The Psychology of Debt: How Shame Keeps You in the Red

Anúncios

Debt is more than just a financial burden; it is deeply intertwined with psychological factors that often exacerbate the struggle to achieve financial freedom. Among these factors, shame has emerged as a powerful force that traps individuals in cyclical debt, impacting decision-making, mental health, and long-term financial behavior. Understanding the psychological mechanisms behind shame and debt can pave the way for healthier relationships with money and smarter financial choices.

The Emotional Weight of Debt: Beyond Numbers

Debt is typically framed in numerical terms—principal, interest rate, repayment schedules—but the emotional consequences are far-reaching. When individuals accumulate debt, especially beyond their control, feelings of shame can surface. Shame is a self-conscious emotion that arises when people perceive themselves as failing to meet societal or personal standards. Unlike guilt, which focuses on specific actions, shame attacks the core self, generating feelings of worthlessness and self-blame.

Anúncios

These feelings often hinder efforts to tackle debt head-on. Many people avoid checking bank statements or credit reports out of fear and shame. A 2019 study published in the *Journal of Behavioral Finance* found that 45% of individuals in debt avoided financial discussions with family and advisors due to shame. This avoidance can delay necessary financial interventions, worsening debt over time.

Imagine Sarah, a young professional who amassed credit card debt after losing her job temporarily. Instead of seeking advice or restructuring her payments, she hid her financial situation from friends and family, fearing judgment. This shame-induced silence prevented her from accessing support networks, prolonging her debt stress.

Anúncios

How Shame Distorts Financial Decision-Making

Shame influences cognitive processes, often leading to poor financial decisions. People in shame may adopt denial or avoidance strategies to cope with their discomfort, which can include ignoring bills, taking on more debt, or relying on high-risk financial products like payday loans. These behaviors do not stem from ignorance alone but from an emotional attempt to escape the distress associated with indebtedness.

A comparative analysis between individuals experiencing shame and those who do not reveals significant differences in coping mechanisms:

| Behavior | Individuals with Shame | Individuals without Shame |

|---|---|---|

| Bill paymentTimeliness | Delayed or missed payments | Regular and timely payments |

| Seeking Advice | Avoidant, secretive | Proactive, open communication |

| Use of Credit | Increased impulsive borrowing | Controlled and planned use |

| Mental Health Impact | Higher anxiety and depression | Lower incidence of distress |

This table illustrates how shame impacts not only financial habits but also mental well-being. The fear of social stigma attached to debt reinforces a cycle where shame leads to poor decisions, which in turn increases debt and deepens feelings of shame.

Social Stigma and the Culture of Financial Failure

Debt shame is heavily influenced by societal norms and cultural expectations. In many societies, financial success is linked to moral virtue, while debt is considered a personal failure or a sign of irresponsibility. This stigma perpetuates negative stereotypes about indebted individuals and discourages open discussion about money struggles.

For example, a 2020 survey by the American Psychological Association found that 56% of adults reported feeling shame about their debt, with 30% admitting that shame prevented them from seeking professional financial help. In some cultures, discussing money struggles is taboo, making it nearly impossible for people to get emotional or practical support.

The social distancing caused by stigma exacerbates loneliness and reduces the chances of seeking solutions through counseling, debt restructuring, or support groups. Consider Tom, who owed medical bills after a serious illness. The social embarrassment he felt about his financial state led him to distance himself from friends and family, resulting in isolation and worsening mental health.

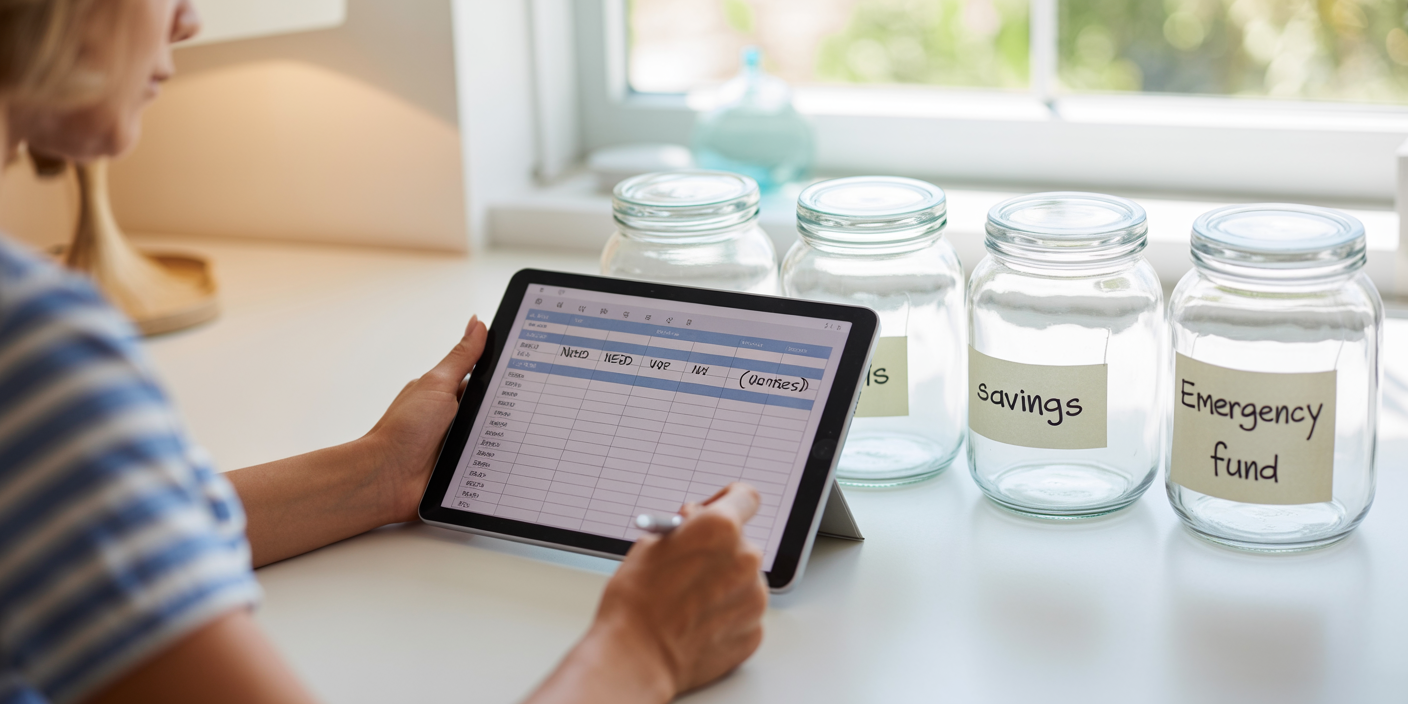

Breaking the Cycle: Practical Strategies to Overcome Shame

Understanding the psychological roots of shame is the first step toward breaking free from its grip. Strategies to combat shame-related debt challenges often focus on reframing the narrative and promoting transparency around finances.

One effective method is financial therapy, which combines counseling with financial planning. By addressing both emotional and practical issues, individuals learn to manage shame and take control of their money. For example, financial therapist Dr. Brad Klontz, co-author of *Mind Over Money*, highlights that normalizing money struggles and accepting past mistakes reduces shame and motivates proactive behavior.

Building a support system also plays a crucial role. Trusted financial mentors, peer groups, or online communities can offer non-judgmental advice and accountability. Jane and her online support group, “Debt-Free Friends,” share monthly budgets and success stories, turning shame into empowerment.

Finally, adopting transparent communication with creditors can lead to better repayment options. Many lenders offer hardship programs once the emotional barrier is overcome, showing that facing debt openly reduces the feeling of powerlessness.

The Role of Financial Education in Preventing Shame

One of the fundamental ways to mitigate debt shame is through comprehensive financial education. When people understand how debt works, the options available, and strategies to manage it, the fear and embarrassment diminishes. Unfortunately, many education systems focus on mathematics or economics without integrating personal finance and emotional intelligence concerning money.

Research from the National Endowment for Financial Education (NEFE) indicates that individuals with higher financial literacy are 25% less likely to experience crippling debt. Lower financial literacy correlates with increased reliance on credit and higher levels of shame due to the unexpected or misunderstood nature of debt.

Practical education must include teaching about psychological responses to debt. For instance, lessons could cover how recognizing shame triggers can enable healthier financial conversations and decisions. Schools and community programs that combine emotional wellbeing with money management display promising outcomes, reducing the social taboo around debt.

Future Perspectives: Reimagining Debt and Emotional Well-being

Looking ahead, tackling debt shame requires systemic and cultural shifts alongside individual efforts. Technology offers potential solutions through anonymous financial counseling apps, AI-driven budgeting tools, and online support communities that reduce social stigma by providing privacy and accessibility.

Corporations and policymakers are also beginning to acknowledge the mental health aspect of debt. Some countries are experimenting with debt forgiveness programs that incorporate psychological counseling, recognizing that financial recovery and emotional healing must go hand in hand.

Additionally, changing societal narratives around debt—from a symbol of personal failure to a temporary challenge—can reduce shame. Social campaigns focusing on stories of financial recovery and resilience can shift perspectives and promote empathy.

Financial institutions might increasingly adopt more compassionate customer service models, where staff are trained to recognize signs of shame and assist clients in non-judgmental ways. This evolution could redefine the debt landscape, transforming fear into hope and inaction into empowerment.

—

Debt is not merely a financial issue; it is a psychological and social challenge profoundly shaped by shame. By understanding the emotional mechanics behind debt-related shame, individuals and societies can develop compassion, better support systems, and effective education that promote financial health and emotional resilience. Breaking free from the shame cycle is essential to moving out of the red and into a future of financial stability and well-being.

Post Comment