The Smartest Way to Build Credit Using Your Credit Card

Anúncios

How to Build Strong Credit with a Credit Card: A Practical Guide

Establishing a solid credit history is one of the most important steps toward long-term financial well-being in the United States. Whether you’re planning to finance a car, rent an apartment, apply for a mortgage, or even qualify for a job that checks credit, your credit score plays a crucial role in determining your financial credibility.

And the good news? One of the most effective tools to boost your credit may already be sitting in your wallet: your credit card.

Anúncios

Why Credit Cards Can Help Build Credit

Contrary to what some might believe, credit cards aren’t inherently bad for your financial health. When used strategically, they can actually become one of the fastest and most accessible ways to improve your credit profile. The key is knowing how to use them responsibly—to gain the benefits without falling into the traps of overspending or revolving debt.

Credit cards provide a powerful opportunity to demonstrate to lenders that you are a reliable borrower—someone who can manage borrowed money wisely, pay on time, and stay within limits.

Anúncios

Understanding Your Credit Score

In the U.S., credit scores typically range from 300 to 850. The higher your score, the more creditworthy you appear to lenders. Your score is calculated based on five main categories:

📊 Breakdown of FICO Score Factors:

-

Payment History (35%)

The most important factor. It reflects whether you’ve paid your bills on time. Even one missed payment can hurt your score. -

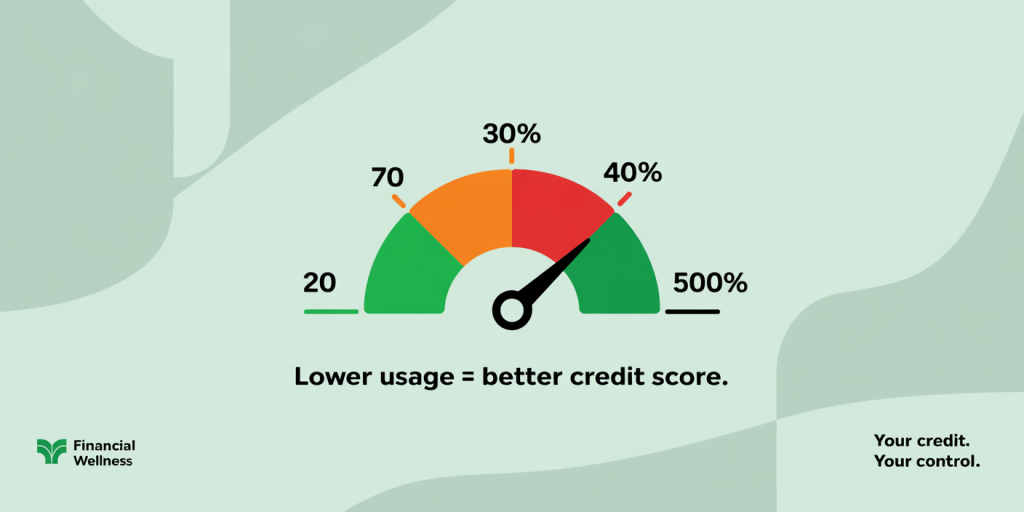

Credit Utilization (30%)

This is the percentage of your available credit you’re using. Lower usage is better. Maxing out your credit card can signal risk. -

Length of Credit History (15%)

The longer you’ve responsibly used credit, the more trustworthy you appear. This includes the age of your oldest and newest accounts. -

Credit Mix (10%)

A variety of accounts—credit cards, auto loans, student loans, etc.—can improve your score, showing that you can manage different types of credit. -

New Credit (10%)

Opening many new accounts at once can be a red flag and may cause a temporary dip in your score.

💡 Tip: Your credit score isn’t static—it fluctuates with your usage. Responsible, consistent habits can raise your score over time.

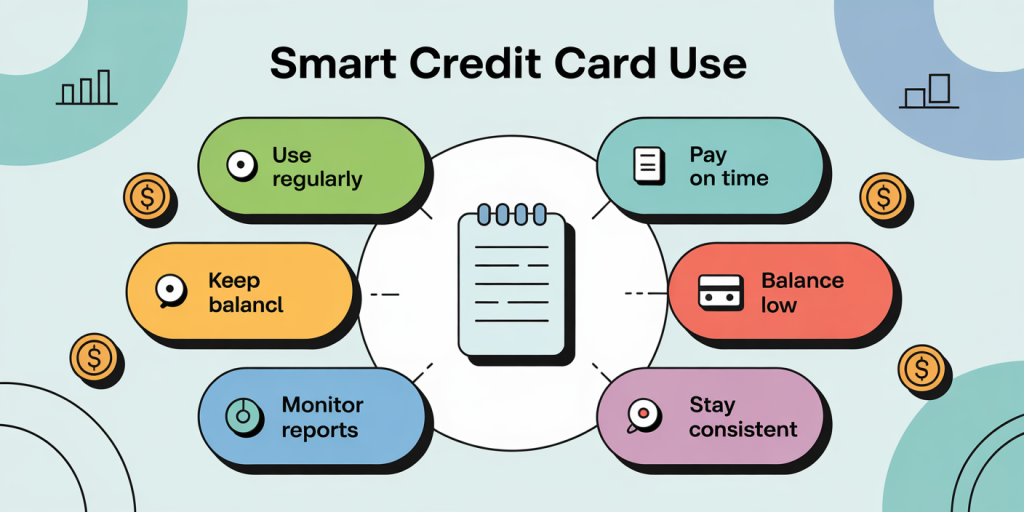

7 Ways to Use Your Credit Card to Build a Stronger Credit Score

Let’s dive into the smartest ways to use your credit card as a tool for credit growth.

1. Choose the Right Card for Your Profile

Not all credit cards are built the same—and choosing one that suits your current financial situation is the first step.

-

Beginners or No Credit? Consider a secured credit card, which requires a deposit but reports to all three major credit bureaus.

-

Some History? A starter card with no annual fee and basic rewards is a great option.

-

More Established? Look for cards with cashback, points, or miles that reward your spending habits while helping grow your credit.

🔍 Key Criteria to Consider:

-

Reports to all three bureaus (Equifax, Experian, TransUnion)

-

No or low annual fees

-

Reasonable APR (even if you plan to pay in full)

-

Easy-to-use mobile or web tools to track activity

2. Use It Regularly, But Stay Within Budget

To build credit, you need to use your credit card—but not recklessly. Making regular, small purchases that you can afford to pay off each month is the way to go.

✅ Examples of Good Use:

-

Gas and groceries

-

Subscriptions like Netflix or Spotify

-

Monthly utility bills

Using the card consistently shows that you are active and responsible, which contributes to both your payment history and credit utilization metrics.

🚫 Avoid using your card for big discretionary purchases unless you’re sure you can pay it off before interest kicks in.

3. Keep Your Credit Utilization Below 30%

Credit utilization is the second most impactful factor in your credit score. It’s calculated by dividing your card balance by your total available credit.

💡 Example:

If your credit limit is $1,000, aim to keep your balance under $300 at all times.

Even better? Keep it under 10% for optimal scoring benefit.

🔒 Strategies to Lower Utilization:

-

Pay your card multiple times a month

-

Request a credit limit increase

-

Use more than one card and divide your spending between them

Keeping your utilization low signals to lenders that you’re not overly reliant on credit.

4. Never Miss a Due Date

Payment history is the most critical part of your credit score—and missing even a single due date by more than 30 days can do serious damage.

📆 How to Stay On Track:

-

Set calendar or phone reminders

-

Enable autopay for at least the minimum amount

-

Pay a few days early to avoid processing delays

Even if you can’t pay the full balance, paying on time is non-negotiable when building credit.

5. Always Pay More Than the Minimum

Paying only the minimum might satisfy the issuer, but it can trap you in a cycle of long-term debt—especially with high interest rates.

Whenever possible, pay:

-

The full statement balance to avoid interest

-

Or at least more than the minimum to reduce your debt faster

📉 Paying more = less interest + faster credit improvement

This habit not only builds your score but helps maintain your financial freedom.

6. Monitor Your Credit Report Frequently

Your credit report is like your financial report card—and errors can happen. It’s up to you to spot and dispute them.

🔍 What to Look For:

-

Incorrect balances or late payments

-

Accounts you don’t recognize (potential fraud)

-

Duplicate entries

-

Outdated personal information

🛠️ Tools to Use:

-

Free reports from AnnualCreditReport.com

-

Credit monitoring services like Credit Karma, Experian, or bank-provided tools

Spotting issues early can prevent major setbacks in your credit-building journey.

7. Stay Consistent and Be Patient

Building credit is a marathon, not a sprint. Even with perfect habits, it can take 6 to 12 months to see substantial progress—and years to reach an excellent score.

🎯 Best Practices to Stay Consistent:

-

Don’t open new cards too often

-

Maintain older accounts (age of credit matters)

-

Continue using your card even when not building urgent credit needs

Over time, your score will reflect your discipline, and the benefits—lower interest rates, better loan terms, premium cards, and financial confidence—will follow.

Final Thoughts

Credit cards are powerful financial tools—but they must be used strategically. They can either open doors to opportunity or lead you into debt, depending on your habits.

🧠 Key Takeaways:

-

Choose the right credit card for your profile.

-

Use your card regularly and responsibly.

-

Keep your balances low and pay on time.

-

Monitor your credit report and make improvements over time.

By treating your credit card like a stepping stone—not a shortcut—you’ll be setting yourself up for strong financial health and long-term security.

Start small, stay consistent, and let time and good habits build the credit future you deserve.

Post Comment