Credit Utilization Ratio: How It Affects Your Credit Score and How to Keep It Low

Anúncios

When it comes to managing your credit and building a strong credit score, one of the most overlooked but critically important factors is your credit utilization ratio. Many consumers are aware of the impact of missed payments or defaulted loans, but few understand how this single percentage can make or break their credit profile.

In this comprehensive guide, we’ll explore what credit utilization is, why it matters, how it’s calculated, and actionable strategies to keep it in the ideal range — generally under 30%.

What Is Credit Utilization Ratio?

Anúncios

Your credit utilization ratio (also known as the debt-to-credit ratio) measures how much of your available revolving credit you’re currently using. It’s expressed as a percentage and applies primarily to credit cards and other lines of revolving credit.

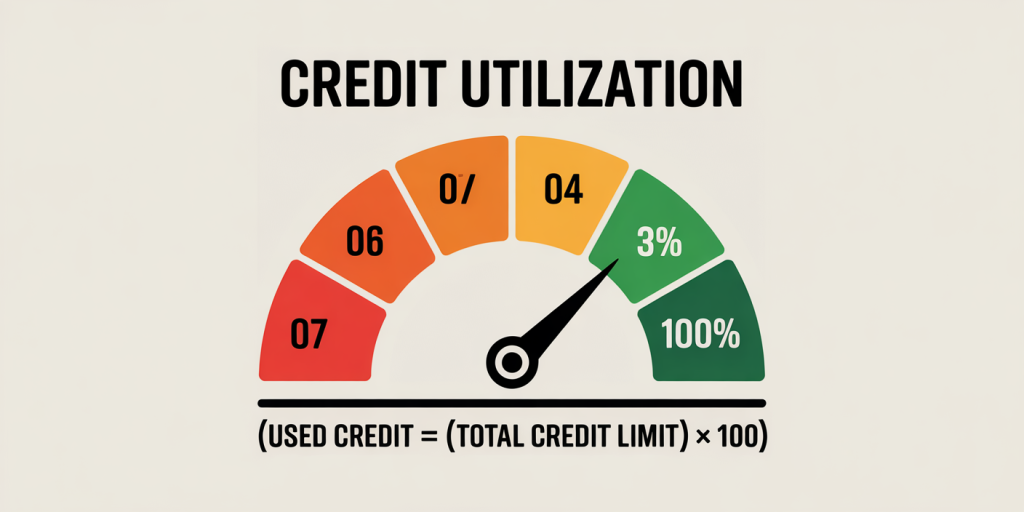

Formula:

Credit Utilization Ratio = (Total Credit Used ÷ Total Credit Limit) × 100

📌 Example:

If you have a total credit limit of $10,000 and you’ve used $3,000 of it, your credit utilization is 30%.

Anúncios

Why Is Credit Utilization So Important for Your Credit Score?

Credit scoring models like FICO and VantageScore weigh credit utilization heavily. In fact, utilization accounts for up to 30% of your FICO score, making it the second most important factor after payment history.

Here’s why it matters:

-

High utilization suggests you’re over-reliant on credit, signaling financial stress to lenders.

-

Low utilization indicates you’re managing credit responsibly and living within your means.

Maintaining low utilization tells creditors that you’re unlikely to max out your cards and default, thus reducing your perceived risk.

What’s the Ideal Credit Utilization Ratio?

Most financial experts — and even the credit bureaus — recommend keeping your utilization under 30% on both:

-

Each individual credit card, and

-

Across all of your credit cards combined.

But for optimal credit scores, below 10% is even better. Some of the highest scorers report keeping their utilization in the 1–7% range.

How Often Is Credit Utilization Calculated?

Your credit card utilization is typically reported monthly to the credit bureaus. This means:

-

It reflects the balance you had on your statement closing date, not your due date.

-

Even if you pay in full each month, if you carry a high balance on the statement date, it can affect your utilization ratio.

👉 Tip: Pay off part or all of your balance a few days before the statement closes to reduce the reported utilization.

Credit Utilization and Credit Score Tiers

Let’s break down how different levels of credit utilization may influence your score:

| Utilization Ratio | Impact on Credit Score |

|---|---|

| 0% – 10% | Excellent |

| 11% – 30% | Good |

| 31% – 50% | Fair to Poor |

| 51% – 75% | Poor |

| 76% and up | Very Poor |

High utilization not only lowers your score but can also lead to higher interest rates, loan denials, and lowered credit limits if issuers reassess your risk profile.

Common Mistakes That Hurt Your Utilization

Many consumers unknowingly sabotage their credit scores by making these mistakes:

-

Maxing out a card, even temporarily.

-

Closing old credit cards, which reduces total credit limit.

-

Only making minimum payments, allowing balances to accumulate.

-

Not tracking your balance before the statement closes.

-

Applying for too many cards, which can lead to hard inquiries and lower your average account age.

Smart Strategies to Lower Your Credit Utilization

✅ 1. Pay More Than Once a Month

Make payments before your statement closing date, not just the due date. This keeps your reported balance low.

✅ 2. Request a Higher Credit Limit

If your spending habits are healthy, ask for a limit increase. A higher credit ceiling means lower utilization — as long as your balance stays the same.

Example:

Old limit: $5,000; Balance: $1,500 → Utilization = 30%

New limit: $7,500; Balance: $1,500 → Utilization = 20%

✅ 3. Keep Old Credit Cards Open

Even if you don’t use them, old cards contribute to your total available credit and help with credit age — another important factor in your score.

✅ 4. Spread Out Purchases Across Multiple Cards

Instead of using one card for everything, use multiple cards to keep individual utilization lower.

✅ 5. Set Alerts for High Balances

Most banks let you set balance or usage alerts. This helps avoid accidentally crossing the 30% threshold.

✅ 6. Use Balance Transfers Wisely

Transferring debt to a 0% APR card can help pay down balances faster, but avoid maxing out the new card.

✅ 7. Automate Your Payments

Auto-pay ensures you don’t miss due dates and keeps your balances under control. Consider automating a mid-cycle payment as well.

Is 0% Utilization Bad for Your Score?

Surprisingly, yes — a utilization of 0% can sometimes hurt your score, as it may appear you’re not using credit at all.

The sweet spot is having a small balance (even $10–$20) that gets reported, then paid off. This shows active and responsible usage.

What If You’re Already Carrying High Balances?

If your utilization is above 50% and you’re struggling to lower it, here’s what you can do:

-

Use the avalanche method to pay off cards with the highest interest rates first.

-

Focus on one card at a time to bring individual ratios below 30%.

-

Consider a personal loan to consolidate credit card debt — installment loans don’t count toward utilization.

-

Avoid new purchases until you bring utilization under control.

How Long Does It Take to Improve Credit Utilization?

Once you pay down your balances and they’re reported to the bureaus, you can see changes within 30–45 days — sometimes sooner.

Improving utilization is one of the fastest ways to boost your credit score, especially if you were carrying high balances.

How Credit Utilization Affects Loan Applications

Lenders use your utilization ratio to assess risk when you apply for:

-

Mortgages

-

Auto loans

-

Personal loans

-

Credit limit increases

High utilization can lead to loan rejections or higher APRs, even if you have no missed payments. Keeping this number low ensures your credit profile appears stable and reliable.

Final Thoughts

Your credit utilization ratio is more than just a number — it’s a reflection of how well you manage credit. Keeping it under 30%, or ideally under 10%, can significantly improve your credit score and open the doors to better financial opportunities.

By tracking your spending, spreading out purchases, keeping old accounts open, and paying strategically, you can build a healthier credit profile and gain long-term financial freedom.

Post Comment