Tax Planning for Freelancers: Avoid Surprises at Tax Time

Anúncios

Freelancers are a growing segment of the workforce, with over 59 million Americans engaging in freelance work in 2023 alone—a trend expected to continue rising. While freelancing offers unparalleled flexibility and autonomy, it also introduces specific tax challenges that can be daunting if not managed properly. Unlike traditional employees, freelancers act as their own business owners, handling their tax responsibilities directly. Without effective tax planning, freelancers risk facing unexpected tax bills, penalties, and missed opportunities for deductions. This article will guide freelancers through practical tax planning strategies, backed by real-world examples and data, to help avoid surprises at tax time and optimize their financial health.

Understanding the Freelancer’s Tax Landscape

Freelancers are responsible for tracking and paying their income taxes, self-employment taxes, and making estimated quarterly payments. Unlike W-2 employees whose taxes are withheld by employers, freelancers must proactively manage these payments themselves. The IRS treats freelancers as self-employed, meaning they need to file a Schedule C (Profit or Loss from Business) along with their personal income tax return.

Anúncios

A freelancer working from a home office surrounded by tax documents, a laptop with accounting software open, and a calendar highlighting quarterly estimated tax payment dates.

Anúncios

A critical element freelancers often overlook is self-employment tax, which covers Social Security and Medicare taxes. In 2024, the self-employment tax rate is 15.3%. This tax applies to net earnings from self-employment above $400. While employees split this tax with employers (7.65% each), freelancers pay the entire amount. This can lead to significantly higher total tax liabilities if not anticipated.

For example, Sarah, a freelance graphic designer earning $70,000 annually, failed to set aside money for self-employment tax. At tax time, she faced a bill exceeding $10,000 in self-employment and income taxes combined. Had she implemented quarterly estimated tax payments, she could have avoided penalties and budgeted more efficiently throughout the year.

Key Tax Deductions Every Freelancer Should Know

One of the significant advantages of freelancing is eligibility to claim numerous business expenses as tax deductions, reducing taxable income. However, it requires meticulous record-keeping and understanding which expenses qualify under IRS rules.

Common deductible expenses include home office costs, business supplies, software subscriptions, internet fees, mileage, professional development, and health insurance premiums. For instance, freelancers who use a dedicated space exclusively for work can claim a home office deduction using either the simplified method ($5 per square foot up to 300 square feet) or the actual expense method (calculating a portion of rent, utilities, and maintenance).

A noteworthy case is John, a freelance writer, who used the simplified home office deduction method on his 200 square foot workspace, thereby deducting $1,000 annually. Without realizing it, these deductions lowered his taxable income by thousands of dollars and saved him over $300 in taxes each year.

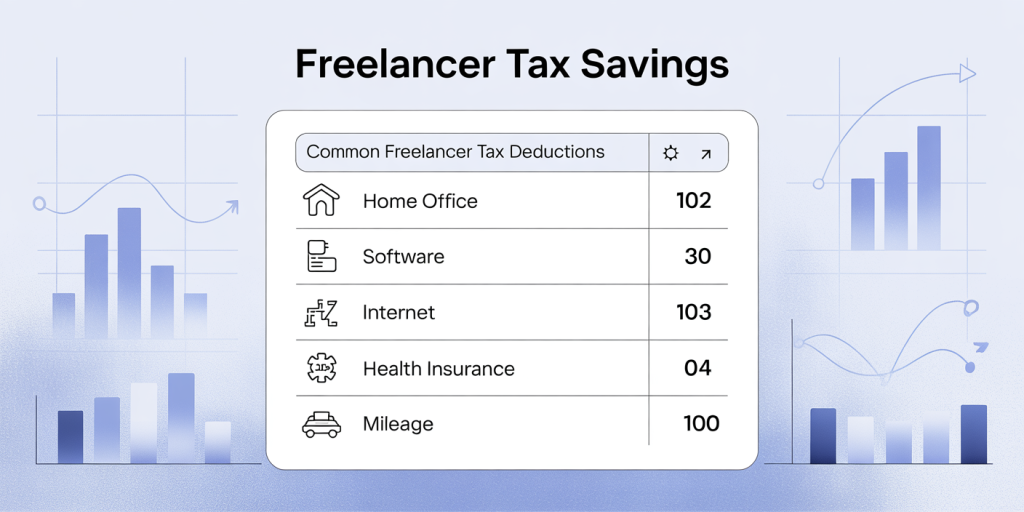

Below is a comparative table of typical freelance deductions and their potential tax-saving impact based on a $60,000 annual income at a 22% federal tax rate:

| Deduction Type | Average Annual Expense | Tax Savings Estimate (22%) |

|---|---|---|

| Home Office | $2,000 | $440 |

| Software & Tools | $1,200 | $264 |

| Internet | $600 | $132 |

| Health Insurance | $4,800 | $1,056 |

| Mileage (5,000 miles) | $2,850 (at $0.57/mile) | $627 |

Such deductions can significantly reduce taxable income, illustrating why detailed expense tracking is a crucial part of freelancer tax planning.

An illustrative table showing common freelancer tax deductions such as home office, software, internet, health insurance, and mileage, with icons representing each expense and corresponding tax savings.

Estimated Tax Payments: Avoiding Penalties with Quarterly Planning

Unlike salaried employees who have taxes automatically withheld, freelancers must estimate their tax liability and send quarterly payments to the IRS and their state tax authorities. These estimated taxes typically cover both income taxes and self-employment taxes, due on April 15, June 15, September 15, and January 15 of the following year.

Failure to pay adequate estimated taxes can result in interest and penalties. According to IRS data, penalties for underpayment can exceed 4% of the unpaid amount annually, penalizing freelancers who wait until tax deadline day to pay their dues.

Consider Maria, a freelance consultant, who started making lump-sum payments only in November, experiencing a $1,200 penalty. After consulting a tax professional, she switched to regular quarterly payments, which smoothed her cash flow and prevented penalties in the following year.

How to calculate estimated payments: Freelancers should project their taxable income for the year, subtract deductions, and multiply by their estimated tax rate (typically their marginal tax rate plus 15.3% for self-employment tax). Alternatively, they can use Form 1040-ES, which includes worksheets and payment vouchers.

By regularly updating income projections and adjusting payments accordingly, freelancers can minimize the risk of underpayment and surprise liabilities.

Record Keeping and Accounting Systems for Freelancers

Maintaining organized financial records isn’t just a best practice—it’s essential when tax season arrives. The IRS recommends keeping records for at least three years, though some documents related to home purchase or business property depreciation may need to be kept longer.

Robust bookkeeping practices ensure freelancers can substantiate their deductions and reduce audit risks. Using accounting software tailored for freelancers, such as QuickBooks Self-Employed or FreshBooks, can automate expense tracking, mileage logging, and monthly income reporting.

For example, freelancer David, a photography artist, transitioned from manual spreadsheets to an automated accounting system. The switch improved his ability to track deductible purchases in real-time and generated detailed financial reports, facilitating faster tax return preparation and accurate quarterly estimated tax payments.

Optimal bookkeeping also supports budgeting for tax liabilities—understanding cash flow patterns and earmarking funds for tax payments throughout the year promotes financial stability.

The Role of Retirement Contributions in Tax Planning

Contributing to retirement accounts not only secures freelancers’ futures but also lowers their current taxable income. Unlike employees with employer-sponsored plans like 401(k)s, freelancers have multiple options such as Solo 401(k), SEP IRA, and SIMPLE IRA, each with different contribution limits and tax advantages.

A visual comparison of retirement plans for freelancers (Solo 401(k), SEP IRA, SIMPLE IRA) featuring contribution limits, tax benefits, and withdrawal rules, designed as an infographic with clear icons and charts.

As an illustration, Amy, a freelance web developer, established a SEP IRA and contributed $20,000 in 2023. This contribution reduced her taxable income by the same amount, moving her into a lower effective tax bracket and saving her thousands in taxes during peak earning years.

Here’s a comparative table of common retirement accounts for freelancers:

| Retirement Plan | 2024 Contribution Limit | Tax Treatment of Contributions | Withdrawal Rules |

|---|---|---|---|

| Solo 401(k) | $22,500 elective + 25% profit share (up to $66,000 total) | Tax-deductible contributions | Penalties apply before age 59½ |

| SEP IRA | Up to 25% of net earnings up to $66,000 | Tax-deductible contributions | Penalties apply before age 59½ |

| SIMPLE IRA | $15,500 employee contribution + 3% employer match | Tax-deductible contributions | Penalties higher if withdrawn < 2 years |

By leveraging these plans, freelancers can both reduce current income tax and build long-term savings.

Future Perspectives: Tax Planning Trends for Freelancers

Looking ahead, the freelancing economy is projected to grow globally, with technology facilitating remote work and digital services. Tax authorities worldwide are increasingly scrutinizing self-employed earnings and developing digital platforms for easier tax compliance. This will likely result in enhanced reporting requirements and potentially higher tax transparency.

Moreover, emerging tax policies are focusing on gig economy protections, including social security contributions and healthcare mandates for freelance workers. Freelancers must anticipate these changes by staying informed, investing in adaptive tax software, and possibly consulting tax professionals regularly.

Technology will also play a role in simplifying tax planning. Artificial intelligence-powered tax tools are being designed to detect deductions automatically, predict quarterly payments accurately, and flag compliance issues proactively. These innovations will empower freelancers to enhance their tax efficiency without extensive manual bookkeeping.

Preparing for evolving tax landscapes by establishing strong record-keeping, understanding deduction options, and engaging retirement planning today will ensure freelancers remain resilient to monetary surprises tomorrow.

In sum, efficient tax planning is absolutely vital for freelancers aiming to avoid stressful tax season outcomes. By mastering key deductions, timely estimated tax payments, organized record-keeping, and retirement savings, freelancers can optimize their tax liabilities. With continued professional growth and evolving tax policies, proactive tax management will be a foundational pillar of freelancing success.

Post Comment