What Type of Insurance Do You Really Need as a Freelancer?

Anúncios

In today’s dynamic gig economy, freelancing has become an increasingly popular career path. According to a 2023 report by Upwork, over 59 million Americans freelanced in some capacity, contributing more than $1.4 trillion to the economy. While freelancing offers flexibility and autonomy, it also exposes workers to unique risks that traditional employees might not face. One critical area often overlooked by freelancers is insurance. Without adequate coverage, freelancers can find themselves vulnerable to financial setbacks from unexpected events that could jeopardize their livelihoods.

Understanding what type of insurance you really need as a freelancer is essential for protecting your income, assets, and professional reputation. This article provides a comprehensive guide designed to help freelancers make informed decisions about insurance coverage. It explores essential types of insurance, provides practical examples, and offers a comparison of different policies to help you secure your freelance future.

Why Insurance is Crucial for Freelancers

Anúncios

Freelancers operate as independent businesses, often without the safety net of employer-provided benefits such as health insurance, workers’ compensation, or liability coverage. This independence requires them to take proactive steps to manage risks commonly mitigated by corporate structures.

For example, imagine a freelance graphic designer who suddenly develops a severe wrist injury, preventing them from working for months. Without health or disability insurance, this freelancer may face mounting medical bills and lost income, severely impacting their financial stability. Similarly, a freelance web developer who unknowingly releases code containing a security flaw might face claims of negligence or breach of contract. Without professional liability insurance, covering legal fees and damages could fall entirely on the freelancer’s shoulders.

Anúncios

A 2022 Insurance Information Institute report revealed that 57% of small business owners, including freelancers, who experienced lawsuits without liability insurance, reported severe financial distress or bankruptcy. These real cases underscore the importance of insurance tailored to the unique needs of freelancers.

Essential Types of Insurance for Freelancers

Freelancers generally require several core types of insurance based on their industry, client agreements, and potential risks. Here are the most critical policies every freelancer should consider:

1. Health Insurance

Health insurance is arguably the most essential coverage for freelancers. The U.S. Census Bureau estimated in 2022 that approximately 28 million Americans were uninsured, a risk that freelancers are particularly exposed to without employer-sponsored plans. Health insurance helps cover medical expenses like doctor visits, prescriptions, and emergency care, providing financial security when illness or injury occurs.

Real-world example: Sarah, a freelance writer in New York, opted out of health coverage initially due to cost concerns. However, after a sudden appendicitis attack requiring surgery and hospitalization, her out-of-pocket costs exceeded $30,000. She learned the hard way that having health insurance is indispensable for crisis readiness.

2. Professional Liability Insurance (Errors & Omissions)

Also known as Errors and Omissions (E&O) insurance, this policy protects freelancers against claims of negligence, mistakes, or failure to deliver services as promised. It covers legal defense costs, settlements, and judgments arising from lawsuits.

A case study: In 2021, a freelance consultant was sued by a client for allegedly providing incorrect financial advice that resulted in substantial losses. Luckily, the consultant had professional liability insurance that covered $75,000 in legal fees and damages, safeguarding their personal assets.

3. General Liability Insurance

This type of insurance covers third-party bodily injury or property damage that occurs because of your business activities. For freelancers who meet clients in person or use rented office spaces, general liability insurance can be a valuable safety net.

Example: A freelance photographer was shooting at a client’s home when their equipment accidentally knocked over a valuable vase, causing damage. General liability covered the cost of replacement, preventing an expensive conflict and loss of reputation.

Comparing Freelancer Insurance Options: Customized vs. Standard Policies

Freelancers face diverse working conditions depending on their industry, location, and client base. This variability necessitates careful selection between tailored insurance packages and standard commercial policies.

| Insurance Type | Standard Business Policy | Customized Freelancer Policy | Best For |

|---|---|---|---|

| Health Insurance | Group plans or marketplace options | Freelancer-specific plans with flexible premiums | Individuals seeking tailored coverage |

| Professional Liability | Broad commercial coverage | Industry-specific E&O policies | Consultants, IT professionals |

| General Liability | General policy caps for small businesses | Customized limits and add-ons catering to freelancers | Photographers, event planners |

| Disability Insurance | Standard income replacement plans | Short-term and partial disability coverage options | Freelancers depending on consistent income |

| Cyber Liability | Included in some standard policies | Dedicated cyber insurance for freelancers handling sensitive data | IT freelancers, social media managers |

For instance, most commercial general liability policies focus on brick-and-mortar operations and might not consider the unique pixelated world of digital freelancers. Customized freelancer policies often strip unnecessary coverages while enhancing those relevant to freelance environments.

An infographic-style table comparing standard business insurance policies versus customized freelancer insurance plans, highlighting differences and best uses for each insurance type.

A futuristic digital workspace showing a freelancer protected by cyber liability and business equipment insurance, with visual elements like encrypted data streams, laptops, cameras, and shield icons symbolizing security.

Disability and Income Protection Insurance: Safeguarding Your Earnings

Freelancers’ income is typically irregular and directly linked to their ability to work. Any interruption due to illness or injury can quickly lead to financial hardship. Disability insurance steps in to replace a portion of lost income during such times.

According to the Council for Disability Awareness, nearly 1 in 4 of today’s 20-year-olds will become disabled before retirement age. Despite this, only 33% of freelancers carry any form of disability insurance.

Consider John, a freelance software developer who fractured his leg in an accident. Unable to work for three months, John’s disability insurance provided 60% of his average monthly earnings, enabling him to meet bills and maintain his quality of life.

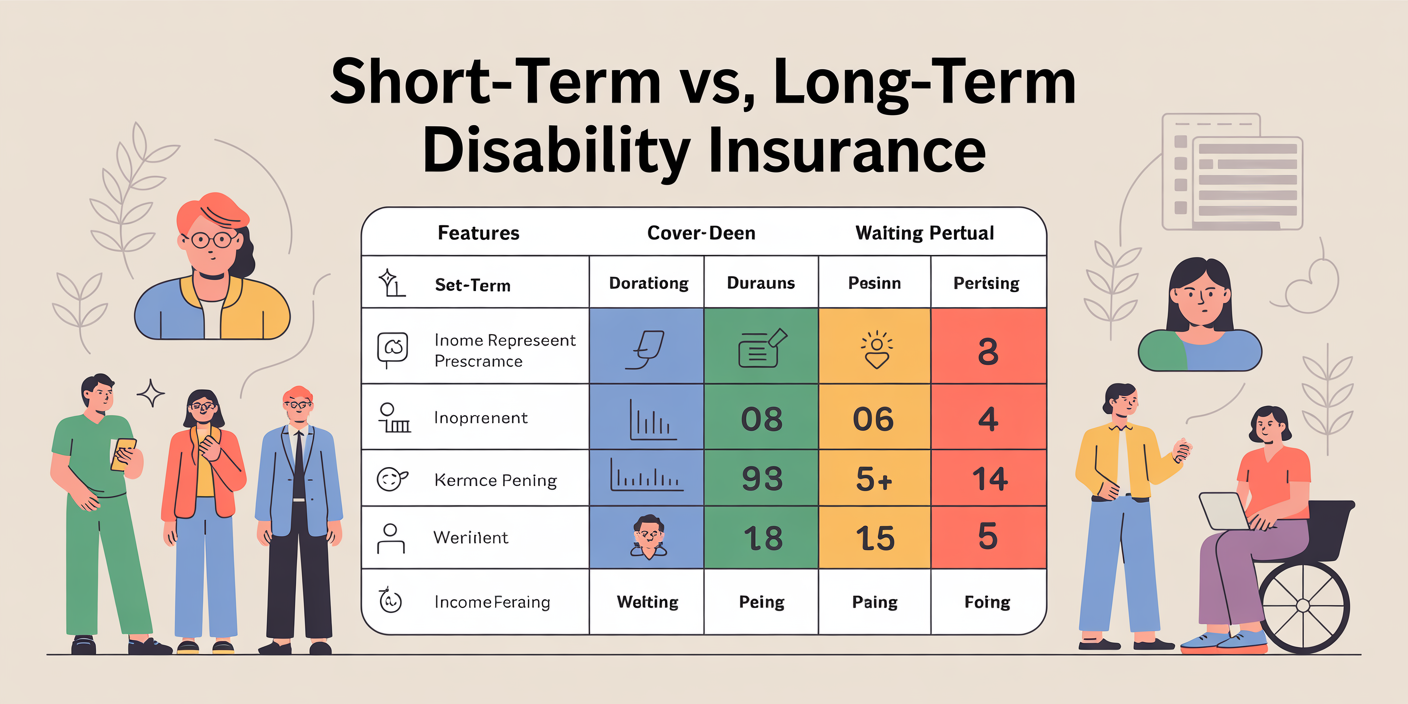

Different disability policies vary greatly: Short-term Disability Insurance typically covers 3-6 months with faster claim approvals. Long-term Disability Insurance begins after short-term ends and can continue for years.

Income protection plans designed specifically for freelancers often allow flexible monthly premiums and coverage options tailored to project-based earnings, unlike traditional employment-based insurance.

The Importance of Cyber Liability and Business Equipment Coverage

Many freelancers operate completely online, managing confidential client data, proprietary designs, or financial information. This digital dependency increases exposure to cybercrime, data breaches, and equipment loss or damage.

Cyber Liability Insurance covers expenses related to data breaches, cyber extortion, recovery costs, and lawsuits stemming from a digital security incident. For instance, a freelance accountant hacked in 2023 had client tax records compromised. Cyber insurance reimbursed costs associated with forensic investigation, notification, and legal liabilities totaling over $50,000.

Additionally, Business Equipment Insurance can protect laptops, cameras, or specialized equipment critical to your freelance work from theft, damage, or loss. Unlike general home insurance, this coverage is specific to your business property.

In a competitive analysis, freelancers specializing in tech or creative fields showed a 40% higher likelihood of experiencing cyber incidents than their counterparts. Hence, cyber insurance is becoming a must-have for digital freelancers.

Tailoring Your Insurance Portfolio: Industry-Specific Needs

Not all freelancers face the same risk profile, making industry-specific insurance recommendations crucial. Writers/Editors: Primarily need health, liability, and perhaps professional indemnity insurance. Their risk of physical injury is lower, but errors in delivering content can trigger disputes. Creative Professionals (Photographers, Designers): Require liability insurance, equipment coverage, and possibly event insurance if working onsite. Consultants and Coaches: Must prioritize professional liability insurance, plus health and disability coverage due to their advisory role leading to higher legal risks. IT Freelancers/Developers: Require robust cyber liability and professional indemnity insurance, alongside standard business policies.

For instance, freelance videographer Maria recently added event insurance after working at large festivals, mitigating risks linked with accidents at public events. Customizing your insurance portfolio based on your freelance niche ensures cost-effectiveness and comprehensive protection.

Looking Ahead: The Evolving Insurance Landscape for Freelancers

The insurance industry has begun adapting to the gig economy’s demands, introducing products explicitly designed for freelancers. Traditional insurer hesitance to cover irregular income and mixed-risk profiles is giving way to innovative solutions.

Technology-driven platforms now enable freelancers to purchase modular insurance packages online, with options to add or remove coverages as projects evolve. Insurtech companies such as Thimble and Next Insurance highlight this trend by offering on-demand liability insurance starting at just $5 a day, perfect for occasional freelance jobs.

Moreover, as remote work and digital freelancing flourish globally, regulatory changes might mandate minimum insurance standards for independent contractors to ensure economic security.

Data from a 2024 Freelancer’s Insurance Trends survey indicates a 30% annual increase in freelancers purchasing combined packages that include health, liability, and income protection. This shift suggests growing awareness and maturation in this market segment.

Considering future perspectives, freelancers should stay informed about: Emerging policies integrating cybersecurity and mental health coverage Flexible premium models that adjust according to income fluctuations Collaborative purchasing through freelancer communities to lower insurance costs

This evolving environment offers freelancers opportunities to better safeguard their future with tailored yet affordable insurance options.

In the expanding freelance economy, protecting yourself with the right type of insurance is not just prudent—it’s essential. By understanding the core policies such as health, professional liability, general liability, and disability insurance, freelancers can mitigate risks and secure their personal and professional livelihoods. Customized solutions, industry-specific coverages, and emerging technology make navigating insurance easier than ever. As the gig economy continues to grow, staying proactive about insurance will be a critical aspect of sustainable freelance success.

A diverse group of freelancers (graphic designer, web developer, photographer) working independently with symbols representing key insurance types (health, professional liability, general liability, disability) surrounding them.

Post Comment