Budgeting Apps Compared: Which One Is Right for Your Goals?

Anúncios

In a world where every dollar counts, budgeting apps have become indispensable tools for managing personal finances. Whether you’re saving for a vacation, paying off debt, or trying to break the paycheck-to-paycheck cycle, the right budgeting app can help you gain control and confidence over your money.

But with so many options available in 2025 — from old favorites like Mint to newer players like Monarch and Rocket Money — how do you know which one fits your financial goals best?

This in-depth comparison explores six of the most popular budgeting apps today: Mint, YNAB (You Need a Budget), PocketGuard, Goodbudget, Monarch Money, and Rocket Money. We’ll break down their key features, ideal users, pricing, and overall pros and cons.

Anúncios

1. Mint – Best Free All-in-One Budgeting Tool

Overview:

Mint, developed by Intuit, is a long-standing free budgeting app that syncs directly with your financial accounts to track spending, categorize transactions, and monitor your credit score.

Anúncios

Strengths:

-

Free to use

-

Automatic transaction syncing

-

Credit score monitoring

-

Budgeting categories with alerts

Best For:

-

Beginners

-

Users wanting a visual snapshot of spending

-

People looking for a no-cost solution

Weaknesses:

-

Ad-supported interface

-

Limited customization

-

Retrospective budgeting only

Verdict:

Mint is ideal for those starting their financial journey who want to passively monitor their finances. It’s not the best for proactive planning or those who want deep customization.

2. YNAB (You Need a Budget) – Best for Proactive Planners

Overview:

YNAB is built on a zero-based budgeting philosophy, where every dollar gets assigned a job. It encourages forward planning, goal setting, and complete control.

Strengths:

-

Encourages mindful, goal-based budgeting

-

Educational workshops and resources

-

Syncs with banks or allows manual input

-

Excellent cash flow control

Best For:

-

Budgeting enthusiasts

-

Freelancers and irregular earners

-

Users focused on long-term habits

Weaknesses:

-

$14.99/month or $99/year

-

Steeper learning curve

-

Requires consistency

Verdict:

YNAB is perfect for people who want to actively manage their money. It’s an investment, but one that pays off in clarity and discipline.

3. PocketGuard – Best for Simplicity and Overspending Control

Overview:

PocketGuard tells you how much money you have left to spend today by automatically calculating bills, savings goals, and budget limits.

Strengths:

-

Real-time spending alerts

-

Clean, intuitive dashboard

-

“In My Pocket” feature simplifies decision-making

-

Subscription tracking

Best For:

-

Casual budgeters

-

Overspenders

-

Those who want automation

Weaknesses:

-

Limited free features

-

Basic customization options

-

Some bugs with syncing

Verdict:

PocketGuard is a solid choice for users who want a clean, simple view of their safe-to-spend amount. Great for day-to-day spending awareness.

4. Goodbudget – Best for Envelope Budgeting Fans

Overview:

Goodbudget mimics the envelope system, assigning money to digital “envelopes” for each spending category. It focuses on planning rather than tracking.

Strengths:

-

Great for couples and families

-

Manual entry fosters awareness

-

Clear envelope structure

Best For:

-

Joint budgeters

-

Envelope system enthusiasts

-

People who like hands-on money tracking

Weaknesses:

-

No automatic syncing

-

Requires frequent manual updates

-

Limited features on free plan

Verdict:

Goodbudget is ideal if you’re already a fan of the envelope method and prefer a manual, structured approach to spending.

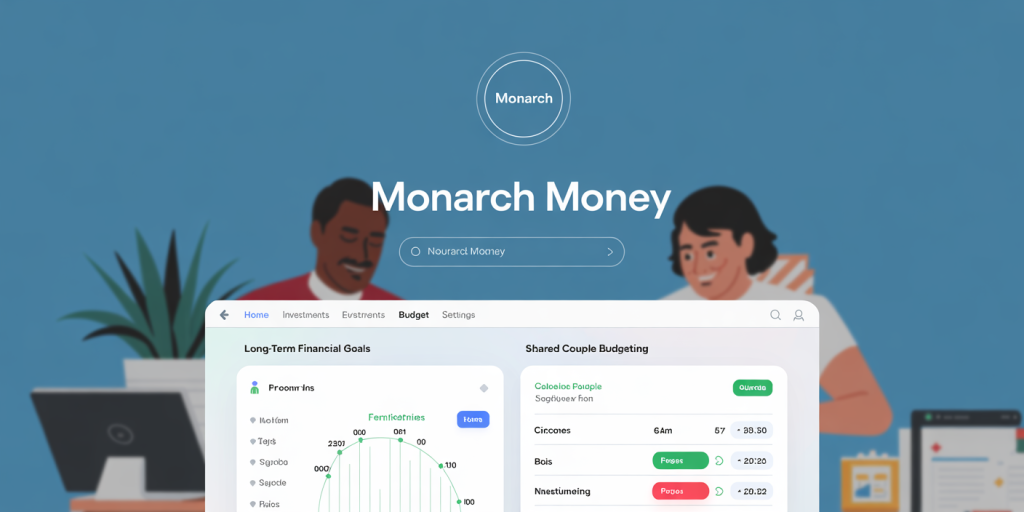

5. Monarch Money – Best for Long-Term Planning and Customization

Overview:

Monarch Money offers powerful customization, long-term goal planning, and an ad-free interface. It combines budgeting with investment and net worth tracking.

Strengths:

-

Shared budgeting for couples

-

Clean, modern design

-

Custom rules, categories, and forecasts

-

Tracks net worth and investments

Best For:

-

Couples or families

-

Users with complex finances

-

Those focused on both short- and long-term goals

Weaknesses:

-

No free tier

-

$14.99/month or $99/year

-

Not as beginner-friendly

Verdict:

Monarch is a premium platform for serious planners who want to consolidate their financial lives in one sleek dashboard.

6. Rocket Money – Best for Subscription and Bill Management

Overview:

Formerly known as Truebill, Rocket Money excels at detecting subscriptions, managing bills, and helping users lower expenses via negotiations.

Strengths:

-

Identifies and cancels unwanted subscriptions

-

Negotiates bills on your behalf

-

Weekly insights and reports

Best For:

-

Users overwhelmed by subscriptions

-

Cost-cutters

-

Passive budgeters

Weaknesses:

-

Budgeting features are basic

-

Relies on premium upsells

-

Limited customization

Verdict:

Rocket Money is best for those who want to clean up financial waste with minimal effort and reduce recurring costs.

📊 Quick Comparison Table

| App | Free Version | Best For | Syncs Accounts | Manual Entry | Price |

|---|---|---|---|---|---|

| Mint | ✅ | Beginners, trackers | ✅ | ✅ | Free |

| YNAB | ❌ | Planners, irregular income | ✅ | ✅ | $14.99/mo |

| PocketGuard | ✅ | Overspenders, simplicity | ✅ | ❌ | Free/$7.99/mo |

| Goodbudget | ✅ | Envelope users, couples | ❌ | ✅ | Free/$8/mo |

| Monarch Money | ❌ | Families, customization | ✅ | ✅ | $14.99/mo |

| Rocket Money | ✅ | Subscriptions, automation | ✅ | ❌ | Free + fees |

🔎 How to Choose the Right Budgeting App for You

1. Define Your Financial Goals

Are you saving for a home? Paying off student loans? Tracking family expenses? Match your app to your top priorities.

2. Consider Your Budgeting Style

Do you want control (YNAB, Goodbudget), or convenience (Mint, PocketGuard)?

3. Evaluate Complexity

If your finances are straightforward, PocketGuard or Mint may be enough. For complex financial lives, Monarch or YNAB are stronger options.

4. Try Before You Commit

Most paid apps offer free trials. Take advantage of those to test the user interface and fit.

🔮 Future Trends in Budgeting Apps (2025 and Beyond)

1. AI-Powered Budgeting

Many apps now offer predictive insights to help users avoid cash shortages and overspending.

2. Real-Time Coaching

Apps like Monarch are integrating real-time coaching or AI-generated advice to guide user decisions.

3. Integration With Investment Tools

Budgeting is becoming part of broader financial ecosystems. Expect tighter integration with investment tracking and retirement planning.

4. Gamification of Savings

Gamified milestones and rewards are keeping users motivated to hit savings goals and stay accountable.

✅ Final Thoughts

The best budgeting app is the one you’ll actually use consistently. Here’s a recap:

-

Choose Mint if you want a free, all-in-one snapshot of your finances.

-

Choose YNAB if you want intentional control and long-term planning.

-

Choose PocketGuard for a quick, simple way to control daily spending.

-

Choose Goodbudget to implement the envelope method manually.

-

Choose Monarch if you’re managing a family budget or long-term wealth.

-

Choose Rocket Money to trim recurring costs and simplify subscriptions.

No matter your choice, the key is starting. Budgeting doesn’t need to be perfect — but it does need to be active. With the right app, you can build a financial life that’s intentional, informed, and empowering.

Post Comment