Pet Insurance: Financial Lifesaver or Waste of Money?

Anúncios

Owning a pet brings immense joy and companionship, but it also comes with responsibilities, including the financial burden of veterinary care. In recent years, pet insurance has gained popularity as a means to manage unexpected veterinary expenses. Pet insurance promises peace of mind and financial relief, but is it truly a financial lifesaver or just an unnecessary expense? This article delves deep into the pros and cons of pet insurance, analyzing its value through real-world examples, data, and practical comparisons.

An emergency veterinary scene showing a dog receiving urgent surgery with a vet team in action, alongside a pet owner relieved by insurance reimbursement, symbolizing financial protection during unexpected pet health crises.

Anúncios

Understanding Pet Insurance: What Does It Cover?

Pet insurance is a type of health insurance policy designed specifically for pets, mostly cats and dogs, to cover veterinary costs. These policies often reimburse a percentage of vet bills for accidents, illnesses, and sometimes routine care, depending on the plan chosen. The coverage can vary widely between providers and plans.

Anúncios

A caring pet owner reviewing various pet insurance plans on a laptop, surrounded by images of cats and dogs, veterinary bills, and insurance documents, illustrating the decision-making process about pet insurance coverage.

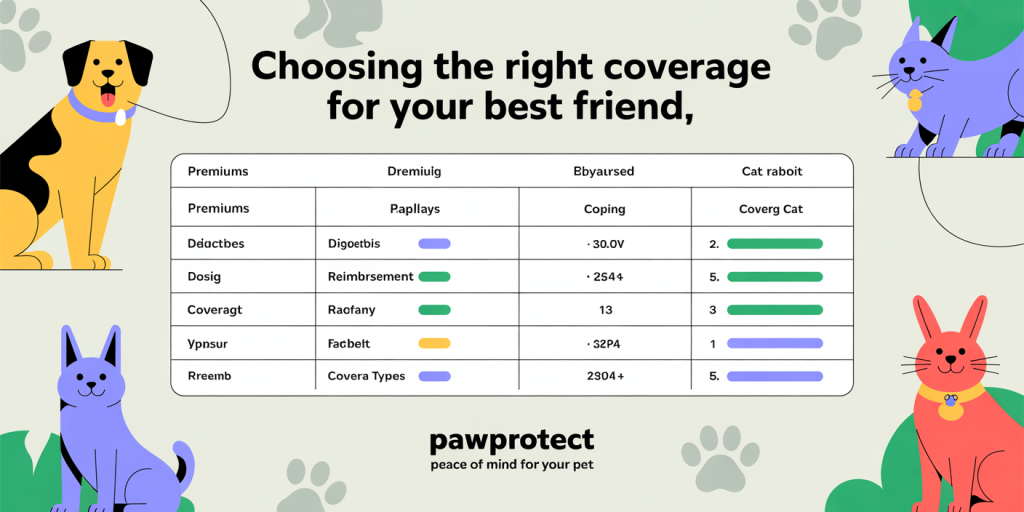

A comparative infographic-style table displaying features of different pet insurance providers with icons for premiums, deductibles, reimbursements, and coverage types, visually summarizing the benefits and costs of pet insurance plans.

For instance, some plans focus exclusively on accidents such as fractures or ingestion of foreign objects. Others extend coverage to chronic illnesses like diabetes or cancer treatments, which can cost thousands of dollars over time. Preventive care plans may cover vaccinations, flea treatments, and annual checkups, though these are often offered as add-ons at an increased premium.

A 2023 survey by the North American Pet Health Insurance Association (NAPHIA) showed that approximately 3.5 million pets in the United States were insured, a number expected to grow 10% annually. The average annual premium for dog insurance is around $600, with cat insurance averaging $450 per year.

Understanding what pet insurance covers—and just as importantly, what it doesn’t—can help owners decide whether the policy meets their financial planning needs.

Financial Impact of Veterinary Expenses: Why Pet Insurance Matters

Unexpected veterinary bills can impose significant financial strain. According to the American Pet Products Association (APPA), the average yearly veterinary expenditure for a dog or cat exceeds $500, but emergency care or treatment for chronic diseases can cost thousands in a single visit. For example, emergency surgery following an accidental poisoning or broken bone can easily exceed $3,000.

Consider the case of Mark, a dog owner from Ohio, whose German Shepherd suddenly developed a painful obstruction in the intestines. Emergency surgery and post-operative care cost him $5,200 out of pocket. Mark’s pet insurance reimbursed 80% of the expenses after his deductible, ultimately saving him over $4,000.

Conversely, Sarah, a young cat owner in California, opted out of pet insurance, reasoning that her indoor cat rarely got sick. When her cat required treatment for a urinary tract infection complicated by bladder stones, her bills mounted to $1,200, which she paid without coverage.

These examples underscore how pet insurance can protect against costly emergencies, but also raise the question of whether the premium spending justifies the coverage for all pet owners.

Comparing Pet Insurance Plans: Features, Costs, and Benefits

Not all pet insurance policies are created equal. Choosing the right plan requires careful comparison of features such as coverage limits, reimbursement percentages, deductibles, exclusions, and monthly premiums.

The table below summarizes three popular pet insurance providers and their basic plans for a middle-aged dog:

| Provider | Monthly Premium | Deductible | Reimbursement % | Annual Limit | Typical Coverage |

|---|---|---|---|---|---|

| HealthyPaws | $50 | $100 per condition | 90% | Unlimited | Accidents, illnesses, hereditary conditions |

| Embrace | $45 | $250 | 80% | $30,000 | Accidents, illnesses, wellness add-on available |

| Petplan | $55 | $100 | 90% | Unlimited | Accidents, illnesses, chronic conditions |

Providers like HealthyPaws and Petplan offer unlimited annual coverage, beneficial for pets with chronic or hereditary conditions. Embrace offers flexibility with wellness care add-ons, useful for routine checks.

Deductibles vary—some policies apply them per condition, while others have annual deductibles. Choosing the right deductible affects monthly premiums and out-of-pocket costs in the event of claims.

According to a 2023 report by Consumer Reports, about 70% of pet owners found that plans covering hereditary and chronic conditions provided the best value over the pet’s lifespan, especially for breeds prone to such issues.

Real-life Cases: Success and Limitations of Pet Insurance

Examining real-life situations can provide a clearer picture of how pet insurance performs: Positive Outcome: Linda’s Labrador Retriever was diagnosed with hip dysplasia, requiring surgery and physical therapy that totaled $7,000. Thanks to her pet insurance plan with a $200 deductible and 80% reimbursement, Linda’s actual expense was reduced to approximately $1,600 (deductible plus 20% copay), freeing her from financial distress and allowing her dog to receive the best treatment. Limitation Case: David insured his 12-year-old cat; however, the policy excluded pre-existing conditions. His cat developed kidney disease, a pre-existing but undiagnosed problem. Claims related to this were denied, resulting in David paying over $4,000 for treatment.

These cases highlight both the benefits and boundaries of pet insurance. Pet owners must carefully assess policy terms, especially concerning pre-existing conditions, waiting periods, and age limits, so they fully understand what is and isn’t covered.

When Pet Insurance Might Not Be Worthwhile

Although pet insurance can be a safeguard, it may not be the best financial option for every pet owner. For young, healthy pets, especially indoor-only cats with low risk of accidents and illnesses, the premium expenses might add up to more than what claims reimburse.

Moreover, pet insurance often requires owners to pay the vet bill upfront and then submit claims for reimbursement, which can lead to temporary cash flow issues. This system might be inconvenient for some.

Some pet owners prefer self-insurance—setting aside an emergency fund instead of paying monthly premiums. For instance, setting aside $50 monthly could amount to $600 annually, potentially offering similar financial coverage if the pet remains healthy.

Additionally, insurance policies rarely cover all costs. Certain treatments, like elective surgeries or alternative therapies, are often excluded. High deductibles and annual limits can also diminish the perceived value of policies.

Emerging Trends and Future Perspectives in Pet Insurance

The pet insurance market is evolving rapidly, influenced by advances in veterinary medicine and changing pet owner attitudes. New products now incorporate wellness plans, preventive care, and even mental health services for pets.

Telemedicine for pets, enabled by apps and virtual vet consultations, is also gaining traction. Insurers in the future might integrate telehealth services as part of their coverage, lowering routine care costs.

Artificial intelligence and big data are expected to refine underwriting processes, enabling more personalized premiums based on breed, lifestyle, and health history, thus making insurance more affordable and tailored.

Moreover, pet insurance adoption is expected to rise worldwide. The UK market, for example, saw a 15% annual increase in pet insurance policies in 2023, driven by rising veterinary costs and greater pet ownership.

Finally, increasing public awareness about genetic screening and preventive care could prompt insurers to develop policies focusing on early detection and chronic disease management, reducing overall treatment costs and improving pet health outcomes.

Weighing the Pros and Cons: Making an Informed Decision

Ultimately, deciding whether pet insurance is a financial lifesaver or a waste of money depends on multiple factors including the pet’s age, breed, health condition, and the owner’s financial situation.

Pet insurance can prevent overwhelming veterinary bills and enable access to advanced treatments that might otherwise be unaffordable. On the other hand, for pets with minimal risk or owners with substantial emergency savings, the cost of premiums may not be rationalized.

The key is thorough research. Prospective buyers should compare plans, scrutinize terms, calculate total potential annual costs versus benefits, and consider their risk tolerance.

By understanding their options and weighing practical considerations, pet owners can make the choice that best supports their animal companion’s health and their own financial peace of mind.

Post Comment