How to Manage Finances in a Relationship Without Conflict

Anúncios

Money is one of the most common sources of tension in romantic relationships. From differences in spending habits to conflicting financial goals, financial disagreements can create serious challenges—even in the healthiest of partnerships. However, with proactive communication, mutual respect, and solid planning, couples can manage their finances in harmony and avoid conflict.

In this comprehensive guide, we’ll explore how to successfully navigate money matters as a team—so you can strengthen your relationship, build trust, and work together toward shared financial success.

Why Money Matters in Relationships

Anúncios

Money is more than just dollars and cents; it represents freedom, security, identity, and values. Each person brings a unique financial background into a relationship. These influences may include:

-

How money was handled in their family growing up

-

Past experiences with debt or wealth

-

Financial trauma or insecurities

-

Personal goals and ambitions

If these differences go unspoken or misunderstood, they can trigger arguments, resentment, or secrecy. That’s why managing money in a relationship is not just about budgeting—it’s about building emotional and financial intimacy.

Anúncios

Step 1: Start with Open and Honest Conversations

The first step to managing finances together is building a foundation of transparency. Sit down and have an honest conversation about your current financial situation and beliefs.

Discuss:

-

Income sources and stability

-

Existing debts (credit cards, student loans, etc.)

-

Savings and investments

-

Monthly expenses and spending habits

-

Credit scores and financial responsibilities

-

Long-term goals (buying a home, retirement, travel, children)

This isn’t a one-time conversation—it should be an ongoing dialogue. The goal is to understand each other’s mindset around money without judgment.

Tip: Schedule regular “money dates” where you review budgets, set goals, and celebrate financial wins.

Step 2: Understand Each Other’s Money Personality

Everyone has a money personality, and understanding yours and your partner’s can help prevent unnecessary tension. Are you a saver or a spender? Risk-taker or security-seeker?

Common Money Types:

-

The Saver: Prioritizes security and hates unnecessary spending.

-

The Spender: Values enjoyment and experiences, may be impulsive.

-

The Avoider: Tries not to think about money or decisions.

-

The Planner: Loves detailed budgets, spreadsheets, and forecasting.

-

The Risk-Taker: Prefers investing and bold financial moves.

Most couples are a mix—and opposites often attract. Knowing your tendencies can help you create a strategy that honors both perspectives.

Step 3: Set Shared Financial Goals

Working toward common goals strengthens the partnership and reduces financial friction. Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) that reflect both of your values.

Example Goals:

-

Save $5,000 for a vacation in 12 months

-

Pay off $20,000 in credit card debt in 3 years

-

Contribute $300/month to a joint retirement fund

-

Buy a house within 5 years

Make sure both partners feel heard and invested in the process. If one partner feels their priorities are ignored, resentment can build.

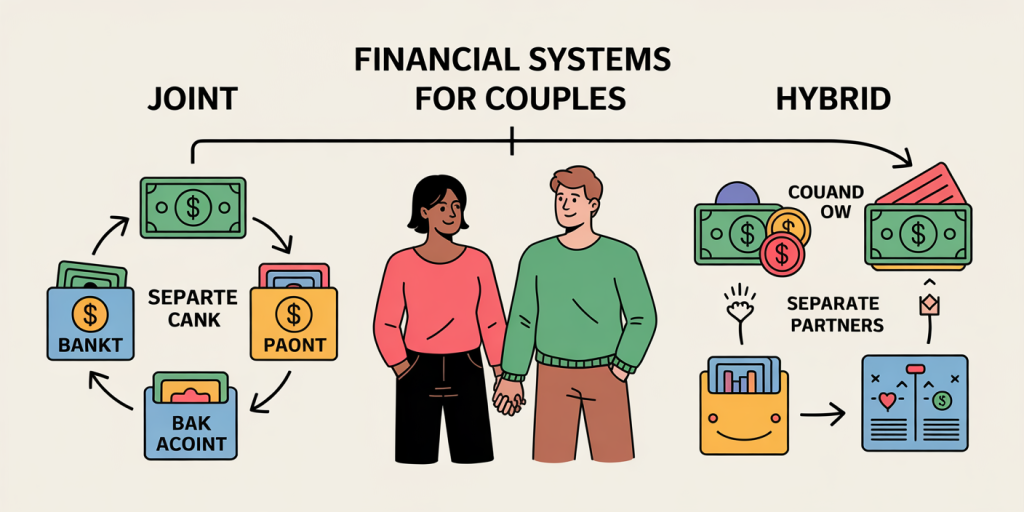

Step 4: Choose the Right System for Managing Money

There’s no one-size-fits-all solution for managing money as a couple. The best approach depends on your income levels, living arrangements, and personal preferences.

Three Common Systems:

-

Joint Finances – All income and expenses go into shared accounts. This is common among married couples or long-term partners.

-

Separate Finances – Each person maintains individual accounts and splits shared expenses. Ideal for couples who value financial independence.

-

Hybrid System – Each partner keeps personal accounts but contributes to a shared account for joint bills and goals. Offers both autonomy and unity.

Choose the method that minimizes tension and promotes teamwork. You can always adjust as your relationship evolves.

Step 5: Create a Joint Budget (Even if You Keep Finances Separate)

Even if you don’t merge all your money, having a shared budget for joint expenses helps you stay organized and avoid surprises.

Include:

-

Rent or mortgage

-

Utilities and internet

-

Groceries and dining

-

Transportation

-

Insurance premiums

-

Pet or childcare expenses

-

Subscriptions and entertainment

-

Emergency savings

Track spending with budgeting apps like You Need a Budget (YNAB), Mint, or Honeydue, which are designed specifically for couples.

Step 6: Define Responsibilities and Roles

Assign financial responsibilities to avoid confusion. One partner may be better at organizing bills, while the other handles investments or savings strategies. What matters is that both stay informed and involved.

Examples of roles:

-

Tracking and paying monthly bills

-

Researching and selecting insurance policies

-

Managing taxes and documentation

-

Monitoring progress toward goals

Avoid falling into a dynamic where only one partner handles all money matters. It creates an imbalance that can lead to resentment or power struggles.

Step 7: Build Emergency and Sinking Funds

Financial stress often stems from unexpected events—medical bills, job loss, car repairs. Build a shared emergency fund that covers 3–6 months of essential expenses.

Also, use sinking funds for known upcoming costs:

-

Holiday gifts

-

Annual insurance payments

-

Vacations

-

Home maintenance

-

Medical copays

Having a plan prevents fights over where the money will come from when surprises happen.

Step 8: Set Boundaries and Respect Autonomy

In every relationship, financial boundaries are essential. Even if you manage money jointly, individual freedom should be protected.

Examples:

-

Set a dollar limit for purchases that require mutual agreement

-

Agree on “no-questions-asked” personal spending budgets

-

Respect each other’s financial goals (even if they’re separate)

These boundaries foster trust and reduce the likelihood of feeling micromanaged or restricted.

Step 9: Deal with Financial Disagreements Calmly

Disagreements are inevitable. The key is to approach them with empathy, not judgment.

Conflict Resolution Tips:

-

Stay calm – Don’t discuss finances in the heat of the moment

-

Focus on solutions, not blame

-

Use “I” statements – e.g., “I feel stressed when we overspend,” instead of “You always blow the budget”

-

Take breaks if things get heated

-

Seek a mediator or financial counselor if necessary

Remember, you’re a team—not opponents. Every challenge is an opportunity to grow stronger together.

Step 10: Protect Your Relationship Legally and Financially

Depending on your stage of the relationship, it may be wise to put protections in place.

Consider:

-

Prenuptial or cohabitation agreements

-

Wills and estate planning

-

Life insurance for each other

-

Power of attorney for financial decisions

-

Transparent record-keeping of shared and individual assets

These tools don’t mean you mistrust each other—they’re acts of love that safeguard both partners in case life takes an unexpected turn.

Final Thoughts

Money doesn’t have to be a source of conflict in your relationship. In fact, when handled with intention, it can become a pillar of trust, collaboration, and shared purpose.

The strongest couples aren’t those who never argue about money—they’re the ones who face it together, with honesty, patience, and a commitment to growing stronger as a team.

Managing finances in a relationship takes work, but it’s worth it. When you’re financially aligned, you’re not just sharing a life—you’re building a future.

Post Comment