

Crypto is anonymous and untraceable — Not true. Blockchain transactions are public, and the IRS partners with chain analysis firms.

-

I don’t owe taxes until I cash out — Also false. Trading, swapping, and using crypto all count.

-

I didn’t receive a tax form, so I don’t owe anything — You are responsible for self-reporting regardless of 1099s.

-

Micro transactions aren’t taxable — Even small transactions count, although enforcement may focus on larger activity.

Crypto Donations and Gifts

Donating crypto directly to charity lets you avoid capital gains and deduct the full fair market value — if you’ve held it more than one year. You’ll need a receipt from a 501(c)(3) and may need an appraisal for large gifts.

Gifting crypto to others (under $17,000 per person in 2025) doesn’t trigger taxes. Gifts over that limit require a gift tax form but don’t usually incur immediate tax.

Looking Ahead: What Might Change in 2026

Keep an eye on these potential policy updates:

-

Applying wash-sale rules to crypto

-

Mandatory 1099s for all crypto exchanges

-

Specific NFT and metaverse tax guidance

-

Global reporting standards from G20 collaboration

Conclusion

In 2025, cryptocurrency taxation is more complex — and more enforceable — than ever. The IRS expects transparency, and technology makes compliance easier. Whether you’re a casual investor or a crypto entrepreneur, keeping accurate records and understanding how the rules apply to you is essential.

Don’t wait until tax season. Start tracking your activity now, consult reliable tools or professionals, and stay on top of regulatory changes. With the right knowledge and preparation, you can keep your crypto compliant — and keep more of your gains.

Post Comment