30-Year Mortgage vs. 15-Year Mortgage: Full Comparison and Analysis

Anúncios

When considering the purchase of a home, choosing the right mortgage term is one of the most critical decisions buyers face. The two most common options—30-year and 15-year mortgages—offer distinct advantages and trade-offs that can affect your financial health, monthly budget, and homeownership experience. Understanding the nuances between these options is crucial for making an informed choice that aligns with your financial goals and long-term plans.

Over the past decade, mortgage products have evolved, yet the 30-year and 15-year fixed-rate loans remain dominant in the market. According to the National Association of Realtors (NAR), approximately 70% of homeowners opt for a 30-year mortgage, while about 20-25% choose a 15-year term. This preference imbalance primarily stems from how borrowers weigh affordability against long-term savings. In this article, we will delve into the differences between the two mortgage types, explore practical examples, analyze costs, and discuss future trends influencing borrower preferences.

Anúncios

Understanding the Basics: What Sets 30-Year and 15-Year Mortgages Apart?

At the core, the primary difference between a 30-year and 15-year mortgage lies in the length of time over which the loan is amortized. A 30-year mortgage spreads your loan payments over three decades, while a 15-year mortgage requires the full repayment within half of that time frame.

Anúncios

This timeframe disparity affects multiple facets of the loan, including monthly payments, total interest paid, and equity accumulation. For instance, spreading payments over 30 years reduces the monthly amount, making the home more affordable monthly but results in higher cumulative interest costs over time. Conversely, a 15-year mortgage demands significantly higher monthly payments but can save borrowers tens of thousands of dollars in interest expenses.

A real-life case exemplifies this effect: a borrower purchasing a $300,000 home with a fixed 3.5% interest rate might pay roughly $1,347 monthly on a 30-year loan (excluding taxes and insurance), while the same loan paid over 15 years could cost about $2,145 monthly. Over the course of the loan, total interest on the 30-year might reach $215,608, whereas a 15-year mortgage would accumulate only about $62,119 in interest, saving approximately $150,000.

Monthly Payment Comparison and Affordability Considerations

Monthly affordability is often the first factor homebuyers assess. The lower monthly payment of a 30-year mortgage appeals to many, especially first-time buyers or those with tighter budgets. This approach frees up cash flow for other expenses such as childcare, savings, or investments.

For example, consider Sarah, a young professional earning $65,000 annually. A 30-year mortgage would allow her to purchase a home with monthly payments fitting comfortably within her budget. If she chose a 15-year mortgage instead, the increased monthly commitment might strain her finances, leaving less room for other obligations and opportunities.

On the other hand, those choosing the 15-year route often prioritize faster debt freedom and interest savings. The higher payments mean less disposable income monthly but the clear benefit of elimination of the mortgage sooner. This might especially make sense for dual-income households or those expecting income growth in the near future.

The table below summarizes the typical monthly payment differences for a $250,000 mortgage at a 3.75% fixed interest rate.

| Loan Term | Interest Rate | Monthly Principal & Interest | Total Interest Paid Over Life of Loan |

|---|---|---|---|

| 30 Years | 3.75% | $1,157 | $171,869 |

| 15 Years | 3.15% | $1,729 | $58,453 |

*Source: Mortgage calculations based on standard amortization formula*

This table reinforces how monthly payments nearly double for a 15-year loan but culminate in substantially lower interest costs.

Interest Rates and Total Cost: Diving Deeper into Financial Impact

Interest rates for 15-year mortgages are generally lower than for 30-year loans. This differential exists because lenders face less risk with a shorter-term loan, and the faster payoff minimizes exposure to market fluctuations. Recent data from Freddie Mac shows average rates for 15-year fixed loans around 0.5% lower than their 30-year fixed counterparts—for instance, 3.1% vs. 3.6% as of mid-2024.

This seemingly small difference significantly impacts total loan costs over time. To illustrate, a $200,000 loan at 3.6% over 30 years accrues approximately $130,000 in interest, but the same loan at 3.1% over 15 years may only accumulate about $50,000 in interest paid. The combination of a shorter payoff term and reduced interest rate accentuates these savings.

Another consideration is the potential for interest rate changes and refinancing. Borrowers with a longer 30-year term might refinance if rates drop, but they could also be subject to rising rates if extending. Meanwhile, 15-year mortgage holders enjoy the stability of a fixed-rate and shorter timeline, with less likelihood of needing to refinance for rate adjustments.

Financial analyses reflect that for every $100,000 borrowed, a homeowner can save upwards of $30,000 in interest by selecting a 15-year mortgage over a 30-year mortgage, assuming current average interest rates.

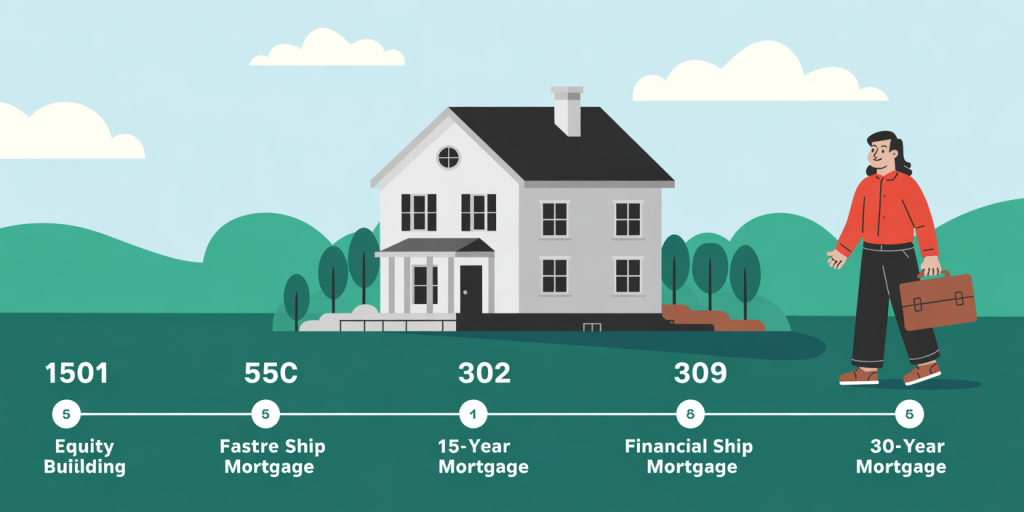

Building Equity and Long-Term Wealth

Another vital element in choosing a mortgage duration is the pattern of equity accumulation. Equity is the difference between the home’s current market value and the outstanding mortgage balance, representing ownership stake.

With a 15-year mortgage, accelerated principal payments result in faster equity building. This speed means homeowners enjoy increased financial security, the ability to leverage equity for home improvements or loans, and more flexibility in selling or refinancing.

On the contrary, with a 30-year mortgage, slower principal paydown delays significant equity buildup. In early years, the bulk of monthly payments largely cover interest rather than the principal, limiting equity growth. This dynamic can affect decisions relating to moving, cashing out equity, or withstanding market fluctuations.

Consider the example of a couple who opts for a 15-year $350,000 mortgage. After five years, their mortgage balance might have dropped to approximately $250,000, representing significant equity. Conversely, with a 30-year mortgage, after five years, the balance might only be reduced to $320,000, indicating slower equity formation.

Equally important is that faster equity acquisition through a 15-year mortgage offers psychological benefits by reducing the looming cloud of debt and reinforcing the claim of homeownership.

Tax Implications and Financial Flexibility

Mortgage interest deductions remain a critical consideration. Because the 30-year mortgage accrues more interest over a longer period, deducting mortgage interest on tax returns is initially higher for 30-year borrowers. This can provide some offset to the interest cost, especially in the early years.

However, with the increase in the standard deduction under the 2017 Tax Cuts and Jobs Act, fewer taxpayers itemize deductions, meaning the mortgage interest deduction benefits fewer borrowers than before. Additionally, 15-year mortgage holders, while paying less total interest, forego some tax deductions—though the overall savings from less interest paid often outweigh this factor.

Furthermore, financial flexibility matters. A 30-year mortgage offers lower mandatory payments and can free up funds for investments, retirement savings, or emergencies. Borrowers who stretch to accommodate 15-year payments risk financial strain if unexpected expenses arise.

Contrastingly, disciplined borrowers who opt for 30-year mortgages might choose to make extra payments toward principal, achieving similar payoff timelines and interest savings as 15-year loans but with more payment flexibility.

An insightful case from the Urban Institute shows that borrowers with more flexible payment options are less likely to default during economic downturns. For many homeowners, a 30-year mortgage can provide a “safety buffer,” promoting sustained homeownership.

Future Perspectives: Trends and Innovations Impacting Mortgage Choices

Looking ahead, mortgage products continue to evolve, influenced by economic cycles, borrower behavior, and regulatory changes. While fixed-rate 15- and 30-year loans remain staples, hybrid products and adjustable-rate mortgages provide alternatives that might suit various scenarios better.

Technological advancements enable more personalized mortgage solutions, allowing lenders to tailor terms and payment schedules based on borrower profiles and preferences. Moreover, social changes such as increasing remote work and shifting demographics may alter homeownership timelines and mortgage needs.

A significant future trend is financial advisory tools powered by AI that help buyers simulate mortgage scenarios dynamically. These tools offer borrowers data-backed insights on how different mortgage terms will impact monthly budgets, interest paid, and equity building comprehensively.

Given rising home prices and inflation, choice of mortgage term gains even more importance. Borrowers may lean toward shorter-term loans to hedge against interest rate volatility and to build wealth faster. Alternatively, some might prioritize liquidity and opt for longer terms with options for principal prepayment.

In conclusion, the decision between a 30-year and 15-year mortgage involves multiple layers of financial planning, personal circumstances, and market conditions. By leveraging data, real examples, and emerging innovations, borrowers can optimize mortgage choices, balancing affordability, cost savings, and future financial goals.

Post Comment