HSBC World Elite Mastercard Credit Card

Anúncios

Anúncios

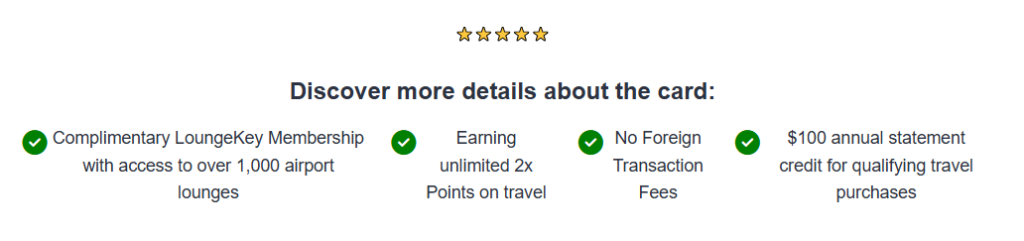

Enjoy over 1,000 airport lounges with complimentary LoungeKey Membership and earn unlimited 2x Points on all travel purchases.

HSBC World Elite Mastercard Credit Card

Experience elevated financial privileges with the HSBC World Elite Mastercard Credit Card, a premium option designed for individuals who seek more from their everyday spending.

Tailored for sophisticated cardholders in the United States, this card unlocks a world of exclusive benefits and rewarding features.

Anúncios

Whether you’re enjoying luxury travel perks or earning generous points on purchases, this card is built to enhance your lifestyle and support your financial goals with exceptional value and security.

Enjoy Complimentary LoungeKey Access to Over 1,000 Airport Lounges

Anúncios

Travel doesn’t have to be overwhelming, especially when airports are packed and noisy.

With the HSBC World Elite Mastercard, you’ll receive Complimentary LoungeKey Membership, giving you access to more than 1,000 airport lounges worldwide.

Step away from the crowds and unwind in a calm, comfortable setting with amenities like refreshments, high-speed Wi-Fi, and more.

This exclusive benefit transforms your travel experience, letting you relax or work in peace before your next flight.

Earn Unlimited 2x Points on Travel

For frequent travelers, the HSBC World Elite Mastercard offers exceptional value.

You’ll earn unlimited 2x Points on all travel-related purchases, including airfare, hotel stays, car rentals, and more.

With no cap on the number of points you can earn, your travel spending can quickly translate into rewarding future experiences.

Whether you’re booking a luxury vacation or a short weekend trip, these points can help reduce the cost of your adventures and make travel more accessible.

No Foreign Transaction Fees

One of the standout features of the HSBC World Elite Mastercard is the absence of foreign transaction fees.

When shopping internationally or purchasing from global merchants online, many credit cards add extra charges—typically around 3%.

With this card, those additional costs are eliminated, allowing for smarter and more affordable international spending.

This is especially beneficial for frequent globetrotters or anyone who regularly transacts in foreign currencies.

$100 Annual Travel Credit

Another attractive perk is the $100 annual statement credit for eligible travel purchases made with your card.

Qualifying expenses might include airline tickets, hotel bookings, or other travel-related costs.

Each year, you can receive up to $100 back, helping to offset the expenses of your journeys.

This credit adds tangible value and encourages cardholders to take advantage of travel benefits while saving along the way.

The most requested product by our readers! Check it out today…

Post Comment